Market Overview

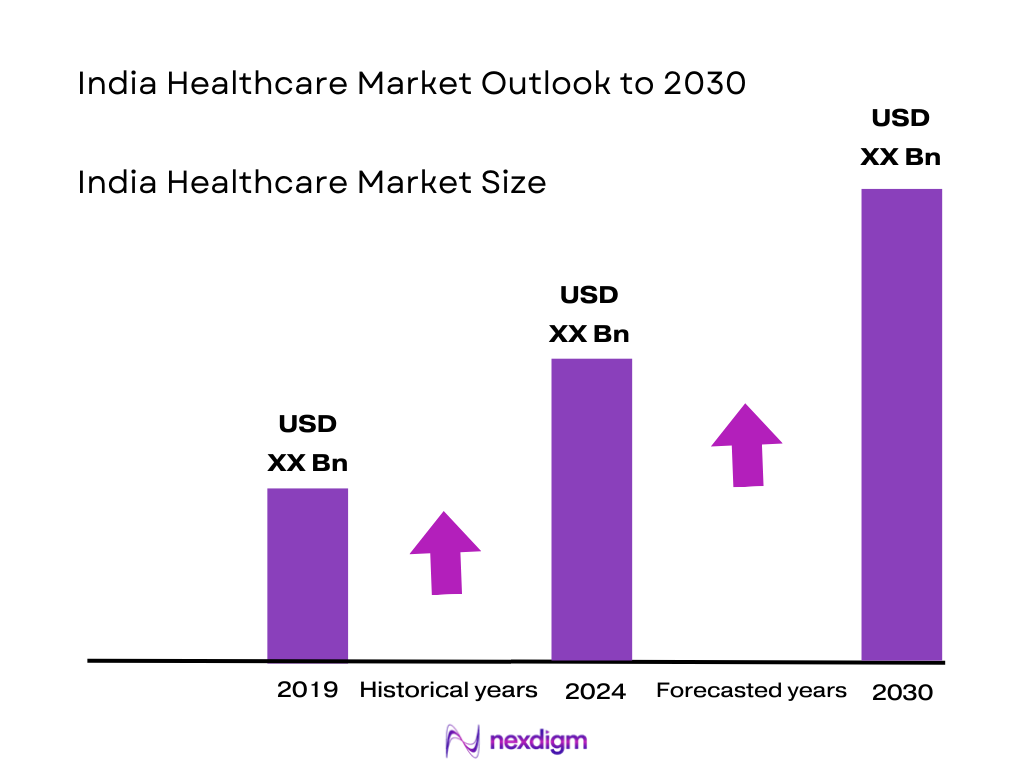

The India healthcare market is valued at approximately USD 180 billion as of 2024, with growth continuing into 2024 as healthcare expenditure accelerates across service lines. This sizeable valuation is driven by expanding hospital infrastructure, rising non‑communicable disease treatment demand, growth in health insurance uptake, and robust digital transformation across diagnostics and healthtech segments.

India’s healthcare landscape is predominantly driven by metropolises such as Mumbai, Delhi‑NCR, Bangalore, Chennai, and emerging secondary cities. These urban centres dominate due to highly advanced private hospital networks, concentrated medical expertise, superior medical infrastructure, and significant inflow of medical tourists, particularly to Chennai, often dubbed the “healthcare capital of India”.

Healthcare innovation (healthtech, pharma services, medtech, CRO/CDMO) is growing robustly, signaling double‑digit expansion. The digital health segment is on a steep growth trajectory with a 24.4 % CAGR from 2025 to 2030. Healthcare analytics is expected to expand at 25.01 % CAGR from 2025–2030. The pharmaceutical industry is projected to reach USD 130 billion by 2030 from USD 50 billion in FY 2023–24. Taken together, these imply a high‑teens CAGR (approx. 18 %‑20 %) for the overall India healthcare market over 2024–2030, driven by digital transformation, pharma exports, private healthcare expansion, and healthtech investments.

