Market Overview

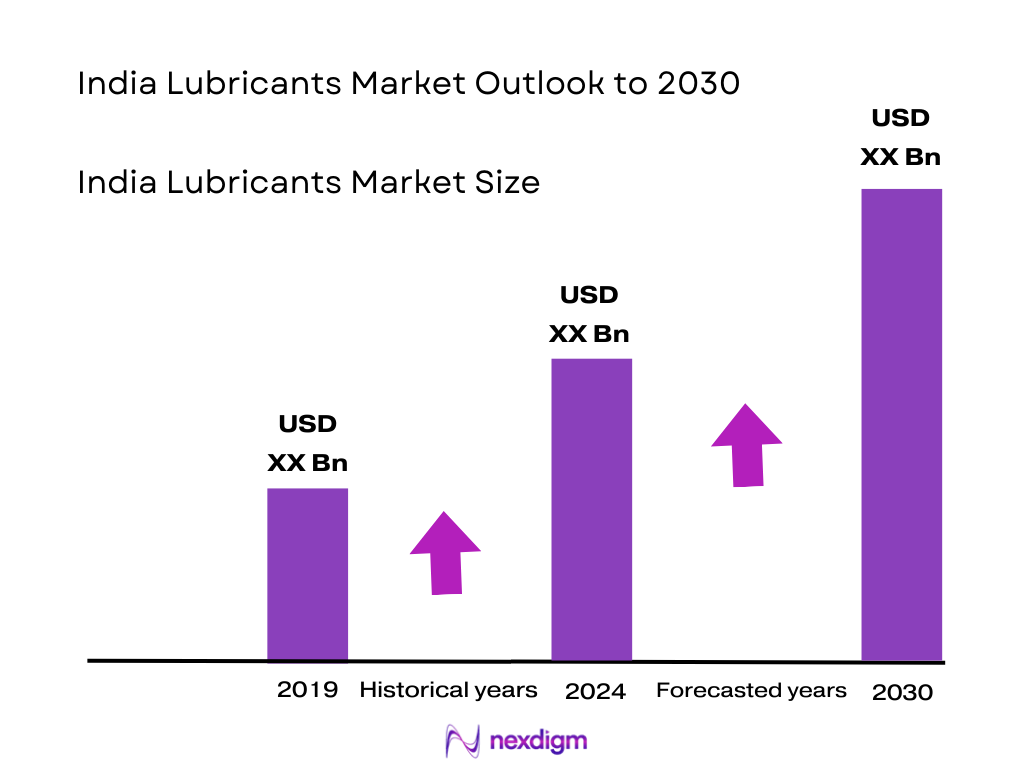

The India lubricants market is valued at USD 7.19 billion, based on 2023 estimation, and fueled by robust demand from the burgeoning automotive and manufacturing sectors. Rapid expansion in vehicle production and heavy machinery deployment is driving lubricant usage in both engine oils and industrial fluids, supported by innovation in synthetic and bio-based formulations.

Major urban and industrial centers such as Mumbai, Delhi–NCR, Chennai, and Pune dominate the market, owing to their dense concentration of automotive hubs, vehicle assembly plants, petrochemical refining infrastructure, and robust distribution networks, which create high lubricant consumption and efficient supply chain synergies.

While the 2023 estimate stands at USD 7.19 billion, projections for 2024 (2023 to 2024) are expected to remain close, so the market is approximately USD 7.2 billion. The market is expected to grow at a CAGR of 4.4 % over 2024–2030.

