Market Overview

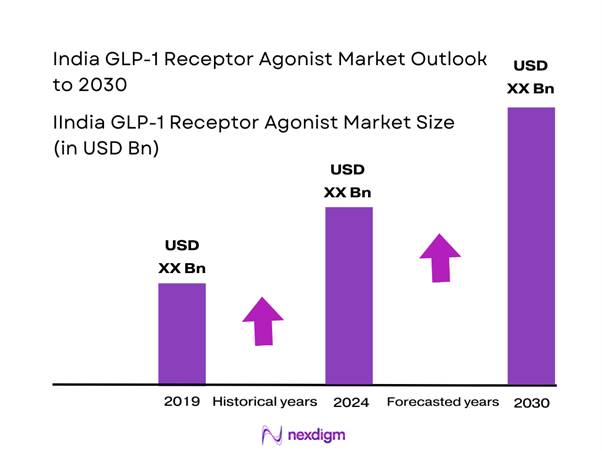

The India GLP-1 Receptor Agonist Market is valued at USD 82.2 million in 2024 with an approximated compound annual growth rate (CAGR) of 24.6% from 2024-2030, based on a comprehensive analysis approved by leading health organizations and market research firms. The soaring prevalence of Type 2 diabetes and obesity in the country is primarily driving this significant market size. With an increasing number of patients seeking advanced therapeutic solutions, the market has seen substantial investments in the development and marketing of GLP-1 receptor agonists as effective management options for these chronic conditions.

Major cities like Mumbai, Delhi, and Bengaluru dominate the GLP-1 receptor agonist market due to their extensive healthcare infrastructure and the presence of leading pharmaceutical companies. These urban centers not only have high patient concentrations but also benefit from advanced healthcare facilities and innovation hubs. Additionally, favorable government policies and healthcare schemes enhance accessibility to diabetes management products in these cities, further driving market growth.

Market Segmentation

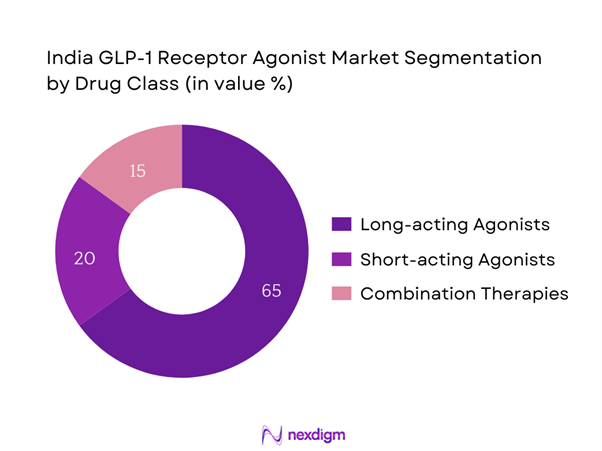

By Drug Class

The India GLP-1 Receptor Agonist Market is segmented by drug class into long-acting agonists, short-acting agonists, and combination therapies. Long-acting agonists currently lead the market due to their convenience and efficacy in providing consistent blood glucose control with fewer injections. Brands like Ozempic and Trulicity have built strong patient adherence due to their once-a-week dosing schedules, which contrasts favorably against shorter-acting alternatives. This convenience not only enhances patient compliance but also reinforces the therapeutic outcomes, making long-acting agonists increasingly preferred in daily practice.

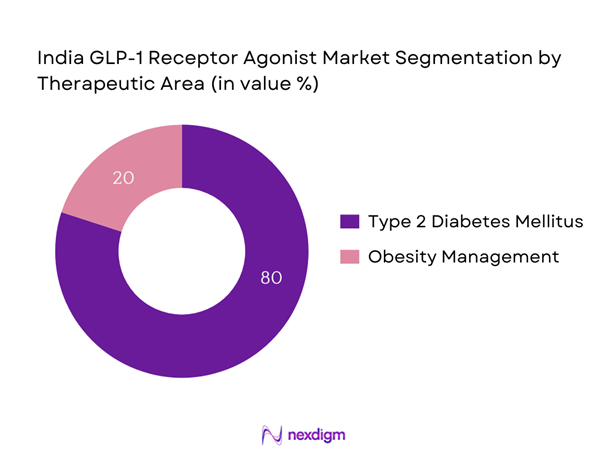

By Therapeutic Area

The market is also segmented by therapeutic area into Type 2 Diabetes Mellitus and obesity management. The Type 2 Diabetes Mellitus sub-segment dominates due to the high prevalence of diabetes cases in India, which has seen a sharp rise, with over 77 million people affected. As healthcare providers engage in creating comprehensive diabetes management regimens, GLP-1 receptor agonists have become integral components due to their multifaceted effects on glycemic control and weight reduction. The efficacy and safety profiles of these medications elevate their value in treating diabetes, thus driving market share within this therapeutic area.

