Market Overview

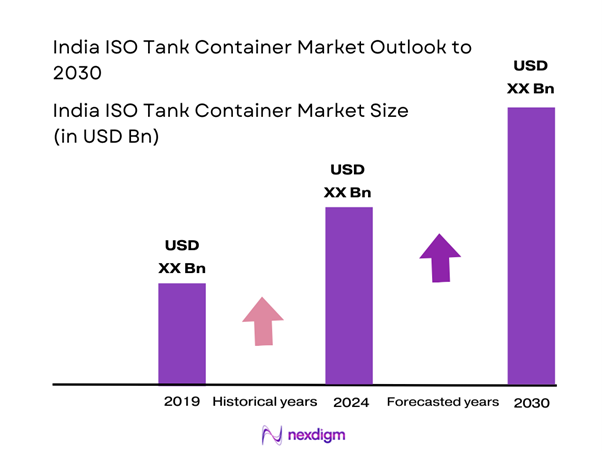

The India ISO Tank Container market is valued at USD 600 million in 2024 with an approximated compound annual growth rate (CAGR) of 4% from 2024-2030, driven primarily by the increasing demand for chemical and food transportation solutions. The growth in the food processing and chemical industries has stimulated the need for safe and efficient logistic practices. Additionally, advancements in manufacturing technology have enhanced the durability and efficiency of ISO tank containers, further propelling market growth.

The dominance of major metropolitan areas such as Mumbai and Delhi significantly contributes to the India ISO Tank Container market. Mumbai, being the financial capital, hosts numerous logistics companies and has one of the busiest ports in the country. Likewise, Delhi, with its substantial demand from the pharmaceutical and food sectors, creates a strong environment for the utilization of ISO tank containers.

The Indian government has implemented stringent safety and quality standards for ISO tank containers to ensure safe and efficient transportation of hazardous and non-hazardous materials. The Bureau of Indian Standards (BIS) mandates specific quality benchmarks that manufacturers must adhere to. These regulations help mitigate risks associated with transport, thereby protecting the environment and ensuring public safety. Additionally, compliance with international standards such as ISO 9001 and ISO 14001 is increasingly demanded by export markets, driving improvements in container quality and safety features.

Market Segmentation

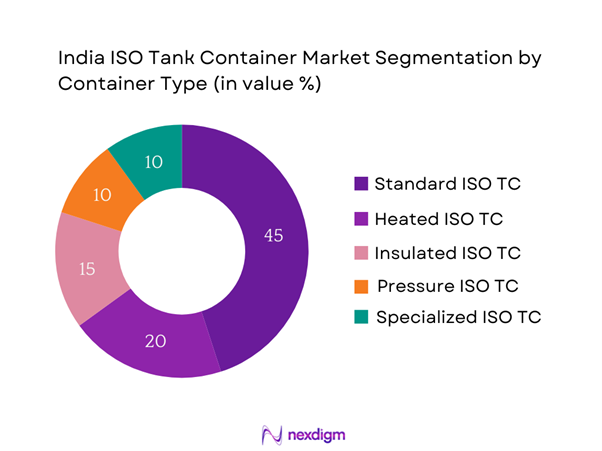

By Container Type

The India ISO Tank Container market is segmented by container type into standard ISO tank containers, heated ISO tank containers, insulated ISO tank containers, pressure ISO tank containers, and specialized ISO tank containers. Among these, standard ISO tank containers hold a dominating market share, as they are versatile and widely used for transporting a variety of liquids, including chemicals and food-grade products. Their standardized design allows compatibility with various transport means, thus facilitating easier global trade and logistics operations. Furthermore, the prevalence of large chemical and food processing industries in India has led to an increased demand for these containers, ensuring they remain a staple in the transportation ecosystem.

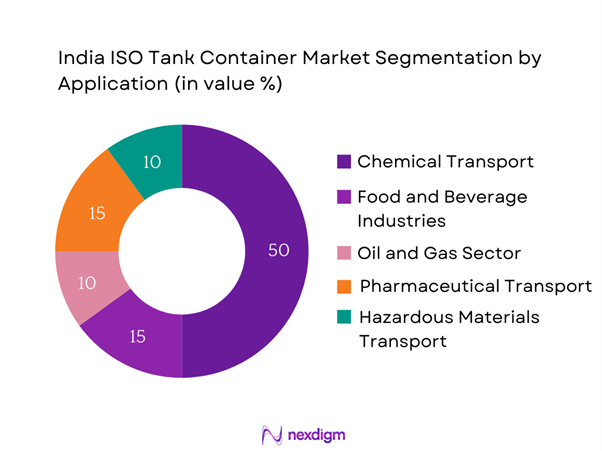

By Application

The India ISO Tank Container market is also categorized by application, including chemical transport, food and beverage industries, oil and gas sector, pharmaceutical transport, and hazardous materials transport. The chemical transport segment leads the market share, driven by India’s position as one of the leading producers and consumers of chemicals in the Asia-Pacific region. This growth is supported by robust chemical manufacturing policies, a vast domestic market, and increasing export demand. With a consistent need for bulk transport solutions, the chemical sector’s reliance on ISO tank containers continues to solidify its dominance within the market.

