Market Overview

As of 2024, the India gold mining market is valued at USD 215.5 Billion, with a growing CAGR of 3.6% from 2024 to 2030. This valuation is driven by the increasing demand for gold as a safe-haven investment, especially during economic uncertainties. Additionally, the country’s thriving jewelry industry contributes significantly to gold consumption, making gold mining a critical sector in India’s economy. The market is expected to continue growing as consumer preferences shift toward investing in gold as a stable asset.

The dominant regions for gold mining in India include Rajasthan and Karnataka. Rajasthan is known for its rich mineral resources, particularly the Kolar Gold Fields, which have historical significance and substantial gold deposits. Karnataka follows closely due to its favourable geological conditions and existing mining infrastructure. Additionally, the government’s focus on promoting domestic mining through supportive policies enhances the appeal of these regions.

Market Segmentation

By Mining Method

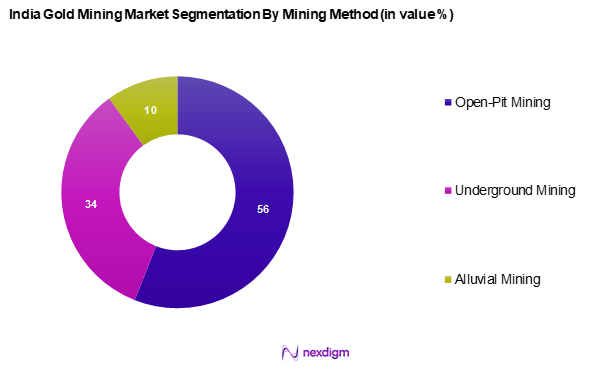

The India gold mining market is segmented into open-pit mining, underground mining, and alluvial mining. Open-pit mining currently dominates this segment due to its cost-effectiveness and the ability to extract large volumes of gold at a lower operational cost. This method is advantageous for large deposits located near the surface, making it attractive for miners looking to maximize output and profitability.

By Application

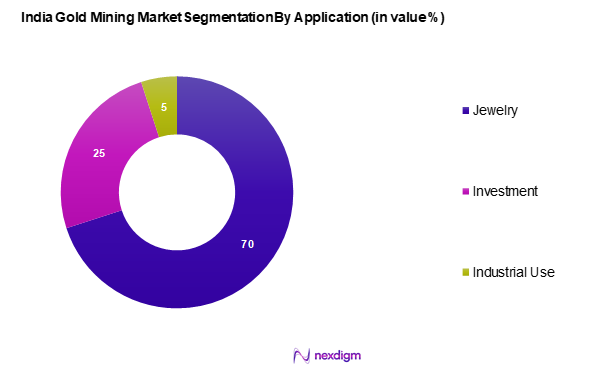

The India gold mining market is segmented into jewelry, investment, and industrial use. Jewellery holds the largest market share, primarily driven by cultural significance and rising consumer disposable income. The demand for gold jewelry remains robust, particularly during festivals and weddings, making it a staple in Indian households. The cultural affinity for gold as a gift item and its status as an investment drive this segment’s continued growth.

Competitive Landscape

The India gold mining market is dominated by several major players, including multinational corporations and local firms. Key players such as Vedanta Resources, Tata Gold Mining, and Hindustan Zinc Limited showcase the competitive landscape of the market. These companies leverage technological advancements and robust distribution networks to maintain influence within the domain.

| Major Player | Establishment Year | Headquarters | Market Share | Mining Capacity | Production Volume | Region Focus |

| Vedanta Resources | 1976 | Maharashtra, India | – | – | – | – |

| Tata Gold Mining | 1995 | Maharashtra, India | – | – | – | – |

| Hindustan Zinc Limited | 1966 | Rajasthan, India | – | – | – | – |

| Ratan Gold Refineries | 1920 | West Bengal, India | – | – | – | – |

| Deccan Gold Mines Ltd. | 2003 | Karnataka, India | – | – | – | – |

India Gold Mining Market Analysis

Growth Drivers

Rising Demand for Gold Jewelry

The Indian gold mining market benefits significantly from the strong cultural affinity for gold jewelry, which continues to dominate consumer preferences. Gold plays an essential role in traditional and ceremonial occasions, such as weddings and religious festivals, which consistently boosts its demand throughout the year. This sustained popularity is further supported by rising urbanization, a growing middle class, and the expansion of organized retail channels, making gold more accessible across diverse consumer segments. The upward trajectory in household incomes is also contributing to higher discretionary spending, reinforcing gold’s position as a symbol of wealth, prosperity, and social status.

Increasing Investment in Gold as a Safe-Haven Asset

Gold remains a favored asset for Indian investors, particularly during times of economic uncertainty and inflationary pressures. As a trusted store of value, it offers a hedge against currency fluctuations and financial volatility. With broader geopolitical instability and economic concerns influencing investor sentiment, gold has gained renewed importance as a secure investment avenue. This shift is evident in the increasing preference for gold-backed instruments and physical holdings, reflecting the nation’s longstanding tradition of preserving wealth through gold ownership.

Market Challenges

Environmental and Sustainability Concerns

The Indian gold mining industry is increasingly challenged by environmental scrutiny and growing sustainability expectations. Mining activities are often linked to ecological degradation, including deforestation, biodiversity loss, and soil erosion. These concerns are heightened by unpredictable climatic conditions that affect mining operations, particularly during the monsoon season. Stricter environmental regulations and the need for detailed impact assessments have introduced procedural delays and compliance burdens. Furthermore, rising environmental consciousness among stakeholders and investors is compelling mining companies to adopt more sustainable practices, adding operational complexity to an already challenging landscape.

