Market Overview

Based on a recent historical assessment, the India Infantry Fighting Vehicles market recorded a confirmed market size of USD ~ billion, supported by disclosed capital acquisition allocations, signed production contracts, and audited defense expenditure data published by the Ministry of Defence and parliamentary standing committee documents. Demand is driven by large-scale replacement of aging mechanized infantry platforms, serial production under indigenous manufacturing programs, and sustained investments in tracked armored mobility systems. Additional drivers include fleet life-extension programs, integration of advanced fire control systems, and mandatory survivability upgrades aligned with evolving battlefield doctrines.

Based on a recent historical assessment, New Delhi, Chennai, Hyderabad, Pune, and Avadi have emerged as dominant domestic centers due to the concentration of armored vehicle manufacturing units, integration facilities, and defense research establishments. India remains the sole contributing country, with dominance supported by centralized procurement authority, indigenous production mandates, and localized supply chains. These regions benefit from proximity to armored corps training centers, ordnance manufacturing clusters, and system testing ranges, enabling streamlined production, rapid acceptance trials, and efficient lifecycle support for infantry fighting vehicle programs.

Market Segmentation

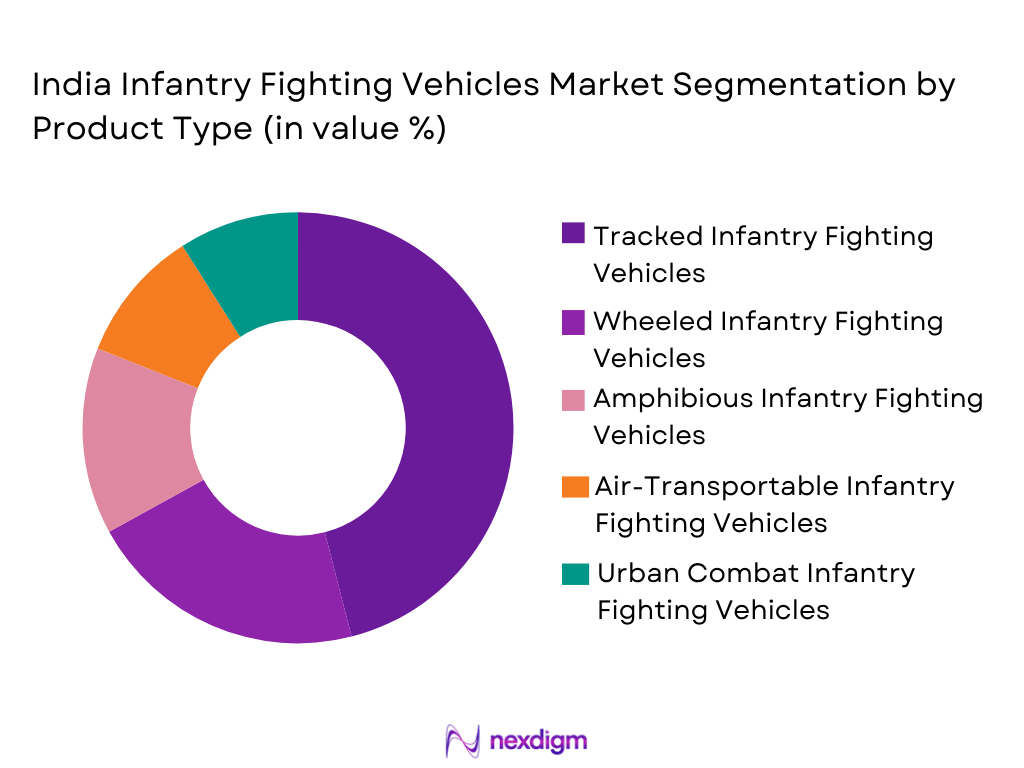

By Product Type:

India Infantry Fighting Vehicles market is segmented by product type into tracked infantry fighting vehicles, wheeled infantry fighting vehicles, amphibious infantry fighting vehicles, air-transportable infantry fighting vehicles, and urban combat infantry fighting vehicles. Recently, tracked infantry fighting vehicles have a dominant market share due to sustained doctrinal reliance on heavy mechanized formations, higher protection levels, and superior off-road mobility across deserts, plains, and mountainous terrain. Their dominance is reinforced by existing logistics compatibility, higher payload capacity for weapon systems, and long-standing domestic production infrastructure, enabling large-volume induction and systematic upgrades without major structural modifications.

