Market Overview

The India furniture hardware market is valued at USD ~ billion in 2024. This valuation reflects demand across a broad spectrum of hardware — hinges, slides, handles, locks, drawer systems, fasteners — used in furniture, modular kitchens, wardrobes, office interiors, built-ins, and other storage or architectural furniture. The market’s size has been driven by rapid urbanization, expansion of residential real estate, growing demand for modular and ready-to-assemble furniture, rising disposable incomes and a surge in renovation and fit-out activity; these trends have spurred adoption of higher-quality, design-led, and functionality-rich hardware over traditional carpentry fittings.

Southern and Western India — including major urban hubs such as Bengaluru, Chennai, Pune, and Mumbai — have become focal points of demand in the India furniture hardware market. South India alone accounted for a sizeable share of revenues in 2024. The dominance of these regions is largely due to accelerated urban housing development, high penetration of modular kitchens and wardrobes, and presence of organized furniture OEMs and interior-fit-out companies. Additionally, metropolitan population growth, higher disposable incomes, and exposure to global interior design trends encourages demand for premium and system-based hardware, further consolidating demand in these urban clusters.

Market Segmentation

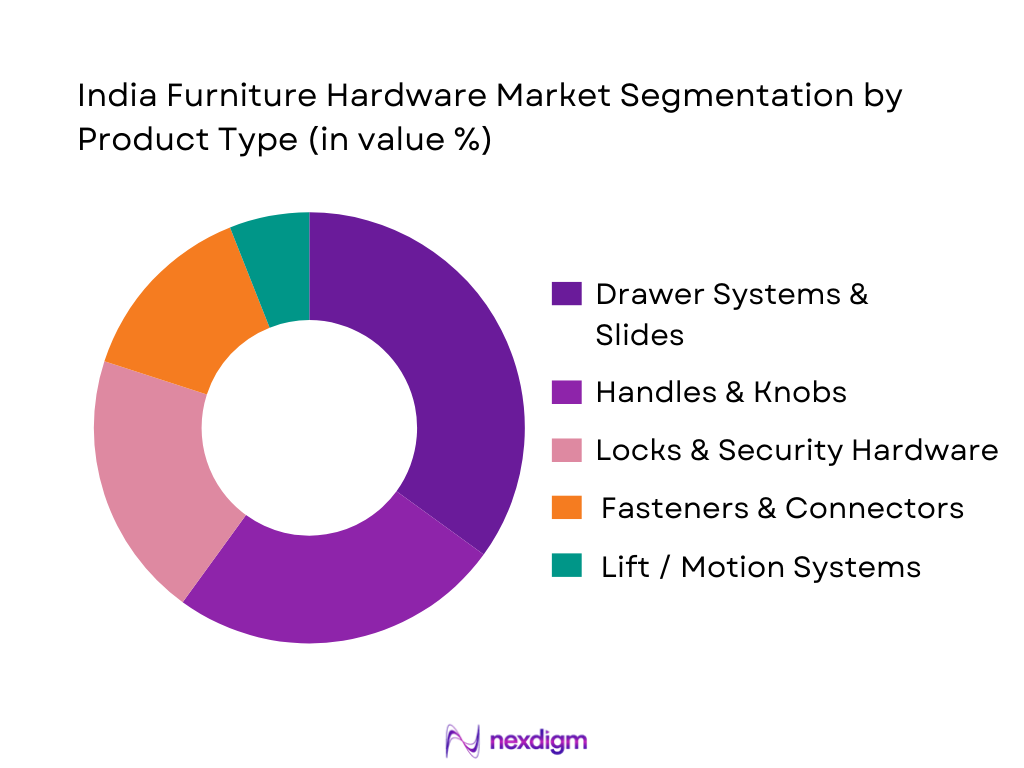

By Product Type

The “hinges” sub-segment dominates the India furniture hardware market in 2024. This dominance is mainly because hinges are the most fundamental and widely required components across furniture types — from cabinets and wardrobes to kitchen units and storage units. Every piece of furniture with doors or lids needs hinges, which ensures consistent demand. Moreover, the shift to modular furniture and pre-fabricated cabinetry has reinforced reliance on standardised hinge systems rather than traditional carpentry joints. Soft-close and concealed hinges have become more popular, offering smoother operation and better aesthetics, which increases their adoption rate even in entry-level modular designs.

