Market Overview

The India Identification Friend or Foe (IFF) Systems market is valued at USD ~ million, driven by defense procurement and technological advancements. This market growth is propelled by India’s commitment to modernizing its defense systems, upgrading IFF capabilities across air, sea, and land platforms. The demand is further fueled by advancements in Mode 5 encryption technology and a growing focus on indigenization in line with the ‘Make in India’ initiative, ensuring cost-effective production. IFF systems are integral to combat identification and friendly force integration in high-stakes military operations. The market saw a notable increase in procurement, with a year-on-year rise in defense spending towards situational awareness and interoperability across platforms.

The dominant players in the IFF market in India include major defense contractors such as Bharat Electronics Limited (BEL), Hindustan Aeronautics Limited (HAL), and other domestic companies supported by governmental procurement through the Ministry of Defence (MoD). International suppliers also hold a significant share, as the market is influenced by collaborations with global firms like Raytheon Technologies and Thales. The dominance of these players is attributed to their established presence, extensive expertise in defense electronics, and robust supply chains that cater to both domestic and international defense requirements. Furthermore, the increasing demand from key defense hubs such as Delhi, Bengaluru, and Hyderabad, which are strategically located near defense establishments, continues to bolster market activity.

Market Segmentation

By Product Type

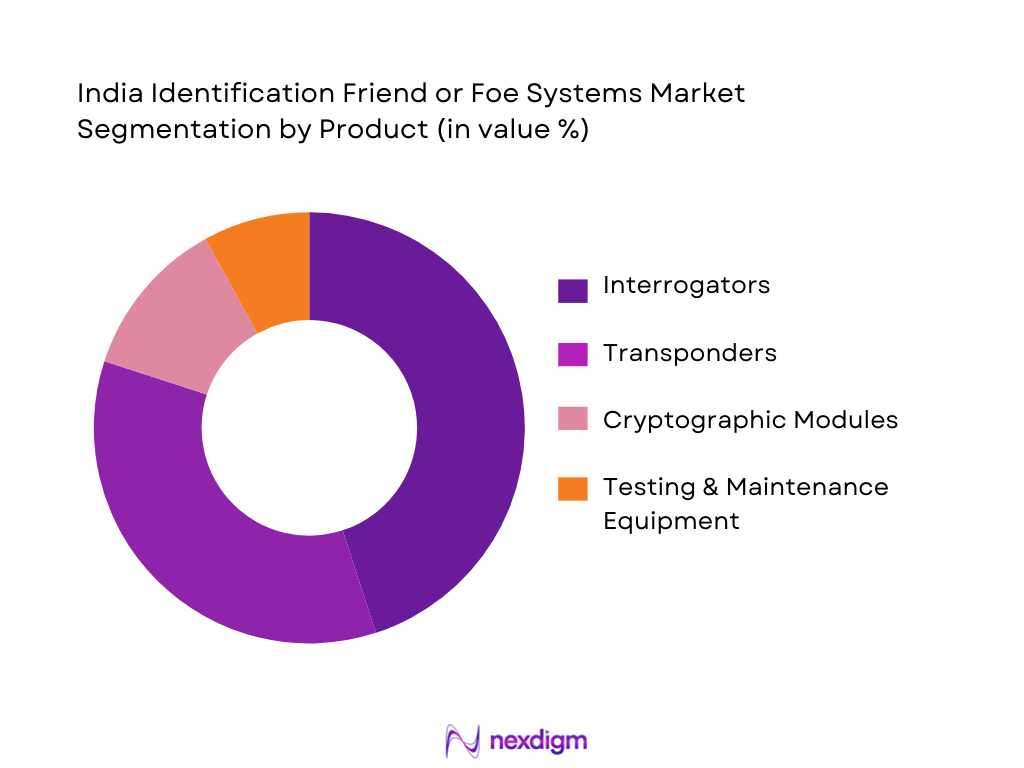

The India Identification Friend or Foe (IFF) Systems market is segmented by product type, with key sub-segments including interrogators, transponders, cryptographic modules, and testing & maintenance equipment. Interrogators and transponders are crucial components in IFF systems, and interrogators, due to their role in the interaction process between identification systems, dominate the market. This is largely due to the increasing demand for high-performing, military-grade interrogators for aircraft, naval vessels, and land-based platforms. HAL and BEL have contributed significantly to the production and integration of interrogators in fighter jets and other tactical aircraft. With the growth of air defense systems and UAV integrations, interrogators continue to hold a dominant position in the market.