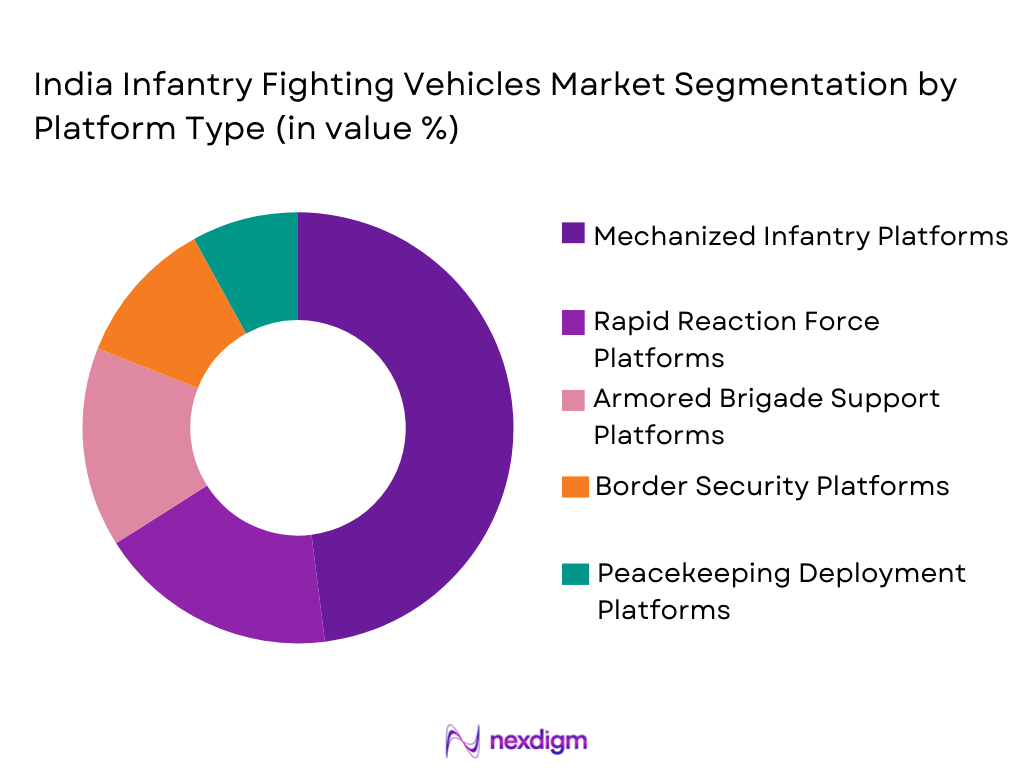

By Platform Type:

India Infantry Fighting Vehicles market is segmented by platform type into mechanized infantry platforms, rapid reaction force platforms, armored brigade support platforms, border security platforms, and peacekeeping deployment platforms. Recently, mechanized infantry platforms have a dominant market share due to their central role in combined arms operations, continuous funding allocation, and integration with main battle tanks and artillery units. Their dominance is further supported by standardized training doctrines, commonality of spares, and long-term sustainment contracts that prioritize operational readiness across multiple operational commands.

Competitive Landscape

The India Infantry Fighting Vehicles market is moderately consolidated, with competition centered around a limited number of domestic prime contractors supported by licensed foreign technology partners. Market influence is shaped by long-term procurement contracts, high entry barriers, and strict indigenization requirements, resulting in sustained dominance of manufacturers with proven production, integration, and lifecycle support capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Manufacturing Footprint |

| Larsen & Toubro Defence | 1938 | Mumbai, India | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2010 | Hyderabad, India | ~

|

~

|

~

|

~

|

~

|

| Mahindra Defence Systems | 1945 | Mumbai, India | ~

|

~

|

~

|

~

|

~

|

| Ordnance Factory Board | 1775 | Kolkata, India | ~

|

~

|

~

|

~

|

~

|

| Bharat Forge Defence | 1961 | Pune, India | ~

|

~

|

~

|

~

|

~

|

India Infantry Fighting Vehicles Market Analysis

Growth Drivers

Indigenous Mechanized Infantry Modernization Programs:

