Market Overview

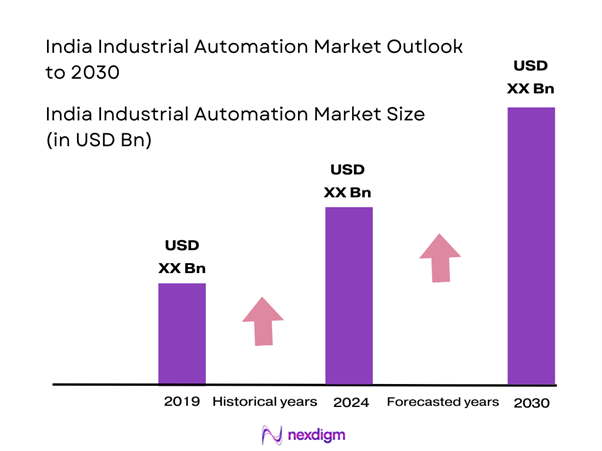

The India Industrial Automation Market is valued at USD 7.57 billion in 2024, demonstrating significant growth driven by the rapid integration of advanced technologies in manufacturing processes. The push for digitization, smart factories, and increased efficiency in operations has fueled this expansion, leading to a robust CAGR of 9.5% from 2024-2030. Key players in the market have invested in innovative solutions, enhancing productivity in various sectors such as automotive, manufacturing, and energy.

The market is primarily dominated by cities like Bengaluru, Pune, and Chennai. These cities are technology hubs that house major companies and startups, showing a strong inclination toward adopting automation solutions. The presence of skilled labor, advanced infrastructure, and significant research and development initiatives in these regions contribute to their dominance in the industrial automation landscape.

As the market in India evolves, there is a growing demand for customized automation solutions. Reports indicate that over 60% of manufacturers are looking for tailored automation systems that meet their specific operational needs and challenges. This shift towards customization is primarily driven by the increasing variety of products and the shift towards smaller batch productions. Companies are seeking automation systems able to adapt easily to new production requirements, and many vendors are investing in research to develop highly flexible and configurable solutions that respond to these demands.

Market Segmentation

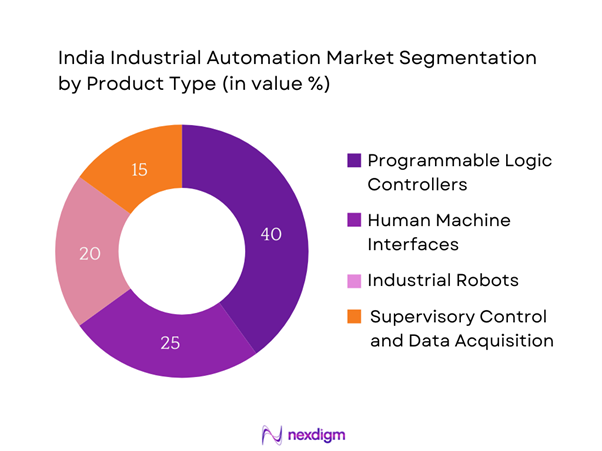

By Product Type

The India Industrial Automation Market is segmented by product type into Programmable Logic Controllers (PLCs), Human Machine Interfaces (HMIs), Industrial Robots, and Supervisory Control and Data Acquisition (SCADA) systems. Programmable Logic Controllers (PLCs) dominate the market significantly, driven by their efficiency and flexibility in managing processes and machinery. Their adaptability to various industrial conditions and ease of programming has made them essential in sectors such as automotive and manufacturing. With the rise of smart factories seeking integrated systems, PLCs emerged as the backbone of industrial automation, providing seamless communication and control over machinery.

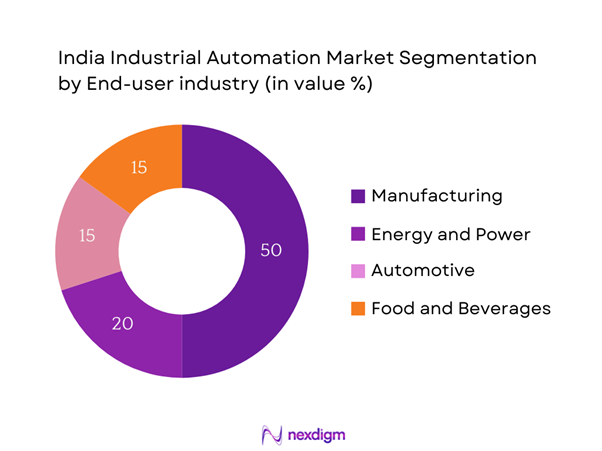

By End-User Industry

The market is also segmented by end-user industry, including Manufacturing, Energy and Power, Automotive, and Food and Beverage. The manufacturing sector dominates the industrial automation market due to the constant demand for enhancing productivity and reducing labor costs. Automation technologies allow manufacturers to streamline operations, improve quality, and minimize downtime. Moreover, as manufacturers increasingly adopt Industry 4.0 practices, the need for real-time monitoring and efficiency optimization solidifies manufacturing’s leading role in the market.