Market Segmentation

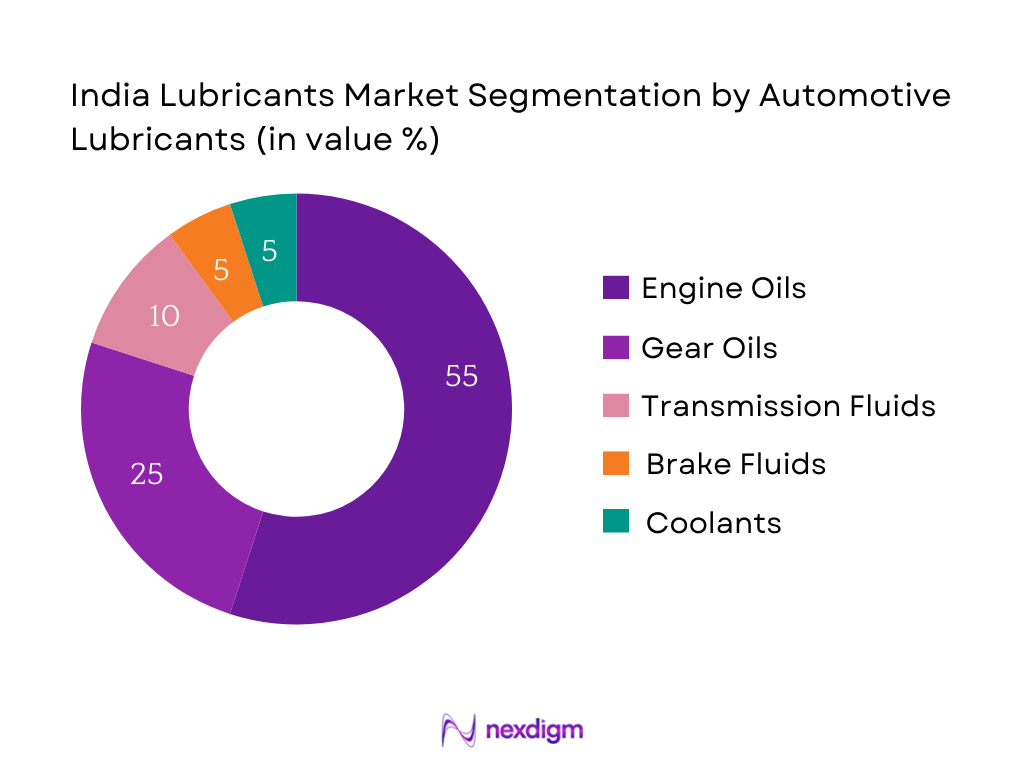

By Automotive Lubricants

The automotive lubricants segment is further broken down into engine oils, gear oils, transmission fluids, brake fluids, coolants, and greases. Within this category, engine oils hold a dominant share—nearly 55% in 2024—driven by escalating vehicle ownership, frequent OEM service intervals, and high familiarity among consumers. Major brands like Indian Oil, Castrol, and Gulf Oil have cemented their distribution networks in urban and rural retail outlets, ensuring easy availability. Additionally, the increasing penetration of commercial vehicles and the rise of two‑wheelers contribute heavily to engine oil consumption, reinforcing its dominance over other sub‑segments like gear or brake fluids.