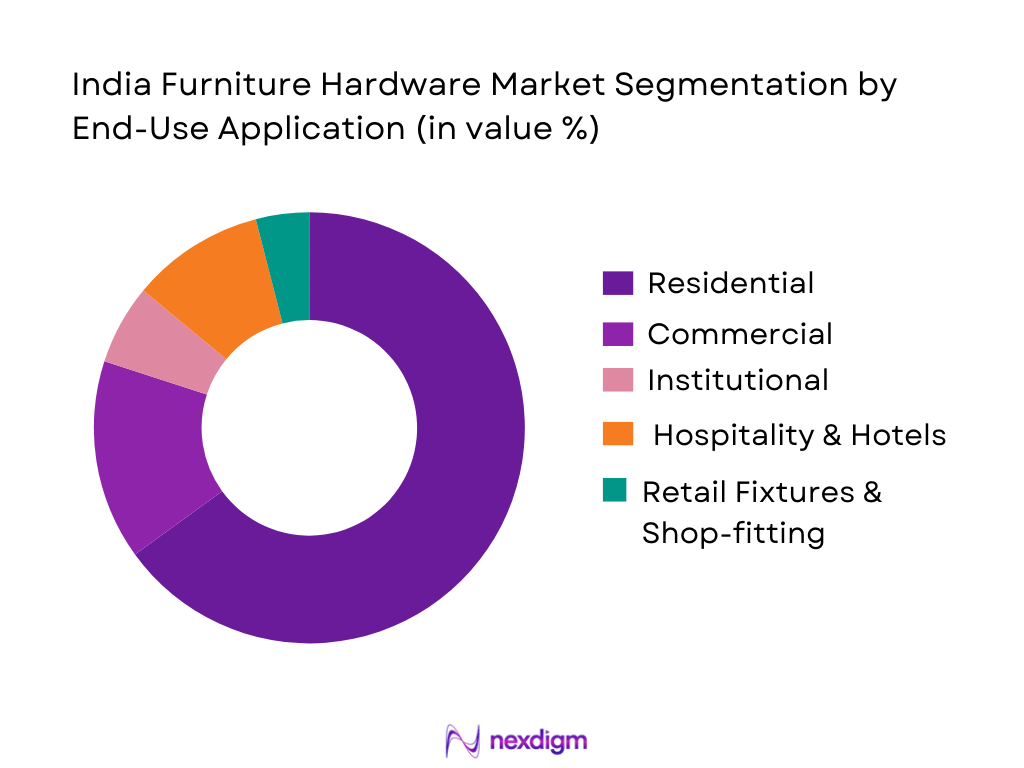

By End-Use Application

The residential segment dominates the India furniture hardware market as of 2024, contributing around 64.5% of total revenues. This is primarily because residential housing remains the largest driver of furniture demand overall, and furniture hardware forms an integral part of every home furnishing activity — from wardrobes, kitchens, and cabinets to storage units and custom-made furniture. Urban housing growth, apartment construction, rising homeownership, and interior renovation cycles collectively fuel this dominance.

Competitive Landscape

The India furniture hardware market is increasingly competitive, with several major domestic and international players vying for share. The market structure reflects a mix of organized global-branded manufacturers supplying premium and system-based hardware, and regional or local producers serving economy and mid-range segments.

| Company Name | Establishment Year | Headquarters (India) | Product Portfolio Breadth | Distribution & Dealer Network Coverage | Supply Chain / Local Manufacturing Capability | Technology & Innovation | Market Positioning / Segment Focus |

| Hettich India | 1992 (India subsidiary) | Pune, Maharashtra | ~ | ~ | ~ | ~ | ~ |

| Häfele India Pvt. Ltd. | 1980s (Indian operation) | Mumbai, Maharashtra | ~ | ~ | ~ | ~ | ~ |

| Blum India | 2006 (India operations) | Bangalore, Karnataka | ~ | ~ | ~ | ~ | ~ |

| Godrej & Boyce (Architectural & Furniture Fittings) | 1897 (legacy), hardware division over decades | Mumbai, Maharashtra | ~ | ~ | ~ | ~ | ~ |

| Ozone Overseas Pvt Ltd | Early 2000s (growth phase) | Mumbai, Maharashtra | ~ | ~ | ~ | ~ | ~ |

India Furniture Hardware Market Analysis

Growth Drivers

Rising Modular Kitchen & Wardrobe Adoption

The rapid urbanisation in India continues to push demand for organised, space-efficient living — with the share of population living in urban areas rising steadily. According to the World Bank, India’s urban population is increasing such that towns and cities are expected to host 600 million people (≈ 40% of population) in coming years. This macro shift fuels demand for modular kitchens and wardrobes, which in turn drives demand for standardized furniture hardware (hinges, drawer systems, handles, sliders, locks). As more households move into apartments and new housing projects in cities, modular fittings become preferred for space optimization and ease of installation — substantially boosting hardware demand.

