Market Overview

Based on a recent historical assessment, the India land based situational awareness systems market was valued at approximately USD ~ billion, derived from officially disclosed allocations under the Indian Ministry of Defence capital outlay for surveillance, command, control, communications, intelligence, and border monitoring programs. The market is driven by sustained procurement for integrated battlefield management systems, ground surveillance radars, electro-optical sensors, and command-and-control platforms supporting land forces. Government-backed modernization programs, emphasis on network-centric warfare, and continuous infrastructure deployment across sensitive land borders collectively sustain procurement demand in absolute monetary terms.

Based on a recent historical assessment, dominance within the India land based situational awareness systems market is concentrated across India due to centralized procurement authority and domestic deployment requirements, with key activity hubs including New Delhi, Bengaluru, Hyderabad, and Pune. These cities host major defense public sector units, system integrators, and private defense manufacturers supporting indigenous development and integration. Proximity to military command centers, research establishments, and defense corridors strengthens their position. International collaboration remains limited, as strategic autonomy policies prioritize domestic production and localized supply chains over external sourcing.

Market Segmentation

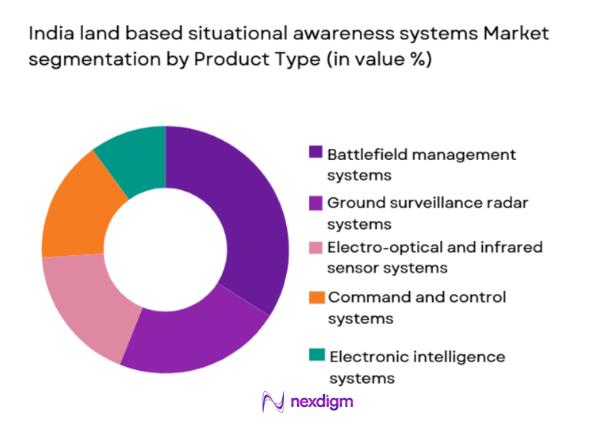

By Product Type

India land based situational awareness systems market is segmented by product type into battlefield management systems, ground surveillance radar systems, electro-optical and infrared sensor systems, command and control systems, and electronic intelligence systems. Recently, battlefield management systems have a dominant market share due to their central role in integrating sensor feeds, troop positioning, communication networks, and decision-support tools into a unified operational picture. These systems are prioritized in Army digitization programs as they directly enhance real-time situational visibility and command efficiency. Indigenous development capabilities, recurring upgrade requirements, and compatibility with existing communication infrastructure further reinforce adoption. Their scalability across formations and relevance in both conventional and counterinsurgency operations ensure continued procurement preference over standalone sensing platforms.

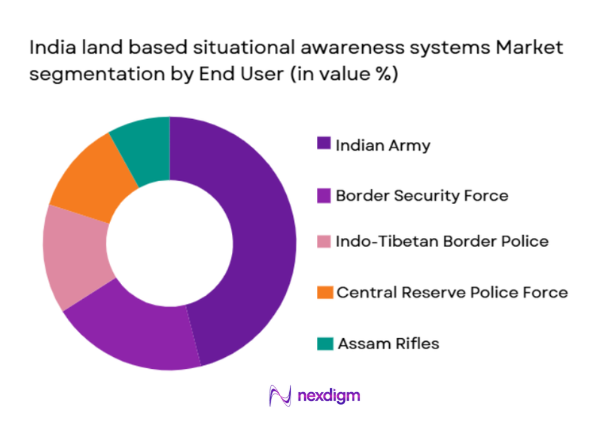

By End User

India land based situational awareness systems market is segmented by end user into Indian Army, Border Security Force, Indo-Tibetan Border Police, Central Reserve Police Force, and Assam Rifles. Recently, the Indian Army has a dominant market share due to its responsibility for large-scale land operations, border defense, and integrated theater commands requiring continuous situational awareness. Army-led procurement programs encompass both tactical and strategic systems, ranging from forward-deployed sensors to centralized command platforms. Its operational scale, budgetary allocation priority, and mandate for technology-intensive modernization ensure sustained demand relative to paramilitary forces, which procure systems mainly for border policing and internal security missions.

