Market Overview

The India High Altitude Pseudo Satellites market is valued at approximately USD ~ billion in 2024, driven by advancements in aerospace technologies and increasing demand for surveillance and communication systems in remote areas. The growing reliance on high-altitude platforms for telecommunication services, surveillance, and defense applications is fueling market expansion. Additionally, continuous investment from government and private players in research and development, along with strategic collaborations, has enhanced market growth. The market is supported by increased interest in sustainable solutions such as solar-powered high-altitude platforms, which offer long-duration flight capabilities for various applications.

India is leading the market for high altitude pseudo satellites, with major contributions from cities like Bengaluru, Hyderabad, and New Delhi. Bengaluru is recognized as the hub for aerospace and defense technology, housing companies such as HAL (Hindustan Aeronautics Limited) and ISRO (Indian Space Research Organisation). The country’s dominance is driven by robust government initiatives, including the Atmanirbhar Bharat campaign, which encourages indigenous production of defense systems and satellite technology. Furthermore, India’s strategic position in the Asia-Pacific region, coupled with its increasing defense spending, reinforces its position as a market leader.

Market Segmentation

By System Type

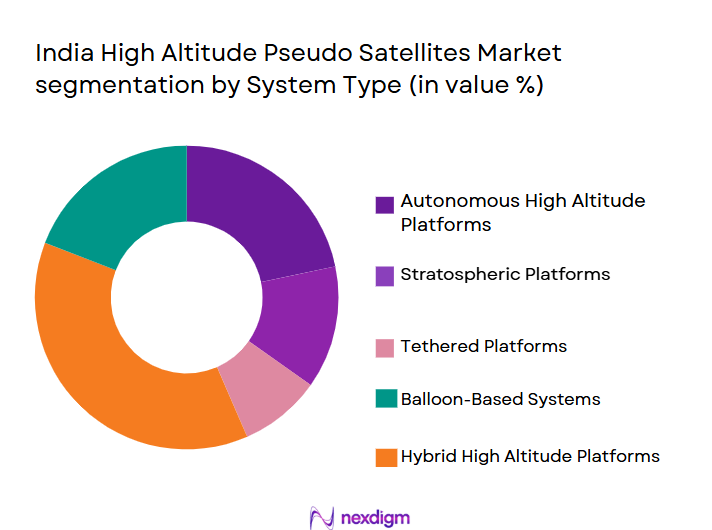

India’s high altitude pseudo satellites market is segmented by system type into autonomous high altitude platforms, stratospheric platforms, tethered platforms, balloon-based systems, and hybrid high altitude platforms. Among these, autonomous high altitude platforms dominate the market share due to their ability to operate independently with minimal human intervention. These platforms are increasingly being favored in defense and telecommunications sectors due to their high endurance and capability to monitor large geographic areas continuously. Moreover, advancements in AI and machine learning have made autonomous systems more reliable and efficient, contributing to their market dominance.

