Market Overview

The India In-Flight Catering market current size stands at around USD ~ million, reflecting sustained demand across commercial aviation meal provisioning, onboard retail programs, and ancillary food services. The market structure spans centralized kitchens, satellite units, cold chain logistics, and airline contract-based provisioning models. Value creation is shaped by service class differentiation, route density, menu localization, food safety compliance, and vendor-managed inventory practices that optimize uplift planning, minimize wastage, and enhance passenger experience across diverse carrier operating models.

Operational concentration is strongest across major aviation hubs with dense flight schedules, robust cold chain infrastructure, and proximity to airline base kitchens. Demand clusters around metro airports supported by mature airport ecosystems, skilled food safety workforces, and regulatory oversight for aviation catering. Regional nodes benefit from expanding terminal capacity, improved apron-side logistics, and policy support for private participation in airport services. The ecosystem maturity varies by airport category, with tier-one hubs driving innovation in digital pre-ordering, sustainability practices, and premium menu curation.

Market Segmentation

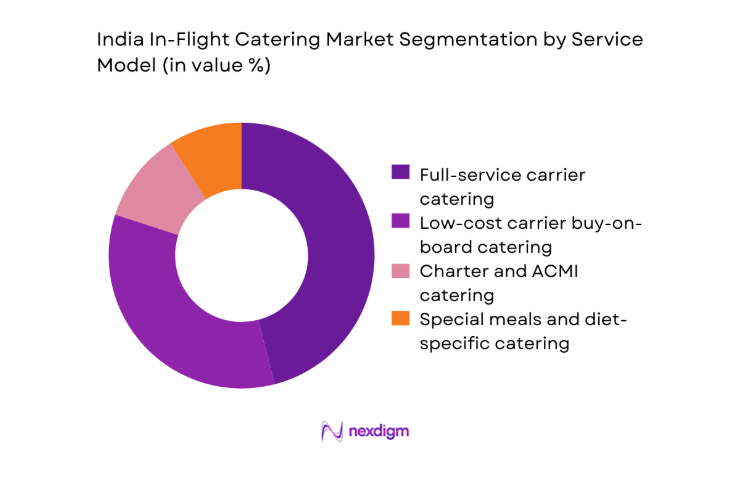

By Service Model

Full-service carrier catering dominates due to bundled meal inclusion, premium cabin differentiation, and standardized service-level agreements that secure predictable uplift volumes. The operational footprint is anchored in hub airports where kitchen capacity, security screening lanes, and apron-side logistics enable reliable service windows. Buy-on-board programs expand alongside low-cost operations but face variability in demand planning and wastage control. Charter catering remains episodic, driven by seasonal travel peaks and ad-hoc operations. Special meals show steady traction due to dietary diversity and medical compliance requirements, supported by pre-order workflows and traceability systems integrated with airline reservation platforms.

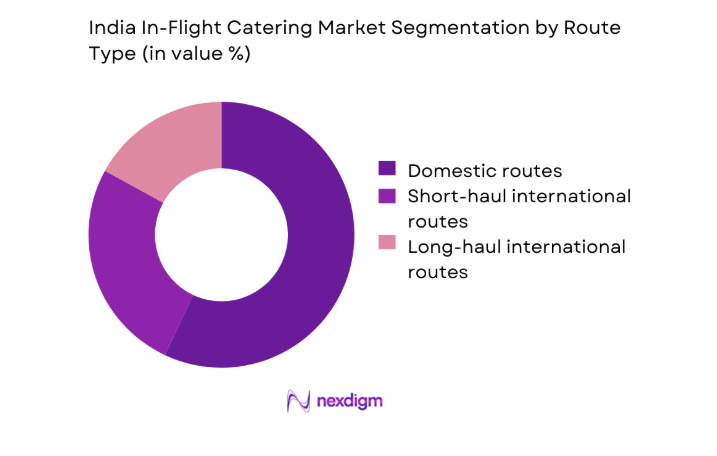

By Route Type

Domestic routes dominate due to higher flight frequency, dense city-pair networks, and shorter turnarounds that favor standardized menus and packaged offerings. Short-haul international routes benefit from premium snack and beverage programs linked to business travel corridors. Long-haul international routes command higher service complexity driven by multi-course meals, stricter cold chain requirements, and premium cabin service differentiation. Operational maturity at gateway airports enables scalable production cycles, while route profitability influences menu breadth and pre-order adoption. Demand variability across seasons necessitates data-led forecasting and modular menu design to manage waste and service consistency.