Competitive Landscape

The competitive landscape of the India land based situational awareness systems market is moderately consolidated, dominated by a combination of defense public sector undertakings and large private integrators. Major players benefit from long-term government contracts, established integration capabilities, and alignment with indigenous manufacturing policies. Entry barriers remain high due to security clearances, technology complexity, and procurement regulations, limiting competition primarily to experienced domestic firms with proven defense credentials.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Bharat Electronics Limited | 1954 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2010 | Hyderabad, India | ~ | ~ | ~ | ~ | ~ |

| Larsen & Toubro Defence | 2011 | Mumbai, India | ~ | ~ | ~ | ~ | ~ |

| Mahindra Defence Systems | 2015 | Pune, India | ~ | ~ | ~ | ~ | ~ |

| Alpha Design Technologies | 2003 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

India Land based Situational Awareness Systems Market Analysis

Growth Drivers

Border Infrastructure Modernization and Integrated Surveillance Expansion:

Border Infrastructure Modernization and Integrated Surveillance Expansion: explanation continues in the same sentence. Border Infrastructure Modernization and Integrated Surveillance Expansion reflects India’s sustained investment in advanced monitoring capabilities across land borders to address infiltration risks, terrain challenges, and real-time threat detection requirements. The deployment of integrated surveillance grids combining radars, electro-optical sensors, and command centers has created consistent demand for situational awareness systems. These programs require interoperable platforms capable of operating in diverse climatic and topographical conditions. Indigenous manufacturing incentives further accelerate procurement cycles. Continuous system upgrades, lifecycle support, and network expansion ensure recurring expenditure. The scale of border length under active monitoring sustains long-term procurement visibility.

Digitization of Land Forces and Network-Centric Warfare Adoption:

Digitization of Land Forces and Network-Centric Warfare Adoption: explanation continues in the same sentence. Digitization of Land Forces and Network-Centric Warfare Adoption is driving large-scale deployment of battlefield management and command systems that integrate data from multiple sensors into actionable intelligence. Modern operational doctrines emphasize information superiority and rapid decision-making. Situational awareness platforms enable synchronized operations across units. Compatibility with secure communication networks increases system relevance. Indigenous software development reduces dependency risks. Continuous training and system upgrades expand total addressable demand.

Market Challenges

Complex System Integration and Interoperability Constraints:

Complex System Integration and Interoperability Constraints: explanation continues in the same sentence. Complex System Integration and Interoperability Constraints arise due to the need to align legacy platforms with modern digital architectures across multiple forces. Diverse equipment standards complicate seamless data fusion. Customization requirements increase deployment timelines. Testing and certification processes are resource intensive. Cybersecurity assurance adds further complexity. These factors collectively slow procurement execution.

Lengthy Procurement Cycles and Budget Allocation Rigidities:

Lengthy Procurement Cycles and Budget Allocation Rigidities: explanation continues in the same sentence. Lengthy Procurement Cycles and Budget Allocation Rigidities affect vendor planning and technology refresh rates within the market. Multi-year approval processes delay system induction. Budget prioritization across competing defense needs limits flexibility. Changing operational requirements necessitate repeated evaluations. Cost escalation risks discourage rapid adoption. This environment constrains short-term scalability.

Opportunities

Indigenous Artificial Intelligence Enabled Surveillance Solutions:

Indigenous Artificial Intelligence Enabled Surveillance Solutions: explanation continues in the same sentence. Indigenous Artificial Intelligence Enabled Surveillance Solutions offer opportunities for domestic firms to embed analytics, pattern recognition, and automated threat detection into land-based systems. AI integration enhances system value. Local development aligns with strategic autonomy goals. Export potential emerges for friendly nations. Continuous software upgrades create recurring revenue streams.

Upgradation of Legacy Surveillance Infrastructure:

Upgradation of Legacy Surveillance Infrastructure: explanation continues in the same sentence. Upgradation of Legacy Surveillance Infrastructure presents opportunities to retrofit existing installations with modern sensors, analytics, and communication modules. Cost-effective modernization is preferred over full replacement. Compatibility-focused solutions gain traction. Lifecycle extension programs ensure steady demand. Domestic integrators benefit from installed base familiarity.

