Market Overview

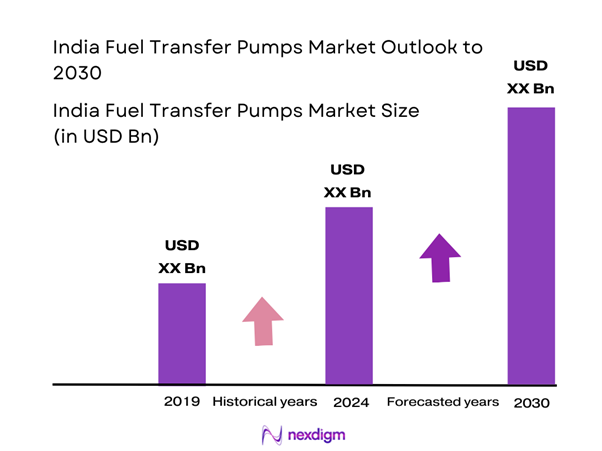

The India Fuel Transfer Pumps Market is valued at USD 160 million in 2024 with an approximated compound annual growth rate (CAGR) of 7% from 2024-2030, based on a comprehensive analysis of historical market data. This market growth is driven primarily by the rising demand for fuel transfer solutions across various sectors such as automotive, agriculture, and industrial applications. The growth is further influenced by trends in automation, the adoption of advanced fuel transfer technologies, and increasing government initiatives aimed at improving efficiency and safety in fuel management systems.

India is home to some dominant cities such as Mumbai, Delhi, and Bengaluru, which significantly contribute to the fuel transfer pumps market. These cities boast robust industrial bases and large automotive sectors, which are essential for fuel pumps usage. Additionally, the high concentration of commercial and logistics activities in these urban areas drives the demand for efficient fuel transfer solutions to meet operational needs. Consequently, the urbanization trends in these regions firmly establish their position as key players in the market.

The Indian agriculture sector, which supports nearly 58% of the rural population, is ramping up its reliance on modern technologies, with an allocation of approximately USD 17 billion in 2023 for agricultural development under the PM Kisan scheme. This funding aims to modernize farming practices, which include the adoption of fuel transfer pumps for machinery and equipment.

Market Segmentation

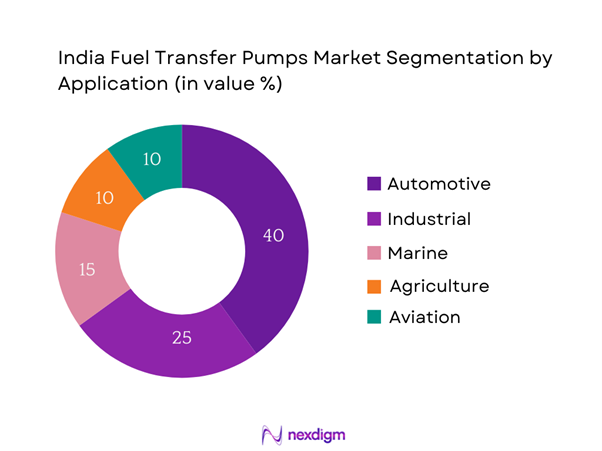

By Application

The India Fuel Transfer Pumps Market is segmented by application into automotive, industrial, marine, agriculture, and aviation. The automotive segment holds a dominant market share. This prevalence is attributed to the increase in vehicle production and sales in India. As the automotive industry expands, the need for reliable fuel transfer systems becomes crucial for various applications, including fueling stations, garages, and vehicle refueling. This segment benefits from innovations that enhance safety and efficiency, making it a cornerstone of the market.

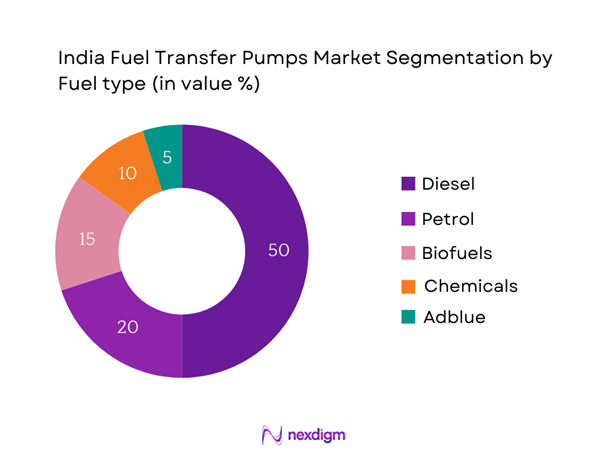

By Fuel Type

The market is also segmented by fuel type into diesel, petrol, biofuels, chemicals, and Adblue. Diesel is the leading sub-segment, reflecting its significant usage in both commercial and residential applications. The diesel market is bolstered by the extensive use of diesel engines in various industries, particularly in transportation and agriculture. The ready availability of diesel fuel infrastructure further enhances its dominance, making it the preferred choice in fuel transfer systems across the sectors.

