Market Overview

The India online food delivery market is valued at USD 45.15 billion in 2024, up from USD 16.56 billion previously reported for India in 2025 projections, illustrating rapid expansion. This surge reflects high smartphone penetration, affordable mobile data, rising disposable incomes, and evolving consumer preference for convenience and variety—especially in metros and emerging Tier‑II/III cities—driving frequent ordering and appetite for app‑based platforms.

Major metros including Delhi, Mumbai, Bangalore, Hyderabad, and Chennai dominate due to dense populations, high digital adoption, widespread presence of food delivery platforms, comprehensive cloud‑kitchen networks, and robust logistic ecosystems. Their high middle-class ratios, greater spending capacity, and restaurant diversity create conducive conditions for large‑volume delivery markets.

Market Segmentation

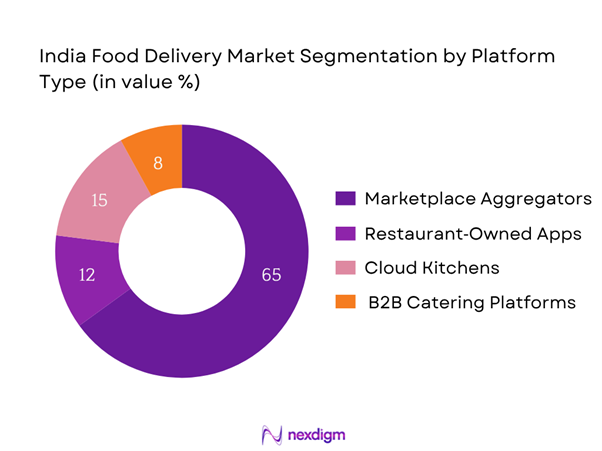

By Platform Type

Market dominated by Marketplace Aggregators (~65%), including Swiggy, Zomato, Dunzo, etc. Their dominance stems from extensive restaurant partnerships, strong logistics infrastructure, loyalty programs, and user-friendly apps that draw the majority of orders. High brand recall and deep urban/rural penetration make this sub-segment the largest contributor to order volume and value.

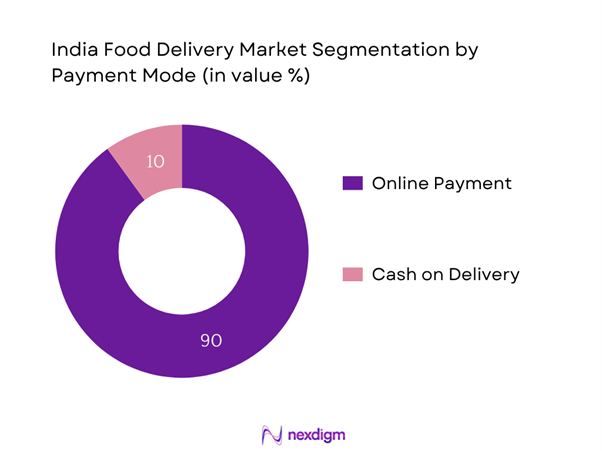

By Payment Mode

Online Payments dominate (~90%) driven by UPI, wallets, credit/debit cards, and convenience. Post‑pandemic preferences, cashback offers, loyalty incentives, and greater digital trust have firmly shifted consumers towards cashless transactions.

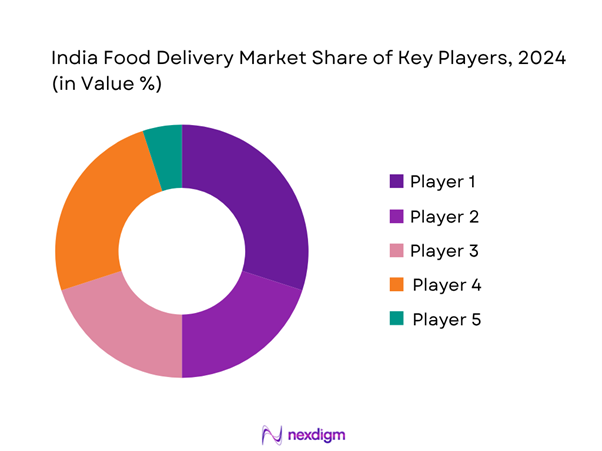

Competitive Landscape

The India food delivery market is consolidated, led by Swiggy and Zomato, followed by key global and local players. This reflects significant concentration among large platforms and cloud‑kitchen innovators. These players control over 80% of platform‑to‑consumer deliveries, reflecting market consolidation.

| Company | Estb. Year | Headquarters | App-Based Order Volume | Delivery Fleet Size | Cloud Kitchen Assets | Average Delivery Time | Loyalty Program Reach | Funding/Revenue Status |

| Swiggy | 2014 | Bangalore, India | – | – | – | – | – | – |

| Zomato | 2008 | Gurugram, India | – | – | – | – | – | – |

| Domino’s (JFL) | 1996 | Noida, India | – | – | – | – | – | – |

| Rebel Foods | 2011 | Mumbai, India | – | – | – | – | – | – |

| Dunzo | 2015 | Bangalore, India | – | – | – | – | – | – |

India Food Delivery Market Analysis

Growth Drivers

Digital Adoption

India has 886 million internet users (58% of population) as of late 2024, with 806 million mobile internet users representing over 90% of connections. 85.5% of households own at least one smartphone, and among youth, 99.5% use UPI payments. These figures highlight vast digital penetration across urban and rural India, enabling food delivery apps to reach billions of active users. Additionally, 1.15 billion mobile subscribers and 949 million broadband connections as of September 2024 establish that digital connectivity is nearly universal. This digital foundation drives frequent app-based ordering, real-time tracking, and cashless payments, making digital adoption a powerful growth lever for the food delivery ecosystem.