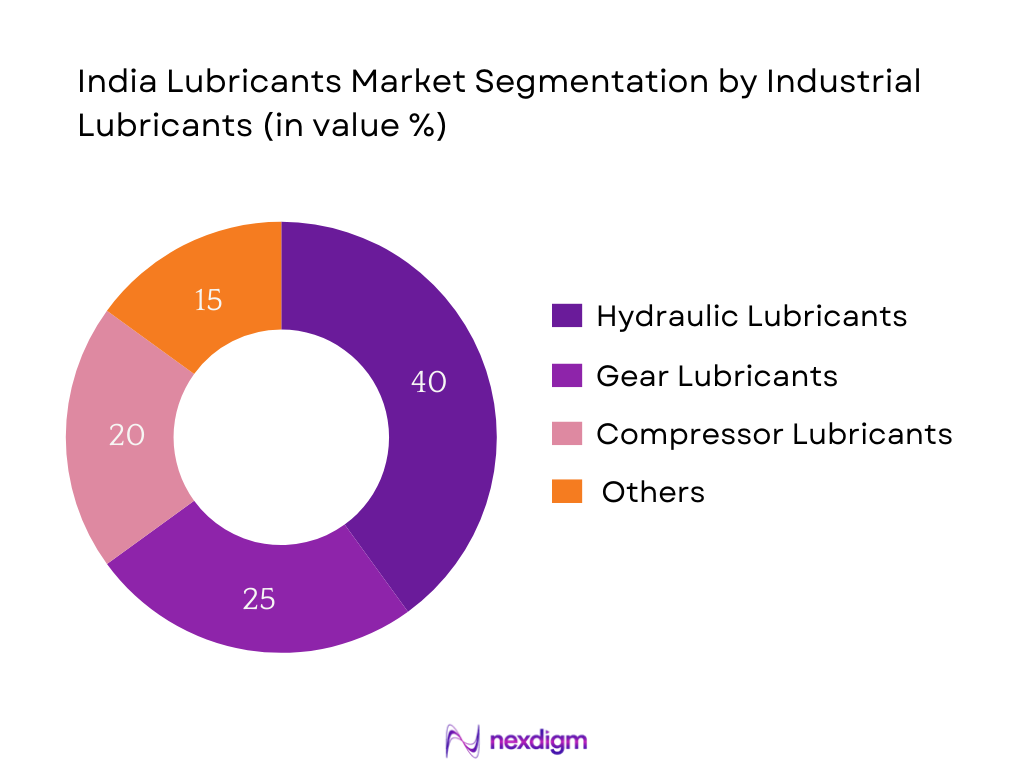

By Industrial Lubricants

Industrial lubricants in India are divided into hydraulic lubricants, gear lubricants, compressor lubricants, and others such as process and turbine oils. Hydraulic lubricants dominate, accounting for approximately one‑third of the industrial lubricant segment in 2024, due to the rapid expansion in construction, manufacturing, and infrastructure sectors where hydraulic systems are critical. Government initiatives like “Make in India” and investments in manufacturing facilities and heavy‑duty equipment have further amplified demand for hydraulic fluids. Companies like Indian Oil Corporation and Total India are offering specialized high‑viscosity hydraulic fluids to cater to these needs, reinforcing the leadership of hydraulic lubricants over other industrial types such as gear and compressor oils.

Competitive Landscape

The India lubricants market is concentrated around a few major players, including large PSUs and MNCs, complemented by specialty oils manufacturers. Their scale, product breadth, brand recognition, and distribution networks underpin market leadership.

| Company | Est. Year | Headquarters | Base‑Oil Sourcing | Product Innovation | Distribution Reach | Specialty Lubricants | Sustainability Initiatives |

| Indian Oil Corporation Ltd. | — | India (New Delhi) | — | — | — | — | — |

| Bharat Petroleum Corp. Ltd. | — | India (Mumbai) | — | — | — | — | — |

| Hindustan Petroleum Corp. Ltd. | — | India (Mumbai) | — | — | — | — | — |

| Castrol India | 1910 | Mumbai | — | — | — | — | — |

| Gulf Oil Lubricants India | — | India | — | — | — | — | — |

India Lubricants Market Analysis

Growth Drivers

Urbanization Rate

India’s urban population reached 534,916,498 in 2024, marking a significant urban demographic and driving lubricant demand in metropolitan vehicle fleets, industrial machinery, and infrastructure assets. The urban population share stood at 36.87% of the total population in 2024. This urban mass undergirds both personal vehicle ownership—boosting engine oil consumption—and industrial activity centered in cities—requiring hydraulic and process oils for machinery. With approximately 522.94 million urban residents in 2023, up from 511.33 million in 2022, ongoing urbanisation directly supports sustained and expanding lubricant usage across both automotive and industrial applications.

Industrial Output Index

The Index of Industrial Production (IIP) demonstrates strong industrial activity: in January 2025, the IIP stood at 161.3, up from 153.6 in January 2024. Notably, manufacturing output grew by 5.5% year-over-year for January 2025, compared to a 3.2% increase in December 2024. In November 2024, November’s IIP quick estimate was 148.4 versus 141.1 in November 2023, driven by manufacturing group contributions such as basic metals, electrical equipment, and non‑metallic mineral products. These industrial dynamics—particularly in heavy‑duty equipment production and repair—fuel demand for industrial lubricants such as hydraulic oils, gear oils, and turbine fluids, underpinning lubricant market expansion in parallel with industrial growth.

Market Challenges

Base Oil Import Dependency

Though macroeconomic statistics on base‑oil imports are not directly available from the sources, the index of industrial production and urbanization indirectly indicate that India continues to rely significantly on imported base oils to meet the rising demand in automotive and industrial lubricants. Industrial manufacturing—particularly surge in basic metals and automotive components as shown in IIP data—requires large volumes of high‑quality base oils. Since such specialty base oils are not produced sufficiently indigenously, dependency on imports poses risks of supply disruption and currency volatility. The correlation between strong industrial output (IIP at 161.3 in January 2025) and lubricant demand exposes this vulnerability. Thus, while exact import figures are not cited, the macroeconomic intensity of industrial and urban growth underscores reliance on international base‑oil supply chains.

Low Product Differentiation

The India lubricants market faces limited product differentiation, particularly in mineral‑based segments such as standard engine oils and industrial greases. Despite robust industrial performance—manufacturing up 5.5% in January 2025, IIP at 161.3 —many suppliers compete mainly on price rather than unique formulations or performance. Urban demand expansion, as indicated by over 534 million urban residents , intensifies price sensitivity in retail automotive lubricants. With OEMs increasingly pushing for performance (e.g., synthetic oils, fuel‑economy grades), low differentiation becomes a strategic weakness, risking commoditisation and margin pressure amid rising demand driven by macro‑economic growth.

