Market Overview

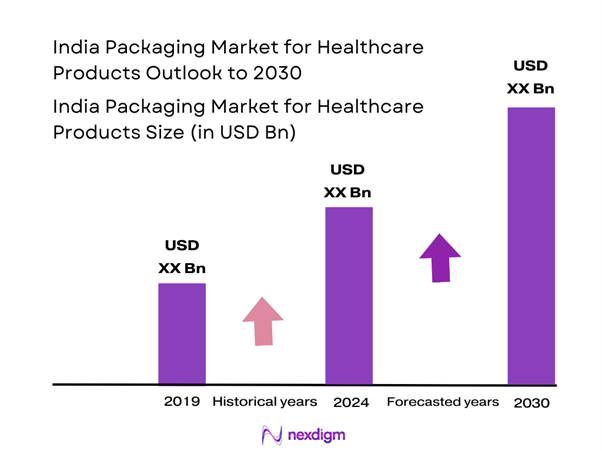

The India packaging market for healthcare products is valued at USD 5.14 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 8.72% from 2025-2030, supported by a growing demand for pharmaceutical packaging, driven by factors such as an expanding healthcare sector, increasing consumer awareness regarding product safety, and rising investments in healthcare infrastructure.

The dominant cities in the Indian packaging market for healthcare products include Mumbai, Bangalore, and Hyderabad. This concentration is primarily due to the presence of a robust pharmaceutical sector, significant research and development investment, and accessibility to advanced logistics facilities. These cities also benefit from a high density of hospitals, healthcare institutions, and packaging manufacturers, making them key players in driving market growth.

Innovations in packaging technology are transforming the healthcare sector, enhancing the efficiency and safety of medical products. The Indian packaging industry is projected to invest approximately INR 100 billion in research and development by end of 2025, focusing on advanced materials and smart packaging solutions such as moisture barriers and tamper-evident seals. Moreover, advancements in biodegradable and compostable materials are attracting investments, ensuring product integrity while meeting consumer demands for safety and sustainability.

Market Segmentation

By Material Type

The India packaging market for healthcare products is segmented by material type into plastic, glass, metal, and paper & paperboard. Currently, plastic is the dominant material type due to its lightweight nature, versatility, and cost-effectiveness, making it the preferred choice for pharmaceutical applications. Plastic packaging provides excellent barrier properties, ensuring longer shelf life while safeguarding product integrity. Furthermore, the shift towards sustainable practices is driving innovations in bioplastics, which are also gaining popularity in healthcare. The increased utilization of high-density polyethylene (HDPE) and polyvinyl chloride (PVC) in packaging solutions fortifies the dominance of the plastic segment.

By Product Type

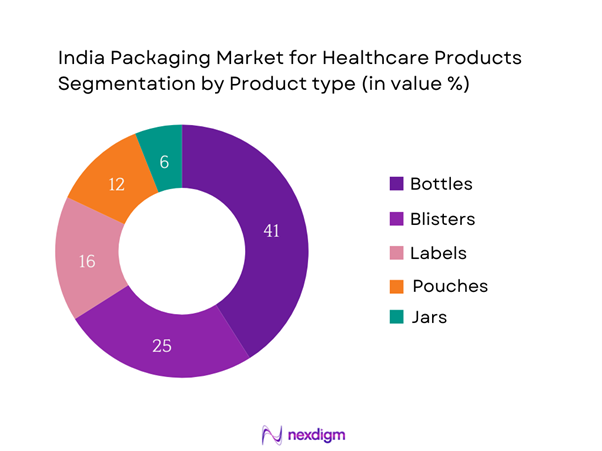

The market is also segmented by product type into bottles, blisters, labels, pouches, and jars. Bottles have a significant market share in the India packaging market for healthcare products, primarily because they are extensively used for liquid medications, supplements, and vaccines. The ease of use, along with the ability to provide adequate protection against external elements, is a key factor contributing to the dominance of this segment. Moreover, technological advancements in bottle designs, such as child-resistant packaging, enhance safety, thereby increasing their appeal among manufacturers and consumers alike.

