Market Overview

As of 2024, the India indoor plants market is valued at USD ~ million, with a growing CAGR of 9.1% from 2024 to 2030, supported by a surge in urbanization and increased health consciousness among consumers. With the growing demand for air-purifying plants and decorative foliage, consumers are increasingly recognizing the environmental and aesthetic benefits of indoor plants. As a result, the market is projected to experience substantial growth, driven in part by the rising trend of indoor gardening among urban dwellers.

Dominant cities such as Delhi, Mumbai, and Bangalore play a vital role in the indoor plants market due to their high population densities, evolving lifestyles, and a robust increase in disposable income. These metropolitan cities not only have well-established retail environments for indoor plants but also showcase a growing demand from both residential and commercial spaces seeking to integrate greenery into their interiors, enhancing overall well-being and aesthetics.

Market Segmentation

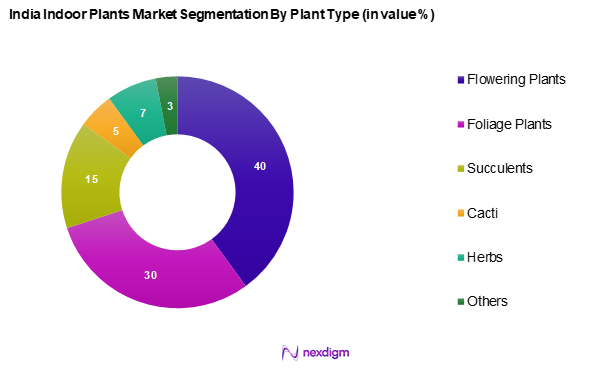

By Plant Type

The India indoor plants market is segmented into flowering plants, foliage plants, succulents, cacti, herbs, and others. Flowering plants dominate the market due to their vibrant colours and varied species, appealing to a wide range of consumers looking to enhance their living spaces. High demand for plants like Peace Lilies and Orchids, known for their beauty and air-purifying qualities, contributes to their popularity. Additionally, the growing trend of gifting flowering plants during festivals and occasions further boosts their market share.

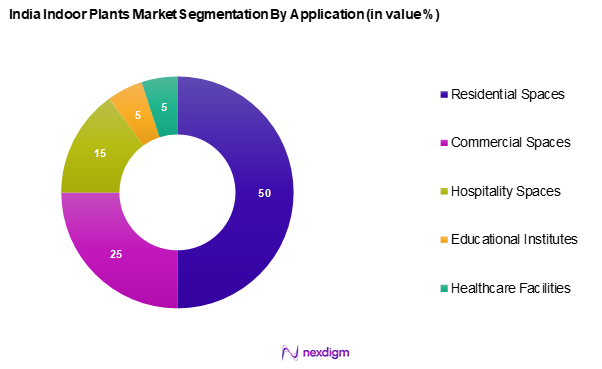

By Application

The India indoor plants market is segmented into residential spaces, commercial spaces, hospitality spaces, educational institutes, and healthcare facilities. Residential spaces dominate the market, primarily due to the increasing trend of urban gardening and home decor enhancement among homeowners. The desire for aesthetic interiors that improve air quality and mental well-being has led to higher investments in plants for living rooms and balconies. Moreover, decorative indoor plants serve as ideal gifts, amplifying their appeal in the residential segment.

Competitive Landscape

The India indoor plants market is dominated by several major players, including local and international suppliers. The competitive landscape is characterized by a mix of established companies and emerging start-ups that are continually innovating to capture greater market share. Key players such as Green Decor, Ferns N Petals, and Ugaoo have established strong brand loyalty and extensive distribution channels, reinforcing their positions in the market.

| Company Name | Establishment Year | Headquarters | Market Share | Main Products | Distribution Channels | Recent Innovations |

| Green Decor | 2002 | New Delhi, India | – | – | – | – |

| Ferns N Petals | 1994 | New Delhi, India | – | – | – | – |

| Ugaoo | 2017 | Pune, India | – | – | – | – |

| Plantshop.in | 2015 | Bangalore, India | – | – | – | – |

| Nurserylive | 2014 | Pune, India | – | – | – | – |

India Indoor Plants Market Analysis

Growth Drivers

Increasing Urbanization

Urbanization is a primary driver of the India Indoor Plants market, with over 34% of India’s population residing in urban areas as of 2022, projected to rise to approximately 37% by 2025. The rapid growth of urban dwellings, as detailed in the World Bank’s urban development reports, leads to an increased affinity for maximizing limited living space through indoor plants, creating a healthy living atmosphere amid rising pollution levels. Furthermore, urban centers are witnessing a cultural shift towards incorporating greenery in residential and office decor, spurring demand for indoor plants.

Rising Health Consciousness

The growing health consciousness among Indian consumers significantly fuels the indoor plants market. Research indicates that around 73% of urban Indians are increasingly aware of the benefits indoor plants provide, such as purifying air and reducing stress levels. A report from the Indian Council of Medical Research highlights that indoor plants can enhance well-being and productivity in individuals—two critical aspects for the urban population facing sedentary lifestyles and high stress. This awareness is expected to drive growth, particularly among health-oriented consumers.