Competitive Landscape

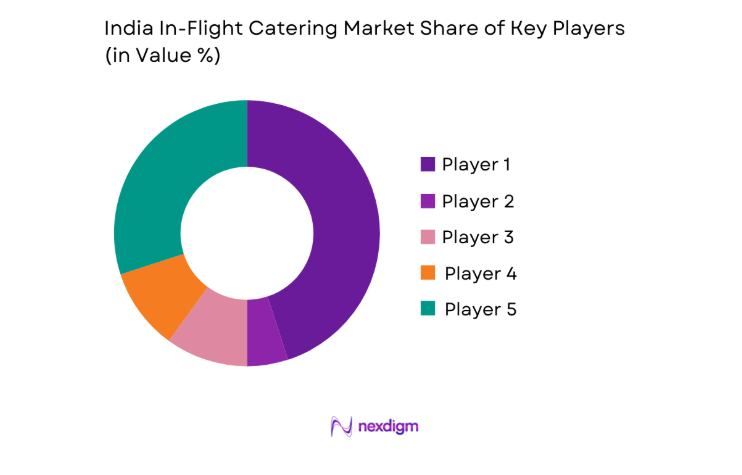

The competitive environment is shaped by airport-centric kitchen networks, multi-year airline service contracts, and compliance-driven operational capabilities. Differentiation centers on production capacity, security screening throughput, menu engineering, and last-mile airside logistics reliability.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| TajSATS Air Catering | 1974 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| LSG Sky Chefs India | 2003 | New Delhi | ~ | ~ | ~ | ~ | ~ | ~ |

| Air India SATS Airport Services | 2008 | New Delhi | ~ | ~ | ~ | ~ | ~ | ~ |

| Newrest India | 2016 | Gurugram | ~ | ~ | ~ | ~ | ~ | ~ |

| Skygourmet Catering Services | 1998 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

India In-Flight Catering Market Analysis

Growth Drivers

Rising domestic air passenger traffic and route expansion

Domestic air traffic intensity increased across high-frequency corridors supported by terminal expansions at 2024 operational nodes and additional gate availability in 2025. Aircraft movements rose by 22 across primary hubs between 2023 and 2024, improving catering uplift windows. Fleet induction added 58 narrow-body aircraft during 2024, raising daily flight rotations. Load stabilization improved through network densification across 2025, increasing predictable meal planning cycles. Airport slot utilization advanced to 41 per peak hour at metro hubs, enabling higher catering throughput. Cold-chain capacity additions across apron-side facilities improved time-to-aircraft reliability across 2024 and 2025.

Fleet additions by low-cost and full-service carriers

Carrier fleet growth accelerated with 2024 deliveries of 64 aircraft and 2025 inductions of 71 aircraft, expanding seat capacity across trunk and regional routes. Turnaround standardization reduced ground times by 6 minutes per flight in 2024, increasing catering coordination windows. Galley retrofits standardized trolley formats across 2023 and 2024, improving kitchen loading efficiency. Increased aircraft utilization to 11 hours per day in 2025 raised meal cycle predictability. Airport apron equipment availability expanded by 19 units across 2024, strengthening service continuity. Regulatory clearances for new bases in 2025 improved regional coverage.

Challenges

High food wastage due to demand forecasting inaccuracies

Demand volatility persisted across 2024 and 2025 due to route seasonality and last-minute schedule changes. Missed uplift forecasts led to disposal incidents rising by 17 incidents per 100 flights during 2024. Cabin mix changes on reconfigured aircraft increased variance in premium meal demand across 2023 and 2024. Weather-driven diversions in 2025 disrupted planned catering cycles across coastal hubs. Inconsistent pre-order penetration limited predictive accuracy across 2024. Security rescreening delays added 14 minutes to apron dwell time in 2024, increasing spoilage risk for temperature-sensitive items across high-humidity operating environments.

Operational complexity in multi-airport kitchen coordination

Multi-base coordination faced synchronization gaps across 2024 due to staggered departure banks and constrained airside access. Kitchen dispatch windows narrowed by 9 minutes on average during peak periods in 2025, elevating misloads. Variability in screening throughput across terminals in 2023 and 2024 disrupted load sequencing. Fleet rotations across three hubs per aircraft increased handover points to 3 per day in 2025, amplifying coordination risk. Staff rotation constraints in 2024 affected service consistency. Infrastructure upgrades across select terminals in 2025 temporarily reduced dock availability, impacting last-mile catering handoffs.

Opportunities

Expansion of centralized catering kitchens in emerging aviation hubs

Terminal expansions commissioned during 2024 and 2025 created new apron frontage and airside access points, enabling scalable kitchen placement. Secondary hubs recorded 28 additional daily departures in 2024, supporting baseline uplift volumes. Cargo cold storage additions across 2025 improved temperature integrity for multi-leg provisioning. Utility reliability upgrades in 2024 stabilized continuous production cycles across high-load days. Workforce skilling programs trained 1,200 handlers in food safety during 2023 and 2024, improving compliance readiness. Ground support equipment additions across 2025 reduced dock-to-aircraft transfer times, enhancing service reliability.