Logistics Infrastructure

India’s road network spans approximately 6,700,000 km by end‑2024—largest globally—and carries about 66% of freight and 82% of passenger traffic. National Highways alone total 146,195 km as of March 2025, growing from around 91,287 km in 2014, a 60% increase. Expressways total 6,059 km operational as of December 2024, with 11,127 km under construction. Annual capital expenditure on roads surged to ₹2.4 trillion (₹2,400 billion) in fiscal 2022‑23, up from ₹510 billion in 2013‑14. This significant investment enhances last‑mile delivery reliability, reduces transit times, and supports expansion of food delivery services into new cities and peri‑urban areas.

Challenges

High Burn Rates

India’s overall logistics cost structure is reflected in road freight cost components: logistics costs account for 14% of GDP, and freight market was valued at INR 12.13 trillion in 2023. High delivery fleet size, rider incentives, fuel and maintenance costs cumulatively strain unit economics of food delivery platforms. The rapid expansion of cloud kitchens and dark stores adds capital expenditure, including kitchen setup, technology stack, and delivery infrastructure, intensifying burn. Despite huge user base, prolonged cash burn remains an issue without profitability at scale.

Regulatory Scrutiny

Food delivery and gig‑economy firms face increasing compliance demands amid evolving labor and food safety regulations. FSSAI mandates packaging and sanitation norms across thousands of cloud kitchens and partner restaurants. At the same time, gig worker minimum standards and insurance regulations are enforced by Ministry of Labour. Moreover, logistics corridors under Bharatmala involve land use and environmental approvals. While macro policy datasets don’t quantify compliance cost, the complexity of multiple regulatory agencies across transport, food safety, labor and state authorities increases operational burden and costs for platforms expanding nationally.

Opportunities

Subscription Models

With 886 million internet users and 85.5% smartphone household penetration, there is strong potential to monetize loyalty through subscriptions. Youth adoption of UPI at 99.5% implies high comfort with recurring digital payments. Platforms can offer subscriptions for free deliveries, priority slots, and partner discounts. Given the age median of 28.8 years, a digitally lithe consumer base values convenience and exclusivity. This presents an opportunity to drive predictable revenue per user, reduce churn, and smooth logistics utilization, supported by macro-scale digital connectivity.

Regional Cuisine Brands

India’s 886 million internet users, including 55% from rural India, are increasingly exploring regional cuisines via apps. Platforms can partner with local food brands from Uttar Pradesh, Bihar, Kerala, Maharashtra and other regions to meet demand for authenticity. High mobile data usage (~32 GB per capita monthly) underlines appetite for food content and regional discovery. Promoting local cuisine brands helps platforms differentiate, tap into underserved demand pockets, and create hyper-local economies-scale growth, while riding on the digital distribution enabled by India’s mobile-first population.

Future Outlook

Over the next six years, India’s food delivery market is expected to grow significantly, driven by continued smartphone adoption, proliferation of cloud kitchens, AI‑based personalization, and shifting consumer preference for convenience and quality. Rising investments into infra, logistics, quick commerce, and autonomous delivery pilots are expected to sustain momentum.

Major Players

- Swiggy

- Zomato

- Domino’s (Jubilant FoodWorks)

- Rebel Foods (EatSure)

- Dunzo

- Zepto (quick commerce)

- Blinkit

- Box8

- FreshMenu

- Biryani By Kilo

- Magicpin

- Thrive

- Uber Eats (integrated)

- EazyDiner Prime Delivery

- Hoi Foods

Key Target Audience

- Chief Strategy Officers (Swiggy, Zomato, Jubilant FoodWorks)

- Heads of Logistics & Supply Chain (Dunzo, Rebel Foods)

- Heads of AI & Personalization (tech teams at food platforms)

- Head of Cloud Kitchens (Rebel Foods, Box8)

- Heads of Quick Commerce (Zepto, Blinkit)

- Investments and Venture Capitalist Firms (Sequoia, SoftBank, Invesco)

- Government and Regulatory Bodies (FSSAI, Ministry of Food Processing Industries, Competition Commission of India)

- Procurement Heads of Retail Chains (BigBasket, Tata Group)

Research Methodology

Step 1: Identification of Key Variables

Mapped stakeholder ecosystem including platforms, delivery fleet, restaurants, and regulators. Used industry publications, secondary databases, and proprietary data to define variables such as order volume, average order value, payment modes.