Market Segmentation

By Service Type

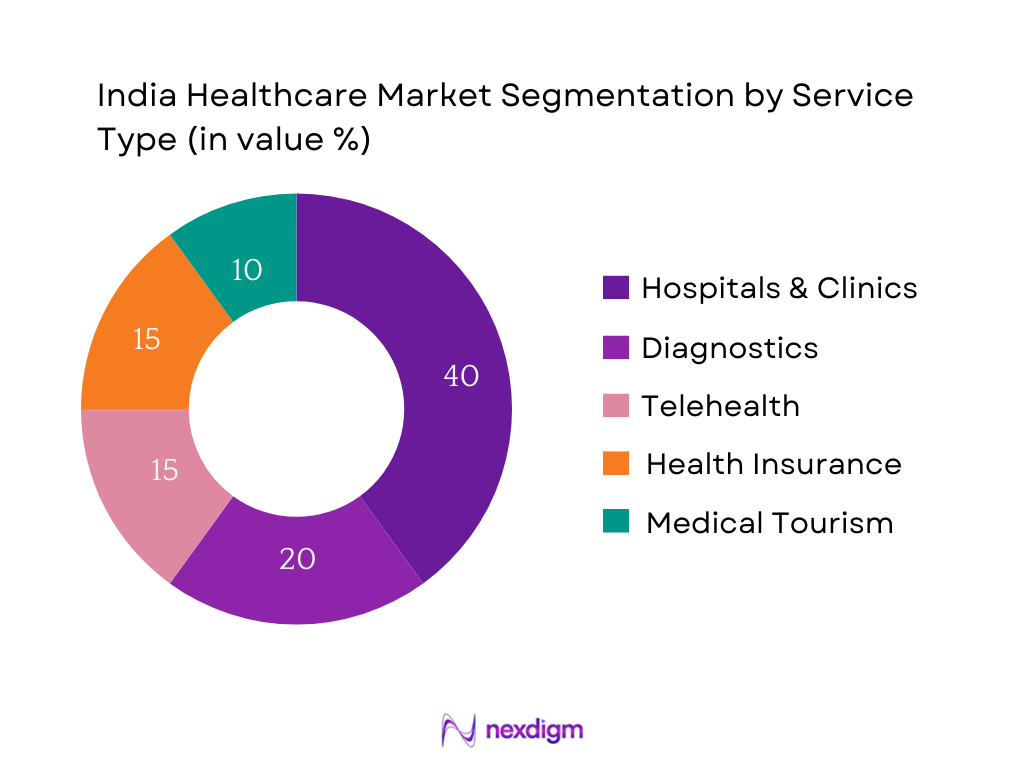

The India healthcare market is segmented into hospitals & clinics, diagnostics, tele‑healthcare, health insurance, and medical tourism. Among these, hospitals & clinics hold a dominant 40 % share. This dominance stems from the extensive growth of private hospital chains (Apollo, Fortis, etc.), continued urbanization, and strong patient inflow due to affordable tertiary care services. Expanding insurance penetration and medical tourism reinforce hospital demand, especially in metro hubs.