Growth of pre-order digital meal platforms and personalization

Airline app adoption expanded across 2024 with 9 feature releases improving pre-order visibility and menu customization. Pre-order cut-off windows standardized to 12 hours in 2025, improving kitchen batching efficiency. Passenger digital check-in usage rose in 2023 and 2024, enabling demand capture earlier in the booking cycle. Payment integration upgrades in 2024 reduced transaction failures by 3 per 1,000 sessions, stabilizing buy-on-board demand signals. Data pipelines integrated with flight ops systems across 2025 improved uplift forecasting cadence. Compliance workflows aligned with aviation security audits during 2024 ensured traceability.

Future Outlook

The outlook through 2035 reflects steady capacity additions, broader hub development, and deeper integration of digital pre-ordering into airline operations. Sustainability practices and waste reduction protocols will shape vendor differentiation. Regional kitchen expansion and standardized galley formats will support scalable service delivery. Policy support for private participation in airport services is expected to improve infrastructure readiness. Service innovation will increasingly target premiumization and personalized onboard experiences.

Major Players

- TajSATS Air Catering

- LSG Sky Chefs India

- Air India SATS Airport Services

- GDN Services

- Ambassador Sky Chef

- Skygourmet Catering Services

- Newrest India

- Celebi NAS Airport Services India

- Bangalore International Airport Catering

- Mumbai Flight Catering Services

- Delhi Flight Services

- TFS India

- Plaza Premium Group India

- Sodexo Onboard Services India

- Bird Group Aviation Catering

Key Target Audience

- Full-service airlines procurement teams

- Low-cost carrier ancillary revenue units

- Airport operators and terminal management authorities

- Central kitchen operators and cold chain logistics providers

- Food safety and aviation security compliance units

- Ground handling service providers

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Route density, fleet utilization, kitchen throughput, cold chain reliability, and security screening cadence were mapped to define operational drivers. Menu complexity, service class mix, and pre-order penetration were framed as demand-side variables. Regulatory checkpoints and apron access constraints were included to capture compliance impacts.

Step 2: Market Analysis and Construction

Operational data from airport movement logs, terminal capacity plans, and galley standardization programs were synthesized to construct service flow models. Demand planning logic aligned flight frequency with meal cycle design. Infrastructure readiness indicators informed hub-specific provisioning assumptions.

Step 3: Hypothesis Validation and Expert Consultation

Operational hypotheses were validated through practitioner workshops covering kitchen dispatch timing, security screening throughput, and airside logistics reliability. Scenario testing assessed disruption handling during peak banks and weather-driven diversions. Compliance workflows were stress-tested against audit requirements.

Step 4: Research Synthesis and Final Output

Findings were consolidated into segment-level narratives aligned with service models and route types. Risk factors and opportunity pathways were prioritized based on operational feasibility. Strategic implications were framed for buyers and service operators across hub and regional contexts.

- Executive Summary

- Research Methodology (Market Definitions and service scope for in-flight catering and ancillary onboard food services, Airline route network mapping and meal uplift volume audits across domestic and international operations)

- Definition and Scope

- Market evolution

- Usage and service delivery pathways

- Ecosystem structure

- Supply chain and channel structure

- Growth Drivers

Rising domestic air passenger traffic and route expansion

Fleet additions by low-cost and full-service carriers

Increasing ancillary revenue focus through buy-on-board programs - Challenges

High food wastage due to demand forecasting inaccuracies

Stringent aviation food safety and security compliance requirements

Operational complexity in multi-airport kitchen coordination - Opportunities

Expansion of centralized catering kitchens in emerging aviation hubs

Growth of pre-order digital meal platforms and personalization

Partnerships with QSR brands and celebrity chefs for onboard menus - Trends

Shift toward buy-on-board and ancillary revenue-led catering models

Adoption of eco-friendly packaging and zero-waste initiatives

Menu localization aligned with regional passenger preferences - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Service Model (in Value %)

Full-service carrier catering

Low-cost carrier buy-on-board catering

Charter and ACMI catering

Special meals and diet-specific catering - By Food Type (in Value %)

Hot meals

Cold meals and snacks

Beverages and alcoholic drinks

Bakery and confectionery items - By Service Class (in Value %)

Economy class

Premium economy

Business class

First class - By Route Type (in Value %)

Domestic routes

Short-haul international routes

Long-haul international routes - By Catering Format (in Value %)

Onboard meal trays

Buy-on-board packaged food

Pre-order digital catering

- Market share of major players

- Cross Comparison Parameters (geographic kitchen coverage, airline contract portfolio, production capacity per day, service class portfolio breadth, menu innovation capability, cold chain logistics reach, pricing flexibility, regulatory compliance track record)

- SWOT Analysis of Key Players

- Pricing and Commercial Model bench marketing

- Detailed Profiles of Major Companies

TajSATS Air Catering

LSG Sky Chefs India

Air India SATS Airport Services

GDN Services

Bharat Hotels’ Flight Catering

Ambassador Sky Chef

Skygourmet Catering Services

Newrest India

Celebi NAS Airport Services India

Bangalore International Airport Limited Catering

Mumbai Flight Catering Services

Delhi Flight Services

TFS India

Plaza Premium Group India

Sodexo Onboard Services India

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035