Market Overview

As of 2024, the India logistics market is valued at USD ~ billion, with a growing CAGR of 8.5% from 2024 to 2030, driven by the booming e-commerce sector and significant investments in infrastructure development. In recent years, the market has seen a strong upward trajectory due to rising consumer demand for efficient supply chain solutions. Moreover, the implementation of the Goods and Services Tax (GST) has streamlined the logistics processes, simplifying transportation across states and enhancing overall operational efficiency.

Major cities such as Mumbai, Bangalore, and Delhi dominate the market due to their strategic geographic locations, comprehensive infrastructure networks, and concentration of manufacturing units. Mumbai serves as a commercial hub with a robust port, whereas Bangalore hosts numerous tech companies driving demand for logistics. Delhi, being the national capital, benefits from well-developed connectivity and logistics support systems, contributing to its prominence in the sector.

Market Segmentation

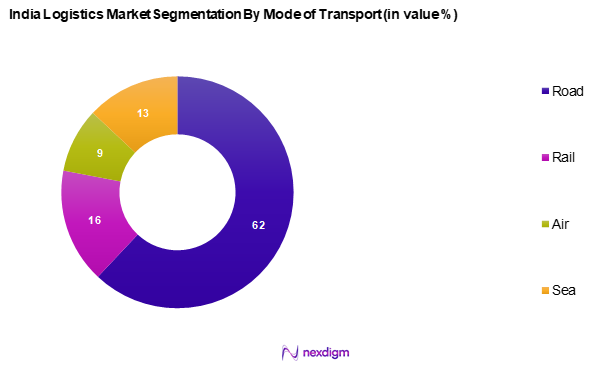

By Mode of Transport

The India logistics market is segmented into road, rail, air, and sea. Road transport segment captures the largest market share owing to its extensive network that offers flexibility and quicker delivery times. With over 60% of freight moved via road, the mode remains essential, especially for last-mile delivery in urban areas. The significant investment in highway infrastructure and the proliferation of logistics companies tapping into the road freight market enhance this segment’s dominance.

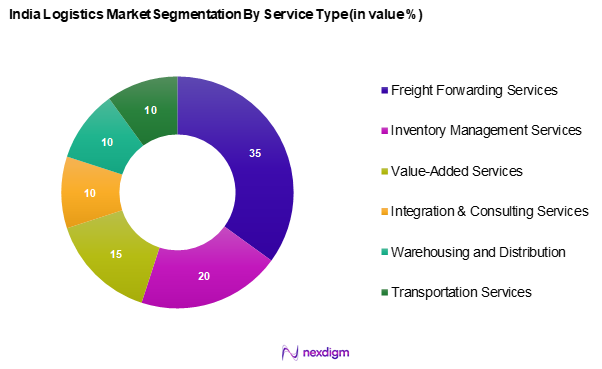

By Service Type

The India logistics market is segmented into freight forwarding services, inventory management services, value-added services, integration & consulting services, warehousing and distribution services, and transportation services. Freight forwarding services hold a considerable market share, primarily due to the increasing volume of international trade and the necessity for reliable shipping solutions. Key industry players provide integrated services that cater to the complexity of logistics management, further solidifying the freight forwarders’ role in the market.

Competitive Landscape

The India Logistics Market is dominated by several major players, indicating a concentrated yet competitive landscape. Key providers such as Blue Dart Express Ltd and DHL lead the sector, ensuring global standards in logistics solutions. These companies’ well-established networks and technological advancements further emphasize their dominance, reflecting strong brand loyalty and service reliability among consumers.

| Company | Establishment Year | Headquarters | Revenue (USD Mn) | Number of Employees | Key Services | Market Strategies |

| Blue Dart Express Ltd | 1983 | Maharashtra, India | – | – | – | – |

| DTDC | 1990 | Karnataka, India | – | – | – | – |

| Gati Ltd | 1989 | Telangana, India | – | – | – | – |

| Mahindra Logistics | 2007 | Maharashtra, India | – | – | – | – |

| DHL | 1969 | Bonn, Germany | – | – | – | – |

India Logistics Market Analysis

Growth Drivers

Expanding E-commerce Sector

India’s booming e-commerce sector is significantly boosting demand within the logistics market. With more consumers shifting to online shopping, thanks to a rapidly increasing internet user base, logistics services are now more essential than ever. The surge in digital retail activity has created a pressing need for robust, agile, and tech-enabled logistics solutions that can ensure timely deliveries across urban and rural areas alike. This transformation is driving investments in last-mile delivery, warehousing, and supply chain optimization throughout the country.

Infrastructure Development

Ongoing infrastructure development initiatives in India, bolstered by government investments exceeding $600 billion through various schemes, are vital growth drivers for the logistics market. The Government of India has launched projects like the Bharatmala and Sagarmala, aiming to improve road and port connectivity. In 2023, the road transport sector witnessed a construction of over 12,349 km of national highways, enhancing freight movement efficiency. Improved infrastructure is essential for reducing transit times and costs, thereby fostering a conducive environment for logistics businesses to thrive.