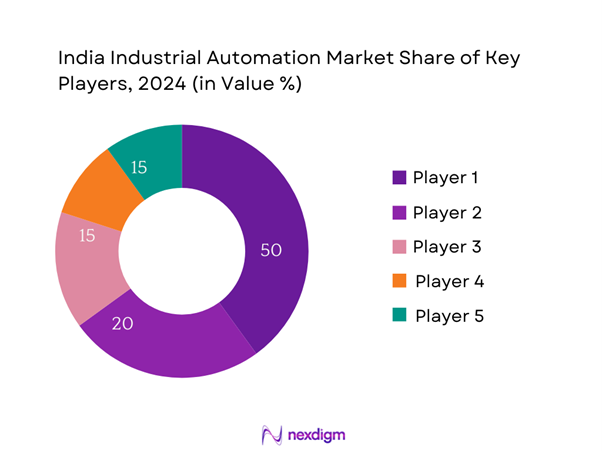

Competitive Landscape

The India Industrial Automation Market is characterized by a competitive ecosystem dominated by major players such as Siemens, Rockwell Automation, and ABB. The market competitive landscape illustrates significant consolidation among global players who leverage their technological expertise to dominate the Indian market. As these companies innovate and develop comprehensive automation solutions, they not only enhance operational efficiencies but also set the standard for future advancements in industrial automation.

| Company Name | Establishment Year | Headquarters | Product Offerings | Market Strategies | Research and Development Focus |

| Siemens AG | 1847 | Berlin, Germany | – | – | – |

| Rockwell Automation | 1903 | Milwaukee, Wisconsin | – | – | – |

| ABB Ltd. | 1988 | Zurich, Switzerland | – | – | – |

| Schneider Electric | 1836 | Rueil-Malmaison, France | – | – | – |

| Honeywell International Inc. | 1906 | Charlotte, North Carolina | – | – | – |

India Industrial Automation Market Analysis

Growth Drivers

Industry 4.0 Adoption

Industry 4.0 is transforming the Indian manufacturing landscape, with a strong focus on smart factories that leverage IoT, AI, and data analytics. According to a report by the World Economic Forum, 45% of companies in India have started embracing digital transformation initiatives. The Indian government’s continuous support for adopting smart manufacturing techniques through schemes like the Digital India initiative aims to increase productivity and simplify processes. As advancements in technology reduce downtime and operational inefficiencies, the Indian manufacturing industry’s value added is projected to reach USD 1 trillion, making Industry 4.0 a critical growth driver.

Increased Production Efficiency

Production efficiency in India is on the rise due to the adoption of automation technologies. According to the Ministry of Heavy Industries, factories implementing automation solutions have reported a productivity increase of 15% to 30%, as these technologies streamline processes and ensure reduced waste. The government has also announced various initiatives to bolster manufacturing efficiency, aligning with the target of achieving USD 5 trillion GDP by 2025. With the focus on optimizing supply chains and reducing lead times, more companies are investing in automation technologies, which support growth in various sectors, including automotive and pharmaceuticals.

Market Challenges

High Implementation Costs

One of the significant challenges hindering widespread adoption of industrial automation in India is the high implementation cost. With initial investment estimates ranging between USD 200,000 and USD 1 million for advanced automation systems, many small and medium enterprises (SMEs) struggle to afford these upfront costs. The Indian government recognizes this issue and is exploring ways to subsidize costs through its production-linked incentive (PLI) schemes. Without significant cost reductions or financial aid, smaller companies may continue to be at a disadvantage compared to larger players who can handle these investments.

Integration Complexities

Integrating new automation technologies into existing processes presents another hurdle for Indian manufacturers. A survey from the Ministry of Electronics and Information Technology found that 58% of manufacturers reported challenges in integrating automation with legacy equipment. This complexity often leads to longer project timelines and increased costs for companies seeking automation. As firms progress down the automation journey, they need to invest time and resources into ensuring seamless integration, which can be a significant barrier to quick implementation.

Opportunities

Smart Manufacturing

Smart manufacturing is at the forefront of opportunities for growth in India’s industrial automation market. Current advancements in IoT and AI offer manufacturers unprecedented data insights that can optimize production processes. Reports suggest that manufacturers adopting smart technologies can reduce operational costs by 20% while improving product quality. The government encourages innovation in smart manufacturing through initiatives under the National Policy on Manufacturing, fostering collaboration between industry stakeholders and technology developers to create solutions aligned with global standards.

Expansion of Industrial IoT

The rapid proliferation of Industrial IoT (IIoT) is positioned as a key opportunity for the Indian automation market. With an estimated 10 billion connected devices expected by end of 2025 globally, the Indian market is gearing up to harness this potential as industries increasingly seek real-time data analytics and monitoring. The demand for connected devices has driven investments in IIoT solutions, with forecasts suggesting growth driven by sectors such as manufacturing, logistics, and energy. Companies are harnessing IoT technologies to improve operational visibility and create smarter factories, thereby enhancing efficiency and reducing downtime. India’s focus on innovation and digital transformation positions it favorably as a market leader in adopting IIoT solutions, with ongoing governmental support aimed at stimulating research and development funding to elevate the industry.

