Market Overview

The India Hydropower Market is valued at INR 76,305 crore, based on a five-year historical analysis of capacity additions and actual generation. According to the Central Electricity Authority (CEA), the country’s cumulative installed hydroelectric capacity stands at 42,078 MW. With a generation output of 115.8 billion units from hydropower plants in the latest fiscal year, the market is propelled by base-load demand from the industrial and utility sectors. The sector benefits from dispatchable clean energy, grid stabilization, and cost advantages in long-term operations, which collectively support its continued investment momentum.

In India, Himachal Pradesh, Uttarakhand, Sikkim, Arunachal Pradesh, and Jammu & Kashmir are the dominant regions in hydropower generation. These states benefit from perennial river systems such as the Brahmaputra, Ganga, and Indus, along with suitable topography featuring steep gradients and high rainfall. Their dominance is also supported by early-stage development of large-scale public sector hydropower projects and consistent state-level energy policies encouraging renewable and infrastructure-linked hydropower investments.

Market Segmentation

By Plant Type

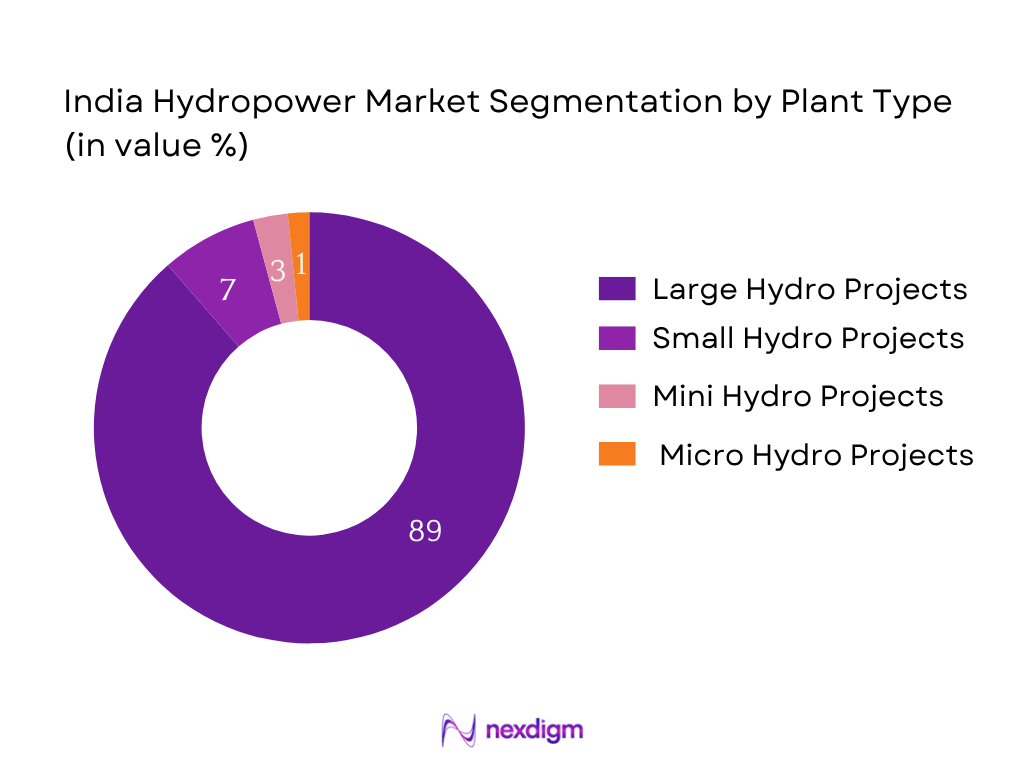

India’s Hydropower Market is segmented by plant type into Large Hydro Projects (Above 25 MW), Small Hydro Projects (1 MW–25 MW), Mini Hydro (100 kW–1 MW), and Micro Hydro (Below 100 kW). Recently, large hydro projects have a dominant market share under this segmentation, primarily due to their established infrastructure and their capacity to generate bulk power for national grid requirements. Operated mainly by central and state utilities such as NHPC and SJVN, these projects are located along major rivers and inter-state basins, receiving considerable financial and policy support from the Government of India.

