Market Overview

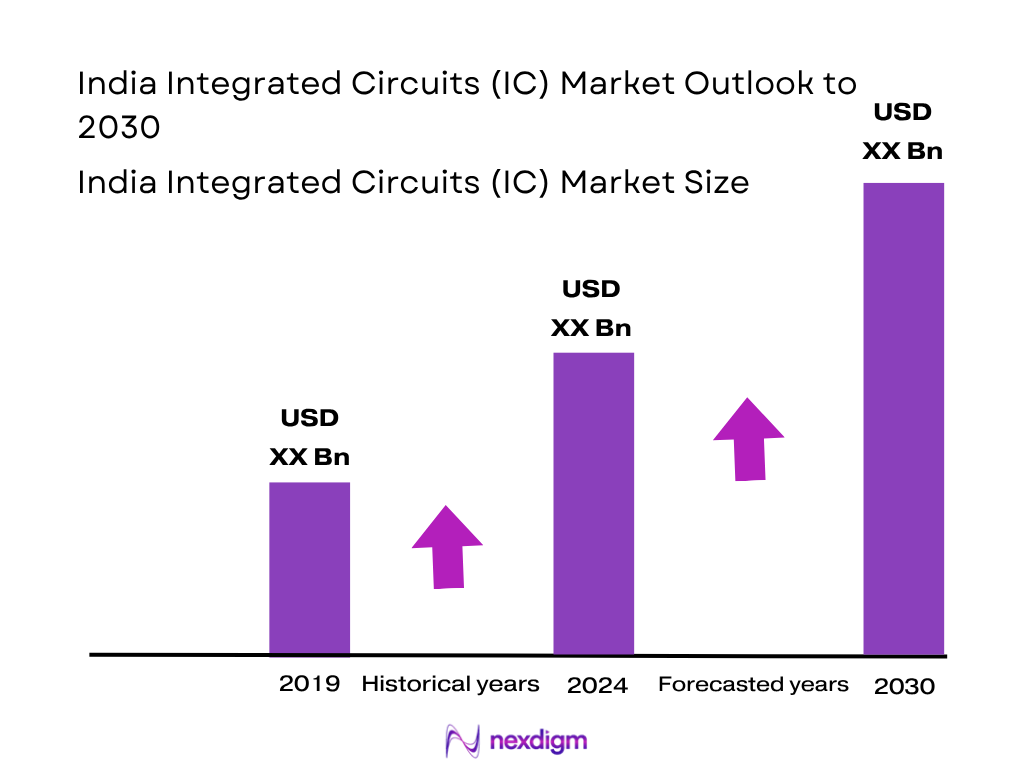

The India Integrated Circuits (IC) market is valued at USD 13.2 billion, based on a five-year historical analysis. This growth is driven by increased demand for ICs in automotive electronics, telecom infrastructure, and consumer electronics. Additionally, the Indian government’s Production Linked Incentive (PLI) scheme for semiconductor manufacturing and the “Make in India” initiative have accelerated local IC production and design activities. This push for domestic self-reliance is reducing import dependency and fostering industry expansion.

South India remains the dominant region in the India IC market, primarily due to its established electronic manufacturing ecosystem in cities such as Bengaluru, Chennai, and Hyderabad. These cities offer a rich base of design engineers, strong infrastructure, and presence of global EMS (Electronics Manufacturing Services) companies and design houses, creating a favorable environment for IC development and consumption. The region also attracts high investment in semiconductor R&D and ESDM (Electronics System Design and Manufacturing).

