Market Overview

The India Launch Vehicle Avionics market is a significant component of the aerospace and defense industry, driven by the increasing demand for space exploration, satellite launches, and defense applications. The market’s size is largely influenced by ongoing developments in India’s space programs, such as those by ISRO, and a growing private sector interest in space exploration. In 2024, the market was valued at approximately USD ~ billion. This market continues to grow due to the country’s space ambitions, increasing investments in satellite technology, and government-backed space missions. Government initiatives such as ‘Atmanirbhar Bharat’ are also promoting the domestic manufacturing of avionics components, further driving market growth.

India is the dominant player in the Indian launch vehicle avionics market, primarily driven by the operations and developments of the Indian Space Research Organisation (ISRO). The country has a robust space launch infrastructure with key cities like Bengaluru, Hyderabad, and Thiruvananthapuram emerging as aerospace hubs. Bengaluru is particularly recognized as the ‘space city’ of India, being the home of ISRO’s satellite center and various aerospace manufacturers. Additionally, other cities like Chennai and Pune also contribute significantly due to the presence of major defense contractors and electronics manufacturing units.

Market Segmentation

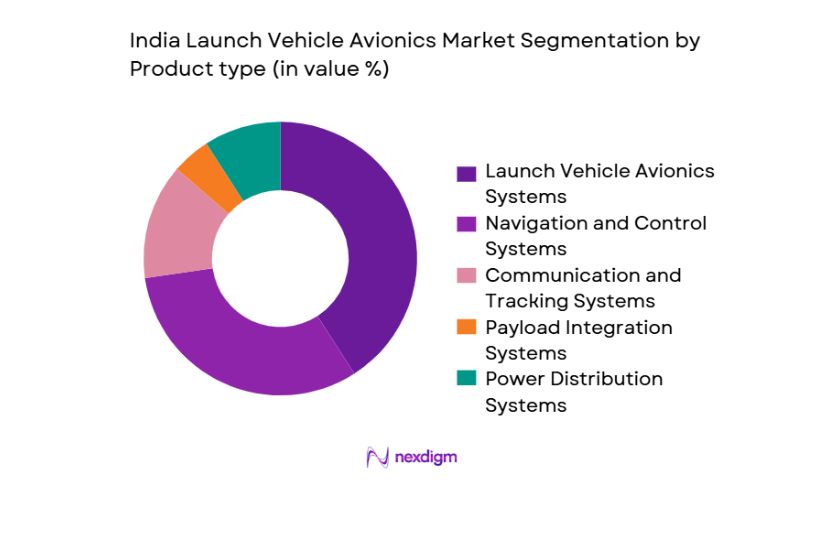

By Product Type

The India Launch Vehicle Avionics market is segmented by product type into Launch Vehicle Avionics Systems, Navigation and Control Systems, Communication and Tracking Systems, Payload Integration Systems, and Power Distribution Systems.

Launch Vehicle Avionics Systems is the dominant sub-segment under this category, accounting for the highest market share in 2024. This dominance is driven by the rapid growth of space missions, both commercial and government-backed, which require reliable and sophisticated avionics systems for navigation, control, and communication. The increasing frequency of satellite launches by ISRO, alongside expanding private sector participation in space ventures, continues to push the demand for advanced launch vehicle avionics systems. The launch of large-scale missions such as GSLV and PSLV also contributes to the increased deployment of these systems, reinforcing their market dominance.

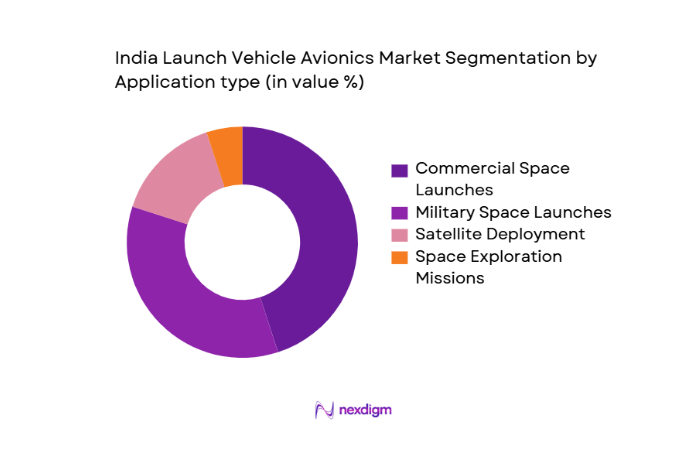

By Application

The India Launch Vehicle Avionics market is segmented into applications such as Commercial Space Launches, Military Space Launches, Satellite Deployment, and Space Exploration Missions.

Commercial Space Launches represents the dominant application segment in the market. The rise of private space companies, coupled with ISRO’s commercial arm, Antrix Corporation, expanding its satellite launch services, contributes significantly to the growing market share of commercial space launches. Companies like SpaceX and Blue Origin also drive demand for avionics systems, leading to increased commercialization of space services. With the Indian government’s goal to increase satellite launches and the global demand for low Earth orbit satellites, this segment continues to dominate the market share in 2024.