By Head Type

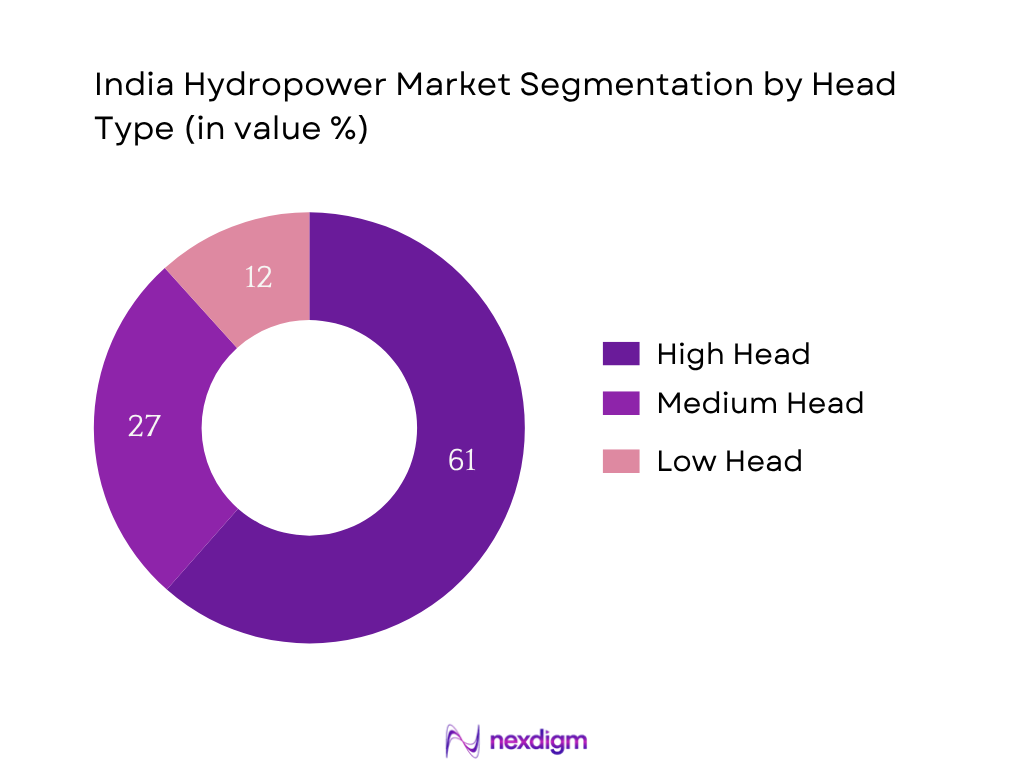

India’s Hydropower Market is segmented by head type into High Head, Medium Head, and Low Head. High-head hydropower plants hold a dominant market share, particularly in the Himalayan states. The terrain allows higher water drops, which significantly improve turbine efficiency and energy output. Projects in Sikkim, Himachal Pradesh, and Uttarakhand utilize such configurations to optimize operational performance. Additionally, these plants typically feature run-of-the-river systems, reducing environmental footprint and capital costs compared to dam-based counterparts in plains.

Competitive Landscape

The India Hydropower Market is consolidated among public sector companies and a few large private firms. Key players include NHPC, SJVN, and NTPC, alongside private developers like JSW Energy and Greenko. These players dominate capacity addition, grid connectivity, and policy-driven incentives under Hydro Purchase Obligation norms. Many of these companies are now transitioning into pumped storage and digital automation projects, reinforcing their long-term market position.

| Company Name | Est. Year | Headquarters | Installed Capacity (MW) | Operational States | OEM/Tech Partners | Ownership Type | Notable Projects | Digitalization Status |

| NHPC Ltd | 1975 | Faridabad, Haryana | 7097 | – | – | – | – | – |

| SJVN Ltd | 1988 | Shimla, HP | 1912 | – | – | – | – | – |

| NTPC Ltd | 1975 | New Delhi | 3900 (Hydro) | – | – | – | – | – |

| JSW Energy | 1994 | Mumbai, MH | 1391 | – | – | – | – | – |

| Greenko Group | 2006 | Hyderabad, TS | 1560 (Hydro) | – | – | – | – | – |

India Hydropower Market Analysis

Growth Drivers

River Basin Development and Water Flow Utilization

India has a total hydropower potential of 1,45,320 MW from identified river basins, of which 42,078 MW has been developed. The Brahmaputra Basin alone contributes over 44,484 MW in potential capacity, followed by the Indus Basin at 33,832 MW and the Ganga Basin at 20,711 MW. As per the Central Electricity Authority (CEA), the North-Eastern region, which houses much of the Brahmaputra’s flow, remains underutilized with less than 2,200 MW developed out of the identified potential. Effective development of basin-wise projects aligns with India’s National Water Policy and inter-state water agreements. In February 2024, the total hydroelectric generation stood at 11,158.49 MU, demonstrating consistent flow-based generation output. With India’s gross water availability at 1,999.20 BCM (Billion Cubic Metres) and per capita availability declining to 1,486 m³, basin optimization is critical for sustainable power generation.