Future Outlook

Over the next five years, the India Industrial Automation Market is expected to experience considerable growth, propelled by continuous advancements in automation technology, the integration of Artificial Intelligence, and increasing investment in smart manufacturing initiatives. The government’s focus on digital transformation and manufacturing efficiency, combined with the global shift toward Industry 4.0 principles, will further catalyze expansion. Additionally, the rise in demand for energy-efficient solutions and sustainable practices will shape the future landscape.

Major Players in the Market

- Siemens AG

- Rockwell Automation

- ABB Ltd.

- Schneider Electric

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Emerson Electric Co.

- Fanuc Corporation

- Yaskawa Electric Corporation

- Bosch Rexroth AG

- Omron Corporation

- Eaton Corporation

- National Instruments Corporation

- KUKA AG

- Delta Electronics

Key Target Audience

- Manufacturing Companies

- Energy and Power Sector Players

- Automotive Manufacturers

- Food and Beverage Industry Executives

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Heavy Industries and Public Enterprises)

- Industrial Automation Solution Providers

- System Integrators and Consultants

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the key stakeholders and variables that drive the India Industrial Automation Market. This step is facilitated by extensive desk research, which combines secondary data from reputable sources and proprietary market intelligence databases. The purpose is to identify the components influencing market dynamics, including technological advancements, economic factors, and regulatory frameworks.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data related to the India Industrial Automation Market. This includes assessing aspects such as market penetration rates, a count of marketplaces versus service providers, and the revenue generated across different segments. A thorough assessment of service quality metrics will be conducted to validate revenue estimates and ensure data reliability.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through computer-assisted telephone interviews (CATIs) with industry experts and decision-makers from various organizations. These interactions will yield valuable insights into operations, market challenges, and growth strategies, which will be crucial for refining and corroborating collected market data.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with various stakeholders in the industrial automation ecosystem to obtain insights into product segments, sales performances, customer preferences, and emerging trends. This process will serve to verify the statistical data gathered and provide a well-rounded analysis of the India Industrial Automation Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Dynamics

- Timeline of Key Developments

- Industry Life Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Technological Advancements

Rising Demand for Operational Efficiency

Government Initiatives - Market Challenges

High Initial Investment

Workforce Skill Gaps - Opportunities

Increasing Adoption of Robotics

Integration of AI and Machine Learning - Trends

Shift Towards Smart Manufacturing

Sustainable and Green Automation Solutions - Government Regulation

Industry Standards Compliance

Incentives for Automation Technologies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019–2024

- By Average Selling Price, 2019-2024

- By Product Type (In Value %)

Programmable Logic Controllers (PLCs)

– Micro PLCs

– Modular PLCs

– Rack-mounted PLCs

– Safety PLCs

Human Machine Interfaces (HMIs)

– Basic HMIs

– Advanced Graphical HMIs

– Web-based HMIs

– Mobile HMIs

Industrial Robots

– Articulated Robots

– SCARA Robots

– Cartesian Robots

– Collaborative Robots (Cobots)

– Delta Robots - By Technology (In Value %)

Robotics

– Industrial Robotics

– Collaborative Robotics (Cobots)

– Mobile Robots (AGVs/AMRs)

– Robotic Vision Systems

Control Systems

– Supervisory Control and Data Acquisition (SCADA)

– Distributed Control Systems (DCS)

– Programmable Automation Controllers (PACs)

– Machine Safety Systems

– Industrial Internet of Things (IIoT) Platforms - By End-User Industry (In Value %)

Manufacturing

– FMCG

– Textiles

– Chemicals & Petrochemicals

– Pharmaceuticals

– Electronics

Energy and Power

– Thermal Power Plants

– Renewable Energy Plants

– Substations & Grids

Automotive

– Assembly Line Automation

– Component Manufacturing

– EV Manufacturing Facilities - By Region (In Value %)

North India

South India

West India

East India - By Application (In Value %)

Process Automation

– Continuous Processes

– Batch Processes

Discrete Automation

– Assembly & Fabrication

– Packaging & Material Handling

– Machine Tools & CNC Integration

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Industrial Automation Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Automation Segment Revenues, After-Sales Support & Service Infrastructure, Customer Interface Points, Distribution Channels, Number of Dealers & Distributors, Segment Margins, Production Plant & Capacity, Unique Value Proposition, others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Siemens AG

Rockwell Automation

Schneider Electric

ABB Ltd.

Yokogawa Electric Corporation

Honeywell International Inc.

Mitsubishi Electric Corporation

Bosch Rexroth AG

Emerson Electric Co.

General Electric (GE)

Omron Corporation

Fanuc Corporation

KUKA AG

Fanuc Corporation

Delta Electronics, Inc.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030