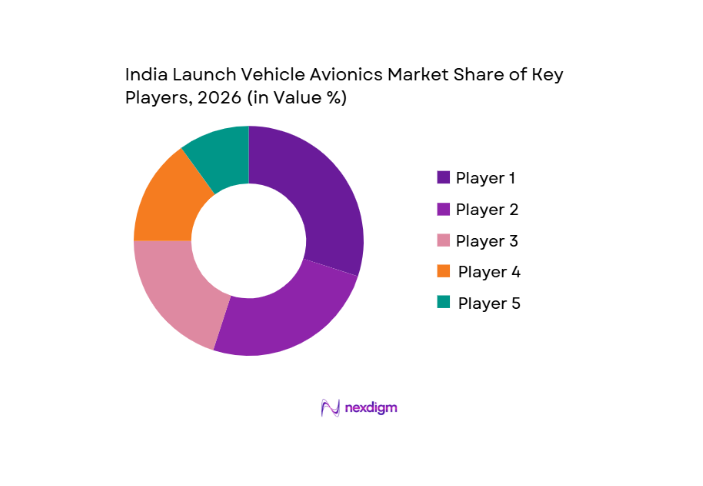

Competitive Landscape

The India Launch Vehicle Avionics market is characterized by a competitive landscape dominated by a mix of government entities, state-owned enterprises, and private sector players. The market is highly consolidated, with several key players contributing to the development of launch vehicle avionics technology. Major players include both domestic and international companies that supply critical avionics systems for launch vehicles.

The competitive environment is driven by technological advancements, product innovation, and strategic partnerships. The consolidation of the market emphasizes the influence of key companies in shaping the direction of avionics technology, leading to a concentrated market share among these industry leaders.

| Company Name | Year of Establishment | Headquarters | Revenue in 2024 | Market Position | Key Products | Global Footprint |

| ISRO | 1969 | Bengaluru, India | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited | 1940 | Bengaluru, India | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | Bengaluru, India | ~ | ~ | ~ | ~ |

| Space Applications Centre | 1972 | Thiruvananthapuram, India | ~ | ~ | ~ | ~ |

| Godrej Aerospace | 1958 | Mumbai, India | ~ | ~ | ~ | ~ |

India Launch Vehicle Avionics Market Analysis

Growth Drivers

Increasing Investments in Space Exploration and Defense Sectors

India has significantly increased its space exploration and defense sector investments. In the fiscal year 2024-2025, the Indian government allocated INR~ crores (USD ~ billion) to the Indian Space Research Organisation (ISRO) for satellite launches and space exploration projects. The defense sector also witnessed growth in spending, with India’s defense budget for 2024 crossing INR ~ lakh crores (USD ~billion), up from INR ~ lakh crores (USD ~ billion) in 2025. This upward trend in both space and defense investments contributes to a growing demand for launch vehicle avionics systems. As space missions expand and defense initiatives like ballistic missile defense grow, avionics systems remain a crucial enabler for both space exploration and military applications.

Technological Advancements in Avionics Systems

Technological innovations in avionics systems have become a significant growth driver in the India launch vehicle avionics market. Advancements in digital avionics, autonomous systems, and AI-enabled technologies are helping improve the reliability, efficiency, and safety of space launches. In 2024, ISRO launched its first indigenous satellite with an integrated AI system, marking a key milestone in the application of advanced technologies in launch vehicles. Additionally, the global spending on aerospace R&D is projected to surpass USD ~billion by 2025, with a large portion dedicated to avionics technology. The push towards autonomous space exploration missions and satellite launches will likely drive further advancements in avionics systems

Market Challenges

High Cost of Research and Development

The high cost of research and development (R&D) in the launch vehicle avionics market remains a major barrier to growth. In India, R&D expenditures in space technology are substantial, with ISRO allocating over INR ~ crores (USD ~ million) annually to develop avionics systems for space missions. The average cost to develop a new avionics system for a satellite launch vehicle is estimated at INR~ crore (USD ~ million). Moreover, private sector companies face challenges in scaling up avionics technology due to the initial high capital expenditure. The global aerospace R&D market is expected to grow by USD ~billion annually through 2025, with a major portion directed toward avionics. These high costs deter new entrants and slow down technological progress.

Regulatory and Compliance Issues

Regulatory and compliance issues pose a significant challenge to the India Launch Vehicle Avionics market. The Indian government and international bodies like the United Nations Office for Outer Space Affairs (UNOOSA) have strict regulations on space missions, which demand high standards of safety, reliability, and data security. For example, the launch of any satellite must comply with India’s space policy, ensuring compatibility with international treaties, and any new avionics system requires certification from the Directorate General of Civil Aviation (DGCA) for aviation applications. Additionally, compliance with export control regulations for space technology remains a concern. The complex regulatory framework adds delays to the development and deployment of new avionics systems.

