Market Overview

The India Laser Hair Removal Devices Market is valued at USD 50 million in 2024 with an approximated compound annual growth rate (CAGR) of 11.5% from 2024-2030, based on a comprehensive analysis of historical data and current consumer trends. The market is driven by the increasing disposable incomes of urban populations, a growing inclination towards aesthetic devices, and the technological advancements in laser hair removal methods. Furthermore, the rise in awareness of the benefits of permanent hair removal solutions significantly fuels market demand, making laser hair removal devices a preferred choice over traditional methods.

Key cities like Mumbai, Delhi, and Bangalore dominate the Indian market due to their dense populations and higher awareness of aesthetic treatments. These urban centers have the highest concentration of beauty clinics and salons offering laser hair removal services, influenced by urban lifestyle changes that prioritize personal grooming. Additionally, these cities benefit from a fast-paced adoption of modern technology and a rising number of professionals seeking effective hair removal options, bolstering the overall market potential.

Recent technological advancements in laser equipment are enhancing treatment efficacy and safety, making laser hair removal more appealing. Innovations such as pain-free laser techniques and devices equipped with advanced cooling systems dramatically improve the patient experience. According to industry reports, over 60% of clinics are now utilizing cutting-edge laser technologies, leading to quicker treatment times and better outcomes.

Market Segmentation

By Technology Type

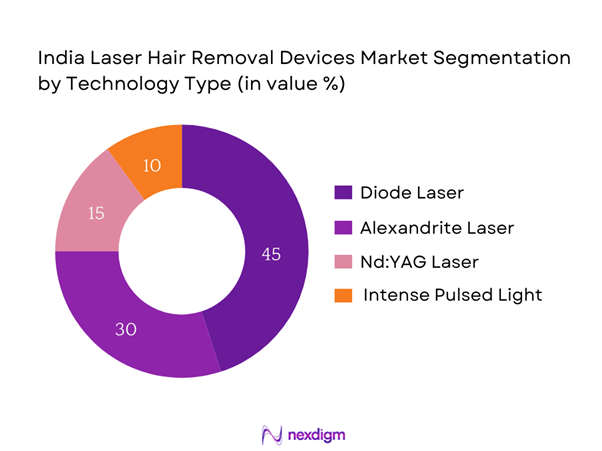

The India Laser Hair Removal Devices Market is segmented by technology type into Diode Laser, Alexandrite Laser, Nd:YAG Laser, and Intense Pulsed Light (IPL). Among these, the Diode Laser segment leads the market share due to its effectiveness for a wide range of skin types and its suitability for various hair colors. This technology is preferred for its precision and minimal discomfort during treatment, making it a popular choice in beauty clinics. Moreover, the continuous advancements in Diode Laser technology, such as improved cooling mechanisms and increased efficacy, contribute to its dominating position in the market.

By Application

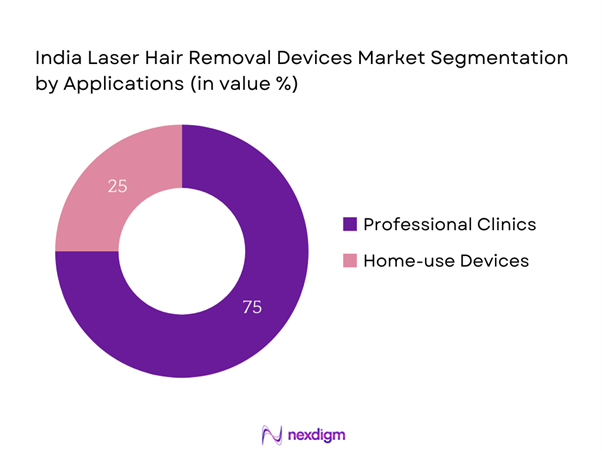

The market is further segmented by application into Professional Clinics and Home-use Devices. The Professional Clinics segment exhibits a dominant market share as consumers prefer professional treatments for their safety and effectiveness. These clinics employ trained specialists who utilize advanced equipment to deliver more reliable results compared to at-home solutions. As beauty standards continue to rise and people seek quick, effective, and long-lasting hair removal techniques, professional clinics stand out due to the expertise they offer along with superior technology.