Competitive Landscape

The India Fuel Transfer Pumps Market is characterized by the presence of both established players and emerging companies. Major players in this market include companies that leverage their strong technological expertise and distribution networks to maintain a competitive edge. The competitive environment is marked by innovation, pricing strategies, and service differentiation, which intensifies competition among key market players.

| Company | Establishment Year | Headquarters | Market Share | R&D Investment | Number of Products | Distribution Network |

| Kirby-Smith Machinery | 1983 | USA | – | – | – | – |

| Graco Inc. | 1926 | USA | – | – | – | – |

| Fill-Rite | 1959 | USA | – | – | – | – |

| Piusi S.p.A. | 1953 | Italy | – | – | – | – |

| Tuthill Corporation | 1892 | USA | – | – | – | – |

India Fuel Transfer Pumps Market Analysis

Growth Drivers

Rising Demand in Automotive Sector

The automotive sector in India has been experiencing significant growth, with vehicle production reaching approximately 4.4 million units in 2023, an increase from 4.2 million in 2022, according to the Society of Indian Automobile Manufacturers (SIAM). This surge in production directly correlates with the rising demand for fuel transfer solutions as manufacturers strive to ensure efficient fueling processes. Furthermore, the Indian automotive market is projected to become the world’s third largest by end of 2025, further emphasizing the need for sophisticated fuel transfer systems to support this growing sector.

Growth of Industrial Activities

India’s industrial sector is set to expand and is projected to contribute approximately USD 1 trillion to the GDP by end of 2025, as reported by the Ministry of Commerce and Industry. The resurgence of various industries such as manufacturing and construction creates a continuous demand for fuel transfer pumps. The government’s ‘Make in India’ initiative has led to a significant increase in manufacturing output—from USD 420 billion in 2022 to an expected USD 500 billion in 2024—driving up the requirement for efficient fuel transfer mechanisms across industries.

Market Challenges

Regulatory Compliance

The fuel transfer pumps market faces stringent regulatory compliance challenges, particularly due to environmental regulations set forth by the Central Pollution Control Board (CPCB). For example, stringent guidelines were established in 2022 regarding the emissions from fuel transfer devices, pushing manufacturers to invest significantly in compliance technologies. As a result, non-compliance could lead to penalties, which can reach up to 5% of annual revenue, representing a considerable financial burden for companies operating in this space.

Price Fluctuations in Raw Materials

The fuel transfer pumps market is also contending with rampant price fluctuations of raw materials. For instance, the cost of steel—which is crucial for manufacturing fuel pumps—rose to approximately USD 800 per metric ton in early 2023, compared to USD 600 in 2022, driven by increased global demand and supply chain disruptions. Such fluctuations impact manufacturers’ ability to maintain cost-effective pricing, thereby affecting their profit margins and market competitiveness.

Opportunities

Technological Advancements

With a focus on innovation, the fuel transfer pumps market is poised for growth driven by technological advancements, particularly in automation and smart fuel management systems. The Indian government allocated USD 1.8 billion towards promoting research and development in 2023, aiming to foster innovation in energy-efficient solutions. This represents a significant opportunity for companies to invest in advanced features such as IoT and AI-enabled pumps, streamlining fuel management practices across various sectors while enhancing operational efficiency.

Growth in Renewable Energy Markets

The shift towards renewable energy in India opens new avenues for the fuel transfer pumps market. The Indian government’s target of achieving 500 GW of renewable energy capacity by 2030 indicates a growing investment in solar, wind, and bioenergy sectors, which all require efficient fuel transfer solutions for operational logistics. With approximately USD 20 billion invested in renewable energy projects in 2023, businesses that align with this trend can capture new market opportunities as sustainable practices become more prominent.

Future Outlook

Over the next several years, the India Fuel Transfer Pumps Market is expected to exhibit significant growth driven by increasing industrialization, expanding urban infrastructure, and a shift towards automation in fuel management systems. The growing focus on environmental sustainability and the evolution of biofuels are likely to impact market dynamics positively, presenting upcoming opportunities for innovation and market penetration.