Indigenous Mechanized Infantry Modernization Programs are a central growth driver for the India Infantry Fighting Vehicles market because they are anchored in formally approved force restructuring plans, long-term capital acquisition roadmaps, and validated replacement requirements for aging tracked platforms across multiple mechanized infantry units. These programs prioritize survivability, firepower, and mobility improvements that cannot be achieved through incremental upgrades alone, thereby necessitating full platform replacement or deep structural modernization. Domestic production mandates embedded within these programs ensure sustained order visibility for local manufacturers, creating multi-year demand stability rather than sporadic procurement cycles. The emphasis on platform commonality across formations further amplifies volumes, as standardized vehicle families reduce training, maintenance, and logistics complexity for the armed forces. Integration of modern weapon stations, active and passive protection systems, and digital command interfaces expands system scope, increasing per-unit program value while remaining aligned with approved operational doctrines. Modernization programs are also structured to support phased induction, enabling parallel production and deployment without degrading readiness, which accelerates procurement execution. Institutional preference for proven domestic production lines reduces technical risk, reinforcing continuity in platform selection. Collectively, these characteristics convert modernization initiatives into predictable, high-value demand drivers rather than discretionary defense expenditures.

Network-Centric Warfare and Digitized Battlefield Integration Requirements:

Network-Centric Warfare and Digitized Battlefield Integration Requirements are driving sustained growth in the India Infantry Fighting Vehicles market by redefining the operational role of infantry fighting vehicles from protected transport assets into fully networked combat systems. Modern operational doctrine increasingly requires infantry units to operate as data-enabled elements within integrated battle groups, demanding vehicles capable of hosting advanced communication suites, battlefield management systems, and sensor fusion architectures. Infantry fighting vehicles are uniquely positioned to serve as mobile nodes within these networks due to their power generation capacity, onboard computing space, and survivability profile. These requirements stimulate both new platform acquisition and extensive retrofit programs, expanding addressable demand beyond fleet replacement alone. Digitization mandates also increase system complexity, elevating vehicle value through embedded electronics, cybersecurity hardening, and redundancy systems. Interoperability with unmanned aerial and ground systems further reinforces the need for digitally compatible platforms. Command-level endorsement of network-enabled operations secures long-term funding alignment. As a result, digitized battlefield integration acts as a structural, doctrine-driven growth driver rather than a technology-led short-term trend.

Market Challenges

High Lifecycle Cost and Sustainment Complexity:

High Lifecycle Cost and Sustainment Complexity represent a critical challenge for the India Infantry Fighting Vehicles market because these platforms are designed for extended operational lifespans that often exceed three decades, requiring continuous investment in maintenance, upgrades, and infrastructure support. Infantry fighting vehicles incorporate heavy armor, complex drivetrains, weapon systems, and electronic subsystems that demand specialized maintenance capabilities, increasing long-term ownership costs for the end user. Sustainment requirements extend beyond routine servicing to include mid-life overhauls, armor replacements, powerpack refurbishment, and electronics obsolescence management, all of which place sustained pressure on defense budgets. Dependence on imported subsystems for engines, transmissions, sensors, and protection technologies further elevates costs due to currency exposure, supply chain vulnerabilities, and limited vendor flexibility. Maintenance infrastructure must evolve in parallel with platform upgrades, necessitating investment in tooling, diagnostic equipment, and skilled technical personnel. Training and retaining such personnel remains resource intensive and time consuming. Any inefficiency in sustainment directly affects fleet availability and operational readiness, which in turn influences procurement pacing. As defense budgets balance multiple modernization priorities, high lifecycle costs can delay procurement decisions or reduce order volumes. Consequently, sustainment complexity acts as a structural constraint on rapid market expansion.