By Provider Type

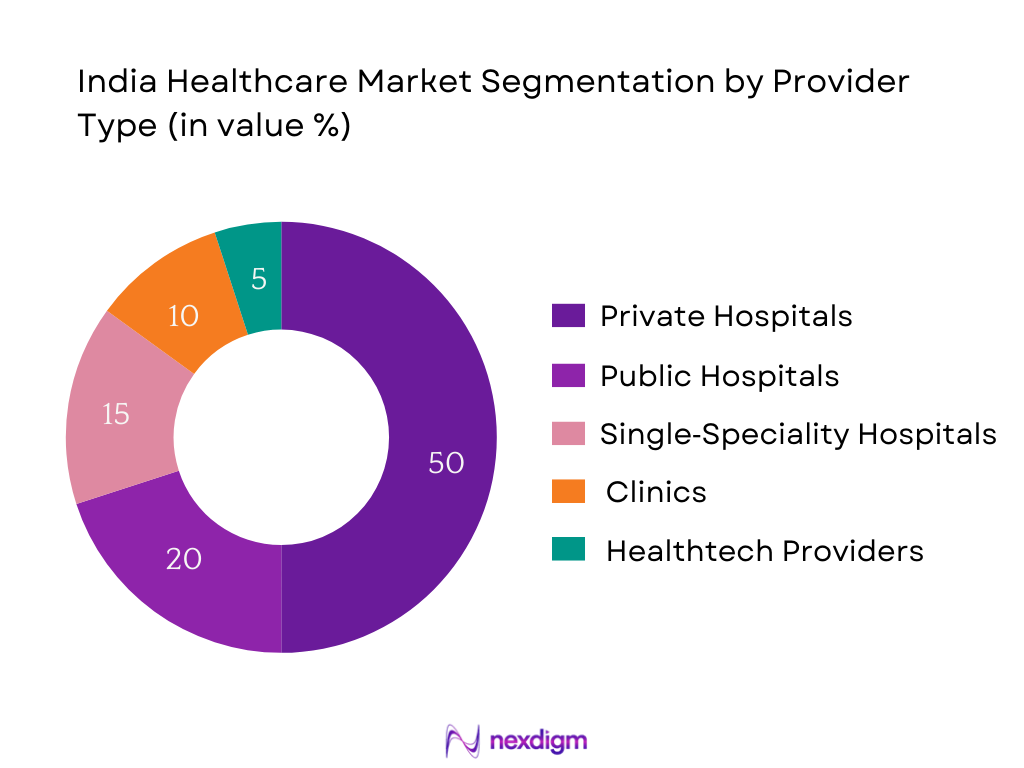

The market is segmented into private hospitals, public hospitals, single‑speciality hospitals, clinics, and healthtech providers. Private hospitals dominate with 50 % share, thanks to their scale, greater investment, advanced infrastructure, and consumer trust. Single‑speciality hospitals are rapidly growing (~15 %) driven by private equity infusion and unmet demand in tier‑2/tier‑3 towns. Public hospitals and smaller clinics, while widely distributed, face infrastructure and quality gaps. Healthtech providers, though emerging, hold a small yet fast‑growing niche.

Competitive Landscape

India’s healthcare market is highly concentrated among a set of powerful players, including leading hospital chains, diagnostic networks, pharma manufacturers, and healthtech innovators. Consolidation is accelerating, notably through private equity investments in hospital and medtech chains, underscoring the influence of major incumbent players.

| Company | Establishment Year | Headquarters | Number of Beds/Facilities | Digital Penetration (EHR/Telehealth) | Specialty Focus / Segment | Accreditation | Private Equity Backing |

| Apollo Hospitals | 1983 | Chennai | – | – | – | – | – |

| Fortis Healthcare | 2001 | Gurugram | – | – | – | – | – |

| Max Healthcare | 2011 | Delhi‑NCR | – | – | – | – | – |

| Narayana Health | 2000 | Bangalore | – | – | – | – | – |

| Dr. Lal PathLabs | 1949 | Delhi | – | – | – | – | – |

India Healthcare Industry Analysis

Growth Drivers

Digital Health Ecosystem & NDHM Implementation

Digital health adoption is rising: telemedicine covers a growing share of care, crucial for the 70 % rural population, where physical access is constrained. Telemedicine platforms are increasingly used to bridge that gap. Investments such as USD 300 million in Apollo’s digital and pharmacy arm, supported by strategic VC funding, highlight the momentum behind digital healthcare infrastructure development aligned with NDHM (National Digital Health Mission) objectives.

Urbanization and Rising Middle‑Class Healthcare Spending

Urbanization and a burgeoning middle class are elevating healthcare demand. Although macro figures specific to the middle class are limited, World Bank data cites 3.31 % of GDP allocated to current health expenditure in 2022. This reflects increasing consumer spending power in expanding urban centers, fueling private healthcare services, insurance uptake, and elective treatments across cities.