Market Segmentation

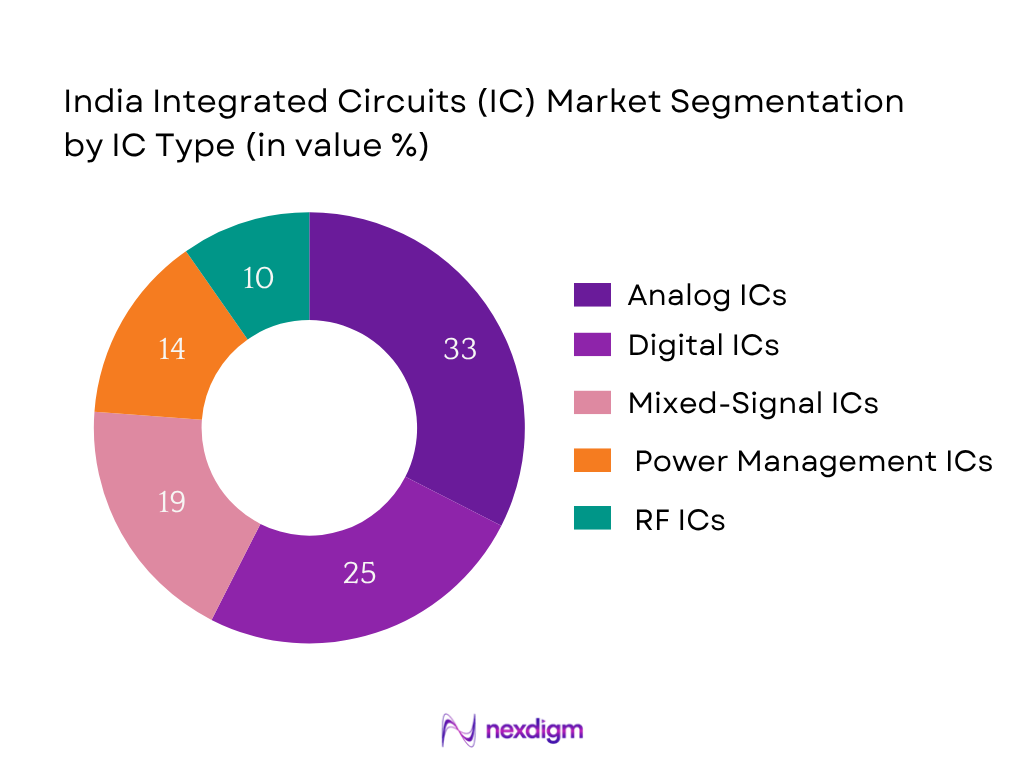

By IC Type

India Integrated Circuits (IC) market is segmented by IC type into Analog ICs, Digital ICs, Mixed-Signal ICs, Power Management ICs, and RF ICs. Among these, Analog ICs currently dominate the market due to their critical role in power regulation, signal processing, and interface applications across various industries. These ICs are embedded in smartphones, vehicles, smart appliances, and industrial equipment. The increasing complexity of devices has amplified the need for analog solutions that support efficient conversion and signal integrity, helping this sub-segment retain market leadership.