Competitive Landscape

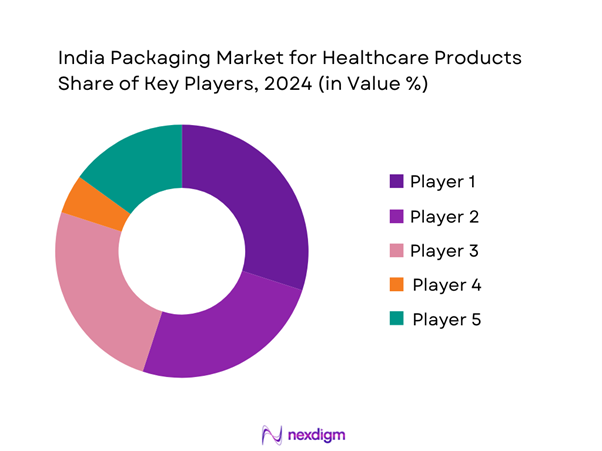

The India packaging market for healthcare products is dominated by several key players, reflecting a consolidated industry structure. Major companies like Amcor plc, Tetra Pak, and West Pharmaceutical Services lead the market due to their extensive portfolios and innovative solutions in packaging. These firms not only benefit from economies of scale but also possess advanced manufacturing capabilities that enhance the efficiency of production processes. Furthermore, their strong distribution networks and continued investment in research and development allow them to respond effectively to consumer demands and regulatory changes.

| Company Name | Establishment Year | Headquarters | Product Offerings | Revenue (USD) | Market Strategies | R&D Investment |

| Amcor plc | 1860 | Sydney, Australia | – | – | – | – |

| Tetra Pak | 1951 | Lund, Sweden | – | – | – | – |

| West Pharmaceutical | 1923 | Exton, Pennsylvania | – | – | – | – |

| Berry Global | 1967 | Evansville, Indiana | – | – | – | – |

| Huhtamaki Group | 1920 | Espoo, Finland | – | – | – | – |

India Packaging Market for Healthcare Products Analysis

Growth Drivers

Rise in Health Awareness

The increasing health awareness among the Indian population is a significant driver for the packaging market in the healthcare sector. India has seen a rise in life expectancy, with the average life expectancy at birth increasing to approximately 70.4 years in 2022, according to the World Bank. This trend leads to higher demand for pharmaceuticals and medical services, necessitating the need for safe and effective packaging solutions. Furthermore, initiatives like the National Health Mission emphasize health education, thereby fueling the growing awareness around health products and their safe consumption among citizens.

Demand for Sustainable Packaging

The shift towards sustainable packaging in India is gaining momentum, driven by environmental concerns and consumer preferences. In 2023, the Ministry of Environment, Forest and Climate Change projected that around 450 million tons of plastic waste is generated annually in the country. Consequently, the Indian government has established guidelines promoting eco-friendly materials and recycling initiatives. The popularity of sustainable packaging options is reflected in increasing investments in the sector, with the Indian government aiming to achieve complete plastic waste management through initiatives like the Plastic Waste Management Rule.

Market Challenges

Regulatory Compliance

Regulatory compliance poses a significant challenge for the healthcare packaging market in India. The country follows strict standards set by agencies like the Central Drugs Standard Control Organization (CDSCO) and the Bureau of Indian Standards (BIS). According to CDSCO, nearly 30% of pharmaceutical products failed to meet regulatory standards due to non-compliant packaging materials as of 2023. This creates hurdles for manufacturers who seek to ensure their products’ safety in the market. Adhering to these regulations requires significant investment in quality control processes and certification, which can strain resources for smaller companies.

Fluctuations in Raw Material Costs

Fluctuations in raw material costs pose a considerable challenge to the healthcare packaging market. The pricing of essential packaging materials such as plastics and metals has shown volatility, influenced by global demand and supply dynamics. For example, the price of polyethylene, a commonly used plastic, surged by 30% from 2022 to 2023, according to the Indian Plastics Industry Association. These cost changes not only increase production expenses but also impact profit margins for manufacturers, who may struggle to pass on these costs to consumers in a competitive market.

Opportunities

Growth of E-commerce in Healthcare

The rapid growth of e-commerce in the healthcare sector provides ample opportunities for the packaging market. In recent years, the Indian e-pharmacy market has witnessed significant expansion, estimated to reach around INR 50,000 crore by end of 2025, driven by increasing internet penetration and consumer preference for online shopping. Packaging plays a critical role in the e-commerce sector by ensuring products are delivered safely and efficiently. Consequently, companies that develop innovative packaging solutions tailored for e-commerce logistics are likely to thrive, as they meet the unique demands of this expanding market.

Increasing Demand for Aesthetic Packaging

There is a burgeoning demand for aesthetic packaging in the healthcare sector, driven by consumer desires for visually appealing products. This trend is reflected in the increasing sales of premium pharmaceuticals and health supplements, which require attractive packaging designs to stand out in a competitive market. Studies indicate that aesthetic packaging can enhance consumer perceptions and drive sales by approximately 20% for health products. As disposable income continues to rise in India, brands catering to affluent consumers are investing in innovative and attractive packaging designs, creating a lucrative opportunity for packaging manufacturers.