Market Challenges

Shortage of Skilled Healthcare Professionals

Despite improvement, healthcare human resource ratios remain strained. As of February 2024, the doctor–population ratio stands at 1:834, better than the WHO benchmark of 1:1,000. There are 13,08,009 registered allopathic doctors (June 2022) and 5.65 lakh AYUSH practitioners. Nursing strength includes 3.433 million registered nurses and 1.3 million allied professionals. Although these numbers indicate improved capacity, workforce distribution continues to skew toward urban areas, leaving rural health centers understaffed.

Dependence on Out‑of‑Pocket Expenditure

India continues to face high out‑of‑pocket (OOP) spending: in 2019, OOP constituted 42 % of current health expenditure, although this share has since begun to decline with government insurance schemes. Total government health spending remains modest—2.1 % of GDP in FY 2022–23—resulting in financial burdens on individuals for care, especially outside urban centers.

Opportunities

Tier‑2 and Tier‑3 City Healthcare Investments

Investment flows indicate expanding opportunities in tier‑2 and tier‑3 cities. In 2023, overall private equity and venture capital funding into India’s healthcare and pharma sectors reached USD 5.5 billion, signifying rising investment interest in expanding infrastructure beyond metros. This capital is likely channeled into developing hospitals and diagnostics centers in secondary cities, aligning with urbanization patterns and unmet rural healthcare needs.

Growth of Preventive Health and Annual Screening Packages

While specific figures for preventive health uptake and screening packages in 2024 aren’t available, digital and private healthcare investments—such as the USD 300 million infusion into Apollo’s digital arm—suggest growing infrastructure to support preventive services. The digital platforms funded enhance health monitoring access including screening services, marking a support base for scaling preventive and wellness care pathways.

Future Outlook

Over the next six years, the India healthcare market is set for robust expansion fuelled by rising chronic disease burden, growing affordability, and accelerated adoption of digital health solutions. The convergence of strong government initiatives (such as Ayushman Bharat), increasing health insurance penetration, medical tourism growth, and global supply chain diversification (especially in pharma services and medtech) will also catalyse sector evolution. Extensive PE/VC investments, especially in single‑speciality hospitals and healthtech, suggest rising consolidation and selective digital transformation in care delivery. Furthermore, India’s pharma sector is expected to scale significantly, both through domestic consumption and exports, reinforcing the country’s position as a global healthcare powerhouse.

Major Players

- Apollo Hospitals

- Fortis Healthcare

- Max Healthcare

- Narayana Health

- Lal PathLabs

- SRL Diagnostics

- Manipal Hospitals

- Medanta – The Medicity

- HCG (Healthcare Global)

- Aster DM Healthcare

- Cloudnine Hospitals

- Rainbow Children’s Hospital

- Pristyn Care

- Biocon (Pharma / Biologics)

- Sun Pharma

Key Target Audience

- Chief Investment Officers / Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Hospital Chain Decision‑Makers (board members, strategy heads)

- Medtech and Healthtech Corporate Strategy Heads

- Private Equity Healthcare Fund Managers

- Health Insurance Company Executives

- Large Pharmaceutical Company Strategy & Export Leads

- Medical Tourism Cluster Planners & State Health Departments

Research Methodology

Step 1: Ecosystem Mapping and Secondary Research

We initiate by outlining the healthcare ecosystem—covering stakeholders across hospitals, diagnostics, pharma, healthtech, payers, and regulators—through detailed desk research, leveraging proprietary and secondary databases to delineate market structure and define variables.

Step 2: Historical Data Analysis and Market Sizing

We collect and analyze historical data (2021–2024) from credible sources—government, industry bodies, financial filings—to quantify the size, correspond services and provider segments, and assess payment models and revenue streams.

Step 3: Expert Consultations and Hypothesis Testing

Market hypotheses are refined and validated through semi‑structured interviews with industry experts across hospital chains, pharma firms, insurers, medtech companies, and regulators to corroborate assumptions and gain qualitative insights.

Step 4: Bottom‑up and Top‑down Synthesis

We consolidate bottom‑up estimations (facility counts, procedure volumes, revenue per service) and top‑down forecasts (macro health spend, policy trajectories) to ensure triangulated accuracy and readiness for strategic recommendations.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, In-Depth Industry Interviews, Primary and Secondary Research Integration, Data Triangulation, Limitations)

- Definition and Scope

- Historical Evolution of Healthcare Sector

- Healthcare Service Delivery Models in India

- Healthcare Spending Distribution (Government vs Private)

- Timeline of Key Industry Reforms (Ayushman Bharat, Digital Health Mission, etc.)

