Market Overview

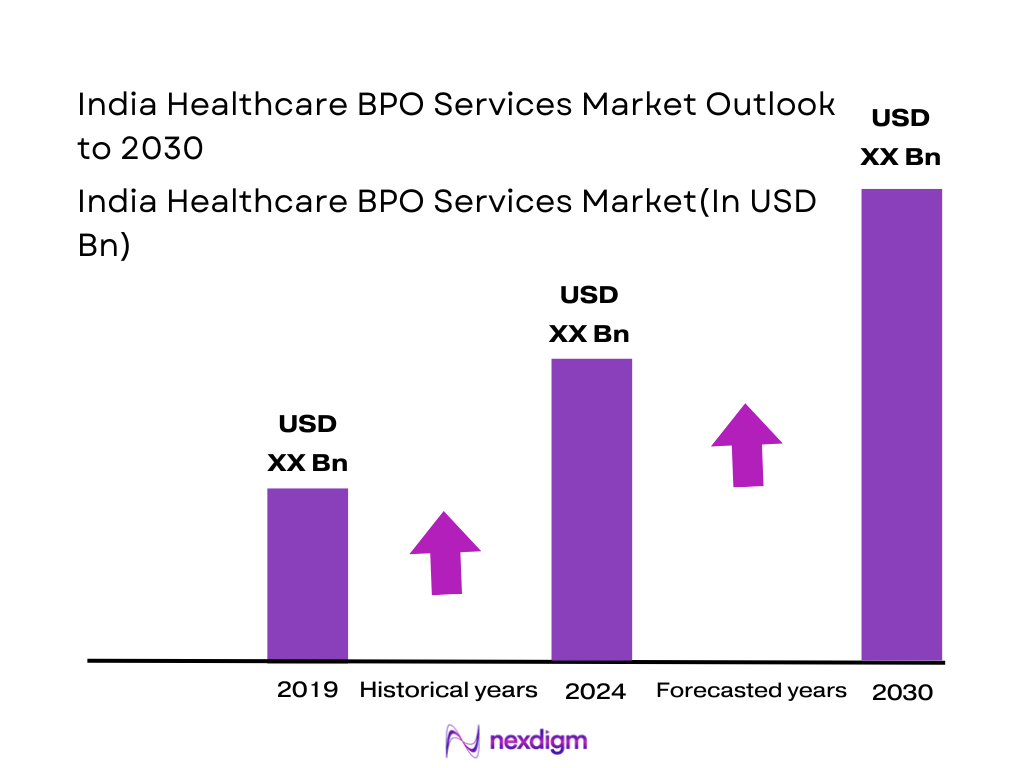

The India Healthcare BPO Services Market is valued at around USD ~ billion, within a wider domestic healthcare industry worth about USD ~ billion. Health expenditure represents roughly 1.9% of GDP, and current health spending per capita is close to USD 80. Combination of a large care-delivery base, rising health spend and a mature IT–BPM backbone drives demand for outsourced services in revenue cycle management (RCM), claims processing, medical coding, patient access, analytics and compliance support, as hospitals, insurers and pharma companies seek to lower administrative overheads and improve turnaround time.

The India Healthcare BPO Services Market is heavily concentrated in Bengaluru, Hyderabad, Chennai, Pune, Mumbai and Delhi-NCR, where IT–BPM exports and healthcare-focused Global Capability Centres (GCCs) are clustered. Bengaluru accounts for roughly a third of India’s GCCs, while Bengaluru and Hyderabad together capture about half of Grade A tech office leasing in top Indian cities, underlining their role as outsourcing hubs. These cities offer deep pools of medical coders, RCM specialists, data analysts and clinical documentation experts, strong healthcare ecosystems (hospital chains, diagnostics, health-tech startups) and cost-efficient office infrastructure, making them the preferred locations for both global and domestic healthcare BPO delivery.