Competitive Landscape

The India ISO Tank Container market is dominated by several key players, including multinational corporations and local manufacturers. The consolidation within the market highlights the significant influence of these companies and their focus on innovation and service enhancements. Companies are striving to meet the growing demand through effective supply chain strategies and value-added services.

| Company Name | Establishment Year | Headquarters | Annual Revenue (USD) | Number of Employees | Container Types Offered | Major Markets Served |

| Maersk Line | 1904 | Copenhagen, Denmark | – | – | – | – |

| Hoyer Group | 1920 | Hamburg, Germany | – | – | – | – |

| Stolt Nielsen | 1959 | Rotterdam, Netherlands | – | – | – | – |

| Bulkhaul | 1980 | Hounslow, UK | – | – | – | – |

| Den Hartogh Logistics | 1920 | Rotterdam, Netherlands | – | – | – | – |

India ISO Tank Container Market Analysis

Growth Drivers

Increasing Demand for Efficient Logistics

The demand for efficient logistics solutions in India has seen significant growth, fueled by the country’s expanding trade activities. The World Bank emphasizes that the logistics cost as a percentage of GDP in India averages around 13% in comparison to the global average of 8%, highlighting inefficiencies that drive demand for improved logistics systems. With an annual growth rate of 10-12%, the logistics sector plays a vital role in enhancing supply chain efficiency, thereby boosting the use of ISO tank containers for liquid bulk transport.

Expanding Chemical and Food Processing Industries

India’s chemical industry is projected to reach USD 300 billion by end of 2025, supported by increasing domestic consumption and export demand. The food processing sector, valued at USD 290 billion, underscores the growing reliance on logistics for transporting various food products, which considerably drives the ISO tank container market. Additionally, the Food and Agriculture Organization (FAO) has reported that food waste in India accounts for about 40% of total production due to inadequate transport and storage solutions. As both sectors expand, the need for reliable ISO tank containers to ensure product integrity during transport becomes even more critical.

Market Challenges

Regulatory Compliance Issues

The Indian logistics sector faces complex regulatory frameworks that often hinder efficiency. The International Monetary Fund (IMF) notes that India’s ease of doing business rank is 63 out of 190, reflecting barriers in regulatory compliance that logistics companies must navigate. Compliance with multi-layered regulations related to transportation safety, environmental standards, and inter-state trade can be cumbersome. The latest amendments to the Environment Protection Act have tightened regulations around chemical waste management, presenting a challenge for ISO tank container usage, as companies must ensure compliance to avoid hefty penalties.

Fluctuations in Manufacturing Costs

Manufacturing costs in India have experienced significant fluctuations due to rising raw material prices and supply chain disruptions. For instance, the cost of steel, a primary material for tank production, increased by about 30% in 2022, attributed to global supply chain issues and post-pandemic recovery tensions. Moreover, according to the Reserve Bank of India, input costs for manufacturing have seen a notable rise, impacting the overall cost of logistics services, including ISO tank containers. These cost pressures can reduce profit margins and complicate pricing strategies for providers in the sector.

Opportunities

Adoption of Eco-Friendly Containers

The Indian government’s commitment to sustainability presents a significant opportunity in the ISO tank container market. As part of the National Infrastructure Pipeline, a substantial investment of USD 1.4 trillion has been allocated for sustainable infrastructure projects. In line with this, the adoption of eco-friendly ISO tank containers made from recyclable materials is gaining traction. Current initiatives, such as the “Swachh Bharat Mission,” aim to reduce waste and pollution while promoting sustainability in transportation, creating a favorable environment for eco-friendly logistics solutions. The emphasis on sustainability will likely shape the future landscape of the ISO tank container market.

Growth of E-commerce Logistics

The rapid growth of e-commerce in India, projected to reach USD 200 billion by 2026, significantly influences the logistics sector. According to the India Brand Equity Foundation (IBEF), the e-commerce market is expected to grow at a compounded annual growth rate of 27% between 2022 and 2026. This growth drives the demand for innovative transport solutions, particularly for perishable and bulk goods that require specialized containers. The surge in e-commerce logistics opens avenues for ISO tank containers, especially in the food and beverage and chemical sectors, where safety and reliability are paramount.

Future Outlook

Over the next five years, the India ISO Tank Container market is forecasted to experience significant growth driven by the expansion of manufacturing sectors, increasing awareness of environmentally friendly transport solutions, and government initiatives aimed at enhancing the logistics infrastructure. The expected CAGR for the period is approximately 7%, indicating robust market confidence among industry stakeholders.