By Platform Type

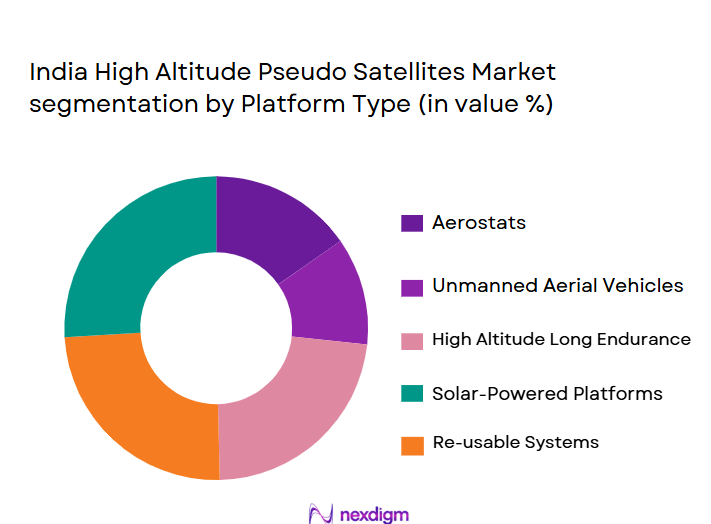

The market for high altitude pseudo satellites is also segmented by platform type, including aerostats, unmanned aerial vehicles (UAVs), high altitude long endurance (HALE) aircraft, solar-powered platforms, and re-usable systems. Among these, UAVs have emerged as the dominant platform type due to their flexibility, cost-effectiveness, and ability to be deployed in a variety of environments. UAVs are widely utilized for surveillance, border patrol, and communication services, owing to their ability to provide real-time data collection at a fraction of the cost of traditional satellite systems. Their rapid development and adoption in both military and commercial sectors make them the most popular platform in the market.

Competitive Landscape

The India High Altitude Pseudo Satellites market is competitive, with a combination of local and global players, including established aerospace manufacturers and emerging technology startups. Major players in the market include ISRO, Hindustan Aeronautics Limited (HAL), and private entities like OneWeb and General Aeronautics. These companies dominate the market through strong technological capabilities, government support, and strategic collaborations. India’s strong focus on enhancing its defense capabilities, particularly through platforms like UAVs, ensures the market’s consolidation around these key players.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technology Focus | Strategic Partnerships | Research & Development Investment |

| ISRO | 1969 | Bengaluru, India | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited (HAL) | 1940 | Bengaluru, India | ~ | ~ | ~ | ~ |

| OneWeb | 2012 | London, UK | ~ | ~ | ~ | ~ |

| General Aeronautics | 2005 | Bengaluru, India | ~ | ~ | ~ | ~ |

| Vayu Aerospace | 2016 | Bengaluru, India | ~ | ~ | ~ | ~ |

India high altitude pseudo satellites Market Analysis

Growth Drivers

Increasing demand for advanced avionics systems

The growth of the Singapore aircraft sensors market is driven by the increasing demand for advanced avionics systems in both commercial and military aviation. As the aviation sector in Singapore continues to modernize, there is a rising need for high-performance sensors to ensure safety, navigation, and communication. The integration of advanced sensor technologies, such as radar, LIDAR, and infrared sensors, in modern aircraft enhances flight safety, improves fuel efficiency, and supports autonomous operations, which is contributing to market growth.

Government initiatives supporting aerospace innovation

The Singapore government has actively supported the development of aerospace technologies, including aircraft sensors, through initiatives like the Singapore Aerospace Programme (SAP). With investments in research and development, as well as partnerships between government bodies, research institutions, and industry players, the government is fostering a conducive environment for innovation. This has led to the adoption of cutting-edge sensor technologies in Singapore’s aviation sector, driving demand for high-tech sensors in aircraft for better performance and reliability.

Market Challenges

High cost of sensor integration and maintenance

One of the key challenges facing the Singapore aircraft sensors market is the high cost associated with the integration and maintenance of advanced sensor technologies. Aircraft sensor systems, particularly those that are cutting-edge, come with significant costs in terms of both installation and ongoing maintenance. Additionally, the specialized nature of these sensors requires highly skilled personnel for installation, calibration, and upkeep, making it financially challenging for smaller operators to fully integrate these technologies into their fleets.

Complex regulatory and certification processes

The regulatory and certification processes for aircraft sensors in Singapore can be complex and time-consuming, creating hurdles for manufacturers and operators. Strict aviation safety standards and regulations, such as those set by the Civil Aviation Authority of Singapore (CAAS), require thorough testing and validation before any sensor system can be approved for use in aircraft. These stringent regulations, while crucial for safety, can slow down the deployment of new technologies and increase the lead time for companies entering the market.

Opportunities

Rising demand for autonomous and electric aircraft

The growing interest in autonomous and electric aircraft presents a significant opportunity for the Singapore aircraft sensors market. These emerging aircraft types rely heavily on advanced sensors for navigation, control, and safety. As Singapore strives to be a hub for aerospace innovation, the adoption of these next-generation aircraft will drive the demand for sensors that enable precise control and data processing, creating a vast growth opportunity for sensor manufacturers in the country.