Market Segmentation

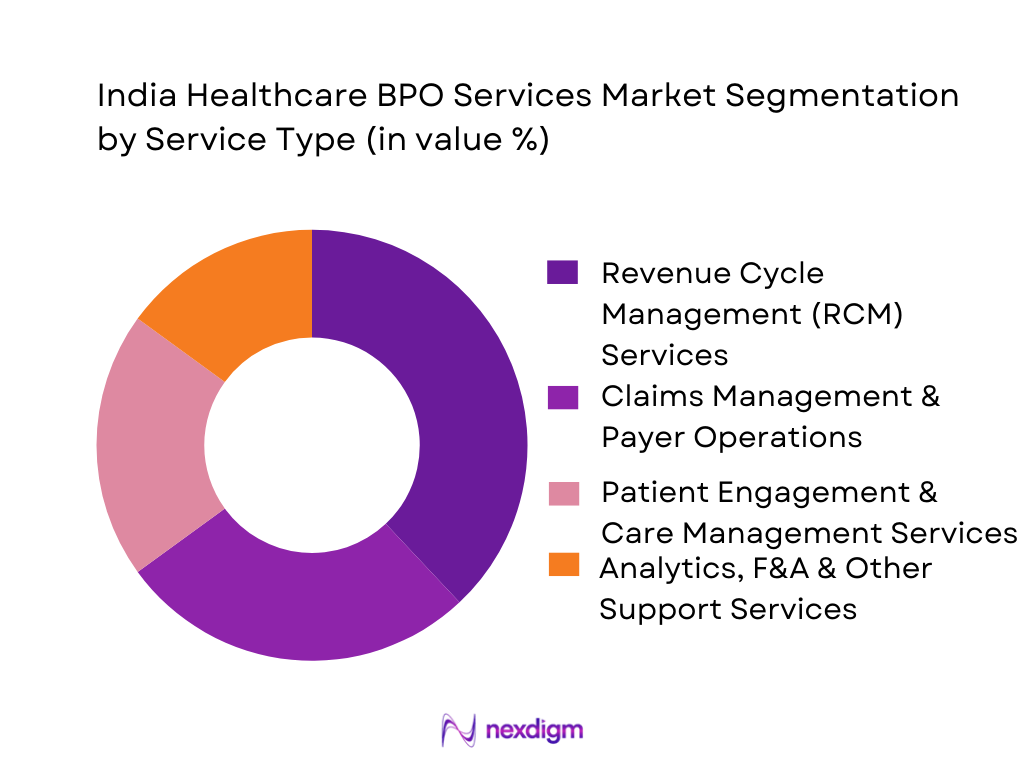

By Service Type

The India Healthcare BPO Services Market is segmented by service type into revenue cycle management services, claims management & payer operations, patient engagement & care management services, and analytics, F&A & other support services. Revenue cycle management holds a dominant share under this segmentation as Indian and global providers increasingly outsource end-to-end RCM – coding, billing, AR follow-up, denial management and cash posting – to India-based centres to address rising cost pressures and staffing shortages. Large hospital chains from North America and the Middle East tap Indian RCM specialists for 24×7 coverage, higher first-pass resolution and strong audit trails, while domestic hospitals outsource RCM to standardize collections and reduce days in accounts receivable. The availability of certified coders (CPC, CCS), strong ICD-10/DRG expertise and AI-enabled coding platforms further cements RCM as the anchor service line, often serving as the entry point for multi-tower healthcare BPO relationships.