Demand for Clean Base Load Energy

India’s total electricity generation in February 2024 was 134,938 MU, with hydropower contributing 11,158.49 MU, accounting for over 8% of the mix. Unlike solar and wind, hydropower provides firm, dispatchable power that aids base-load requirements. As per CEA Load Generation Balance Report, India’s peak demand crossed 243,271 MW in 2024, and with rising industrial load in Northern and Western India, the need for continuous clean power has intensified. Thermal plants supplied over 100,000 MU in the same period but contribute significantly to India’s 2.41 billion tonnes of CO₂ emissions annually (as per IEA 2023). Hydropower stands as a reliable alternative, given its inertia support for frequency stability and black start capabilities.

Market Challenges

Environmental Clearances and R&R Issues

The Ministry of Environment, Forest and Climate Change (MoEFCC) reports that as of 2024, 61 hydropower projects are delayed due to pending Stage-I or Stage-II forest clearances. The Environmental Impact Assessment Notification (2023 amendment) mandates Category A classification for all projects above 25 MW, subjecting them to 4-level appraisals. R&R (Resettlement and Rehabilitation) delays affect projects like the Luhri Stage-I (210 MW) and Vishnugad Pipalkoti (444 MW), which face opposition from displaced communities. According to the National R&R Policy dashboard, over 26,500 individuals await compensation and relocation under hydro-linked acquisitions.

Geological and Seismic Risks

According to the National Disaster Management Authority (NDMA), over 59% of India’s hydropower potential lies in seismic zones IV and V. Notably, Uttarakhand, Himachal Pradesh, and Arunachal Pradesh report frequent microseismic activity. In 2024, tremors ranging between 4.2–5.6 magnitude occurred near Tapovan, Teesta, and Subansiri projects, leading to temporary shutdowns and structural checks. Moreover, the landslide in Sikkim’s Chungthang region led to reservoir-induced flow blockage for over 19 hours. The Central Water Commission (CWC) mandates dam break analysis and slope stability assessments for all projects in hilly terrain, significantly increasing engineering and compliance timelines.

Market Opportunities

Pumped Storage Development for Grid Stability

India’s grid demand-supply mismatch due to solar and wind intermittency necessitates flexible storage. The CEA (2024) lists 63 pumped storage schemes (PSS) with over 96,524 MW potential, of which only 4,745 MW is operational. NHPC’s upcoming 2,880 MW Dibang project and Greenko’s 1,200 MW Pinnapuram facility are designed with integrated storage solutions. POSOCO reports grid frequency breaches above 50.05 Hz for 23 days in 2024, highlighting the need for pumped hydro. The Ministry of Power has also classified PSS as essential grid infrastructure, ensuring faster clearances and concessional wheeling.

Repowering and Modernization of Old Plants

As per MNRE, over 74 hydropower plants in India are above 25 years old, with a cumulative capacity of 18,207 MW eligible for repowering. Plants like Bhakra Left Bank, Sileru, and Hirakud have already undergone partial turbine upgradation. CEA’s 2024 report indicates that modernization leads to 12–17% improvement in output efficiency without major civil works. BHEL and Voith have signed O&M MoUs with multiple utilities for digital retrofit and turbine replacement programs. Government support under Renovation and Modernization (R&M) schemes has increased by INR 300 crore in the latest budget.

Future Outlook

Over the next five years, the India Hydropower Market is expected to show moderate yet sustained growth driven by new pumped storage schemes, government-funded modernizations, and private equity inflows into small hydro projects. The market is anticipated to expand at a CAGR of 4.8% during the 2024–2030 period. Increasing demand for firm, renewable base-load energy, coupled with rising grid reliability requirements, will support this trend. Furthermore, India’s energy transition plan that includes the 207 GW hydro potential, of which only about 25% has been tapped, provides long-term investment opportunities.

Major Players

- NHPC Limited

- SJVN Limited

- NTPC Limited

- THDC India Limited

- NEEPCO

- JSW Energy

- Tata Power

- Greenko Group

- L&T Hydro Power

- BHEL

- Voith Hydro India

- Andritz Hydro

- GMR Energy

- Megha Engineering & Infrastructure Ltd

- Sikkim Power Development Corporation

Key Target Audience

- Central Electricity Authority (CEA)

- Ministry of Power, Government of India

- Ministry of New and Renewable Energy (MNRE)

- State Renewable Energy Development Agencies (e.g., HPPCL, UREDA, APGENCO)

- Private Hydropower Developers

- Large Industrial Energy Consumers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., CERC, SERCs)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the hydropower ecosystem in India, encompassing stakeholders such as developers, regulators, OEMs, and utilities. Desk research draws on CEA reports, MNRE policy frameworks, and capacity databases to identify key demand and supply-side variables.