Opportunities

Growing Demand for Commercial Satellites

The demand for commercial satellites is expanding rapidly, creating significant opportunities in the India Launch Vehicle Avionics market. As of 2024, India launched over ~ commercial satellites, with demand driven by the increasing need for telecommunications, Earth observation, and Internet of Things (IoT) applications. The Indian government’s push towards improving communication infrastructure, as well as private sector initiatives like Bharti Airtel’s satellite broadband project, drives this demand. The Indian satellite communication market is expected to grow at a steady pace, contributing to a higher demand for launch vehicle avionics systems for satellite deployment.

Expansion of Launch Vehicle Programs

The expansion of India’s space missions and launch vehicle programs presents significant opportunities for the avionics market. India plans to launch a record number of satellites over the next few years, including ambitious missions such as the Gagan Yaan crewed spaceflight and Chandrayaan-3 lunar mission. In 2024, ISRO will increase the frequency of its satellite launches, aiming for ~ successful launches annually. Additionally, the growing number of private space ventures like Sky root Aerospace and Agni Kul Cosmos is further expanding the demand for launch vehicle systems. These programs require advanced avionics systems for mission success and will continue to drive market growth.

Future Outlook

Over the next five years, the India Launch Vehicle Avionics market is expected to experience substantial growth driven by continuous advancements in avionics technology, the increasing frequency of satellite launches, and the expanding participation of private space companies in the sector. The government’s emphasis on self-reliance in space technologies and growing investments in defense and aerospace technologies will further boost market expansion. Additionally, India’s increasing integration into global space missions will present new opportunities for market players. With the expected growth of commercial space ventures and defense applications, India’s launch vehicle avionics market will continue to thrive and evolve.

Major Players

- ISRO

- Hindustan Aeronautics Limited

- Bharat Electronics Limited

- Space Applications Centre

- Godrej Aerospace

- Lockheed Martin

- Boeing

- Thales Alenia Space

- Northrop Grumman

- Airbus Defence and Space

- L&T Defence

- Tata Advanced Systems Ltd

- Rolls-Royce India

- Antrix Corporation

- ISRO Propulsion Complex

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace & Defense Manufacturers

- Satellite Operators

- Space Exploration Agencies

- Defense Contractors

- Space Launch Providers

- Aerospace Component Suppliers

Research Methodology

Step 1: Identification of Key Variables

The first phase of the research process involves identifying all critical variables affecting the India Launch Vehicle Avionics market. This is done through desk research using secondary data from reliable sources such as industry reports, government publications, and market analysis.

Step 2: Market Analysis and Construction

Historical data related to the avionics market, launch frequency, and technological advancements are analyzed to assess market size and growth. This phase includes evaluating the competitive landscape and understanding supply-demand dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated by conducting interviews with key experts in the avionics and aerospace sector. This ensures the accuracy of the data and helps refine market assumptions.

Step 4: Research Synthesis and Final Output

Data from primary research is synthesized to create a comprehensive market report, including insights into market trends, opportunities, and challenges. The final report integrates both top-down and bottom-up approaches for a holistic market view.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Investments in Space Exploration and Defense Sectors

Technological Advancements in Avionics Systems

Rise of Private Space Companies - Market Challenges

High Cost of Research and Development

Regulatory and Compliance Issues

Limited Access to Key Components - Opportunities

Growing Demand for Commercial Satellites

Expansion of Launch Vehicle Programs - Trends

Shift Towards Autonomous Launch Vehicle Systems

Integration of AI and Big Data in Avionics - Government Regulation

- SWOT Analysis

- Porter’s Five Forces Analysis

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Product Type (In Value %)

Launch Vehicle Avionics Systems

Navigation and Control Systems

Communication and Tracking Systems

Payload Integration Systems - By Application (In Value %)

Commercial Space Launches

Military Space Launches

Satellite Deployment

Space Exploration Missions - By Technology (In Value %)

Traditional Avionics

Digital Avionics

Advanced Avionics - By Distribution Channel (In Value %)

Direct Sales

Third-party Suppliers

Online Sales Platforms

Strategic Partnerships and Joint Ventures - By Region (In Value %)

Northern India

Southern India

Western India

Eastern India

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, business strategies, recent developments, strengths and weaknesses, organizational structure, revenues by product category, distribution network and dealer channels, and margins and profitability are key parameters used to assess the competitive positioning and performance of companies in the India Launch Vehicle Avionics market.)

- SWOT Analysis of Major Players

- Pricing and Cost Analysis

- Detailed Profiles of Key Players

Airbus Defence and Space

Lockheed Martin

Boeing

SpaceX

Thales Alenia Space

Northrop Grumman

Indian Space Research Organisation

Hindustan Aeronautics Limited

Bharat Electronics Limited

Antrix Corporation

Space Applications Centre

Godrej Aerospace

Tata Advanced Systems Ltd

L&T Defence

Rolls-Royce India

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035