Market Overview

The India Homeland Security and Emergency Management market is valued at approximately USD ~ billion. This market is primarily driven by growing investments in national security and increasing threats from natural disasters and terrorism. The Indian government’s focus on infrastructure development and modernization of emergency management systems is further boosting market growth. Additionally, technological advancements in security systems, such as AI-driven surveillance and data analytics, are also playing a crucial role in expanding the market’s reach.

The dominant cities and countries driving the India Homeland Security and Emergency Management market include metropolitan areas like Delhi, Mumbai, and Bengaluru. These cities, being key urban hubs, are home to critical infrastructure, government agencies, and a high concentration of businesses requiring advanced security and emergency management solutions. Furthermore, these areas have significant investments in surveillance technologies, disaster preparedness, and smart city initiatives, making them the driving forces in the market.

Market Segmentation

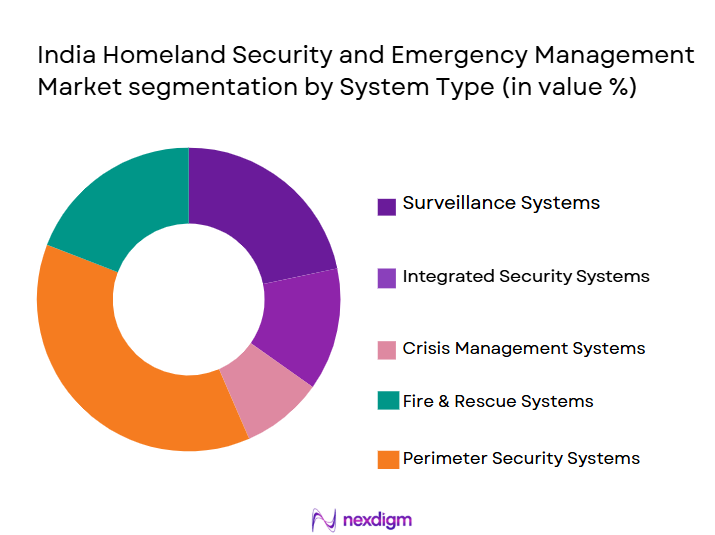

By System Type

India Homeland Security and Emergency Management market is segmented by system type into surveillance systems, integrated security systems, crisis management systems, fire and rescue systems, and perimeter security systems. Recently, surveillance systems have dominated the market share in India under the system type segmentation. This dominance is due to their broad application in both urban and rural areas for monitoring and security purposes. With the increasing need for public safety and crime prevention, surveillance systems such as CCTV cameras and AI-based monitoring solutions have been widely adopted by both government and private sectors. Government investments in urban surveillance, smart city projects, and crime monitoring initiatives have bolstered the demand for surveillance systems.

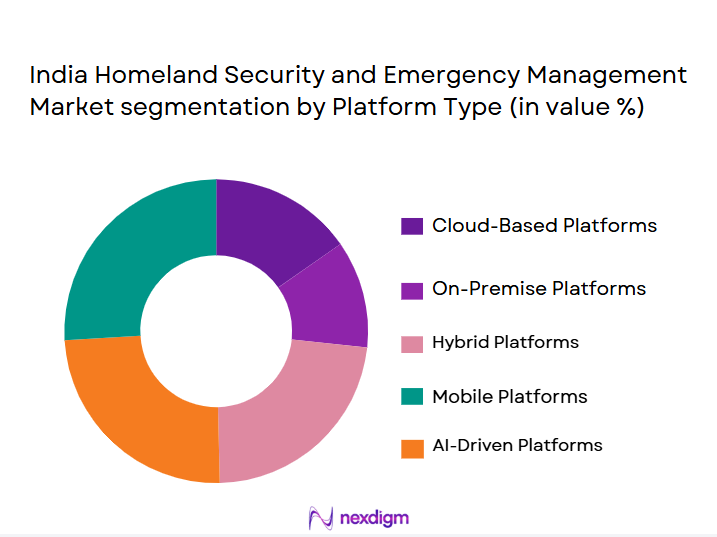

By Platform Type

The India Homeland Security and Emergency Management market is also segmented by platform type into cloud-based platforms, on-premise platforms, hybrid platforms, mobile platforms, and AI-driven platforms. The cloud-based platform segment is currently leading the market share. This is attributed to the increasing shift toward digital transformation across industries, as cloud platforms offer scalability, cost-efficiency, and ease of data management. Additionally, the integration of AI and data analytics with cloud solutions has further enhanced the effectiveness of security and emergency management systems. Cloud platforms enable real-time monitoring, data storage, and accessibility, which is critical for emergency response systems.