- Healthcare Ecosystem Map (Public, Private, Insurance, Pharma, Diagnostics, MedTech)

- Value Chain and Cost Chain Analysis (Prevention, Diagnosis, Treatment, Post-care)

- Healthcare Infrastructure Development Status

- Growth Drivers

Ayushman Bharat and PM-JAY Scheme Expansion

Rise in Non-Communicable Diseases

Increased Medical Tourism and Wellness Travel

Digital Health Ecosystem & NDHM Implementation

Urbanization and Rising Middle-Class Healthcare Spending - Market Challenges

Skewed Healthcare Infrastructure in Rural India

Regulatory Ambiguity and Licensing Delays

Shortage of Skilled Healthcare Professionals

Dependence on Out-of-Pocket Expenditure - Opportunities

Tier-2 and Tier-3 City Healthcare Investments

Growth of Preventive Health and Annual Screening Packages

Telemedicine and Remote Care Adoption

Public-Private Partnership Projects - Trends

Integration of AI/ML in Diagnostic Labs

Rise of Specialty and Daycare Chains

Increasing Adoption of EMR and EHR Platforms

Patient-Centric and Value-Based Care Models - Government Regulation

Clinical Establishment Acts & Compliance

NDHM and Data Protection Norms

Insurance Regulatory Framework

Foreign Direct Investment Norms in Healthcare - SWOT Analysis

- Stakeholder Ecosystem (Patients, Providers, Payers, Regulators, Pharma, MedTech)

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume (Patient Admissions, OPD Visits, Procedures, etc.), 2019-2024

- By Healthcare Coverage (Public Health, Private Health, Insurance Penetration), 2019-2024

- By Service Type (In Value %)

Inpatient Care

Outpatient Care

Emergency Services

Daycare Services

Diagnostic Services - By Payer Type (In Value %)

Out-of-Pocket Expenditure

Government Schemes (CGHS, ESI, Ayushman Bharat)

Private Insurance

Employer-Sponsored Health Plans

NGOs & Philanthropic Health Financing - By Facility Ownership (In Value %)

Public Hospitals

Private Hospitals

Not-for-Profit Hospitals

Specialty Chains

Single Specialty Clinics - By Medical Specialties (In Value %)

General Medicine

Cardiology

Oncology

Orthopedics

Obstetrics & Gynecology - By Region (In Value %)

North India

South India

West India

East India

Central India

North-East India

- Market Share Analysis

By Service Type

By Facility Ownership

By Geography - Cross Comparison Parameters (Company Overview, Geographic Presence, Number of Beds / Facilities, Service Portfolio Diversification, Digital Integration (Telemedicine, EHR, etc.), Strategic Partnerships & JV Presence, CSR Initiatives in Public Health, NABH Accreditation & Quality Certifications)

- SWOT Analysis of Leading Players

- Pricing Analysis (Consultation, Surgery, OPD Rates, Diagnostics, etc.)

- Detailed Profiles of Major Players

Apollo Hospitals

Fortis Healthcare

Max Healthcare

Narayana Health

Dr. Lal PathLabs

SRL Diagnostics

Manipal Hospitals

Medanta – The Medicity

HCG (Healthcare Global)

Aster DM Healthcare

Cloudnine Hospitals

Rainbow Children’s Hospital

Pristyn Care

Biocon (Pharma / Biologics)

Sun Pharma

- Usage Patterns and Service Uptake

- Healthcare Affordability Index Across States

- Health Insurance Adoption Trends

- Urban vs Rural Healthcare Behavior

- Telehealth Usage and Challenges

- By Value, 2025-2030

- By Volume (Procedures, Beds, Patients Treated), 2025-2030

- By Healthcare Coverage (Insured vs Non-Insured Population), 2025-2030