Market Overview

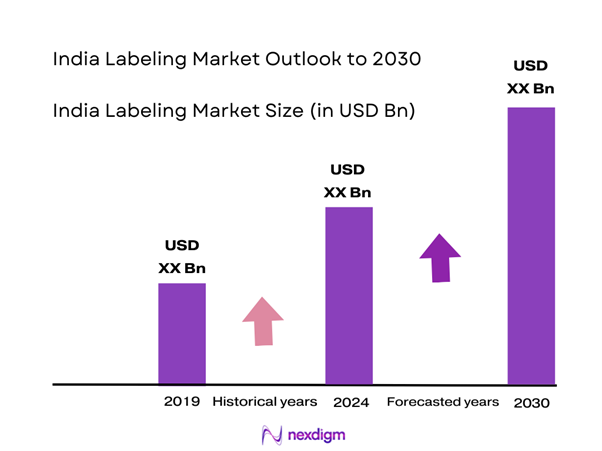

The India Labeling Market is valued at USD 2.46 Billion in 2025 with an approximated compound annual growth rate (CAGR) of 13.29% from 2025-2030, reflecting robust growth driven by increasing consumer demand for packaged goods and stringent regulatory requirements in various sectors, including food and pharmaceuticals. This growth is underpinned by advancements in labeling technology and the rise of e-commerce, which necessitates effective labeling solutions.

Major cities such as Mumbai, Delhi, and Bengaluru dominate the India Labeling Market due to their robust industrial infrastructure and significant consumer bases. These urban centers are home to numerous manufacturing units and distribution networks, enhancing accessibility for labeling solutions. Additionally, Mumbai is a financial hub, driving investment and innovation in labeling technologies, while Delhi serves as a major consumer market, accounting for a substantial share of labeling demand across various sectors.

Regulatory frameworks surrounding product labeling have tightened, catalyzing growth in the labeling market. The Food Safety and Standards Authority of India (FSSAI) mandates specific labeling requirements for food products, which encompass detailing nutritional information, ingredients, and expiry dates. Non-compliance can lead to significant fines, placing enormous pressure on manufacturers to ensure precise labeling. The continuous updates in regulations contribute to an increased need for labeling solutions that adhere to legal standards, reinforcing market growth prospects.

Market Segmentation

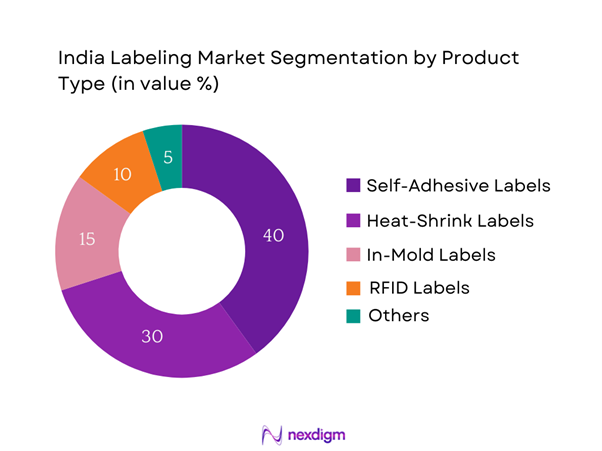

By Product Type

The India Labeling Market is segmented by product type into self-adhesive labels, heat-shrink labels, in-mold labels, RFID labels, and others. Self-adhesive labels have a dominant market share in India under this segmentation, attributed to their versatility and ease of application across various industries. These labels are preferred for packaging in sectors such as food and beverage, pharmaceuticals, and retail, due to their durability and cost-effectiveness. The increasing trend of customized labels for branding purposes further propels the demand for self-adhesive labels, making them a favorable choice among manufacturers.

