Market Overview

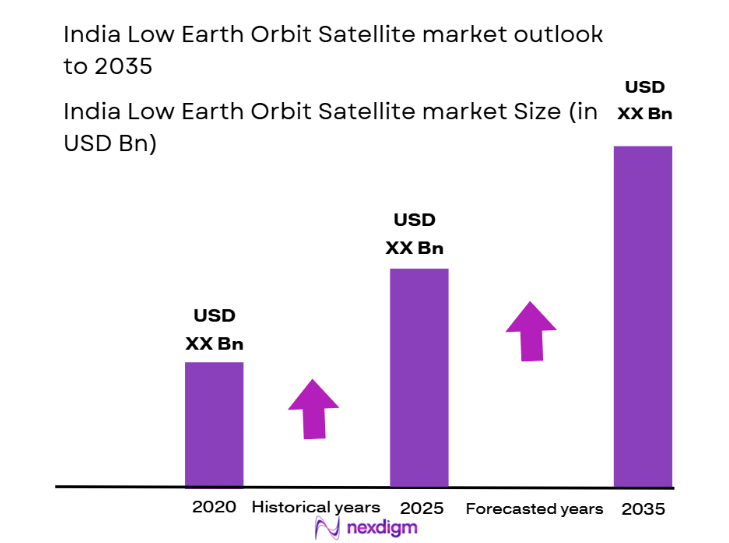

The India Low Earth Orbit Satellite market is valued at approximately USD ~ billion, based on a recent historical assessment. The market is primarily driven by increasing demand for satellite services across telecommunications, defense, and environmental sectors. A significant factor fueling growth is the Indian government’s initiatives to enhance digital infrastructure and expand satellite communication networks. Technological advancements, such as the miniaturization of satellite components and the reduction in satellite launch costs, further contribute to the market’s positive outlook. By 2026, the market is anticipated to reach USD ~ billion, reflecting continued growth.

India is a global leader in the Low Earth Orbit Satellite market due to its established space infrastructure, spearheaded by the Indian Space Research Organisation (ISRO). India’s strategic geographic location also provides a competitive advantage in serving a broad market, including neighboring regions in Asia and beyond. Cities like Bengaluru, which is home to ISRO, and other space hubs such as Hyderabad and New Delhi, drive technological innovation. Furthermore, India’s burgeoning private sector, including companies like Bharti Airtel and Reliance Jio, plays a pivotal role in satellite communications, adding to the nation’s dominance in the sector.

Market Segmentation

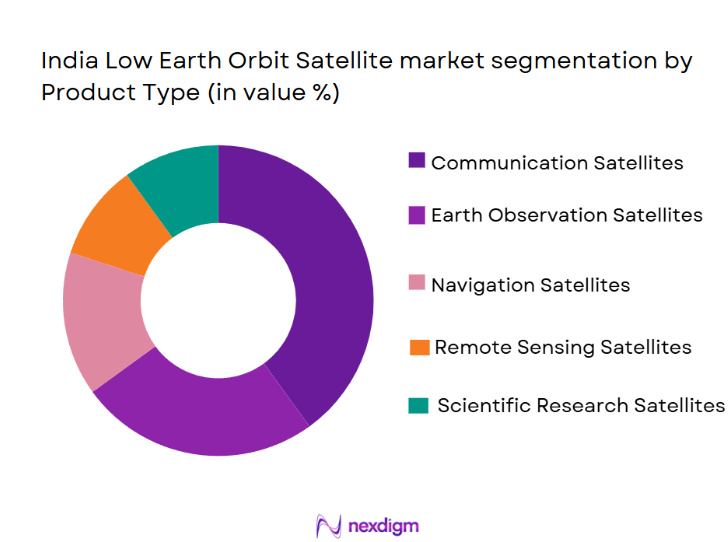

By Product Type

The India Low Earth Orbit Satellite market is segmented by product type into communication satellites, earth observation satellites, navigation satellites, remote sensing satellites, and scientific research satellites. Recently, communication satellites have a dominant market share due to the significant rise in demand for internet services, particularly in rural areas. These satellites are critical for providing high-speed internet access and telecommunication services. Government initiatives like BharatNet, along with the rapid growth in mobile connectivity, especially in remote and underserved regions, continue to fuel the demand for communication satellites. This has led to their dominant share in the overall market.