Competitive Landscape

The India Homeland Security and Emergency Management market is dominated by several major players. These companies leverage their global presence and cutting-edge technology to provide advanced security and emergency management solutions. The key players in this market include large multinational companies such as Thales Group, Honeywell, and Siemens, as well as local giants like Bharat Electronics Limited and Tata Advanced Systems. These companies have established strong footholds in the market due to their ability to deliver integrated solutions and their extensive service offerings in various sectors, including defense, public safety, and disaster management

| Company | Establishment Year | Headquarters | Market Penetration | Technological Innovation | Product Portfolio | Service Coverage | Partnerships with Government | Revenue Growth | Competitive Advantage |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Honeywell International | 1906 | Morris Plains, USA | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens AG | 1847 | Munich, Germany | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | Bangalore, India | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2008 | Mumbai, India | ~ | ~ | ~ | ~ | ~ | ~ | ~ |

India homeland security and emergency management Market Analysis

Growth Drivers

Increasing Government Focus on National Security

The Indian government has significantly increased its focus on national security, resulting in higher investments in homeland security and emergency management systems. In recent years, security budgets have expanded, with a clear emphasis on modernizing infrastructure, enhancing surveillance capabilities, and improving response times to natural disasters and terrorism-related threats. This ongoing commitment from the government to strengthen national security contributes to the growth of the market, providing funding for advanced technologies such as AI-powered surveillance and integrated emergency management systems.

Technological Advancements and Integration

Advancements in technology, especially in AI, machine learning, and IoT, are reshaping the homeland security and emergency management landscape in India. The integration of these technologies into public safety infrastructure is enabling smarter surveillance systems, better disaster prediction models, and more efficient emergency responses. Additionally, the rise of cloud-based platforms and big data analytics is providing more scalable, real-time solutions, thereby enhancing the capabilities of India’s security infrastructure to manage emergencies more effectively.

Market Challenges

Budgetary Constraints and Resource Allocation

Despite the government’s focus on national security, budgetary constraints remain a significant challenge. In 2023, India’s security infrastructure budget saw a modest increase, but it still falls short of the resources required to deploy cutting-edge technology across all regions. The allocation for security and emergency management systems often competes with other national priorities, leading to slower adoption of new technologies and a reliance on outdated systems, especially in rural or less-developed areas.

Complexity in Implementing Technological Innovations

The integration of advanced technologies into India’s existing homeland security and emergency management systems presents a major challenge. With legacy infrastructure in place, it is often difficult to implement AI, machine learning, and IoT-based solutions seamlessly. The lack of skilled workforce to manage and operate such sophisticated technologies, along with the high upfront costs of upgrading systems, hinders the speed of technological adoption across the country, particularly in smaller cities and rural areas.

Market Opportunities

Growth of Smart Cities and Urbanization

India’s rapid urbanization and the ongoing Smart Cities Mission present significant opportunities for the homeland security and emergency management market. The government’s push to develop smarter, safer cities with integrated technologies for surveillance, disaster management, and emergency response is fostering greater demand for advanced security systems. Smart cities will incorporate AI and IoT-based platforms for real-time monitoring and quick responses to any security threats, which in turn will drive market growth in the coming years.

Public-Private Partnerships for Infrastructure Development

Public-private partnerships (PPPs) are becoming increasingly common in India’s infrastructure projects, including those related to homeland security and emergency management. The government’s commitment to modernizing national security through increased collaboration with private players is driving opportunities for technology providers to contribute their expertise. This collaborative approach will accelerate the development and deployment of advanced security solutions such as AI-driven surveillance systems, automated emergency management tools, and integrated security infrastructure, fostering growth in the market.

Future Outlook

Over the next decade, the India Homeland Security and Emergency Management market is poised to experience significant growth. This growth is primarily fueled by continuous advancements in security technologies, especially in surveillance, AI-driven platforms, and cloud-based systems. The Indian government’s increasing focus on modernizing its defense and public safety infrastructure, alongside the rising need for disaster management and response solutions, will drive further investments. Furthermore, as urbanization continues at a rapid pace, the demand for smart city solutions and integrated emergency management systems will expand, leading to a substantial increase in market size.