By Platform Application

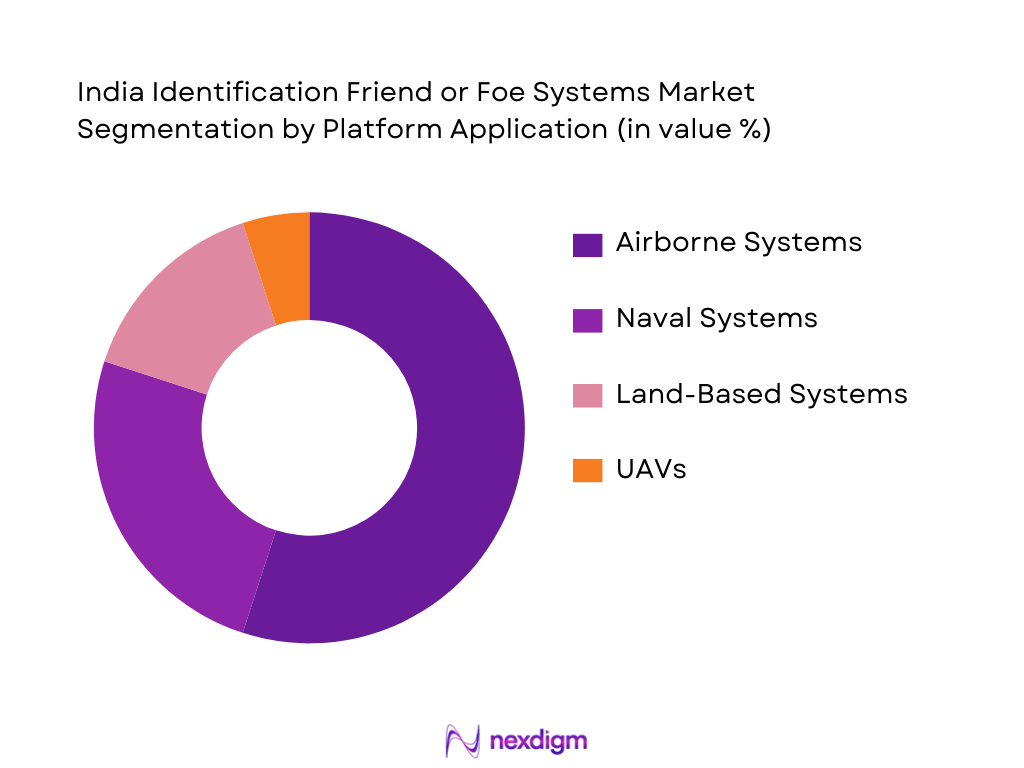

The IFF systems market is further segmented based on platform applications, which include airborne systems, naval systems, land-based systems, and UAVs. Among these, airborne systems dominate the market share due to their significant role in modern warfare. Fighter jets and AEW&C platforms require advanced IFF systems to identify and distinguish friendly and enemy forces in complex battle environments. The Indian Air Force, with its modernizing fleet, is a major driver in the demand for IFF systems tailored for high-performance aircraft. The presence of systems integrators like HAL and collaborations with global defense tech firms for advanced fighter aircraft such as the Su-30MKI contribute to the high demand for airborne IFF solutions.

Competitive Landscape

The Indian IFF systems market is competitive, with several key players involved in both domestic production and international collaborations. The major players include domestic entities like Bharat Electronics Limited (BEL) and Hindustan Aeronautics Limited (HAL), alongside international players such as Raytheon Technologies and Thales. These companies have well-established relationships with India’s Ministry of Defence (MoD) and other defense agencies, making them significant contributors to the market’s growth. The market is highly influenced by strategic collaborations and procurement agreements with both local and international entities.

| Company Name | Establishment Year | Headquarters | Platform Integration | IFF Mode Support | Annual Revenue (INR) | Key Clients | Strategic Partnerships |

| Bharat Electronics Limited (BEL) | 1954 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited (HAL) | 1940 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Saab AB | 1937 | Linköping, Sweden | ~ | ~ | ~ | ~ | ~ |

India Identification Friend or Foe (IFF) Systems Market Analysis

Growth Drivers

Operational environment complexity

The operational environment for India’s armed forces has become increasingly complex, particularly along the nation’s borders with Pakistan and China. In such a dynamic and often hostile environment, the need for advanced Identification Friend or Foe (IFF) systems has grown significantly. These systems provide real-time, automated identification of friendly and enemy forces, ensuring that military personnel can distinguish between threats and allies in high-stakes situations. Modern IFF systems are integrated into a wide range of military platforms, including aircraft, naval ships, and ground-based systems, enabling seamless communication and situational awareness across multiple domains of warfare. As the Indian Armed Forces continue to enhance their capabilities in countering both conventional and non-conventional threats, IFF systems are becoming a critical tool in operational efficiency.