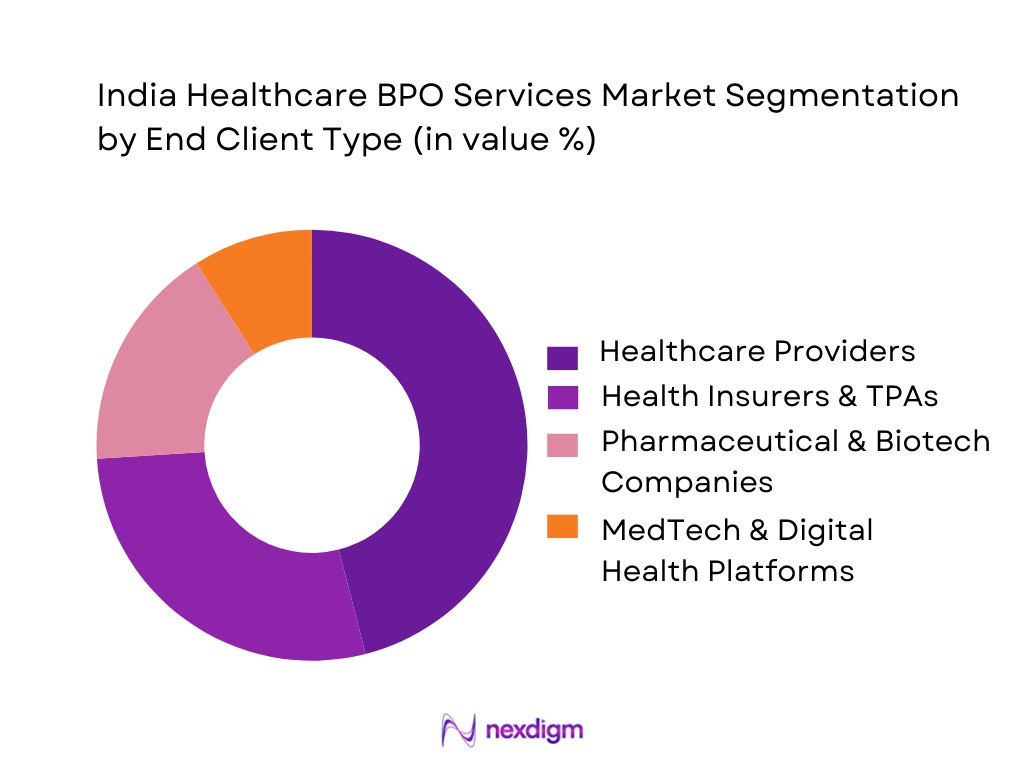

By End Client Type

The India Healthcare BPO Services Market is segmented by end client type into healthcare providers, health insurers & TPAs, pharmaceutical & biotech companies, and medtech & digital health platforms. Healthcare providers command the largest share owing to India’s sizeable hospital industry – valued at roughly USD ~ billion and projected to continue expanding, according to Invest India and NITI Aayog-linked analyses. As private multi-specialty chains, day-care centres and diagnostics networks scale, they face complex coding guidelines, payer contracting requirements and rising patient expectations on transparency and billing. Outsourcing RCM, clinical documentation improvement (CDI), prior authorization management and patient access services to specialist BPO partners in India helps providers address chronic staffing gaps, reduce claim denials and improve cash flows. Furthermore, international hospitals—particularly in the US and GCC—leverage India-based provider BPO centres as global command hubs, integrating contact centres, insurance verification, coding, billing and collections in one location.