Major Players

- Thales Group

- Honeywell International

- Siemens AG

- Bharat Electronics Limited

- Tata Advanced Systems

- L&T Defence

- Bosch Security Systems

- General Electric

- Rockwell Collins

- Lockheed Martin

- BAE Systems

- Northrop Grumman

- Nexter Systems

- Safran Group

- Raytheon Technologies

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Defence Contractors and Suppliers

- Public Safety Agencies (Police, Fire & Rescue Services)

- Emergency Response and Management Companies

- Infrastructure Development Companies

- Homeland Security Solution Providers

- Disaster Management Agencies

Research Methodology

Step 1: Identification of Key Variables

The first step of the research involves identifying the key variables that influence the India Homeland Security and Emergency Management market. This includes understanding key market drivers such as technological advancements, government policies, and increasing disaster management requirements. We gather this information through secondary research, including data from industry reports and databases.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data and trends in the India Homeland Security and Emergency Management market. The analysis includes studying the growth of various system types, technological adoption, and the expansion of infrastructure projects related to homeland security and emergency management. We assess key performance indicators such as revenue generation and service quality.

Step 3: Hypothesis Validation and Expert Consultation

Once the hypotheses are established, they will be validated through expert consultations. These consultations will be conducted through phone interviews with industry practitioners, government officials, and experts in emergency management. These discussions will provide deeper insights into the challenges and opportunities within the market.

Step 4: Research Synthesis and Final Output

In the final phase, we will compile all data gathered from the previous steps to develop a comprehensive market report. We will consult with manufacturers, service providers, and government agencies to validate the findings and ensure accuracy. This final output will include actionable insights and strategies for stakeholders in the India Homeland Security and Emergency Management market.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Terrorism Threats

Rising Natural Disasters and Climate Change

Technological Advancements in Security Systems - Market Challenges

Budget Constraints in Government Spending

Complexity in Integrating New Technologies

Data Privacy and Security Concerns - Market Opportunities

Growth of Smart Cities and IoT Integration

Government Investments in Infrastructure

Adoption of AI and Big Data Analytics - Trends

Shift Towards AI and Automation in Homeland Security

Increase in Public-Private Partnerships

Integration of Cloud-Based Security Solutions

- Government Regulations & Defense Policy

FDI Rules

Offset Obligations

Export Licenses - SWOT Analysis (Capability Strengths, Cost Vulnerabilities, Competitive Pressures)

- Porter’s Five Forces (Procurement Power, Supplier Concentration, Substitutes, Barriers to Entry)

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surveillance Systems

Integrated Security Systems

Crisis Management Systems

Fire & Rescue Systems

Perimeter Security Systems - By Platform Type (In Value%)

Cloud-Based Platforms

On-Premise Platforms

Hybrid Platforms

Mobile Platforms

AI-Driven Platforms - By Fitment Type (In Value%)

Fixed Systems

Mobile Systems

Portable Systems

Custom Solutions

Modular Systems - By EndUser Segment (In Value%)

Government Agencies

Private Sector & Corporations

Emergency Response Services

Military & Defense

Transportation & Infrastructure - By Procurement Channel (In Value%)

Direct Procurement

B2B Procurement Platforms

Public Tendering

Distributors & Resellers

Online Procurement

- Market Share Analysis

- Cross Comparison Parameters

(Market Penetration, Technology Adoption Rate, Government Contract Size, Market Penetration, Technology Integration, R&D Investment, Operational Efficiency, Customer Retention, Regulatory Compliance, Product Portfolio Diversity Industry Partnerships, Product Innovation) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Tata Advanced Systems

Bharat Electronics Limited

Larsen & Toubro

Reliance Industries

Hindustan Aeronautics

Nexter Systems

Thales Group

Siemens AG

General Electric

Boeing

Rockwell Collins

Lockheed Martin

Honeywell International

Bae Systems

Northrop Grumman

- Growing Demand from Public Safety Agencies

- Private Sector Investment in Security Solutions

- Shift Toward Real-Time Data Access and Reporting

- Increased Focus on Cybersecurity in Emergency Management

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035