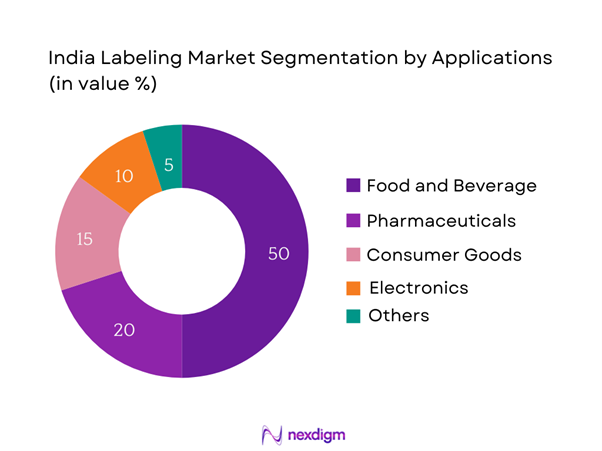

By Application

The market is also segmented by application into food and beverage, pharmaceuticals, consumer goods, electronics, and others. The food and beverage sector holds a significant market share due to the stringent regulatory requirements for product labeling, ensuring accurate information on nutritional value, ingredients, and allergens. The increased awareness regarding health and safety among consumers drives manufacturers to prioritize compliant and clear labeling. Furthermore, the growing trend of e-commerce necessitates the use of effective labeling solutions in the food and beverage sector to enhance delivery accuracy and customer satisfaction.

Competitive Landscape

The India Labeling Market is dominated by major players, including local and international companies, indicating a consolidated competitive environment. Key players influence the market significantly, with established brands leveraging technology and innovative solutions to capture market trends. Prominent players include Ecoflex, Avery Dennison, UPM Raflatac, Brady Corporation, and CCL Industries. Their extensive portfolios and robust distribution channels ensure a strong presence across various regions, thereby fulfilling diverse labeling needs effectively.

| Company | Establishment Year | Headquarters | Market Presence | Product Offerings | Revenue (Estimation) | Key Clients |

| Ecoflex | 1998 | Mumbai, India | – | – | – | – |

| Avery Dennison | 1935 | Glendale, USA | – | – | – | – |

| UPM Raflatac | 1970 | Helsinki, Finland | – | – | – | – |

| Brady Corporation | 1914 | Milwaukee, USA | – | – | – | – |

| CCL Industries | 1951 | Toronto, Canada | – | – | – | – |

India Labeling Market Analysis

Growth Drivers

Increasing Demand for Sustainable Packaging

The demand for sustainable packaging solutions has witnessed an upsurge, driven by consumer awareness regarding environmental issues. In India, 1 in 3 consumers prefer brands utilizing eco-friendly packaging materials. Current estimates suggest a rising trend where 67% of individuals are willing to pay more for sustainable packaging. This shift is further reinforced by the Indian government’s initiative to reduce plastic waste, as indicated by the implementation of the Plastic Waste Management Amendment Rules (2021). Growing recognition of sustainability in packaging sets a pivotal foundation for the label market’s expansion.

Rapid Growth of E-Commerce

The rapid expansion of e-commerce in India has notably influenced the labeling market, with the sector projected to reach USD 100 billion by end of 2025. This growth is fueled by increased internet penetration, which is expected to nearly double, from 560 million users in 2022 to 1.2 billion users by end of 2025. Online shopping accounted for 9% of retail sales in 2023, witnessing a consistent rise driven by the convenience of shopping from home. The need for clear, compliant labels on products sold online is pivotal in supporting this sector’s surge.

Market Challenges

Raw Material Price Volatility

Volatility in the prices of raw materials for labels, such as paper and plastics, poses a substantial challenge to the industry. It has been observed that plastic prices surged by approximately 22% in 2023 due to fluctuating crude oil costs, directly affecting production costs of labeling materials. Furthermore, the global paper market has experienced price increases stemming from supply chain disruptions, with instances where the price of paper raw materials rose by 10% year-on-year in 2023. This fluctuation threatens the profitability and pricing strategies of label manufacturers.

Technological Challenges

Technological advancements in the labeling sector are imperative; however, the pace at which companies must adapt is often a significant challenge. The integration of smart labels and advanced printing technologies is becoming essential, yet many companies struggle to invest in such technologies due to high initial costs and the need for skilled labor, which is scarce. As of 2023, it was reported that 40% of small to medium enterprises (SMEs) in India face workforce-related technological constraints that inhibit the adoption of modern labeling solutions.

Opportunities

Growing Trend of Smart Labels

Smart labeling is gaining traction, presenting substantial growth opportunities for the labeling market. In 2023, the global smart label market reached USD 24 billion, and India’s share in this segment is set to increase as more industries adopt RFID technology for better supply chain management. Presently, approximately 20% of Indian manufacturers utilize some form of smart labeling technology. The benefits include enhanced inventory tracking and improved customer engagement, making this segment poised for significant expansion due to technological adoption in logistics and retail sectors.