Competitive Landscape

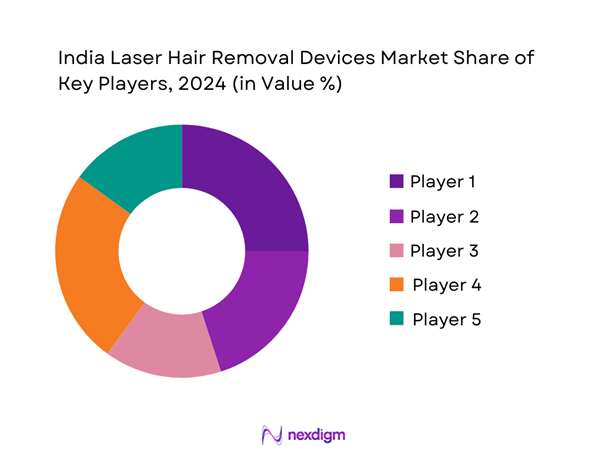

The India Laser Hair Removal Devices Market is characterized by a concentrated competitive landscape where several key players dominate. Major companies include Candela, Lumenis, and Alma Lasers, which have established strong brand equity and trust among consumers. This consolidation indicates the significant influence these top companies exert within the market, supported by comprehensive product offerings and innovative technology advancements.

| Company | Establishment Year | Headquarters | Technology Offerings | Market Focus | Distribution Channels | Recent Developments |

| Candela | 2006 | Wayland, MA, USA | – | – | – | – |

| Lumenis | 1991 | Yokneam, Israel | – | – | – | – |

| Alma Lasers | 2005 | Caesarea, Israel | – | – | – | – |

| Sciton | 1997 | Palo Alto, CA, USA | – | – | – | – |

| Syneron Candela | 2003 | Yokneam, Israel | – | – | – | – |

India Laser Hair Removal Devices Market Analysis

Growth Drivers

Rising Demand for Aesthetic Procedures

The demand for aesthetic procedures in India is significantly increasing, with the beauty and wellness market projected to reach USD 34.8 billion in 2024. This is driven by changing lifestyles and heightened beauty standards among consumers. As disposable incomes rise, more individuals are seeking effective solutions for personal grooming, including laser hair removal. The increasing influence of social media on beauty trends is further propelling this demand, encouraging more individuals to explore aesthetic treatments that enhance personal confidence. With a growing urban population, the inclination toward aesthetic services is set to broaden, reinforcing market growth.

Increasing Awareness and Acceptance of Laser Treatments

Awareness regarding the benefits of laser hair removal is rising among Indian consumers, with nearly 75% of urban individuals being aware of its efficacy over traditional hair removal methods. This awareness is fostered through marketing campaigns, online platforms, and word-of-mouth endorsements. Moreover, the increase in dermatological clinics offering educational seminars and free trials contributes to the growing acceptance of these treatments. With India’s health and wellness industry projected to be worth USD 49 billion by end of 2025, such awareness is vital as it drives more customers towards seeking professional laser hair removal services.

Market Challenges

High Treatment Costs

High treatment costs act as a significant barrier to entry for many potential consumers in the laser hair removal market. The average cost for multiple sessions in urban centers ranges from INR 15,000 to INR 35,000, deterred by the average monthly income of around INR 32,000 among Indian households. Additionally, costs related to device maintenance and clinical operation can hinder the scalability of clinics providing these services. Balancing affordability with quality remains a challenge for many providers in the market, which ultimately affects consumer accessibility.

Regulatory Hurdles

The regulatory landscape for laser hair removal devices in India poses various challenges, such as stringent approval processes that device manufacturers must navigate. The Health Ministry mandates specific safety and efficacy standards for lasers used in aesthetic treatments, which can delay market entry for innovators. In 2022, the Bureau of Indian Standards (BIS) initiated a review of safety regulations affecting aesthetic devices, indicating ongoing regulatory oversight. This evolving framework can create uncertainty for businesses attempting to expand operational capabilities or introduce new products to the market.

Opportunities

Expanding Middle-Class Population

The expanding middle-class population in India represents a considerable opportunity for the laser hair removal market. With approximately 600 million individuals projected to belong to the middle class by end of 2025, more people will have access to discretionary spending for aesthetic services. This demographic shift, coupled with rising living standards and increasing urbanization, underscores the potential for rapid market growth. The influence of this demographic on beauty standards positions the laser hair removal market favorably for future demand enhancement.

Growth in Skin and Hair Care Sector

The growth of the skin care and hair care sector creates a fertile ground for laser hair removal services. This sector is expected to grow to USD 14 billion by end of 2025, driven by increased consumer focus on beauty and personal care. With rising trends towards holistic wellness, customers are more inclined to invest in complete skincare routines which include long-term hair removal solutions. As consumers prioritize skin health, the intersection of skin care advancements and laser technology serves as a catalyst for demand in hair removal services.