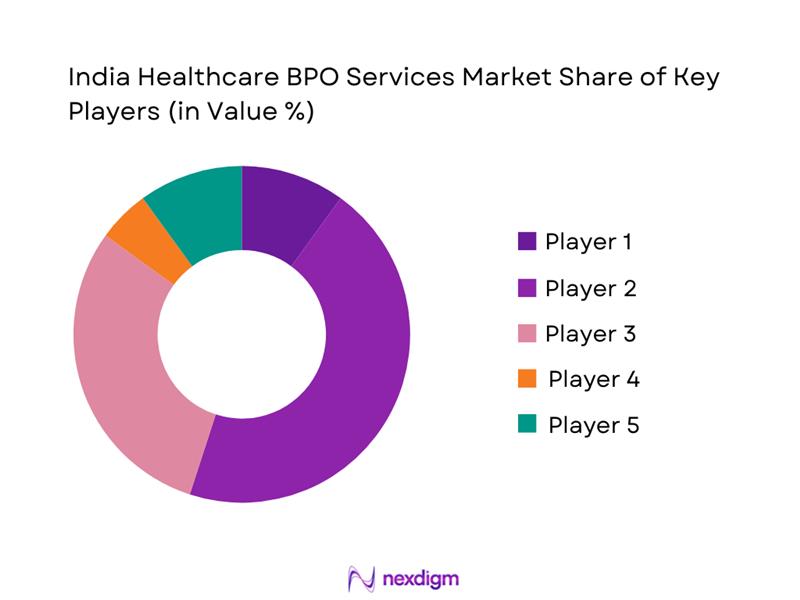

Competitive Landscape

The India Healthcare BPO Services Market features a blend of global IT–BPM majors and pure-play healthcare BPO/RCM specialists. A handful of large integrated providers – such as TCS, Infosys BPM, Cognizant and WNS – dominate multi-tower deals, bundling healthcare BPO with IT services and analytics. Alongside these, specialized firms such as Omega Healthcare, GeBBS, AGS Health and Access Healthcare focus almost exclusively on healthcare revenue cycle and clinical processes, giving them strong domain depth. Competition is increasingly driven by automation maturity, clinical credentialing of staff, compliance track record (HIPAA, HITRUST) and the ability to co-own outcomes such as denial reduction and net collections improvement, rather than pure labour arbitrage.

| Company | Establishment Year | Headquarters (Global) | India Healthcare BPO Focus (Service Mix) | Key Healthcare BPO Offerings (India Delivery) | India Delivery Hubs (Illustrative) | Technology & Automation Focus | Strategic Position in India Healthcare BPO Services |

| Tata Consultancy Services (TCS) | 1968 | Mumbai, India | ~ | ~ | ~ | ~ | ~ |

| Infosys BPM | 2002 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| WNS Global Services | 1996 | Mumbai, India | ~ | ~ | ~ | ~ | ~ |

| Cognizant | 1994 | Teaneck, New Jersey, USA | ~ | ~ | ~ | ~ | ~ |

| Omega Healthcare | 2003 | Chennai, India | ~ | ~ | ~ | ~ | ~ |

India Healthcare BPO Services Market Analysis

Growth Drivers

Global Healthcare Cost Pressure

Global public healthcare systems are under visible cost stress, which drives outsourcing of repetitive and rules-based processes to India’s healthcare BPO providers. Public healthcare spending worldwide averaged 3.8% of GDP in 2022, up from 3.5% before the pandemic, according to data compiled from WHO health expenditure statistics. In India, total health expenditure reached 3.83% of GDP in 2021-22, with government health expenditure alone accounting for 1.84% of GDP and 48% of total health spending, indicating a rapid shift of more fiscal resources into health but also highlighting pressure on budgets to contain non-clinical costs. As policymakers expand coverage under schemes such as PM-JAY, which targets over 12 crore families (about 55 crore beneficiaries) with a defined cover for secondary and tertiary care, international payers and providers seek offshore partners in India to manage claims, utilisation review and back-office functions more efficiently while keeping clinical capacity focused on patient care.

Provider & Payer Margin Compression

India’s movement towards universal health coverage is expanding volumes faster than public and private reimbursements, compressing margins for hospitals and insurers and strengthening the case for healthcare BPO partnerships. National Health Accounts data show total health expenditure of 3.83% of GDP in 2021-22, with current health expenditure forming 87.32% of this and capital only 12.68%, underscoring how operating costs dominate provider P&Ls. At the same time, government schemes are covering more lives – 55 crore individuals covered under ~ crore health insurance policies in 2022-23, in addition to about 55 crore beneficiaries eligible under PM-JAY. While this reduces catastrophic out-of-pocket spending, it also intensifies pressure on both public and private payers to manage administrative ratios tightly, pushing them to outsource large parts of claims adjudication, member services, medical coding, provider data management and pre-authorization workflows to specialized Indian healthcare BPO hubs.