Competitive Landscape

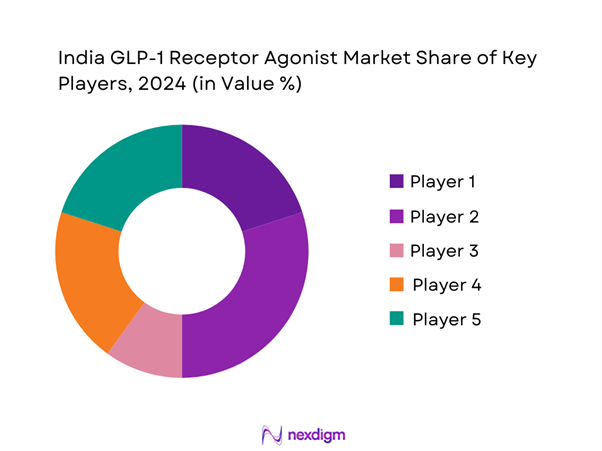

The India GLP-1 Receptor Agonist Market is dominated by several key players, reflecting a mix of local and global entities. The presence of major pharmaceutical companies indicates a competitive landscape focused on innovation and product development. Key players such as Novo Nordisk and Eli Lilly utilize robust distribution networks and research-based marketing strategies to maintain their positions.

| Company Name | Establishment Year | Headquarters | Drug Portfolio | Market Strategy | R&D Focus |

| Novo Nordisk | 1923 | Denmark | – | – | – |

| Eli Lilly | 1876 | USA | – | – | – |

| Sanofi | 2004 | France | – | – | – |

| AstraZeneca | 1999 | UK | – | – | – |

| Boehringer Ingelheim | 1885 | Germany | – | – | – |

India GLP-1 Receptor Agonist Market Analysis

Growth Drivers

Rising Incidence of Diabetes and Obesity

The rising incidence of diabetes and obesity significantly drives the GLP-1 receptor agonist market in India. According to the International Diabetes Federation, India is home to approximately 77 million adults with diabetes, expected to rise by 134 million by 2045. Furthermore, the World Health Organization states that 5.1% of India’s adult population is obese, with this figure expected to reach 9% by end of 2025. Such alarming statistics emphasize the urgent need for effective diabetes management solutions, including GLP-1 therapies, which are proven to help in weight management and glycemic control.

Increasing Awareness of GLP-1 Therapies

Awareness of GLP-1 receptor agonists as effective treatment options for diabetes is steadily increasing in India. The prevalence of diabetes care awareness events and health campaigns in urban centers led to an increase in patient consultations, with health facilities reporting a 20% rise in consultations related to diabetes management in the last two years. Additionally, healthcare expenditure on diabetes education programs is projected to reach USD 500 million by end of 2025 according to a report from the Diabetes Foundation of India. This increase in awareness and proactive healthcare measures contributes positively to the GLP-1 receptor agonist market.

Market Challenges

Pricing Pressures from Generic Drugs

The GLP-1 receptor agonist market faces significant pressure from the increasing number of generic drugs entering the diabetes medication space. According to the National Pharmaceutical Pricing Authority of India, the volume of generic medications has increased by 15% annually, contributing to shrinking profit margins for proprietary GLP-1 drugs. In 2023 alone, the Indian pharmaceutical sector saw nearly 54% of its market value derived from generic drugs, affecting brand loyalty for more costly branded products. As a result, existing players in the GLP-1 market find it increasingly challenging to sustain their market positions amidst growing affordability from generics.

Regulatory Hurdles

The regulatory landscape surrounding drug approvals in India can pose significant hurdles for companies aiming to introduce new GLP-1 therapies. Recent data from the Central Drugs Standard Control Organization notes that the approval process for new drugs can take between 12 to 24 months, leading to delays in product launches. Furthermore, the increase in stringent regulations for clinical trials and safety assessments has prompted over 35% of companies to reconsider their product development pipelines, delaying their ability to meet market demand. This regulatory complexity can not only slow down market entry for new therapies but may also deter investment in innovative diabetes treatments.

Opportunities

Emerging Demand for Personalized Medicine

The demand for personalized medicine is generating substantial opportunities for growth within the GLP-1 receptor agonist market. With the rapid advancements in genomics and biotechnology, tailored diabetes treatments are becoming feasible. According to a report by the Ministry of Health and Family Welfare, over 30% of patients express a preference for therapies specifically customized to their health profiles and genetic markers. Moreover, initiatives promoting personalized healthcare approaches are backed by a healthcare expenditure projected to reach USD 50 billion in the next three years, highlighting a significant opportunity for GLP-1 products that accommodate this trend.