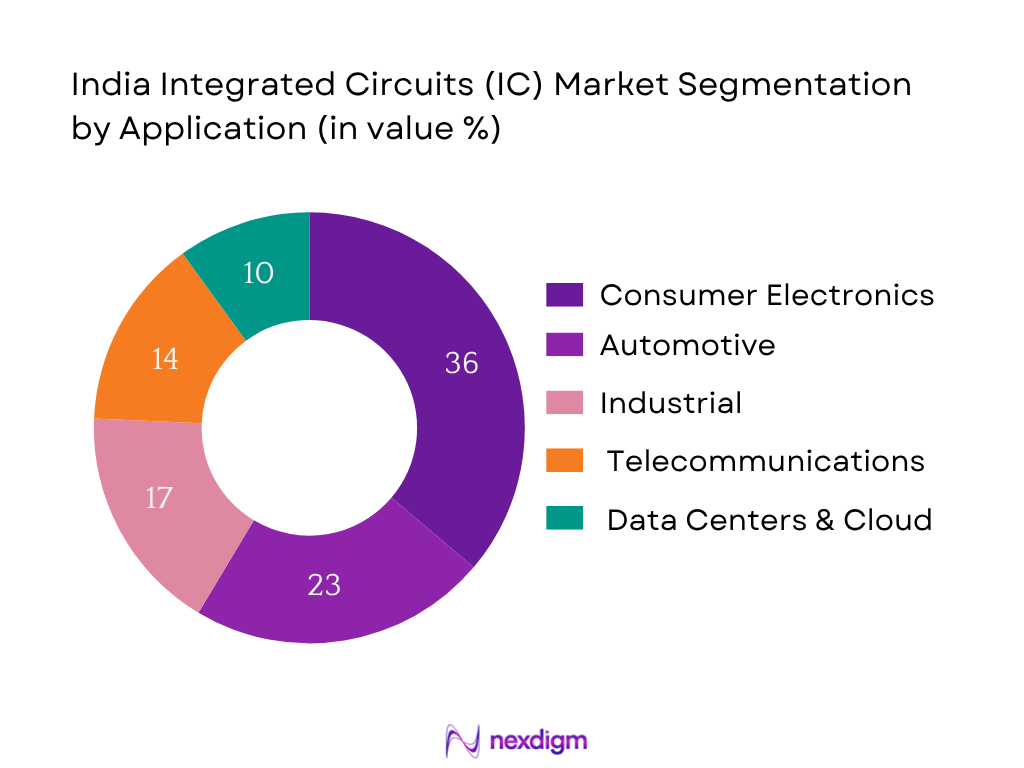

By Application

India Integrated Circuits (IC) market is segmented by application into Consumer Electronics, Automotive, Industrial, Telecommunications, and Data Centers & Cloud. Consumer Electronics holds the largest share due to high demand for smartphones, wearables, tablets, and smart TVs in India’s burgeoning digital economy. The availability of affordable devices, rising internet penetration, and increase in disposable incomes have made consumer electronics a key driver of IC consumption. Additionally, domestic brands and global OEMs increasingly rely on localized assembly and PCB integration, further fueling the dominance of this segment.

Competitive Landscape

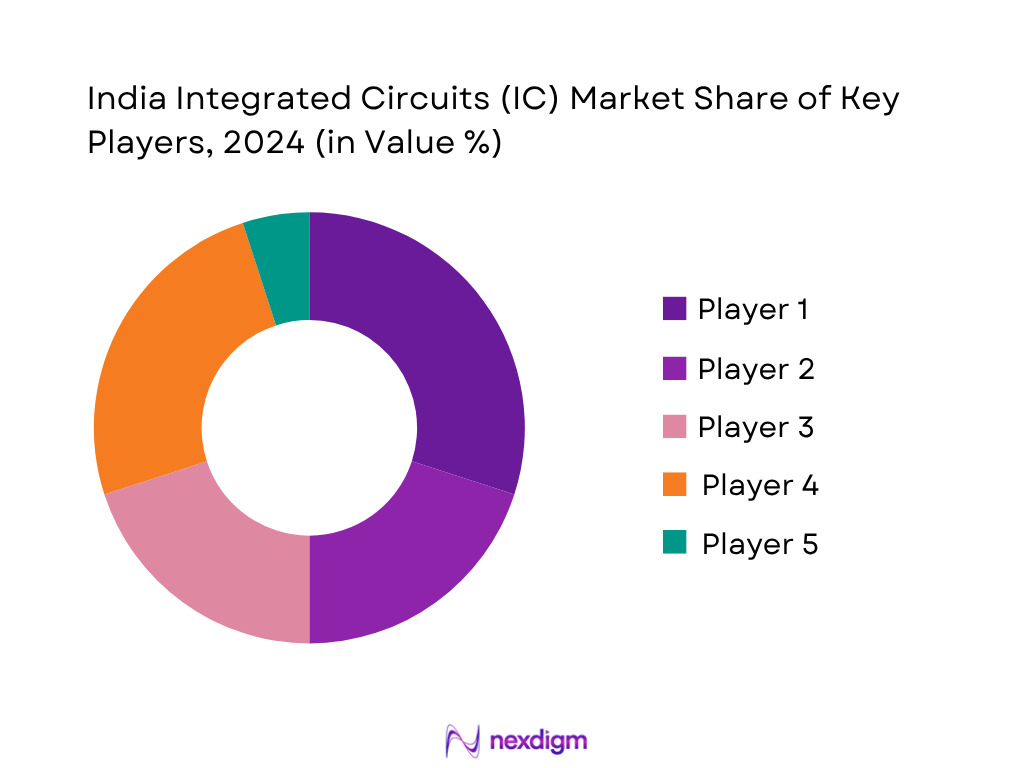

The India Integrated Circuits market is characterized by the presence of global semiconductor giants and a growing base of local design-focused companies. The market is currently dominated by companies such as Texas Instruments, Qualcomm, and MediaTek. The entry of domestic players like Polymatech Electronics and Saankhya Labs, supported by government incentives, is shaping a competitive yet collaborative ecosystem that blends global technology with local manufacturing capacity.