Step 2: Market Analysis and Construction

Compiled 2018–2023 historical data (DAUs, revenues, AOV, delivery times) through public databases and SEC filings. Assessed quality via delivery metrics and logistics efficiency to ensure revenue accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Developed hypotheses on platform share, consumer behaviour, and delivery economics. Validated via CATI surveys with operations/finance leaders from Swiggy, Zomato, Rebel Foods, and FSSAI officials.

Step 4: Research Synthesis and Final Output

Conducted interviews with executives from Rebel Foods, BigBasket’s Tata‑group quick‑commerce unit, and dark kitchen operators. Used bottom‑up revenue models triangulated with platform metrics for final market sizing and forecast validation.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Method, Understanding TAM/SAM/SOM through Expert Interviews, Primary and Secondary Data Collection, Limitations and Future Considerations)

- Definition and Scope

- Market Evolution and Timeline of Key Milestones

- Food Delivery Ecosystem (Platform Aggregators, Cloud Kitchens, Dark Stores, Riders)

- Business Model Overview (Hyperlocal, Logistics-Only, Full-Stack)

- Delivery Value Chain and Logistics Framework

- Growth Drivers

Digital Adoption

Logistics Infrastructure

Cloud Kitchen Surge

Consumer Lifestyle Shifts - Challenges

High Burn Rates

Regulatory Scrutiny

Rider Retention

Profitability Issues - Opportunities

Subscription Models

Regional Cuisine Brands

EV Integration

Grocery-Food Synergy - Trends

AI-Based Personalization

Health-Focused Deliveries

Loyalty Programs

Kitchen as a Service (KaaS) - Government Regulations

FSSAI Compliance

GST, Labor Laws

E-commerce Food Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Order Value, 2019-2024

- By Average Delivery Time, 2019-2024

- By Monthly Active Users, 2019-2024

- By Platform Type (In Value %)

Marketplace Aggregators (Swiggy, Zomato)

– Standard Restaurant Listings

– Premium/Pro Subscription Services

– Quick Commerce Integration (Instamart, Blinkit)

Restaurant-Owned Platforms

– Fast Food Chain Apps (e.g., Domino’s, McDonald’s)

– Regional Chains with Own Ordering System

– Loyalty/Reward Program Integration

Cloud Kitchens

– Multi-brand Cloud Kitchens

– Single-brand Virtual Kitchens

– Delivery-Only Models (No dine-in)

Direct-to-Consumer (D2C) Food Brands

– Niche Healthy/Organic Brands

– Gourmet & Artisanal D2C Meals

– Meal Box & DIY Kit Startups

B2B Food Delivery Services

– Catering Orders for Institutions

– Office Cafeteria Management

– Bulk Order Tech-Enabled Logistics - By Cuisine Type (In Value %)

North Indian

South Indian

Chinese

Fast Food

Desserts & Beverages - By Order Type (In Value %)

On-Demand Orders

– Instant Meals

– Individual or Family Packs

– Peak Meal-Time Traffic (Lunch/Dinner)

Scheduled Orders

– Pre-booked Breakfast & Lunch Deliveries

– Events & Social Gatherings

– Time-Slot Based Deliveries

Bulk/Party Orders

– Catering-Size Meals

– Office Events or Home Parties

– Combo Deals and Group Menus

Subscription-Based Deliveries

– Daily Tiffin & Meal Box Subscriptions

– Calorie-Controlled Diet Plans

– Corporate Lunch Subscriptions

Corporate Meal Deliveries

– Central Kitchen Services for Offices

– App-Based Employee Food Programs

– Customized Menus & Coupons - By Region (In Value %)

Tier 1 Cities

Tier 2 Cities

Tier 3 & Rural Expansion - By Delivery Model (In Value %)

Platform-to-Consumer

Restaurant-to-Consumer

Logistics-Only Partnerships

Hybrid Delivery (Aggregator + In-House)

Robo and Drone-Based Pilots

- Market Share by Order Volume/Value

- Cross Comparison Parameters (Company Overview, Business Model & Strategy, MAUs and DAUs, Average Order Value, Delivery Fleet Size, Restaurant Partner Network, Average Delivery Time, Loyalty and Rewards Program, Geographic Penetration, Marketing & Cash Burn, Technology Stack & AI Personalization, Profit Margins & Unit Economics)

- SWOT of Major Players

- Pricing Strategy (Delivery Charges, Commission, Subscription Plans)

- Detailed Profiles of Major Companies

Swiggy

Zomato

Domino’s (Jubilant FoodWorks)

Pizza Hut (Devyani International)

Dunzo

Zepto Cafe

EatSure (Rebel Foods)

Box8

FreshMenu

Biryani By Kilo

Magicpin

Thrive

Uber Eats (now integrated into Zomato)

EazyDiner Prime Delivery

Hoi Foods

- Consumption Patterns (Metro vs Non-Metro)

- Price Sensitivity and Order Frequency

- Health, Convenience & Dining-Out Substitution

- Decision-Making Parameters

- Pain Points (Packaging, Delays, Consistency)

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Order Value, 2025-2030

- By Monthly Active Users, 2025-2030

- By Delivery Cost Efficiency, 2025-2030