Advancements in Drug Delivery Systems

Technological advancements in drug delivery systems represent another key growth opportunity for the GLP-1 receptor agonist market. Recent innovations, such as new subcutaneous injection devices and inhalable formulations, cater to patient preferences for convenience and needle-free options. As of 2023, the Indian government has allocated INR 500 crore to support research in drug delivery technologies, encouraging local pharmaceutical companies to invest in enhancing delivery methods for chronic conditions like diabetes. These advancements are expected to increase patient adherence, ultimately driving market growth for GLP-1 receptor agonist therapies.

Future Outlook

Over the next five years, the India GLP-1 Receptor Agonist Market is projected to undergo significant growth fueled by the continuous rise in diabetes cases, enhanced awareness about chronic disease management, and ongoing innovations in drug formulations. Increased government initiatives aimed at improving healthcare access and patient education regarding lifestyle changes also offer a supportive environment for this market’s expansion.

Major Players

- Novo Nordisk

- Eli Lilly

- Sanofi

- AstraZeneca

- Boehringer Ingelheim

- Merck & Co.

- GlaxoSmithKline

- Johnson & Johnson

- Pfizer

- Amgen

- Bayer

- Zydus Cadila

- Sun Pharmaceutical Industries

- Intas Pharmaceuticals

- Mylan

Key Target Audience

- Pharmaceutical Companies

- Healthcare Providers

- Medical Retailers

- Hospitals and Healthcare Institutions

- Insurance Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health and Family Welfare, FDA)

- Non-Governmental Organizations (NGOs)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India GLP-1 Receptor Agonist Market. This encompasses a blend of healthcare professionals, pharmaceutical manufacturers, and patient advocacy groups. Comprehensive desk research employing secondary databases is utilized to gather extensive information about market dynamics, trends, and stakeholder motivations.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the India GLP-1 Receptor Agonist Market. This includes assessing the penetration levels of GLP-1 drugs, evaluating patient ratios, and their impact on revenue generation. A thorough investigation into service quality metrics is conducted to ensure accuracy and reliability in our revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed in previous steps will be validated through a series of interviews and surveys with industry experts, including healthcare practitioners and pharmaceutical executives. These consultations will yield critical qualitative insights that help refine the data, revealing operational dynamics and financial realities.

Step 4: Research Synthesis and Final Output

The final phase includes engaging with multiple manufacturers and healthcare providers to acquire insights regarding product performance, patient preferences, and sales data. This real-world engagement serves to cross-verify data obtained from earlier phases and hollow out an accurate, validated analysis of the India GLP-1 Receptor Agonist Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics and Genesis

- Timeline of Major Players

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Incidence of Diabetes and Obesity

Increasing Awareness of GLP-1 Therapies - Market Challenges

Pricing Pressures from Generic Drugs

Regulatory Hurdles - Opportunities

Emerging Demand for Personalized Medicine

Advancements in Drug Delivery Systems - Trends

Shift Towards Combination Therapies

Innovations in Formulations - Government Regulations

Policy Changes Impacting Drug Approvals - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Drug Class (In Value %)

Long-acting Agonists

– Dulaglutide

– Semaglutide

– Albiglutide

Short-acting Agonists

– Exenatide (twice daily)

– Lixisenatide

Combination Therapies

– GLP-1 + Basal Insulin

– GLP-1 + SGLT2 Inhibitors

– GLP-1 + Metformin - By Therapeutic Area (In Value %)

Type 2 Diabetes Mellitus

– First-line injectable therapy

– Second-line add-on after oral therapy failure

Obesity Management

– Non-diabetic patients with BMI >30

– Diabetic patients with comorbid obesity - By Distribution Channel (In Value %)

Hospital Pharmacies

– Tertiary care hospitals

– Endocrinology centers

Retail Pharmacies

– Independent chemists

– Chain pharmacy outlets (e.g., Apollo, MedPlus)

Online Pharmacies

– 1mg

– Netmeds

– PharmEasy - By Region (In Value %)

North Region

West Region

South Region

East Region - By Patient Type (In Value %)

Adult Population

– Aged 18–60 years

– Elderly (>60 years)

Pediatric Population

– Adolescents (10–17 years)

– Off-label or clinical trial-based use

- Market Share of Major Players by Value/Volume, 2024

Market Share by Drug Class, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Product Pipeline, Revenues, Revenues by Therapy/Indication, Distribution Network, Regulatory Compliance & Approvals, Innovation Capacity, Manufacturing Capabilities, Geographic Footprint, Strategic Collaborations and Licensing Deals, Unique Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Novo Nordisk

AstraZeneca

Eli Lilly and Company

Sanofi

Boehringer Ingelheim

Merck & Co.

GlaxoSmithKline

Johnson & Johnson

Pfizer

Amgen

Bayer

GSK

Abbott

Zydus Cadila

Sun Pharmaceutical Industries

- Market Demand and Utilization Patterns

- Budget Allocations for Healthcare

- Compliance and Regulatory Considerations

- Patient Needs, Desires, and Pain Points

- Decision-Making Process for Therapies

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030