Friendly Fire Avoidance

Friendly fire incidents have historically been one of the most devastating risks in military operations. As the Indian military modernizes, the need for advanced IFF systems to prevent such occurrences has intensified. IFF systems ensure that forces can identify and distinguish friendly units from adversaries, especially in complex battle environments where traditional visual identification may be difficult. The development of more secure, cryptographically protected IFF solutions, such as Mode 5, has been crucial in minimizing the risks of misidentification. Furthermore, these systems enable communication between air, sea, and ground forces, enhancing coordination and preventing tragic mistakes in friendly fire situations.

Market Challenges

High Certification Hurdles

One of the significant challenges facing the India Identification Friend or Foe (IFF) systems market is the high certification hurdles that IFF technologies must overcome before they are deployed in military operations. IFF systems must meet strict standards set by Indian defense authorities, including the Defence Research and Development Organisation (DRDO) and the Ministry of Defence (MoD). These standards often require extensive testing to ensure that the systems meet performance and security requirements, particularly when dealing with sensitive technologies like cryptographic keying and signal encryption. Moreover, certification processes are time-consuming and costly, which can delay the deployment of critical systems and hinder the overall market growth. Manufacturers, whether domestic or international, must navigate these rigorous processes while ensuring that their products remain compatible with the Indian Armed Forces’ evolving needs and interoperability standards.

Cryptographic Key Management

As IFF systems increasingly incorporate cryptographic technologies, managing and securing the cryptographic keys becomes a significant challenge. Mode 5, a highly secure form of IFF, relies on encrypted communication to protect against electronic warfare and spoofing. The management of these cryptographic keys involves stringent control measures, including the generation, distribution, and periodic updating of keys, which are crucial to maintaining system integrity. In the Indian context, cryptographic key management is further complicated by the need for compliance with national security protocols and international standards. A key management failure or a breach could lead to catastrophic failures in the identification process, making the system vulnerable to cyber-attacks.

Growth Opportunities

Indigenization via DRDO/ADE and Private Firms

Indigenization of defense technologies, including IFF systems, represents a significant growth opportunity in India. Under the ‘Make in India’ initiative, the Indian government has made substantial efforts to promote domestic manufacturing of defense equipment, reducing reliance on foreign imports and improving cost-effectiveness. DRDO (Defence Research and Development Organisation) and ADE (Aeronautical Development Establishment) are leading efforts to develop indigenous IFF systems that cater to the unique needs of the Indian Armed Forces. Private defense companies, too, are entering the market, collaborating with DRDO and other government bodies to produce advanced IFF systems. This move towards indigenization not only bolsters national security but also provides opportunities for local manufacturers to enter the global defense supply chain.

Export to Allied Nations

India’s growing defense capabilities and expanding defense partnerships with allied nations create a significant opportunity for the export of IFF systems. Indian defense manufacturers, having developed expertise in systems like Mode 4 and Mode 5 IFF solutions, are well-positioned to cater to the demands of countries seeking to modernize their military technology. Many nations, particularly in the Asia-Pacific and Middle East regions, are looking to upgrade their defense systems to ensure better interoperability and to counter emerging threats. India’s geopolitical positioning, along with its strengthening defense relations with countries like the United States, Israel, and ASEAN nations, presents an opportunity to establish itself as a key player in the global IFF market.

Future Outlook

Over the next five years, the Indian IFF Systems market is poised for substantial growth driven by government efforts to modernize defense systems, increasing procurement by the Indian Armed Forces, and continued investment in research and development for more sophisticated IFF technologies. Furthermore, as India pushes for self-reliance through the ‘Make in India’ initiative, local manufacturers are expected to meet a larger portion of the demand for these systems, reducing dependency on foreign imports. Advances in cryptographic technologies and air/sea/land integration will also play a significant role in the evolving market landscape.

Major Players in the Market

- Bharat Electronics Limited (BEL)

- Hindustan Aeronautics Limited (HAL)

- Raytheon Technologies

- Thales Group

- Saab AB

- Northrop Grumman

- Leonardo

- Elbit Systems

- BAE Systems

- L3Harris Technologies

- Leonardo DRS

- General Dynamics Mission Systems

- RADA Electronic Industries

- Curtiss-Wright Corporation

- Data Patterns

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Defence, DRDO, Indian Air Force, Indian Navy, Ministry of Electronics and Information Technology)

- Indian Defense Contractors and OEMs

- Military Equipment and Systems Integrators

- Indian and International Defense Suppliers

- Private Sector Aerospace & Defense Manufacturers

- Military Technology Research Institutions

- Export Agencies and Foreign Defense Alliances

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing a comprehensive ecosystem map for the Indian IFF Systems market. This is achieved through secondary research, leveraging public sources and proprietary databases to gather market-specific insights. Key variables such as system types, platform applications, and regional demand are defined and mapped.