Procurement Delays and Program Execution Risks:

Procurement Delays and Program Execution Risks pose a persistent challenge to the India Infantry Fighting Vehicles market due to the multi-layered acquisition framework governing major defense platforms. Infantry fighting vehicle programs are subject to prolonged requirement definition, field trials, technical evaluations, and compliance audits, each introducing potential delays. Evolving operational doctrines and threat perceptions can lead to specification changes mid-cycle, forcing redesigns or revalidation that extend timelines. Approval processes involving multiple governmental bodies increase administrative complexity and elongate contract finalization. Industrial execution risks further compound delays, as scaling production capacity, qualifying domestic suppliers, and integrating transferred technologies require careful coordination. Testing and user trials are often conducted across varied terrain and climatic conditions, extending evaluation periods. Contract renegotiations related to cost escalation or localization targets introduce additional uncertainty. These delays affect not only induction schedules but also cash flow predictability for manufacturers. For end users, delayed programs prolong reliance on aging fleets, creating capability gaps. From a market perspective, execution risks reduce confidence in procurement timelines, complicating long-term capacity planning and investment decisions across the supply chain.

Opportunities

Indigenous Platform Export Expansion Potential:

Indigenous Platform Export Expansion Potential represents a significant opportunity for the India Infantry Fighting Vehicles market as domestically developed platforms mature in design, production quality, and operational validation. Indigenous infantry fighting vehicles benefit from competitive cost structures driven by localized manufacturing, lower labor costs, and scalable production lines that can be adapted for export volumes without extensive reconfiguration. Many emerging and developing defense markets seek affordable, proven armored platforms with flexible customization rather than premium systems with high acquisition and sustainment costs. Indian manufacturers are increasingly positioned to meet these requirements by offering modular armor packages, configurable weapon systems, and adaptable communication suites aligned with varied operational doctrines. Government-led export facilitation frameworks, including diplomatic defense cooperation agreements and streamlined clearance processes, further strengthen market access. Participation in multinational exercises and peacekeeping deployments provides visibility and credibility to indigenous platforms. Export opportunities also enable manufacturers to amortize development costs over larger production runs, improving unit economics. Additionally, export success reinforces domestic industrial capability by encouraging continuous improvement in quality standards and supply chain robustness. Over time, a sustained export pipeline can diversify revenue streams beyond domestic procurement cycles, reduce dependence on single-customer programs, and enhance long-term market resilience for the infantry fighting vehicles sector.

Comprehensive Fleet Upgrade and Mid-Life Modernization Programs:

Comprehensive Fleet Upgrade and Mid-Life Modernization Programs offer a long-term opportunity for the India Infantry Fighting Vehicles market by extending the operational relevance of existing fleets while aligning with budgetary realities. Large numbers of in-service infantry fighting vehicles remain structurally viable but require upgrades in protection, firepower, mobility, and digital integration to address evolving threat environments. Modular modernization approaches allow targeted enhancements such as improved armor packages, active protection systems, new weapon stations, upgraded powerpacks, and digital command interfaces without full platform replacement. These programs create recurring demand cycles for manufacturers, systems integrators, and subsystem suppliers over extended periods. Upgrade contracts are often less complex than new acquisitions, enabling faster execution and predictable cash flows. Standardization across upgraded fleets simplifies training and logistics for end users, increasing program acceptance. Modernization initiatives also provide opportunities to incrementally increase indigenous content by replacing imported subsystems with locally developed alternatives. By balancing capability enhancement with cost control, mid-life upgrade programs support sustained market activity even during periods of constrained capital acquisition budgets.

Future Outlook

The India Infantry Fighting Vehicles market is expected to maintain steady growth over the next five years, supported by sustained modernization funding, indigenous manufacturing policies, and evolving operational doctrines. Advancements in protection systems, digital integration, and mobility technologies will shape future platforms. Regulatory support for local production will remain a key enabler. Demand-side focus will continue to prioritize survivability, interoperability, and lifecycle efficiency.