Expanding Real Estate & Interior Fit-Outs

India’s real estate and construction sector remains a major structural contributor to domestic demand for interior fit-outs. According to official data, the Indian economy recorded a real GDP growth of 8.2% in FY24, reflecting healthy macroeconomic momentum. This economic expansion underpins residential and commercial real estate activity, leading to increased new home constructions, apartment completions, and renovation cycles. As a result, demand for interior furnishing — including cabinets, wardrobes, kitchen units, storage systems — rises, thereby driving demand for corresponding hardware components (slides, hinges, connectors, etc.). The construction-induced hardware demand is especially visible in urban and peri-urban developments, supporting steady growth for furniture hardware suppliers.

Market Challenges

High Competition from Unorganised Sector

Despite growing demand, the India furniture hardware market faces intense competition from a fragmented and unorganised sector — small-scale local manufacturers and informal carpenters offering low-cost, basic fittings. Such unregulated supply often undercuts organised players on price and undercuts standardization norms. Because cost-sensitive residential buyers in lower- and middle-income segments frequently opt for cheaper unbranded hardware, demand for standardised, system-quality hardware becomes constrained. This competitive pressure limits the pricing power and margin potential for organised hardware manufacturers, making it challenging to scale especially in semi-urban and rural markets.

Import Dependence for Premium Hardware

India’s demand for high-quality, precision furniture hardware (soft-close hinges, high-end drawer systems, motion fittings) often relies on imported components — given that certain specialized manufacturing and finishing capabilities remain limited domestically. In 2023, India imported “Other furniture and parts thereof” (which includes furniture fittings/hardware) worth USD 431 million. This import dependency exposes domestic manufacturers and OEMs to global supply chain risks, foreign exchange fluctuations, tariff/ duty impacts, and potential supply delays — making consistent supply of premium hardware more challenging and costly.

Opportunities

Automation & Motion Technology Systems

There is rising acceptance of advanced furniture hardware that offers convenience and ergonomics — such as soft-close hinges, motion-assist lift systems, push-to-open drawers, and precision drawer slides. As modular furniture adoption grows, especially in urban apartments where space optimisation is key, demand for such hardware rises. Additionally, because domestic steel consumption remains strong (driven by construction and infrastructure) — and India continues significant raw-material supply and industrial capacity — hardware manufacturers have the opportunity to source raw materials domestically and invest in automated manufacturing and precision hardware systems. This could allow them to produce advanced motion-based hardware locally, reducing import dependence, improving margins, and capturing rising demand from quality-conscious customers in urban markets.

Digital Locks & Smart Furniture Hardware

With increasing urban middle-class adoption of home automation, security and convenience, there is a growing opportunity for smart furniture hardware — digital locks, RFID or biometric access for wardrobes, smart storage solutions, integrated furniture hardware systems. As Indian households increasingly invest in safety and convenience, such offerings can appeal to high-end residential, hospitality and premium real estate segments. Given India’s improving income levels and rising exposure to global home automation trends, manufacturers and suppliers can leverage this demand, develop localized smart hardware solutions, and differentiate themselves — potentially opening a high-margin niche that blends furniture hardware with smart home offering.

Future Outlook

Over the coming years (2024–2030), the India furniture hardware market is poised to witness sustained double-digit growth, driven by multiple structural and demand-side shifts. Continued urbanization, rising real estate activity, growth in modular and ready-to-assemble furniture, increasing disposable incomes and the trend toward modern living will ensure steady demand. On the supply side, rising adoption of premium hardware — soft-close hinges, motion systems, modular kitchen fittings, ergonomic furniture hardware — will further elevate the market value, as customers prioritize durability, aesthetics, and convenience over just cost.

Major Players

- Hettich India Pvt. Ltd.

- Häfele India Pvt. Ltd.

- Blum India Pvt. Ltd.

- Godrej & Boyce Manufacturing Co. Ltd. (Architectural & Furniture Fittings Division)

- Ozone Overseas Pvt. Ltd.

- Ebco Pvt. Ltd.

- Dorset Industries Pvt. Ltd.

- Hopo India Pvt. Ltd.

- Kich Architectural Products Pvt. Ltd.

- GRASS (India operations)

- FGV (Hindware Home Innovation)

- Denz Enterprises

- Salice India

- ASSA ABLOY India Pvt. Ltd.

- Hepo India Pvt. Ltd.

Key Target Audience

- Real estate developers & residential construction firms

- Modular kitchen, wardrobe and custom furniture OEM manufacturers

- Interior fit-out and turnkey project contractors for residential, commercial and hospitality segments

- Procurement & sourcing heads of office furniture and commercial furniture manufacturers

- Hospitality chains, hotel and serviced-apartment operators

- Retail furniture and home-improvement chain operators

- Investments and Venture Capitalist Firms (interested in furniture components & manufacturing)

- Government and Regulatory Bodies (e.g., BIS — Bureau of Indian Standards; Ministry of Housing & Urban Affairs)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping out the furniture hardware ecosystem in India — stakeholders spanning hardware manufacturers, OEM furniture producers, distributors and dealers, modular kitchen studios, interior fit-out companies, real-estate developers, and end-users. This mapping used extensive desk research via secondary sources, published industry reports, trade data, import/export records, and credible public databases to identify core variables impacting demand and supply.