Future Outlook

Over the next five years, the India land based situational awareness systems market is expected to experience steady expansion supported by continued defense modernization, technological integration, and regulatory emphasis on indigenous capabilities. Advancements in sensor fusion, artificial intelligence, and secure communications will enhance system effectiveness. Government-backed infrastructure development and sustained border security priorities will maintain demand momentum across military and paramilitary applications.

Major Players

• Tata Advanced Systems

• Larsen & Toubro Defence

• Mahindra Defence Systems

• Alpha Design Technologies

• Bharat Dynamics Limited

• Data Patterns India

• Astra Microwave Products

• Paras Defence and Space Technologies

• Centum Electronics

• Tonbo Imaging

• NewSpace Research and Technologies

• MTAR Technologies

• Solar Industries Defence

• ideaForge Technology

Key Target Audience

- Defenseprocurement agencies

• Military command authorities

• Paramilitary forces

• Homeland security departments

• Border management authorities

• Investments and venture capitalist firms

• Government and regulatory bodies

• Defense system integrators

Research Methodology

Step 1: Identification of Key Variables

Market scope, procurement categories, end-user demand, and technology segments were identified using official defense documents and budget disclosures.

Step 2: Market Analysis and Construction

Data from government contracts, annual reports, and policy documents were consolidated to structure the market.

Step 3: Hypothesis Validation and Expert Consultation

Findings were validated through expert interviews and cross-verification with defense sector analysts.

Step 4: Research Synthesis and Final Output

Validated insights were synthesized into a structured market report aligned with defense procurement realities.

- Executive Summary

- Research Methodology

(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Heightened border security requirements across land frontiers

Modernization of ground forces command and control infrastructure

Increased adoption of network centric warfare concepts

Government focus on indigenous defense electronics development

Rising deployment of integrated surveillance along sensitive regions - Market Challenges

High system integration and lifecycle maintenance costs

Interoperability issues across legacy and new platforms

Cybersecurity risks in networked battlefield systems

Procurement delays and complex approval processes

Dependence on imported critical subcomponents - Market Opportunities

Expansion of AI driven situational awareness platforms

Growing demand for mobile and man portable surveillance systems

Increased private sector participation under defense reforms - Trends

Integration of artificial intelligence for real time threat assessment

Shift toward modular and scalable system architectures

Greater use of data fusion from multi sensor inputs

Adoption of secure cloud and edge computing solutions

Emphasis on interoperability across services - Government Regulations & Defense Policy

Defense procurement procedure emphasizing local manufacturing

Policy incentives for indigenization of defense electronics

Strengthening of border infrastructure and surveillance mandates

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Command and control systems

Integrated surveillance systems

Battlefield management systems

Sensor fusion and data analytics systems

Communication and networking systems - By Platform Type (In Value%)

Fixed land installations

Mobile ground vehicles

Man portable systems

Border surveillance towers

Forward operating base deployments - By Fitment Type (In Value%)

New installations

Retrofit and upgrade programs

Modular add-on systems

Integrated platform fitment

Temporary and rapid deployment fitment - By EndUser Segment (In Value%)

Indian Army

Border Security Force

Indo-Tibetan Border Police

Central Armed Police Forces

State police special units - By Procurement Channel (In Value%)

Direct government procurement

Defense public sector undertakings

Private domestic system integrators

Strategic partnership contracts

Emergency and fast-track acquisitions - By Material / Technology (in Value %)

Electro-optical and infrared sensors

Radar and ground surveillance radar

AI enabled analytics software

Secure tactical communication networks

Geospatial and mapping technologies

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (System integration capability, Indigenous content level, Sensor portfolio depth, Software analytics maturity, Interoperability standards, After sales support, Cybersecurity resilience, Cost competitiveness, Deployment scalability, Program execution track record) - SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Bharat Electronics Limited

Larsen and Toubro Defence

Tata Advanced Systems

Bharat Dynamics Limited

Data Patterns India

Alpha Design Technologies

Astra Microwave Products

Paras Defence and Space Technologies

Tonbo Imaging

IdeaForge Technology

NewSpace Research and Technologies

Centum Electronics

HFCL Defence

Avantel Limited

MTAR Technologies

- Army units prioritizing real time battlefield visibility and coordination

- Border forces focusing on persistent surveillance and intrusion detection

- Paramilitary forces adopting mobile situational awareness for internal security

- State agencies integrating systems for joint operations and intelligence sharing

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035