Expansion in Emerging Markets

The increasing focus on emerging markets, especially in rural areas, is shaping growth prospects for the India Labeling Market. The government’s initiatives to boost rural entrepreneurship and startups, combined with rising disposable incomes in rural areas, are driving demand for labeled products. In 2023, rural market potential accounted for nearly 30% of total consumption in food and beverage categories, indicating a lucrative opportunity for label providers. As more products reach these markets, the necessity for clear and compliant labeling will continue to escalate.

Future Outlook

Over the next several years, the India Labeling Market is expected to experience significant growth bolstered by advancements in labeling technology, increasing health awareness, and the rapid expansion of e-commerce platforms. The growing demand for transparency in product information and compliance with regulatory standards will drive innovation and adaptability among labeling solutions providers. Investments in research and development will likely lead to the introduction of smarter labeling technologies, enhancing user experience and operational efficiency.

Major Players

- Ecoflex

- Avery Dennison

- UPM Raflatac

- Brady Corporation

- CCL Industries

- R. Donnelley

- Multi-Color Corporation

- Henkel AG & Co.

- Labels and Labeling

- SATO Holdings

- Skanem AS

- WS Packaging Group

- Omet Group

- IntegraLabel

Key Target Audience

- Manufacturing Companies

- Retail Chains

- Food and Beverage Companies

- Pharmaceuticals (e.g., Central Drugs Standard Control Organization)

- Consumer Goods Firms

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (e.g., Food Safety and Standards Authority of India)

- E-commerce Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Labeling Market. This is achieved through extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Labeling Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple labeling solution manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the India Labeling Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Evolution

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Sustainable Packaging

Rapid Growth of E-Commerce

Regulatory Requirements for Product Labeling - Market Challenges

Raw Material Price Volatility

Technological Challenges - Opportunities

Growing Trend of Smart Labels

Expansion in Emerging Markets - Trends

Digitalization and Automation in Labeling

Advancements in Labeling Technologies - Government Regulation

Compliance Standards

Import Tariffs - SWOT Analysis

- Stakeholders Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Self-Adhesive Labels

– Paper-Based Labels

– Film-Based Labels (BOPP, PET, PE)

– Removable vs. Permanent Adhesives

Heat-Shrink Labels

– Full-Body Shrink Sleeves

– Tamper-Evident Bands

– Multi-Pack Shrink Bands

In-Mold Labels (IML)

– Injection Molding IML

– Blow Molding IML

– Thermoforming IML

RFID Labels

– Passive RFID Tags

– Active RFID Tags

– Smart Labels with Integrated Sensors

Others

– Wet Glue Labels

– Wrap-Around Labels

– Holographic Security Labels - By Application (In Value %)

Food and Beverage

– Packaged Foods

– Beverages (Alcoholic & Non-Alcoholic)

– Dairy and Bakery Products

Pharmaceuticals

– Prescription Drugs

– OTC Products

– Medical Devices Packaging

Consumer Goods

– Home Care Products

– Personal Care and Cosmetics

– Toiletries

Electronics

– Appliance Identification Labels

– Warning and Safety Labels

– Component Traceability Labels

Others

– Automotive

– Industrial Equipment

– Chemicals and Lubricants - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer-to-Brand Contracts

– Bulk Procurement for Large Enterprises

Distributors

– Regional Label Distributors

– Specialized Packaging Distributors

Online Retail

– B2B Platforms (e.g., Indiamart, TradeIndia)

– Label E-commerce Solutions - By Region (In Value %)

North

South

East

West - By End-User Industry (In Value %)

Food and Beverage

– Bottled Water & Soft Drinks

– Snacks and Processed Foods

– Packaged Spices & Condiments

Personal Care

– Skincare and Haircare Labels

– Perfume & Fragrance Labelling

– Hygiene Products

Healthcare

– Hospital Supplies

– Diagnostic Products

– Supplement Packaging

Industrial

– Chemicals and Solvents

– Machinery & Equipment

– Lubricants and Oils

Others

– Logistics & Warehousing

– E-commerce Packaging

– Education and Stationery

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Product, Number of Touchpoints, Distribution Channels, Number of Dealers and Distributors, Margins, Production Plant, Capacity, Unique Value offering and others)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

Ecoflex

Avery Dennison

UPM Raflatac

Brady Corporation

CCL Industries

R.R. Donnelley

Multi-Color Corporation

Henkel AG & Co.

Labels and Labeling

SATO Holdings

Skanem AS

WS Packaging Group

Omet Group

IntegraLabel

Smartrac Technology

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030