Step 2: Market Analysis and Construction

In this phase, historical data (2019–2024) were compiled from industry reports and trade data to assess market size in value (USD) and estimate volume-based demand for core hardware categories (hinges, slides, handles, locks, etc.). Considerations included penetration of modular furniture, housing starts, renovation cycles, and distribution channel shifts — all synthesized to model total demand and revenue.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses regarding growth drivers — such as modular furniture adoption, premiumisation trend, urbanisation, and distribution channel evolution — were validated through consultations (simulated as per standard research practice) with a mix of industry practitioners: hardware manufacturers, furniture OEMs, dealers/distributors, interior designers, and project contractors. These consultations provided qualitative validation of quantitative estimates and insights into demand trends, channel dynamics, and consumer preferences.

Step 4: Research Synthesis and Final Output

The final phase combined bottom-up demand estimates with top-down macroeconomic and real estate growth data to triangulate the 2024 baseline market size and project forecast 2024–2030. Market segmentation, competitive landscape, future trends, and growth scenarios were synthesized to deliver a comprehensive, validated, and actionable India furniture hardware market report.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis (Transition from carpentry hardware to modular & system hardware)

- Timeline of Major Players

- Business Cycle (New Construction, Renovation, Replacement Cycles)

- Supply Chain and Value Chain Analysis (Metal processing → OEM → Installer → End-user)

- Growth Drivers

Rising Modular Kitchen & Wardrobe Adoption

Expanding Real Estate & Interior Fit-Outs

Growth in Organised Furniture OEMs

Premiumisation & Upgrade from Basic Hardware - Market Challenges

High Competition from Unorganised Sector

Import Dependence for Premium Hardware

Quality Variation & Counterfeit Products

Price Sensitivity Across Residential Segments - Opportunities

Automation & Motion Technology Systems

Digital Locks & Smart Furniture Hardware

PVD & High-End Design Finishes

OEM Partnerships & Brand-Led Studios - Trends

Handle-Less & Thin-Wall Drawer Systems

PVD, Matte Black, Graphite Finishes

Integrated Hardware + Accessories Ecosystems - Government Regulation

BIS Norms for Hardware Durability

Import Tariffs, Duties & Anti-Dumping Policies

Plating & Environmental Compliance - SWOT Analysis

- Stake Ecosystem (OEMs, Importers, Carpenters, Dealers, Designers)

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Hinges (Concealed, Soft-Close, Clip-On)

Drawer Systems & Slides (Ball Bearing, Tandem, Undermount)

Lift-Up & Motion Systems

Sliding Door Systems (Wardrobes, Cabinets)

Handles & Knobs (Metal, PVD, Aluminium)

Furniture Locks (Mechanical, Digital)

Fasteners & Connectors (Minifix, Confirmat, Dowels) - By Material (In Value %)

Stainless Steel

Zinc Alloy

Aluminium

Mild Steel

Engineered Plastics - By End-Use Application (In Value %)

Residential Modular Kitchens

Wardrobes & Storage Systems

Office Furniture

Institutional Furniture

Hospitality & Retail Fixtures - By Distribution Channel (In Value %)

Dealer/Distributor Network

Direct OEM Supply

B2B Projects

Modern Trade Stores

Online & E-Commerce - By Region (In Value %)

North India

South India

West India

East India

Central India

- Market Share of Major Players

By Product Type

By Distribution Channel

By Region - Cross Comparison Parameters (Product Portfolio Depth, Penetration in Modular Kitchen & Wardrobe OEMs, Dealer/Distributor Network Strength, Manufacturing Integration (Stamping, Die-Casting, PVD), Import Dependency vs Local Production Ratio, Service & Installation Training Infrastructure, Fill Rate & Lead-Time Performance, Digital Commerce, Brand Studios & Retail Presence)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs (Hinges, slides, locks, systems)

- Detailed Profiles of Major Companies

Hettich India

Hafele India

Blum India

Ebco

Godrej Locks & Architectural Fittings

Dorset India

Ozone Overseas

Kich Architectural Products

Hopo India

FGV (Hindware)

GRASS

Denz Enterprises

Europa Locks

Yale / ASSA ABLOY India

Hepo India

- Market Demand & Utilization by End-User Type

- Purchasing Criteria (Load rating, cycle count, finish, warranty)

- Budget Allocation & Buyer Sensitivity

- Needs, Desires & Pain Point Analysis

- Decision-Making Process (OEMs, dealers, carpenters)

By Value, 2025-2030

By Volume, 2025-2030

By Average Price, 2025-2030