Regulatory Compliance Issues

Navigating India’s multifaceted regulatory environment presents significant hurdles for gold mining companies. The process of acquiring mining licenses and land permissions is time-consuming and often involves navigating overlapping jurisdictional requirements. Many projects face prolonged delays due to bureaucratic inefficiencies and evolving policy frameworks. Non-compliance risks, coupled with the complexity of legal and administrative procedures, deter rapid expansion and discourage new entrants. This regulatory uncertainty contributes to a cautious approach among market players, often slowing innovation and reducing the pace of exploration and development.

Opportunities

Technological Advancements in Mining

The adoption of advanced mining technologies offers promising prospects for the Indian gold mining sector. Innovations such as automation, artificial intelligence, and smart data analytics are revolutionizing traditional mining processes. These advancements not only enhance productivity and operational efficiency but also improve worker safety and environmental performance. Government initiatives encouraging local manufacturing and innovation further support technological integration. As companies invest in modernizing their operations, the sector is poised to benefit from improved recovery rates and cost optimization, paving the way for sustainable long-term growth.

Growth in Export Markets

India’s expanding role in global trade presents a valuable opportunity for the gold mining industry to tap into international markets. The country’s reputation for high-quality gold processing, combined with strategic trade agreements and export incentives, is positioning it as a key supplier in the global value chain. Emerging export-oriented infrastructure, including specialized units for gold refining and processing, is enhancing production efficiency and output. Strengthening trade relationships with gold-importing nations further opens avenues for sustained export growth, boosting the sector’s contribution to the national economy.

Future Outlook

Over the next five years, the India gold mining market is expected to show significant growth driven by rising consumer demand for gold jewelry and increasing investments in gold as a hedge against inflation. The sector will likely benefit from advancements in mining technologies and favorable government policies aimed at promoting domestic gold production. These factors, combined with sustained interest in gold as a long-term investment, will support market expansion and attract international investments.

Major Players

- Vedanta Resources

- Tata Gold Mining

- Hindustan Zinc Limited

- Deccan Gold Mines Ltd.

- Malabar Gold and Diamonds

- Goldstone Technologies Ltd.

- Alliance Minerals

- Auroch Minerals

- Shree Ram Minerals

- NMDC Limited

- Ratan Gold Refineries

- Jaipur Gold

- Ashoka Gold Mines

- Kauffman and Sons Mining

Key Target Audience

- Gold Mining Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Mines, Geological Survey of India)

- Jewelry Manufacturers and Retailers

- Financial Institutions and Banks

- Mining Equipment Suppliers

- Environmental and Sustainability Consultancies

- Trade Associations and Industry

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India gold mining market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including mining techniques, investment trends, consumer behavior, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India gold mining market. This includes assessing market penetration, the ratio of mining operations to gold production, and the resultant revenue generation. Furthermore, an evaluation of operational efficiency statistics will be conducted to ensure the reliability and accuracy of the revenue estimates and to identify key performance metrics utilized by leading players in the industry.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies within the gold mining sector. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data obtained through earlier research phases.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple gold mining firms to acquire detailed insights into production techniques, market trends, and consumer preferences. This interaction will serve to verify and complement the statistics derived from a bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India gold mining market. Additionally, this synthesis will help highlight potential areas for future growth and investment opportunities.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Demand for Gold Jewelry

Increasing Investment in Gold as Safe-Haven Asset - Market Challenges

Environmental and Sustainability Concerns

Regulatory Compliance Issues - Opportunities

Technological Advancements in Mining

Growth in Export Markets - Trends

Shift Toward Sustainable Mining Practices

Increase in Recycling of Gold - Government Regulations

Mining Licenses and Permitting

Environmental Impact Assessments - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price of Gold, 2019-2024

- By Mining Method

Open-Pit Mining

– Surface Blasting and Excavation

– Heap Leaching

– Truck & Shovel Operations

Underground Mining

– Cut and Fill

– Room and Pillar

– Sub-level Stoping

Alluvial Mining

– Dredging

– Panning

– Sluicing - By Region

Western Region

Southern Region

Eastern Region

Northern Region - By Grade of Ore

Low-Grade Ore

Medium-Grade Ore

High-Grade Ore - By Application

Jewelry

– Traditional Jewelry

– Designer/Contemporary Gold Jewelry

Investment

– Government-Minted Gold Coins

– Bullion Bars

– Digital Gold

Industry

– Electronics

– Medical

– Aerospace & Defense - By Market Structure

Organized Sector

– Government-backed operations (e.g., Hutti Gold Mines Ltd.)

– Licensed private sector miners

– Compliance with safety and environmental norms

Unorganized Sector

– Small-scale illegal/unauthorized operations

– Informal labor and limited mechanization

– Low recovery rates and high environmental impact

- Market Share of Major Players by Value and Volume

Analysis of Major Players by Region - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths & Weaknesses, Organizational Structure, Revenues, Competitor Differentiation, Distribution Channels, Market Reach, and Technological Capabilities)

- SWOT Analysis of Major Players

- Pricing Analysis Based on Gold Types for Major Players

- Detailed Profiles of Major Companies

Vedanta Resources

Tata Gold Mining

Hindustan Zinc Limited

Deccan Gold Mines Ltd.

Kolar Gold Fields

Goldstone Technologies Ltd.

Alliance Minerals

Auroch Minerals

Shree Ram Minerals

NMDC Limited

Malabar Gold and Diamonds

Ratan Gold Refineries

Jaipur Gold

Ashoka Gold Mines

Kauffman and Sons Mining

- Market Demand and Utilization Trends

- Consumer Preferences and Budget Allocations

- Compliance and Regulatory Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process for Investments

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030