Major Players

- Kirby-Smith Machinery

- Graco Inc.

- Fill-Rite

- Piusi S.p.A.

- Tuthill Corporation

- ARO (Ingersoll Rand)

- GPI (Grove/General Pump)

- Continental Hydraulics

- Silverlake Group

- ZSI Global

- Smith Corporation

- Dispensing Solutions, Inc.

- Lario Oil & Gas

- Tuthill Farm

- Axiom Hydraulics

Key Target Audience

- Automotive Manufacturers

- Industrial Equipment Distributors

- Agricultural Sector Buyers

- Logistics and Transport Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Petroleum and Natural Gas)

- Fuel Retailers

- Environmental and Safety Compliance Agencies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating a comprehensive ecosystem map that identifies all major stakeholders within the India Fuel Transfer Pumps Market. This step utilizes extensive desk research and a combination of secondary and proprietary databases to gather pertinent industry data. The goal is to define critical variables that influence market dynamics, ranging from technological advancements to regulatory factors that shape the industry.

Step 2: Market Analysis and Construction

In this phase, historical data related to the India Fuel Transfer Pumps Market will be compiled and assessed. This includes analyzing market penetration, comparing supply chains, and evaluating the resultant revenue generated across different segments. A meticulous evaluation of service quality statistics will be undertaken to ensure the accuracy and reliability of revenue estimates, thereby realizing a comprehensive view of the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed based on the initial research and subsequently validated through consultations with industry experts via computer-assisted telephone interviews (CATIs). These experts, representing diverse companies in the fuel transfer pump sector, will provide valuable insights to refine market data and enhance understanding of operational and financial variables that influence industry performance.

Step 4: Research Synthesis and Final Output

The final stage involves interacting directly with a range of fuel transfer pump manufacturers to gather detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This engagement serves to verify and enrich the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Fuel Transfer Pumps Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Demand in Automotive Sector

Growth of Industrial Activities - Market Challenges

Regulatory Compliance

Price Fluctuations in Raw Materials - Opportunities

Technological Advancements

Growth in Renewable Energy Markets - Trends

Shift to Automation

Sustainability Practices - Government Regulation

Environmental Standards

Import Tariffs and Duties - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Application (In Value %)

Automotive

– Fuel Dispensing at Service Stations

– Vehicle Refueling Systems

Industrial

– Fuel Handling in Manufacturing Plants

– Emergency Power Generator Refueling

Marine

– Ship Refueling Systems

– Dockside Fuel Supply

Agriculture

– Tractor Refueling

– Diesel Irrigation Pumps

Aviation

– Airport Ground Support Equipment

– Small Aircraft Refueling Units - By Fuel Type (In Value %)

Diesel

– High-Flow Pumps for Generators and Heavy Vehicles

– Low-Flow Pumps for Agricultural Equipment

Petrol

– Dispensers for Two-Wheelers and Cars

– Explosion-Proof Petrol Transfer Units

Biofuels

– Biodiesel Pumps

– Ethanol-Compatible Pumps

Chemicals

– Acid and Solvent Transfer Pumps

– Industrial Chemical Pumps

Adblue

– Urea Dispensing Units

– ISO-Compliant Adblue Pumps - By Product Type (In Value %)

Electric Pumps

– 12V/24V Pumps for Mobile Use

– AC Powered Pumps for Stationary Use

Mechanical Pumps

– Gear Pumps

– Diaphragm Pumps

Manual Pumps

– Hand-Operated Rotary Pumps

– Lever Action Pumps - By Distribution Channel (In Value %)

Direct Sales

Distributors

Online Retail - By Region (In Value %)

Delhi NCR

Punjab

Uttar Pradesh

Karnataka

Tamil Nadu

Telangana

West Bengal

Odisha

Bihar

Maharashtra

Gujarat

Rajasthan

Madhya Pradesh

Chhattisgarh

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Fuel Transfer Pumps Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Number of Touchpoints, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Kirby-Smith Machinery

Piusi S.p.A.

Graco Inc.

Fill-Rite

ARO (Ingersoll Rand)

Tuthill Corporation

Dispensing Solutions, Inc.

GPI (Grove/General Pump)

A. O. Smith Corporation

Continental Hydraulics

Silverlake Group

Tuthill Farm

Lario Oil & Gas

Axiom Hydraulics

ZSI Global

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030