Future Outlook

Over the next 5 years, the India Laser Hair Removal Devices Market is expected to witness robust growth fueled by rising consumer demand for non-invasive aesthetic procedures. A significant surge in disposable incomes and lifestyle changes has increased the acceptance of laser treatments among diverse consumer segments. Furthermore, advancements in laser technologies that enhance safety and efficacy will contribute to market expansion, making laser hair removal increasingly appealing to the broader population.

Major Players

- Candela

- Lumenis

- Alma Lasers

- Sciton

- Syneron Candela

- Cutera

- BTL Industries

- Zepter International

- InMode

- Hologic

- Lutronic

- Quanta System

- Elysion

- Venus Concept

- Photonic Solutions

Key Target Audience

- Beauty Clinics and Aesthetic Centers

- Dermatologists and Cosmetic Surge

- Surgeons

- Spa Owners and Operators

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (NCCIH, MoHFW)

- Retail Distributors of Beauty Equipment

- E-commerce Platforms Specializing in Beauty and Personal Care

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the key stakeholders in the India Laser Hair Removal Devices Market. This ecosystem analysis uses primary and secondary sources to collect relevant market data. Understanding these variables is crucial for establishing market dynamics, competitive serving, and regulatory constraints, which shape consumer behavior and preferences.

Step 2: Market Analysis and Construction

Historical data on device sales and consumer usage trends is compiled and analyzed to construct a comprehensive market overview. This includes examining market penetration rates, consumer demographics, and service provider ratios. By evaluating these factors, we establish an accurate revenue generation framework and validate trends.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary hypotheses will be formulated and tested through one-on-one interviews with industry experts and stakeholders within the sector. Capturing insights from successful practitioners allows us to refine our data-driven estimates, ensuring they accurately reflect market realities and current developments.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing all collected data from expert consultations, market research, and quantitative analyses. Engaging directly with manufacturers and service providers helps corroborate data points, offering a multi-dimensional understanding of product segments, market demands, and consumer preferences. This synthesis ensures that the final report presents a validated and comprehensive analysis of the India Laser Hair Removal Devices Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Market Insights

- Timeline of Major Players

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Demand for Aesthetic Procedures

Increasing Awareness and Acceptance of Laser Treatments

Technological Advancements - Market Challenges

High Treatment Costs

Regulatory Hurdles - Opportunities

Expanding Middle-Class Population

Growth in Skin and Hair Care Sector - Trends

Shift Towards Non-invasive Procedures

Increasing Adoption of At-home Devices - Government Regulation

Safety and Efficacy Standards

Licensing of Practitioners - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Technology Type (In Value %)

Diode Laser

– 810 nm Wavelength Devices

– Triple Wavelength (755nm, 810nm, 1064nm) Diode

– Ice-Cooled Diode Systems

Alexandrite Laser

– 755 nm High-Speed Devices

– Cooling-Assisted Alexandrite Systems

Nd:YAG Laser

– 1064 nm Long-Pulse Nd:YAG

– Dual-Mode Nd:YAG for Deep Skin Penetration

Intense Pulsed Light (IPL)

– Standard IPL Systems

– Filtered IPL for Skin Tone Adaptability

– IPL with Radiofrequency Integration - By Application (In Value %)

Professional Clinics

– Dermatology Clinics

– Cosmetic and Aesthetic Centers

– Laser Chains & Skin Clinics

Home-use Devices

– Corded Laser Devices

– Rechargeable Handheld Devices

– Multi-Mode Home IPL Systems - By Distribution Channel (In Value %)

Direct Sales

– Manufacturer-to-Clinic Supply Contracts

– Institutional Sales to Dermatologists

Online Retail

– E-commerce Platforms (e.g., Amazon, Flipkart)

– Brand-Owned Online Stores

– Influencer/Instagram Shop Channels

Retail Pharmacies

– Pharmacy Chains (e.g., Apollo, MedPlus)

– Independent Pharmacy Outlets - By Region (In Value %)

North India

South India

East India

West India - By End-User (In Value %)

Women

Men

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Organizational Structure, Strengths and Weaknesses, Revenues, Revenues by Product Type, Distribution Channels, Unique Value Offering, Product Portfolio Breadth, Regulatory Certifications, Pricing Strategy, Technology Integration, Customer Satisfaction Metrics, Market Reach)

- SWOT Analysis of Major Players

- Pricing Analysis Based on SKUs for Major Players

- Detailed Profiles of Major Companies

Candela

Lumenis

Cutera

Alma Lasers

Syneron Candela

BTL Industries

Ellipse

Sciton

Venus Concept

Elysion

Lutronic

Zepter International

InMode

Quanta System

Hologic

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030