Future Outlook

Over the next five years, the India packaging market for healthcare products is expected to exhibit substantial growth, driven by increasing healthcare expenditure, technological advancements in packaging solutions, and heightened consumer demand for safety and quality. The ongoing development of sustainable packaging materials and the implementation of regulatory frameworks will further bolster market dynamics. Key players are likely to enhance their product offerings to meet evolving consumer expectations and compliance requirements.

Major Players

- Amcor plc

- Tetra Pak

- West Pharmaceutical Services

- Berry Global

- Huhtamaki Group

- Sealed Air Corporation

- Crown Holdings

- Becton, Dickinson and Company

- Sonoco Products Company

- Gerresheimer AG

- AptarGroup, Inc.

- Schott AG

- RPC Group PLC

- Stora Enso

- CCL Industries

Key Target Audience

- Pharmaceutical Manufacturers

- Biotech Firms

- Medical Device Companies

- Healthcare Institutions (Hospitals and Clinics)

- Logistics and Supply Chain Companies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Drug Controller General of India)

- Packaging Material Suppliers

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing an ecosystem map encompassing all major stakeholders within the India packaging market for healthcare products. Extensive desk research is conducted utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India packaging market for healthcare products is compiled and analyzed. This includes assessing market penetration, the ratio of manufacturers to healthcare providers, and resultant revenue generation. Additionally, an evaluation of service quality statistics is conducted to ensure reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from practitioners, instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple packaging manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India packaging market for healthcare products.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Evolution

- Timeline of Major Players

- Business Cycle and Competitive Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rise in Health Awareness

Demand for Sustainable Packaging

Innovations in Packaging Technology - Market Challenges

Regulatory Compliance

Fluctuations in Raw Material Costs - Opportunities

Growth of E-commerce in Healthcare

Increasing Demand for Aesthetic Packaging - Trends

Smart Packaging Technologies

Shift Towards Eco-Friendly Solutions - Government Regulation

Packaging Standards and Certifications

Import Tariffs and Duties - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Material Type (in Value %)

Plastic

– High-Density Polyethylene (HDPE)

– Polyethylene Terephthalate (PET)

– Polypropylene (PP)

– Polyvinyl Chloride (PVC)

Glass

– Type I (Borosilicate Glass)

– Type II (Treated Soda-Lime Glass)

– Type III (Soda-Lime Glass)

Metal

– Aluminum

– Tin

– Stainless Steel

Paper & Paperboard

– Folding Cartons

– Corrugated Boxes

– Paper Labels

Other Materials

– Biodegradable Polymers

– Composite Materials - By Product Type (in Value %)

Bottles

– Plastic Bottles

– Glass Bottles

– Dropper Bottles

Blisters

– Thermoform Blisters

– Cold Form Blisters

Labels

– Pressure-Sensitive Labels

– Shrink-Sleeve Labels

– Tamper-Evident Labels

Pouches

– Stand-Up Pouches

– Single-Dose Sachets

– Foil Pouches

Jars

– Plastic Jars

– Glass Jars - By Application (in Value %)

Pharmaceuticals

– Prescription Drugs

– Over-the-Counter (OTC) Drugs

Biologics

– Vaccines

– Blood Products

– Gene & Cell Therapies

Medical Devices

– Syringes & Needles

– Surgical Instruments

– Diagnostic Kits

Nutraceuticals

– Dietary Supplements

– Functional Foods

– Herbal Products

Others

– Veterinary Products

– Clinical Trial Supplies - By Region (in Value %)

North India

West India

South India

East India - By Packaging Type (in Value %)

Primary Packaging

– Vials

– Ampoules

– Blisters

– Syringes

Secondary Packaging

– Cartons

– Sleeves

– Inserts

Tertiary Packaging

– Pallets

– Crates

– Shrink Wraps

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Revenues by Packaging Type, Production Capabilities, Number of Touchpoints / Distribution Reach, Distribution Channels, Product Portfolio Diversity, Regulatory Compliance & Certifications, Material Innovation and Sustainability Credentials, Unique Value Offering, Customer Base, Geographic Presence, Others)

- SWOT Analysis of Major Players

- Pricing Analysis of Key Players

- Detailed Profiles of Major Companies

Amcor plc

Tetra Pak

Sealed Air Corporation

West Pharmaceutical Services

Barry-Wehmiller

Huhtamaki Group

Crown Holdings

Becton, Dickinson and Company

Sonoco Products Company

Berry Global

CCL Industries

Gerresheimer AG

AptarGroup, Inc.

RPC Group PLC

Schott AG

- Market Demand and Utilization

- Purchasing Behavior and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030