| Company Name | Estd. | Headquarters | Core Segment | No. of India Offices | R&D Centers in India | Domestic Partnerships | Indian Fabrication Activity | Flagship IC Products |

| Texas Instruments | 1930 | Dallas, USA | – | – | – | – | – | – |

| Qualcomm | 1985 | San Diego, USA | – | – | – | – | – | – |

| MediaTek | 1997 | Hsinchu, Taiwan | – | – | – | – | – | – |

| Polymatech Electronics | 2007 | Tamil Nadu, India | – | – | – | – | – | – |

| Saankhya Labs | 2006 | Bengaluru, India | – | – | – | – | – | – |

India Integrated Circuits (IC) Market Analysis

Market Drivers

R&D Investments

India has significantly stepped up its commitment to semiconductor and IC-related R&D under the Ministry of Electronics and IT. For FY 2024–25, the central government allocated ₹6,903 crore (approx. USD 828 million) to MeitY, with over ₹1,000 crore directed specifically toward R&D schemes under the Semiconductor Mission and SCL (Semiconductor Complex Limited) Chandigarh. This includes allocations for chip design tools, EDA software licensing for fabless startups, and silicon validation facilities. The number of design startups receiving R&D grants has increased from 45 in 2022 to 111 in 2024 under the DLI (Design Linked Incentive) Scheme, showing the strong impact of R&D investment in stimulating IC innovation.

ESDM Policies

India’s Electronics System Design and Manufacturing (ESDM) policy environment has played a pivotal role in supporting IC growth. According to MeitY’s ESDM Report 2024, over 265 new ESDM units were registered under the SPECS scheme, contributing ₹54,000 crore in electronics production. Of this, the components and IC design segment accounted for over ₹14,200 crore. The Modified Special Incentive Package Scheme (MSIPS) also catalyzed ₹27,000 crore worth of IC design and electronics assembly projects till early 2024. The concentration of such policy-driven initiatives, combined with fiscal incentives of up to 50% for capital expenditure, directly benefits IC component R&D and domestic assembly integration.

Market Challenges

Import Dependency

Despite progress, India continues to rely heavily on IC imports. According to the Ministry of Commerce, the value of IC and microprocessor imports stood at ₹1.87 lakh crore (USD 22.3 billion) in FY 2023–24, comprising nearly 68% of the country’s total semiconductor demand. The trade deficit created by such imports strains fiscal balances and delays local industry capability-building. Furthermore, 70% of India’s IC imports come from China and Taiwan, creating strategic vulnerabilities in times of geopolitical instability.

Fabrication Infrastructure

India’s domestic wafer fabrication infrastructure remains severely underdeveloped. As of April 2024, the only government-owned facility—SCL Chandigarh—operates at 180nm node and has limited capacity. While three proposals for advanced fabs have been approved (including those by Vedanta-Foxconn, IGSS Ventures, and ISMC), none have yet begun wafer production due to delays in technology transfer and land clearance. According to MeitY, India currently processes less than 5,000 wafers/month, whereas leading countries like Taiwan and South Korea process over 1.5 million wafers/month each. This gap highlights the immediate need for robust fab infrastructure to support the IC market.

Emerging Opportunities

PLI Scheme

The Production Linked Incentive (PLI) Scheme for semiconductors and display manufacturing offers a ₹76,000 crore corpus, of which ₹19,500 crore has been allocated specifically for the development of IC manufacturing capabilities. According to MeitY, as of February 2024, 32 IC-focused projects were approved under the PLI and DLI schemes, attracting cumulative proposed investments worth ₹88,000 crore. This capital inflow is being utilized for packaging facilities, silicon photonics, and analog/mixed-signal chip development. The PLI scheme’s back-end support model—where incentives are tied to milestone achievements—encourages scale while safeguarding quality.

Fabless Design Startups

India is witnessing a surge in fabless IC design startups, particularly focused on low-power AI, 5G, and automotive-grade applications. According to Startup India, over 128 registered startups are engaged in IC design as of Q1 2024—up from just 42 in 2021. Bengaluru, Noida, and Hyderabad host over 65% of these firms, many of which are receiving support through C2S (Chips to Startup) programs. These startups are reducing reliance on imported IP cores and are increasingly collaborating with global foundries for tape-outs, accelerating India’s IC design capabilities.

Future Outlook

Over the next 5 years, the India Integrated Circuits (IC) market is expected to show significant growth driven by consistent policy support, rising demand for electronic hardware, and an expanding fabless IC design ecosystem. The sector is also projected to benefit from government initiatives such as the DLI (Design Linked Incentive) Scheme, which offers financial support to domestic design startups. India’s increasing emphasis on domestic semiconductor capability, combined with strategic partnerships with nations like the US, Japan, and Taiwan, will foster a more resilient and indigenous IC supply chain. With investments flowing into both design and manufacturing, the market is poised for rapid and diversified growth across verticals.