Major Players

- Maersk Line

- Hoyer Group

- Stolt Nielsen

- Bulkhaul

- Den Hartogh Logistics

- Eric Hauser

- TWS Group

- ChemCentral

- P. Moller-Maersk

- SeaCube Containers

- Cryo-Trans

- Aitken Spence

- Transcontainer

- Hapag-Lloyd

- Mitsubishi Corporation

Key Target Audience

- Chemical Manufacturing Companies

- Food and Beverage Processing Firms

- Oil and Gas Sector Enterprises

- Logistics and Shipping Corporations

- Pharmaceutical Companies

- Government and Regulatory Bodies (Ministry of Shipping, Department of Chemicals and Petrochemicals)

- Investments and Venture Capitalist Firms

- Export-Import Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that encompasses all major stakeholders within the India ISO Tank Container market. This step relies heavily on extensive desk research, using a mixture of secondary data sources and proprietary databases to gather comprehensive information. The objective is to identify and define the critical variables that influence market dynamics, ensuring a well-informed basis for further analysis.

Step 2: Market Analysis and Construction

In this phase, historical data pertaining to the India ISO Tank Container market will be compiled and analyzed. This includes evaluating market penetration, the ratio of ISO tank containers to other transport solutions, and the resultant revenue generation. An assessment of service quality metrics will also be conducted to provide reliability and accuracy to the revenue estimates and projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through interviews with industry experts representing various sectors involved in the ISO Tank Container market. These consultations will yield valuable insights regarding operational and financial dynamics directly from practitioners, which will be instrumental in verifying and refining statistical analyses.

Step 4: Research Synthesis and Final Output

The final phase includes engaging with multiple ISO tank container manufacturers and service providers to collect detailed insights about product segments, sales performance, and market trends. This interaction facilitates the verification and supplementing of the statistics obtained through the bottom-up approach. Consequently, a comprehensive and validated analysis of the India ISO Tank Container market will emerge.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Historical Insights and Market Evolution

- Key Industry Developments Timeline

- Business Cycle Analysis

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Efficient Logistics

Expanding Chemical and Food Processing Industries - Market Challenges

Regulatory Compliance Issues

Fluctuations in Manufacturing Costs - Opportunities

Adoption of Eco-Friendly Containers

Growth of E-commerce Logistics - Trends

Introduction of Smart Tank Solutions

Innovations in Container Design - Government Regulation

Standards for Safety and Quality

Impact of GST on Transportation Costs - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Container Type (In Value %)

Standard ISO Tank Containers

Heated ISO Tank Containers

Insulated ISO Tank Containers

Pressure ISO Tank Containers

Specialized ISO Tank Containers - By Application (In Value %)

Chemical Transport

– Industrial Chemicals

– Petrochemicals

– Specialty Chemicals

Food and Beverage Industries

– Edible Oils

– Dairy Liquids

– Alcoholic and Non-Alcoholic Beverages

Oil and Gas Sector

– Crude Oil

– LNG/LPG

– Lubricants

Pharmaceutical Transport

– Bulk Pharma Ingredients

– Liquid Medicines

– Hazardous Materials Transport

Corrosive Liquids

– Flammable Liquids

– Toxic Substances - By End User (In Value %)

Logistics Companies

– Bulk Liquid Logistics Providers

– Intermodal Transporters

Manufacturing Companies

– Chemical Manufacturers

– FMCG Manufacturers

Shipping and Transport Firms

– Exporters and Importers

– Container Freight Stations

Refineries

– Public Sector Refineries

– Private Oil Refineries

Wholesalers/Retailers

– Bulk Raw Material Traders

– Distribution Networks - By Region (In Value %)

North Region

South Region

East Region

West Region

Central Region - By Rental/Ownership Model (In Value %)

Owned ISO Tank Containers

– Fleet Owned by Shippers

– Manufacturer-Owned Containers

Rented ISO Tank Containers

– Short-Term Rentals

– Project-Based Rentals

Leasing Models

– Operating Lease

– Finance Lease

– Trip Lease

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Market Share of Major Players by Type of ISO Tank Container Segment, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Distribution Channels, Margins, Production Capacity, Technical Innovations, Unique Value Propositions, and Service Offerings and others)

- SWOT Analysis of Major Players

- Pricing Analysis of Key Competitors

- Detailed Company Profiles

Maersk Line

Hyundai Merchant Marine

Hoyer Group

Stolt Nielsen

Eric Hauser

Bulkhaul

TWS Group

ChemCentral

Den Hartogh Logistics

A.P. Moller-Maersk

NTC Logistics

Conlin Post

SeaCube Containers

Cryo-Trans

Hapag-Lloyd

- Market Demand and Utilization Patterns

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Need Analysis for Different End Users

- Decision-Making Process Insights

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030