Market Challenges

Supply Chain Disruptions

The supply chain disruptions in the India Indoor Plants market have impacted availability and delivery timeframes for various plants. The COVID-19 pandemic highlighted vulnerabilities in supply chains, with the logistics sector facing challenges owing to a decline in operational capabilities; as reported by the Ministry of Commerce & Industry, India imports majority of ornamental plants annually. As of 2024, ongoing issues with international shipping routes and domestic logistics hinder timely plant delivery, affecting consumer access and market fluidity.

Seasonal Demand Variability

Seasonal demand variability presents a significant challenge in the indoor plants market, particularly during holiday months when customers are more inclined to purchase plants as gifts. However, a study revealed that demand can dip by 30% outside of peak gifting seasons such as Diwali and Christmas. The Agricultural Products Marketing Committee indicated that fluctuations, driven by cultural traditions and long-distance transportation costs, can lead to overstocking during peak seasons and shortages during lean periods, significantly affecting profitability.

Opportunities

Growing Interior Designing Trends

The rise of interior design trends presents a significant opportunity for the India indoor plants market. As urban living spaces become more focused on aesthetics, indoor plants are increasingly viewed as essential decor elements. The number of interior design firms in India has grown by 20% between 2022 and 2024, indicating a higher demand for innovative design solutions that incorporate plants. Designers emphasize the importance of greenery in creating inviting atmospheres, which enhances sales opportunities for various indoor plant categories, contributing to market growth.

Expansion of E-commerce Platforms

With the booming e-commerce sector in India, which reached USD 84 billion in 2023, the indoor plants market benefits from enhanced accessibility for consumers through online retail platforms. Major e-commerce players have reported a 45% increase in sales of indoor plants. This shift reflects consumer preferences for convenient purchasing options and diverse selections available online. E-commerce optimization, alongside targeted marketing efforts, presents substantial future growth opportunities for retailers and suppliers to tap into broader customer bases.

Future Outlook

Over the next five years, the India indoor plants market is anticipated to witness remarkable growth, propelled by increasing interest in health and wellness trends, heightened awareness of indoor air quality, and accelerated adoption of urban gardening practices. As more consumers integrate greenery into their homes and office spaces, the demand for diverse plant varieties and sustainable products is expected to rise, driving the overall market expansion.

Major Players

- Green Decor

- Ferns N Petals

- Ugaoo

- Plantshop.in

- Nurserylive

- MyBageecha

- Easyhomes

- Blossoms

- Yebhi

- Bageecha

- The Urban Plant

- GardenShed

- GroGuy

- Plants Guru

- Kyari.co

Key Target Audience

- Indoor Plant Retailers

- Home Decor Companies

- Landscaping Service Providers

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Agriculture, Indian Council of Agricultural Research)

- Hotels and Hospitality Chains

- Educational Institutions (Schools and Colleges)

- Healthcare Facilities (Hospitals and Wellness Centers)

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves outlining the market structure by mapping significant players and stakeholders in the India Indoor Plants market. This entails conducting extensive desk research utilizing secondary data from industry reports, government publications, trade associations, and proprietary databases, which aids in establishing the variables that influence market behavior and trends.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled to analyze the India indoor plants market thoroughly. This includes evaluating market penetration, current trends in indoor plant purchases, and the role of various stakeholders in revenue generation. Quality of service data will also be assessed to ensure reliability in revenue estimates and to understand consumer preferences.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and subsequently verified through consultations with industry experts from various organizations. These discussions, likely conducted through interviews and surveys, will provide insights into market dynamics, consumer preferences, and potential growth areas, enabling a more accurate interpretation of the data collected.

Step 4: Research Synthesis and Final Output

The conclusive phase encompasses engaging with key indoor plant manufacturers and distributors to gain insights regarding product ranges, sales trends, and consumer behaviours. This interaction will validate and enhance the data obtained through previous research steps, ensuring a comprehensive understanding of the India Indoor Plants market is accurately represented in the final report.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Increasing Urbanization

Rising Health Consciousness - Market Challenges

Supply Chain Disruptions

Seasonal Demand Variability - Opportunities

Growing Interior Designing Trends

Expansion of E-commerce Platforms - Trends

Rise of Urban Gardening

DIY Plant Care Kits - Government Regulation

Plant Health Regulations

Fertilizer Usage Guidelines - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Plant Type, (In Value %)

Flowering Plants

Foliage Plants

Succulents

Cacti

Herbs

Others - By Application, (In Value %)

Residential Spaces

Commercial Spaces

Hospitality Spaces

Educational Institutes

Healthcare Facilities - By Distribution Channel, (In Value %)

Online Retail

Specialty Stores

Supermarkets/Hypermarkets

Wholesale Markets - By Region, (In Value %)

North India

South India

East India

West India - By Potting Medium, (In Value %)

Soil-based

Hydroponics

Peat-based - By Maintenance Type, (In Value %)

Low Maintenance

Medium Maintenance

High Maintenance - By Space, (In Value %)

Office Plants

Living Room Plants

Balcony Plants

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Plant Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Number of Retail Outlets)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SK

Pricing Analysis Basis SKUs for Major Players - Detailed Profiles of Major Companies

Green Decor

Ferns N Petals

Ugaoo

Plantshop.in

The Plant Company

Nurserylive

MyBageecha

Easyhomes

Blossoms

Yebhi

Bageecha

The Urban Plant

GardenShed

GroGuy

Plants Guru

Kyari.co

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030