Step 2: Market Analysis and Construction

In this phase, historical data from defense procurements, platform integrations, and budgetary allocations are analyzed to construct the current market size. This includes assessing demand for air, sea, and land-based IFF systems and the performance of local manufacturers versus global suppliers.

Step 3: Hypothesis Validation and Expert Consultation

We validate market hypotheses through primary research, conducting interviews with industry experts from military agencies, system integrators, and OEMs. These discussions provide operational insights and clarify market trends, helping refine the gathered data.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all data collected, integrating insights from market participants and manufacturers. We engage with both local and international defense suppliers to verify market segments, ensuring a holistic and validated understanding of the India IFF market.

- Executive Summary

- Research Methodology (Market definitions and assumptions specific to defense acquisition nomenclature, Abbreviations (e.g., Modes 4/5, SSR, OEM/Tier‑1/Tier‑2, DRDO, HAL), Defense market sizing and triangulation approach (top‑down & bottom‑up), Primary research with military users, system integrators, test & evaluation agencies, Limitations & sensitivity analysis (security clearance restricts data visibility))

- Definition, scope, operational role of IFF (combat identification, friend/foe discrimination in multi‑domain operations)

- Genesis of IFF in India and global context

- Defense Capability Timeline and Technology Evolution

- IFF generational evolution (Modes 1/2, 3/A, 4, Mode 5 cryptographically secured)

- Integration into airborne, naval, land and space systems

- Operational Value Chain & Supply Ecosystem (Platform‑specific integration)

- Sensor integration, interrogator/transponder supply, cryptographic keying, interoperability, testing stations, ground/air/sea ECCM

- Security, Compliance & Standards Framework

- DRDO/ADE qualification, interoperability protocols (NATO/India), encryption compliance

- Growth Drivers

Operational environment complexity

Friendly fire avoidance

Integration with AEW&C/SAM/VSHORAD ecosystems

Digital battlefield networking - Market Challenges

High certification hurdles

Cryptographic key management

Legacy integration

Survivability against EW threats - Growth Opportunities

Indigenization via DRDO/ADE and private firms

Export to allied nations

Integration with AI/ML for classification - Technology & Innovation Trends

Multi‑mode transponders

Advanced ECCM

Cyber‑secure authentication

Miniaturized modules for UAVs - Government & Defense Policy Impact

Procurement policies

Offset requirements

Security clearance norms - Porter’s Five Forces

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By System Component (In Value %)

Interrogators (ground/air/sea)

Transponders (airborne/naval/ground)

Cryptographic Module & Keying Software

Test & Certification Equipment

Maintenance & Lifecycle Support - By Frequency & Mode Support (In Value %)

Mode 4 compliant units

Mode 5 cryptographically secure units

Dual‑mode/Multi‑mode variants - By Platform Application (In Value %)

Airborne combat aircraft & AEW&C

UAV/UAS integrations

Naval combat systems

Land‑based air defense - By End User (In Value %)

Indian Air Force

Indian Navy

Indian Army AD Command

Paramilitary Air Defense

Exports to friendly nations - By Deployment Type (In Value %)

New procurements

Retrofits/Upgrades (legacy to Mode 5)

Life cycle sustainment & obsolescence management

- Market Share by Value & Volume (Domestic Vs. Imports)

- Domestic suppliers vs. foreign OEMs

- Cross Comparison Parameters (Company overview (defense portfolios), Platform integration capabilities (air/sea/land), Modes supported (Mode 4/5 readiness), Certified cryptographic/keying capability, Production capacity in India, Security clearances obtained (DGAQA/MTCR etc.), Interoperability credentials (NATO/US/DGQA acceptance), After‑sales sustainment & repair networks)

- Company Profiles

Bharat Electronics Limited (BEL) – IFF integrator & radar solutions

Hindustan Aeronautics Limited (HAL) – Transponder production & aircraft integration

Data Patterns – Electronic defense systems & IFF units

Alpha Design Technologies – IFF modules & avionics

DRDO Centre for Airborne Systems – Design & R&D

Thales Group (France) – IFF interrogators & transponders

Raytheon Technologies (US) – Mode 5 cryptographic IFF

BAE Systems (UK) – Combat ID suites

Northrop Grumman (US) – Air defense IFF

Leonardo (Italy) – Defense electronics

Elbit Systems (Israel) – Airborne IFF suites

SAAB AB (Sweden) – Integrated defense systems

RADA Electronic Industries (Israel) – Ground‑based IFF & surveillance

Curtiss‑Wright (US) – Military avionics

L3Harris (US) – Interrogators & SSR systems

- Operational readiness impact

- Budgetary allocation per service

- Mission requirement gap analysis

- Procurement cycle influences

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-2035