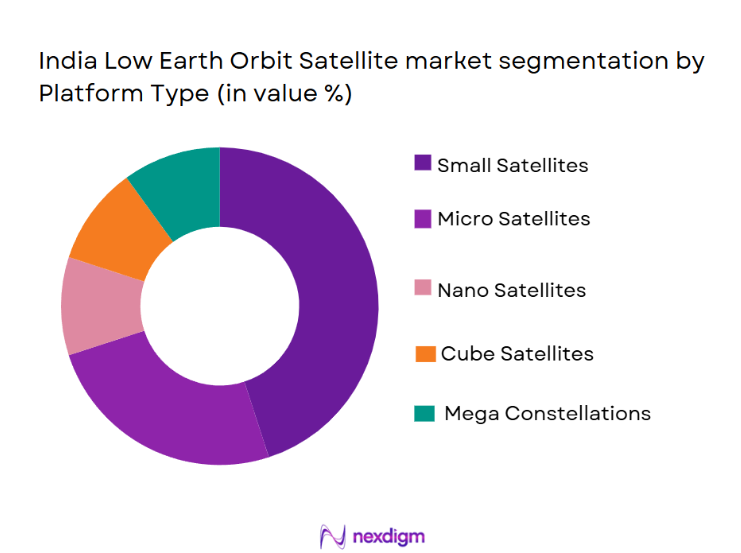

By Platform Type

The India Low Earth Orbit Satellite market is segmented by platform type into small satellites, micro satellites, nano satellites, cube satellites, and mega constellations. The small satellite segment leads the market due to its lower cost and shorter development timelines compared to larger traditional satellites. These cost-effective satellites are particularly popular among emerging satellite service providers and startups. Small satellites are versatile and can be deployed for a range of applications, such as telecommunications, weather monitoring, and environmental surveillance, making them a dominant force in the market.

Competitive Landscape

The competitive landscape in the India Low Earth Orbit Satellite market is dynamic, marked by both government agencies and private players actively investing in satellite technology and infrastructure. The market has seen significant consolidation, with major satellite operators partnering with technological innovators to advance satellite communication systems. Leading players such as ISRO, SpaceX, and Bharti Airtel have significantly expanded their satellite deployments and infrastructure. Additionally, new entrants are also entering the space, driven by the growing demand for satellite-based internet services and government funding initiatives.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Indian Space Research Organisation (ISRO) | 1969 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ |

| Bharti Airtel | 1995 | New Delhi, India | ~ | ~ | ~ | ~ | ~ |

| SpaceX | 2002 | Hawthorne, USA | ~ | ~ | ~ | ~ | ~ |

| Reliance Jio | 2007 | Mumbai, India | ~ | ~ | ~ | ~ | ~ |

| OneWeb | 2012 | London, UK | ~ | ~ | ~ | ~ | ~ |

India Low Earth Orbit Satellite Market Analysis

Growth Drivers

Increased Demand for Satellite-Based Services

The demand for satellite services in India is rising due to the increasing need for high-speed internet, especially in rural areas. This is largely driven by the expanding population and growing digital economy, where seamless communication and data transfer are essential. The Indian government’s push to improve broadband connectivity, through initiatives like BharatNet, further supports the demand for satellite communication services. As a result, the Low Earth Orbit satellite market is poised for continued growth, attracting investments from both public and private sectors.

Technological Advancements in Satellite Manufacturing

The continuous advancement in satellite technology is a key growth driver for the India Low Earth Orbit Satellite market. The development of small, cost-effective satellites has made space-based solutions more affordable for a broader range of industries. The miniaturization of satellite components and advancements in propulsion systems, along with the increasing reliance on data-driven solutions across various sectors, are making satellite services more accessible and efficient. This is expected to fuel demand for Low Earth Orbit satellites, particularly in applications like telecommunication and environmental monitoring.

Market Challenges

High Initial Investment and Capital Constraints

One of the significant challenges faced by the India Low Earth Orbit Satellite market is the high capital investment required for satellite development and infrastructure. While advancements in satellite technology are making the systems more affordable, the initial costs involved in launching and maintaining a satellite remain a barrier for many players, particularly new entrants. This challenge is compounded by the limited availability of funding and a lack of adequate financial support for private sector players, especially smaller organizations seeking to deploy satellite constellations.

Regulatory and Geopolitical Risks

The Low Earth Orbit satellite market in India faces challenges related to regulatory constraints and geopolitical risks. Satellite operators mustcomply withvarious licensing requirements and regulatory frameworks enforced by agencies like the Department of Space and the Indian government. Additionally, geopolitical tensions could disrupt the satellite services, as the space industry is often impacted by international political relations, leading to risks for companies operating in global markets. These factors create uncertainty, which could hinder the growth of the market in the long term.

Opportunities

Growing Adoption of Satellite Internet in Rural Areas

The increasing digital divide between urban and rural areas presents a significant opportunity for the India Low Earth Orbit Satellite market. The government’s emphasis on connecting rural India through affordable internet services, particularly in remote areas, is expected to boost demand for satellite-based broadband services. Moreover, international players like SpaceX and OneWeb are targeting India for satellite internet services, which will enhance the market’s growth opportunities in the coming years.

Development of Small Satellite Constellations

The development of small satellite constellations provides a huge opportunity for the India Low Earth Orbit Satellite market. By launching a network of small satellites, companies can reduce costs and improve the reliability of satellite services. This will also create more opportunities for businesses and startups to enter the market and offer specialized satellite-based solutions. With the increasing demand for real-time data and connectivity, the small satellite market in India is expected to experiencestrong growth.