Step 2: Market Analysis and Construction

This step evaluates hydropower penetration by analyzing capacity growth, generation statistics, and grid absorption rates. It also considers regional distribution trends and inter-state transmission impact on project viability.

Step 3: Hypothesis Validation and Expert Consultation

Telephone interviews (CATIs) and video-based consultations were conducted with government officials, developers, and EPC contractors. Their insights validated assumptions related to project pipeline, cost viability, and regulatory bottlenecks.

Step 4: Research Synthesis and Final Output

Multiple project developers and turbine OEMs were directly consulted to analyze pricing models, lead times, technology adoption, and value chain gaps. Final numbers were cross-validated using bottom-up capacity and generation forecasts.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Methodology, Hydropower Plant Classification, Installed Capacity Mapping, Primary Expert Interviews, Limitations and Future Directions)

- Definition and Scope

- Hydropower Project Lifecycle

- Evolution of Hydropower Projects in India

- Business Model Overview (IPP, BOT, BOOT, EPC)

- Stakeholder Value Chain Analysis

- Timeline of Major Regulatory Events and Policy Milestones

- Infrastructure Development Impact Assessment

- Growth Drivers

River Basin Development and Water Flow Utilization

Demand for Clean Base Load Energy

Investment Surge in Sustainable Infrastructure

Government Incentives and Policy Mandates - Market Challenges

Environmental Clearances and R&R Issues

Geological and Seismic Risks

Delays in Land Acquisition

High Upfront Capital Costs - Market Opportunities

Pumped Storage Development for Grid Stability

Repowering and Modernization of Old Plants

Cross-Border Hydro Power Trade

Integration with Green Hydrogen Projects - Market Trends

Hybrid Hydropower Solutions

Digitization of Hydropower Plants (SCADA, AI, Remote Sensing)

Floating Hydropower Pilot Initiatives

Private Equity Participation in Small HydroPolicy and Regulatory Landscape

National Electricity Policy & Tariff Policies

Hydro Power Purchase Obligation (HPO)

Revised Environmental Impact Assessment (EIA) Norms

Grid Interconnection Norms and Open Access Policy - SWOT Analysis

- Stakeholder Ecosystem (Developers, IPPs, Turbine Manufacturers, EPCs, Grid Operators, Financiers)

- Porter’s Five Forces Analysis

- By Installed Capacity (MW), 2019-2024

- By Generation Output (GWh), 2019-2024

- By Value (INR Crores), 2019-2024

- By Plant Type (In Value %)

Large Hydropower Projects (Above 25 MW)

Small Hydro Projects (1 MW – 25 MW)

Mini Hydro Projects (100 kW – 1 MW)

Micro Hydro Projects (Below 100 kW) - By Head Type (In Value %)

High Head

Medium Head

Low Head - By End-Use Sector (In Value %)

Industrial

Commercial

Residential

Agricultural

Utility Grid - By Ownership Type (In Value %)

Central Government

State Government

Private Sector

Public-Private Partnership (PPP) - By Region (In Value %)

North India

South India

East India

West India

North-East India

- Market Share of Major Players (By Installed Capacity, Value, and Region)

- Cross Comparison Parameters (Company Overview, Installed Hydropower Capacity, Turbine Suppliers and OEM Partnerships, Geographic Plant Distribution, Business Model and Strategy, Revenue by Plant Type, Regulatory Compliance Record, Digital Transformation Status, Project Pipeline and Execution Timelines)

- SWOT Analysis of Major Players

- Capital Cost and Tariff Benchmarking for Top Companies

- Detailed Company Profiles (with Operational Projects & Capacity in MW)

NHPC Limited

SJVN Limited

THDC India Limited

NEEPCO

NTPC Ltd

JSW Energy

Tata Power

L&T Hydro Power

BHEL

Voith Hydro

Alstom India

Andritz Hydro

GMR Energy

Greenko Group

Megha Engineering & Infrastructure Ltd

- Energy Demand Mapping by Sector

- Sectoral Hydropower Utilization Rate

- Grid vs. Off-grid Consumption Models

- Sectoral Regulatory Compliance Landscape

- End-User Pain Points and Investment Intentions

- By Installed Capacity (MW), 2025-2030

- By Generation Output (GWh), 2025-2030

- By Value (INR Crores), 2025-2030