Market Challenges

Regulatory Hurdles

Despite positive developments, the logistics market in India continues to face regulatory complexities. Fragmented compliance requirements across different states and frequent changes in taxation or labor laws create inconsistencies in logistics operations. While some reforms have eased certain aspects of inter-state commerce, challenges like documentation delays and bureaucratic procedures still slow down the seamless flow of goods. These hurdles make it difficult for logistics providers to scale up efficiently across diverse geographies.

High Operational Costs

Operational expenses in the logistics sector remain on the higher side, driven by elevated fuel prices and rising labor costs. Transportation, which forms a significant portion of logistics spending, is particularly affected. The need to offer competitive pricing while managing fluctuating input costs puts pressure on logistics firms, especially smaller players. This cost burden often limits innovation and restricts investments in advanced technologies or service enhancements.

Opportunities

Growth in Cold Chain Logistics

The cold chain logistics sector is witnessing significant opportunities, fueled by the increasing demand for perishable goods and pharmaceuticals. In 2023, the Indian cold chain market was valued at approximately USD 14.49 billion, underscoring potential for expansion driven by rising consumer demand for fresh produce and temperature-sensitive products. With the government’s push for organized retail and increasing urbanization rates, growth in this sub-segment is expected to accelerate. The integration of advanced technologies like IoT for temperature monitoring is further propelling the expansion of cold chain logistics, making it a lucrative segment.

Increased Demand for Green Logistics

As sustainability becomes a priority, there is a notable shift towards green logistics in India. In 2023, over 30% of logistics companies reported implementing eco-friendly practices to reduce carbon emissions, driven by regulatory pressures and consumer preferences. The government’s commitment to achieving net-zero emissions by 2070 is prompting logistics firms to adopt sustainable practices such as electric vehicles and alternative fuels. This evolving landscape presents significant growth opportunities for companies that align their strategies with environmentally sustainable logistics solutions, appealing to a socially conscious consumer base.

Future Outlook

The India Logistics Market is expected to witness substantial growth over the next five years, spurred by continuous infrastructure improvements, the rapid expansion of e-commerce, and increasing demand for optimized supply chain solutions. The adoption of digital technologies such as AI and IoT will revolutionize the logistics landscape, enhancing efficiency and reducing operational costs. Companies are also focusing on sustainable practices, aligning with the global trend towards environmentally friendly logistics solutions, thereby strengthening their competitive edge.

Major Players

- Blue Dart Express Ltd

- DTDC

- Gati Ltd

- Mahindra Logistics

- TCI Express

- XpressBees

- Ecom Express

- Amazon Transportation Services

- Reliance Logistics

- Aegis Logistics

- Sical Logistics

- DHL

- FedEx Express

- Shadowfax

- Others

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Shipping, Ministry of Commerce)

- Supply Chain Managers

- Manufacturing Companies

- E-commerce Enterprises

- Retail Corporations

- Logistic Service Providers

- Transportation Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map that includes all significant stakeholders within the India Logistics Market. This stage relies heavily on comprehensive desk research, incorporating both secondary and proprietary databases to compile extensive industry-level data. The aim is to define and outline the critical variables influencing market dynamics effectively.

Step 2: Market Analysis and Construction

This phase focuses on aggregating and analyzing historical data related to the India Logistics Market. This includes assessing market penetration, evaluating the ratio of service providers to marketplaces, and estimating resultant revenue generation. Additionally, quality metrics of services will be reviewed to ensure the reliability and accuracy of revenue estimates put forth in the analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will undergo validation through structured interviews with industry experts representing a broad spectrum of companies within the logistics sector. These consultations will yield valuable operational and financial insights directly from practitioners, which will play a crucial role in refining and substantiating the market data collected.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple logistics providers to gather detailed insights into various product segments, sales performance, consumer preferences, and other relevant metrics. This interaction will validate and complement the data derived from the bottom-up approach, ensuring a thorough, accurate, and substantiated analysis of the India Logistics Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Expanding E-commerce sector

Infrastructure Development - Market Challenges

Regulatory Hurdles

High Operational Costs - Opportunities

Growth in Cold Chain Logistics

Increased Demand for Green Logistics - Trends

Digital Transformation in Logistics

Rise of Last-Mile Delivery Solutions - Government Regulation

GST Impact

Emission Norms - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Mode of Transport, (In Value %)

Road

Rail

Air

Sea - By Service Type, (In Value %)

Freight Forwarding Services

Inventory Management Services

Value-Added Services

Integration & Consulting Services

Warehousing and Distribution Services

Transportation Services - By End-User Vertical, (In Value %)

Manufacturing

Consumer Goods

Retail

Food and Beverages

IT Hardware

Chemicals

Construction

Automotive

Telecom

Others - By Model, (In Value %)

1PL

2PL

3PL

4PL - By Category, (In Value %)

Conventional Logistics

E-Commerce Logistics - By Customer Type, (In Value %)

B2B

B2C

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Mode of Transport Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue Analysis, Service Offerings, Technology Adoption)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Blue Dart Express Ltd

DTDC

Gati Ltd

Mahindra Logistics

TCI Express

XpressBees

Ecom Express

Amazon Transportation Services

Reliance Logistics

Aegis Logistics

Sical Logistics

DHL

FedEx Express

Shadowfax

Others

- Market Demand and Utilization Patterns

- Purchasing Power Analysis

- Regulatory and Compliance Requirements

- Needs and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Mode of Transport, 2025-2030