Market Challenges

Wage Inflation & Attrition

Although India remains a cost-competitive destination, wage dynamics in the broader IT-BPM sector are tightening, putting pressure on healthcare BPO margins and retention. NASSCOM’s Strategic Review indicates that India’s technology sector added around 2.9 lakh employees in FY23, taking the total IT-BPM workforce to about ~ million, with the IT services and BPO/ITeS segment alone estimated at ~ million direct employees in FY23. Global real wage growth, after contracting in 2022, turned positive again in 2023 and the first half of 2024, with global real wages increasing by 2.7% in 2024, according to the ILO Global Wage Report, signalling renewed wage pressures in many emerging markets that compete for the same digitally skilled talent pool. At the same time, Indian formal employment creation was strong, with EPFO payroll data showing ~ million net new formal jobs in 2023-24, up from ~ million in 2022-23, tightening the labour market in high-skill urban clusters where healthcare BPO centres operate. These trends collectively raise salary benchmarks and attrition risk for medical coders, claims adjudicators, and clinical documentation specialists in India.

Currency Volatility

Healthcare BPO revenues are largely denominated in foreign currencies, particularly USD, while costs are rupee-linked, making currency swings a key operational challenge. Trading Economics data show the USD/INR exchange rate at about 90.26 on 8 December 2025, following a one-month weakening of around 1.75% in the rupee, and recent RBI reference rate archives underscore sustained volatility around multi-year lows. A recent policy cycle saw the RBI repeatedly cutting the repo rate to 5.25% while simultaneously using forex swaps and bond purchases worth ₹ ~ trillion and $ ~ billion to stabilise markets, highlighting the degree of intervention required to manage currency movements. For India-based healthcare BPO centres serving US, UK and GCC payers, such fluctuations can significantly alter realised margins and pricing benchmarks on long-term contracts, forcing firms to invest in hedging strategies, diversified currency exposure and dynamic pricing models to maintain profitability.

Opportunities

End-to-End RCM Transformation Deals

The scale and complexity of India’s financing architecture – combining large government schemes, private health insurance, corporate coverage and out-of-pocket spending – creates a strong case for end-to-end revenue cycle management (RCM) outsourcing to India. National Health Accounts show total health expenditure at 3.83% of GDP in 2021-22, with government health expenditure covering 48% of that, and per-capita health spending at Rs 6,602, confirming a sizeable, centrally mediated payment flow. Report cites 55 crore lives covered under ~ crore health policies, while PM-JAY targets over 12 crore families with up to Rs ~ lakh annual coverage per family, together representing hundreds of millions of transactions annually that require eligibility checks, coding, claims adjudication, denial management and analytics. Meanwhile, ABDM’s 71.16 crore ABHA IDs and 45.99 crore linked records provide digital rails for automating documentation, prior-authorization and utilisation review. These fundamentals underpin large, multi-year RCM transformation mandates where global and Indian payers and hospital chains can outsource full revenue cycles – from patient access to payment posting – to integrated healthcare BPO platforms in India.

Clinical & High-Acuity BPO Services

India’s expanding clinical infrastructure and digital health datasets enable a shift from purely transactional work towards higher-acuity healthcare BPO services such as clinical documentation improvement, remote care coordination, medical review and analytics. Under Ayushman Bharat, government data show ~ crore screenings for non-communicable diseases (hypertension, diabetes, and common cancers) conducted at Health and Wellness Centres by March 2024, alongside 3.22 crore wellness sessions, creating rich longitudinal clinical datasets for secondary use. ABDM has generated over ~ crore ABHA IDs, ~ lakh registered health facilities and ~ crore linked health records, giving BPO providers access (under strict consent) to standardized, coded clinical information. On the workforce side, the IT-BPM sector employs about ~ million professionals, and more than ~ million work in global capability centres, creating a large, tech-savvy pool that can be upskilled into clinical data management roles. These structural enablers support growth in complex services such as chronic-care management, population-health analytics, clinical trial support, pharmacovigilance and tele-ICU coordination for clients in the US, UK, EU and the GCC, moving India’s healthcare BPO industry up the value chain.

Future Outlook

The India Healthcare BPO Services Market is estimated at around USD ~ billion in 2024, under a scope that spans payer, provider and life-sciences outsourcing streams. The same study expects the market to reach about USD ~ billion by 2033 at a CAGR of 7.6% for 2025–2033. To frame a 2024–2030 outlook that is consistent with this trajectory, this report assumes a similar CAGR of roughly 7.6% for the mid-term, implying that the India healthcare BPO market could expand to around USD ~ billion by 2030 under a conservative scenario. Upside potential exists if domestic health insurance penetration, hospital consolidation and digital health adoption accelerate faster than base-case assumptions, and if India continues to capture a larger share of global healthcare BPO deals shifting from traditional locations.