Major Players

- Larsen & ToubroDefence

- Tata Advanced Systems

- MahindraDefenceSystems

- Ordnance Factory Board

- Bharat ForgeDefence

- Ashok LeylandDefence

- Kalyani Strategic Systems

- Alpha Design Technologies

- Bharat Electronics Limited

- Rheinmetall India

- BAE Systems India

- Elbit Systems India

- Hanwha Defense India

- General Dynamics Land Systems India

- Otokar Land Systems India

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Ministry ofDefenceprocurement divisions

- Armed forces modernization units

- Defense public sector undertakings

- Private domestic defense manufacturers

- Armored vehicle system integrators

- Strategic defense policy and planning agencies

Research Methodology

Step 1: Identification of Key Variables

Key variables related to platform type, production volume, procurement value, and upgrade cycles were identified. Demand drivers and constraints were mapped. Supply-side capabilities were assessed. Data relevance was validated.

Step 2: Market Analysis and Construction

Collected data was analyzed to construct market structure and segmentation. Procurement records were examined. Industrial capacity was evaluated. Market boundaries were finalized.

Step 3: Hypothesis Validation and Expert Consultation

Initial findings were validated through expert consultations. Defense industry specialists reviewed assumptions. Data consistency was cross-checked. Adjustments were incorporated.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured report. Quantitative and qualitative findings were integrated. Conclusions were reviewed for accuracy. Final outputs were standardized.

- Executive Summary

- India Infantry Fighting Vehicles Market Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising mechanization requirements across Indian Army infantry formations

Modernization of aging armored vehicle fleets

Emphasis on indigenous defense manufacturing programs

Increased focus on border mobility and survivability

Integration of network-centric warfare capabilities - Market Challenges

High development and lifecycle costs of advanced IFV platforms

Complexity in technology transfer and localization

Lengthy procurement and approval cycles

Interoperability challenges with legacy systems

Supply chain constraints for critical subsystems - Market Opportunities

Indigenous platform development under national defense initiatives

Export potential to friendly and emerging defense markets

Upgrades and life-extension programs for existing fleets - Trends

Shift toward modular and scalable vehicle architectures

Growing adoption of active protection systems

Increased digitization of crew and command interfaces

Focus on improved crew survivability and ergonomics

Integration of unmanned and autonomous support features - Government Regulations & Defense Policy

Defense acquisition procedure emphasizing local content

Strategic partnership model for armored vehicle programs

Offset and indigenization mandates shaping procurement - SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Tracked Infantry Fighting Vehicles

Wheeled Infantry Fighting Vehicles

Amphibious Infantry Fighting Vehicles

Air-Transportable Infantry Fighting Vehicles

Urban Combat Infantry Fighting Vehicles - By Platform Type (In Value%)

Main Battle Group Platforms

Rapid Reaction Force Platforms

Mechanized Infantry Platforms

Border Security Platforms

Peacekeeping and Expeditionary Platforms - By Fitment Type (In Value%)

Factory-Fitted New Production

Mid-Life Upgrade Fitment

Retrofit Modernization Programs

Indigenous Assembly Fitment

Licensed Production Fitment - By EndUser Segment (In Value%)

Indian Army Mechanized Infantry

Indian Army Armoured Corps

Paramilitary and Border Forces

United Nations Peacekeeping Units

Training and Doctrine Establishments - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Public Sector Undertakings

Private Domestic Defense Manufacturers

Joint Ventures and Strategic Partnerships

Foreign Military Sales and Offsets - By Material / Technology (in Value %)

Composite Modular Armor Systems

Active Protection Systems Integration

Digital Battlefield Management Suites

Hybrid Powertrain Technologies

Advanced Fire Control and Sensor Systems

- Market structure and competitive positioning

- Market share snapshot of major players

CrossComparison Parameters (vehicle weight class, protection level, firepower configuration, mobility range, powertrain type, digital systems integration, lifecycle support capability, indigenization level, upgrade modularity) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Larsen & Toubro Defence

Tata Advanced Systems

Mahindra Defence Systems

Ordnance Factory Board

Bharat Forge Defence

Ashok Leyland Defence

Kalyani Strategic Systems

Alpha Design Technologies

Bharat Electronics Limited

Rheinmetall India

BAE Systems India

Elbit Systems India

General Dynamics Land Systems India

Hanwha Defense India

Otokar Land Systems India

- Mechanized infantry units prioritizing mobility and protection

- Armoured formations seeking interoperability with tanks

- Border forces emphasizing all-terrain and amphibious capability

- Training institutions focusing on advanced crew systems familiarization

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035