Expansion of the aircraft maintenance, repair, and overhaul (MRO) industry

Singapore’s strategic position as a regional hub for aircraft maintenance, repair, and overhaul (MRO) services is an opportunity for the aircraft sensors market. As airlines continue to modernize their fleets and adopt newer sensor technologies, there is a rising need for MRO services that can maintain and upgrade sensor systems. This growing MRO industry is expected to boost demand for sensors, as regular maintenance and sensor replacements will be required to ensure the optimal performance of aircraft.

Future Outlook

Over the next decade, the India High Altitude Pseudo Satellites market is expected to experience substantial growth, driven by the government’s push for defense modernization and infrastructure development. Continuous technological advancements, including the integration of AI, machine learning, and solar power, will enhance the efficiency and cost-effectiveness of high-altitude platforms. Additionally, demand for remote surveillance, communication, and data collection will continue to grow, particularly in rural and border areas, boosting the market’s potential.

Major Players

- ISRO

- Hindustan Aeronautics Limited (HAL)

- OneWeb

- General Aeronautics

- Vayu Aerospace

- Aerovironment

- Elbit Systems Ltd.

- Thales Group

- L3 Technologies

- Boeing

- Northrop Grumman

- Lockheed Martin

- Airbus Defence and Space

- Raytheon Technologies

- Bluebird Aero Systems

Key Target Audience

- Government and regulatory bodies (e.g., Ministry of Defence, ISRO)

- Aerospace and defense manufacturers

- Military and defense agencies

- Private aerospace firms

- Investors and venture capitalist firms

- System integrators

- OEMs (Original Equipment Manufacturers)

- Telecom service providers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India High Altitude Pseudo Satellites Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India High Altitude Pseudo Satellites Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India High Altitude Pseudo Satellites Market.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising demand for telecommunication services in remote areas

Advancements in high-altitude platform technologies

Increasing defense spending on surveillance and reconnaissance platforms - Market Challenges

High operational costs and maintenance complexity

Limited regulatory frameworks and challenges in certification

Interference with existing satellite and drone networks - Market Opportunities

Expansion of satellite-based internet services

Growth of defense and surveillance contracts

Increasing demand for low-cost, long-endurance platforms - Trends

Increased adoption of solar-powered high-altitude platforms

Integration of AI and machine learning for autonomous navigation

Growing interest in hybrid systems combining UAVs and aerostats

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Autonomous High Altitude Platforms

Stratospheric Platforms

Tethered Platforms

Balloon-Based Systems

Hybrid High Altitude Platforms - By Platform Type (In Value%)

Aerostats

Unmanned Aerial Vehicles (UAVs)

High Altitude Long Endurance (HALE) Aircraft

Solar-Powered Platforms

Re-usable Systems - By Fitment Type (In Value%)

Standalone Systems

Integrated Systems

Upgradable Platforms

Modular Platforms

Retrofit Systems - By EndUser Segment (In Value%)

Telecommunications

Military & Defense

Remote Sensing & Surveillance

Scientific Research

Disaster Management & Emergency Response - By Procurement Channel (In Value%)

Direct Sales

Distributors & Resellers

Government Tenders & Contracts

Partnerships with Aerospace Companies

OEM Partnerships

- Market Share Analysis

- Cross Comparison Parameters

(Platform Type, System Complexity, Geographic Reach, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity Integration Capabilities, System Durability) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Astra Communications Pvt Ltd

Skyward Innovations

Vayu Aerospace

Hindustan Aeronautics Limited (HAL)

ISRO

OneWeb

General Aeronautics Pvt Ltd

Aerovironment

Elbit Systems Ltd.

Drone Aviation Corp

Thales Group

L3 Technologies

Boeing

Northrop Grumman

Lockheed Martin

- Telecommunications sector increasing investments in remote area connectivity

- Military applications driving demand for surveillance and reconnaissance platforms

- Growing interest from scientific research institutions for atmospheric data collection

- Governments focusing on disaster relief and emergency response technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035