Major Players

- Texas Instruments

- Qualcomm

- MediaTek

- Intel

- Broadcom

- NXP Semiconductors

- STMicroelectronics

- Analog Devices

- Infineon Technologies

- ON Semiconductor

- AMD

- Samsung Electronics

- Saankhya Labs

- Polymatech Electronics

- Tata Elxsi

Key Target Audience

- OEMs and Electronics Manufacturers

- Fabless IC Design Companies

- EMS (Electronics Manufacturing Services) Providers

- Semiconductor Fabrication Units

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies

- Automotive Electronics Integrators

- Telecom Infrastructure Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the India Integrated Circuits (IC) ecosystem, including all major stakeholders such as OEMs, fabless design companies, and EMS players. Desk research from proprietary databases and government publications helps define the critical market influencers and technology drivers.

Step 2: Market Analysis and Construction

We compile and analyze historical data on IC consumption, technology transitions (node-level and packaging innovations), and application-specific penetration. Data includes procurement volumes, import-export trends, and use-case breakdowns across consumer electronics, auto, and industrial sectors.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses derived from secondary research are validated through CATI interviews with semiconductor experts, OEM executives, and local fab owners. These discussions provide real-time insights into R&D investments, pricing strategies, and vendor selection patterns.

Step 4: Research Synthesis and Final Output

We consolidate insights from expert interviews and proprietary datasets to create a robust and validated forecast. Final deliverables include market sizing by segment, CAGR projections, key player benchmarks, and application-level dynamics that ensure actionable business intelligence.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Expert Interviews and Industry Validation, Primary Research Sources, Market Triangulation, Limitations and Assumptions)

- Definition and Scope

- Market Genesis and Historical Evolution

- India Semiconductor Policy Framework and IC Ecosystem

- Industry Lifecycle and Maturity Mapping

- Supply Chain and Value Chain (Design–Fabrication–Testing–Packaging–Assembly)

- Import Dependency Analysis and Indigenous Capability

- Market Drivers

R&D Investments

ESDM Policies

Localization - Market Challenges

Import Dependency

Fabrication Infrastructure

Talent Deficit - Emerging Opportunities

PLI Scheme

Fabless Design Startups

AI & IoT Adoption - Key Trends

Rise of 5G-enabled ICs

Miniaturization

Automotive-grade ICs - Regulatory Framework

MEITY

Semiconductor Policy 2.0

RoHS - Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- SWOT Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By ASP (Average Selling Price), 2019-2024

- By IC Type (In Value %)

Analog ICs

Digital ICs

Mixed-Signal ICs

Power Management ICs

RF ICs - By Technology Node (In Value %)

≤7nm

8–16nm

20–45nm

65–90nm

≥130nm - By Wafer Size (In Value %)

≤150 mm

200 mm

300 mm - By Application (In Value %)

Consumer Electronics

Automotive

Industrial

Telecommunications

Data Centers and Cloud - By Region (In Value %)

North India

South India

West India

East India

- Market Share of Major Players by Value and Volume

Competitive Positioning by IC Type - Cross Comparison Parameters (Company Overview, Business Strategies, Design Capabilities, Number of Tape-outs, IP Portfolio, Fabrication Capability, Design-to-Market Turnaround Time, Geographic Reach, Client Portfolio, Quality Certifications)

- Price Benchmarking Across Key IC Types

- SWOT Analysis of Key Players

- Detailed Company Profiles

Broadcom

Texas Instruments

MediaTek

Qualcomm

Intel

Samsung

NXP Semiconductors

Renesas Electronics

STMicroelectronics

Infineon Technologies

AMD

Analog Devices

ON Semiconductor

Polymatech Electronics

Saankhya Labs

- Procurement Behavior by OEMs and Tier 1/2 Suppliers

- Customization Needs for Application-specific ICs

- Key Demand Centers and Clusters (Bangalore, Pune, Noida, Chennai)

- Adoption Patterns by Industry Vertical

- Cost Sensitivity and Innovation Expectations

- By Value, 2025-2030

- By Volume, 2025-2030

- By ASP (Average Selling Price), 2025-2030