Major Players

- Tata Consultancy Services

- Infosys BPM

- WNS Global Services

- Cognizant Technology Solutions

- Accenture

- Genpact

- HCLTech

- Tech Mahindra

- Omega Healthcare

- GeBBS Healthcare Solutions

- AGS Health

- Access Healthcare

- Hinduja Global Solutions

- Firstsource Solutions

Key Target Audience

- Multi-specialty hospital chains and healthcare provider networks

- Standalone hospitals and regional healthcare groups

- Health insurers and Third-Party Administrators (TPAs)

- Pharmaceutical and biotech companies

- MedTech, digital health and health-tech platform companies

- Investments and venture capitalist firms

- Government and regulatory bodies

- Large corporate employer groups and benefits administrators

Research Methodology

Step 1: Identification of Key Variables

The initial step involves developing an ecosystem map of the India Healthcare BPO Services Market, covering payers, providers, life-sciences companies, specialist RCM firms, IT–BPM majors and regulatory institutions. This is grounded in extensive desk research using industry databases, NASSCOM and IBEF publications, World Bank/WHO health expenditure data and healthcare BPO market reports. The objective is to define critical variables such as outsourcing penetration by function, cost-of-service differentials, deal sizes, regulatory constraints and technology adoption levels that shape market behaviour.

Step 2: Market Analysis and Construction

In this phase, we compile and analyse historical revenue data and forecast tables for India within global healthcare BPO studies alongside IT–BPM sector statistics from NASSCOM and Invest India. We examine trends in payer and provider outsourcing, GCC build-outs, RCM demand and pharma KPO activities, triangulating top-down estimates (share of India in global healthcare BPO) with bottom-up indicators (number of large contracts, headcount, delivery-centre expansion). Service-line and client-type splits are then constructed to build an internally consistent India market model.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses on growth drivers, pricing trends, service mix evolution and competitive positioning are validated through interviews or structured questionnaires with stakeholders such as hospital CFOs, RCM heads, BPO delivery leaders, GCC site heads and health insurers. Wherever feasible, we leverage computer-assisted telephone/virtual interviews (CATIs/CAWIs) and industry webinars to gather operational and financial insights. These inputs help refine assumptions on average revenue per FTE, transition timelines, SLA constructs, automation levels and client retention, ensuring that the India Healthcare BPO Services Market estimates and forecasts reflect on-ground reality rather than purely model-driven projections.

Step 4: Research Synthesis and Final Output

The final step synthesizes quantitative modelling and qualitative insights into a structured narrative covering market size, segmentation, competitive landscape and forward-looking scenarios. Cross-checks are performed by benchmarking India’s healthcare BPO metrics against overall healthcare sector size, IT–BPM exports and health-spending trends to confirm plausibility. The output is then formatted into decision-oriented sections and exhibits tailored for business professionals—investors, CXOs of BPOs, provider and payer leadership—highlighting addressable opportunity, white spaces (e.g., value-based care support, risk-sharing RCM models) and strategic moves required to capture growth in the India Healthcare BPO Services Market.

- Executive Summary

- Research Methodology (Market Definitions & Service Taxonomy, Inclusion–Exclusion Criteria, Data Triangulation Approach, Top–Down & Bottom–Up Sizing Methods, Primary Interview Split (Payers, Providers, Life Sciences, Vendors), Secondary Data Sources, Assumptions & Normalization Logic, Forecasting Framework, Study Limitations)