Future Outlook

The future outlook for the India Low Earth Orbit Satellite market is optimistic, with significant growth expected over the next five years. Technological innovations, such as the development of smaller, more cost-effective satellites, are expected to increase satellite deployments, particularly in the communication and environmental sectors. The Indian government’s push for space exploration and digital infrastructure is likely to continue driving growth. Additionally, the expansion of private satellite operators and the rise of satellite-based internet services will further contribute to the market’s positive trajectory.

Major Players

- Indian Space Research Organisation (ISRO)

- Bharti Airtel

- SpaceX

- Reliance Jio

- OneWeb

- Hughes Communications India

- Tata Communications

- Satcom India

- Globalstar India

- Inmarsat India

- SES Networks

- O3b Networks

- Telesat

- Planet Labs

- LeoSat Enterprises

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite communication providers

- Telecommunication service providers

- Satellite manufacturers

- Aerospace companies

- Satellite service operators

- Commercial and defense space organizations

Research Methodology

Step 1: Identification of Key Variables

Key market variables such as demand drivers, growth patterns, and industry challenges are identified through initial desk research and expert interviews.

Step 2: Market Analysis and Construction

A detailed market analysis is conducted based on historical data, current market trends, and demand-supply dynamics. Forecast models are built to predict future trends and market growth.

Step 3: Hypothesis Validation and Expert Consultation

A set of hypotheses regarding market growth is validated through discussions with industry experts, manufacturers, and stakeholders to ensure accuracy.

Step 4: Research Synthesis and Final Output

The research is synthesized into a comprehensive report, consolidating all findings, insights, and data into a final output for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Demand for Communication and Data Connectivity

Advancements in Satellite Manufacturing Technology

Government Initiatives and Funding for Space Missions - Market Challenges

High Capital Investment and Funding Constraints

Technological Barriers and Complexity in Satellite Design

Geopolitical Risks and Regulatory Challenges - Market Opportunities

Emerging Private Sector Investments in Satellite Technology

Growing Demand for Earth Observation Data

Development of Low-cost Small Satellites for Emerging Markets - Trends

Integration of AI and Machine Learning in Satellite Operations

Collaborations Between Private and Government Space Agencies

Miniaturization and Cost Reduction in Satellite Technology - Government Regulations

Regulatory Framework for Satellite Launch and Operations

Licensing Requirements for Satellite Operators

Government Policies on Space Exploration and Satellite Data Access

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Communication Satellites

Earth Observation Satellites

Navigation Satellites

Remote Sensing Satellites

Scientific Research Satellites - By Platform Type (In Value%)

Small Satellites

Micro Satellites

Nano Satellites

Cube Satellites

Mega Constellations - By Fitment Type (In Value%)

Commercial Satellites

Military Satellites

Government Satellites

Research & Development Satellites

Private Sector Satellites - By EndUser Segment (In Value%)

Telecommunications

Defense & Security

Agriculture & Environmental Monitoring

Space Exploration & Research

Weather & Climate Forecasting - By Procurement Channel (In Value%)

Direct Sales

Government Contracts

Commercial Space Ventures

Public-Private Partnerships

Research Institutions & Universities

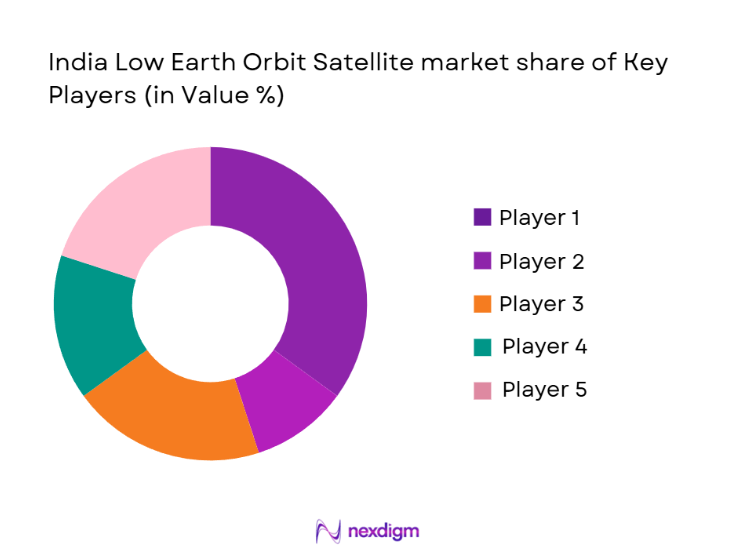

- Market Share Analysis

- CrossComparison Parameters (System Type, Platform Type, Fitment Type, End-User Segment, Procurement Channel)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Indian Space Research Organisation (ISRO)

OneWeb India

Bharti Airtel

Tata Communications

Globalstar India

Reliance Jio

Inmarsat India

Hughes Communications India

Satellogic

SpaceX India

Amazon Kuiper

O3b Networks

Telesat India

Astra Space

Planet Labs

- Telecommunication Sector’s Contribution to Satellite Growth

- Defense Sector’s Increasing Demand for Secure Communications

- Agricultural Sector Adoption of Satellite Technologies for Monitoring

- Environmental and Weather Forecasting Sector’s Role in Satellite Expansion

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035