- Definition and Scope of India Healthcare BPO Services

- Evolution of Healthcare Outsourcing in India

- India’s Position in the Global Healthcare BPO Landscape

- Business Cycle, Investment Phases and Margin Cyclicality

- Stakeholder, Supply Chain and Value Chain Mapping

- Growth Drivers

Global Healthcare Cost Pressure

Provider & Payer Margin Compression

Shift from Capex to Opex

Standardization of Administrative Workflows

Digital Health & Telehealth Expansion - Market Challenges

Wage Inflation & Attrition

Currency Volatility

Data Privacy & Cybersecurity Risk

Regulatory Compliance Burden

IP & Confidentiality Concerns - Opportunities

End-to-End RCM Transformation Deals

Clinical & High-acuity BPO Services

Analytics & Decision Support Pods

Domestic India Healthcare BPO Opportunity

Platform-led BPaaS Models - Trends

AI, NLP and Computer-assisted Coding Adoption

Generative AI in Documentation & Coding

RPA & Intelligent Workflows

Omni-channel Patient/Member Engagement

Self-service & Digital Front Door - Regulatory and Policy Landscape

- Technology & Automation Landscape

- ESG and Sustainability Considerations

- Porter’s Five Forces Analysis

- Risk Assessment and Mitigation Framework

- Stakeholder Ecosystem Mapping

- By Value, 2019-2024

- By Transaction Volume, 2019-2024

- By FTEs, Seat Capacity and Delivery Centers, 2019-2024

- By Active Clients and Contracts, 2019-2024

- By Service Type (in Value %)

Revenue Cycle Management

Claims Management

Health Information Management & Medical Coding

Patient/Member Contact Center

Clinical & Pharmacovigilance Services - By Client Type (in Value %)

Health Plans & Payers

TPAs & PBMs, Hospitals & Health Systems

Physician Groups & Clinics

Life Sciences

Health-tech & Digital Health Platforms - By Service Cluster (in Value %)

Payer BPO Services

Provider BPO / RCM Services

Life Sciences BPO Services

Cross-vertical Shared Services - By Delivery Model (in Value %)

Pure Offshore

Nearshore + Offshore Hybrid

Onshore + Offshore Hybrid

Virtual/Work-from-Home Delivery

BOT & Captive Build Models - By Contract & Pricing Model (in Value %)

FTE-based Contracts

Transaction-based

Outcome-based & Risk–Reward Models

Gainshare & Hybrid Models

BPaaS and Platform-led Engagements - By Provider Type (in Value %)

Global IT–BPM Majors

Specialized Healthcare BPO Providers

Mid-size India-focused Players

Captive In-house Centers

Niche Tech-first Healthcare BPO Startups - By Delivery Region and City Cluster within India (in Value %)

South India Delivery Hubs

West India Hubs

North India Hubs

East & Central Hubs

Tier-2/3 City Penetration

- Market Share of Major Players

Market Share of Major Players by Service Cluster - Cross Comparison Parameters (Service Portfolio Breadth in Healthcare BPO, India Healthcare BPO Revenue Scale, Healthcare FTE & Delivery Footprint in India, Payer–Provider–Life Sciences Revenue Mix, Digital & Automation Maturity Index, Onshore–Offshore–Nearshore Delivery Mix, Compliance & Certification Depth (HIPAA/ISO/SOC etc.), Client Concentration, Retention and Deal Tenure Metrics)

- Strategic Positioning Matrix of Key Players

- Pricing and Commercial Benchmarking

- Detailed Profiles of Major Companies

Tata Consultancy Services (TCS)

Infosys BPM

Wipro Limited

Cognizant

Accenture

Genpact

WNS Global Services

HCLTech

Tech Mahindra

Teleperformance

EXL Service

Omega Healthcare

Hinduja Global Solutions

GeBBS Healthcare Solutions

- Health Plans, Payers and TPAs

- Hospitals, Health Systems and Provider Groups

- Physician Groups, Clinics and Ambulatory Care Providers

- Life Sciences, Pharma, Biotech and MedTech Clients

- Health-tech, Insurtech and Digital Health Platforms

- By Value, 2025-2030

- By Transaction Volume, 2025-2030

- By FTEs, Seat Capacity and Delivery Centers, 2025-2030

- By Active Clients and Contracts, 2025-2030