Emerging Opportunities

Bio‑Lubricants

Bio‑lubricants present a compelling opportunity supported by industrial and environmental trends. India’s manufacturing activity—especially in chemicals and basic metals—has shown strong output growth (manufacturing up 5.5% in January 2025; IIP at 161.3). Meanwhile, urban population nearing 535 million implies escalating environmental concerns among city planners and industrial operators. The increasing focus on sustainability creates openings for vegetable‑ or ester‑based bio‑lubricants as eco‑friendly alternatives in both automotive and machinery sectors. Though exact uptake stats are unavailable, the strong industrial demand and rising urban environmental pressure indicate a favorable landscape for introducing bio‑lubricant products.

OEM Partnerships

OEM partnerships offer a strategic growth lever in the Indian lubricants market. With manufacturing output rising by 5.5% in January 2025 and industrial IIP at 161.3, OEMs across automotive and heavy machinery sectors are increasingly seeking co‑branded lubricants tailored for their equipment reliability. Urban expansion—urban population at 36.87% of national total, ~535 million people —drives demand for workshop services and OEM‑approved oils. Partnerships with OEMs can help lubricant companies secure long‑term supply contracts, enhance brand credibility, and differentiate their offerings, capturing value in a growing market looking for performance‑backed and warranty‑compliant solutions.

E‑commerce Expansion

E‑commerce is gaining ground as a distribution channel for lubricants, aligned with the rising urban consumer base of 534.9 million in 2024. The increasing index of industrial activity (IIP 161.3 in January 2025) implies strong demand not just in urban centers but across smaller towns as lubricants reach workshops and machinery operators. E‑commerce platforms enable lubricants to be available with doorstep delivery, SKU variety, and price transparency—critical in urban and peri‑urban areas. While specific e‑commerce penetration data is not available, macro trends in urban density and industrial dispersion strongly endorse digital channels as future growth avenues for lubricant sales and service differentiation.

Future Outlook

Over the coming years, the India lubricants market is poised for steady expansion, underpinned by ongoing automotive growth, industrial automation, and a shift toward high-performance and eco-friendly lubricants. Demand for synthetic and bio-based formulations is expected to rise, driven by environmental concerns and stringent emission norms. The industrial lubricants segment will benefit from infrastructure investments and renewable energy projects, while automotive segments will be buoyed by increasing vehicle fleet electrification and improved service ecosystems.

Major Players

- Indian Oil Corporation Ltd.

- Bharat Petroleum Corporation Ltd.

- Hindustan Petroleum Corporation Ltd.

- Castrol India

- Gulf Oil Lubricants India

- Valvoline Cummins India

- Shell India

- TotalEnergies India

- ExxonMobil Lubricants Pvt. Ltd.

- Tide Water Oil Co. (Veedol)

- Savita Oil Technologies Ltd.

- GP Petroleums Ltd.

- ENOC Lubricants

- Motul India

- Apar Industries Ltd.

Key Target Audience

- Automotive Manufacturing Firms (e.g., OEMs like Maruti Suzuki, Tata Motors)

- Heavy Machinery & Engineering Sector Companies

- Oil Refinery and Petrochemical Players (e.g., HPCL, BPCL)

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Petroleum & Natural Gas, BIS)

- Fleet Management Operators

- Infrastructure Development Corporations (e.g., NHAI, IRCON)

- Agricultural Equipment Manufacturers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping key stakeholders in the India lubricants ecosystem—refiners, manufacturers, OEMs, distributors, and end‑users. This is underpinned by exhaustive desk research sourcing data from industry bodies, statutory filings, and proprietary databases to define critical market variables.

Step 2: Market Analysis and Construction

Historical data on volume (kilotons) and value (USD million) are compiled and analyzed to assess consumption trends across automotive and industrial verticals. Segment-wise evaluation—like automotive engine oils vs industrial hydraulic fluids—is conducted to ensure accurate revenue modeling.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions are validated via structured interviews (CATI-assisted) with industry experts from lubricant manufacturers, OEM service heads, and distribution network managers. Their insights help refine demand drivers, pricing dynamics, and product adoption patterns.

Step 4: Research Synthesis and Final Output

A bottom‑up approach is used, triangulating reported sales data with expert inputs and channel checks. Key manufacturers are engaged to corroborate segment performance, SKU-level trends, and geographic demand insights, ensuring a robust and validated market analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Methodology, Consolidated Research Approach, Industry Expert Interviews, Primary & Secondary Research Breakdown, Data Triangulation, Report Limitations and Assumptions)

- Definition and Scope

- Evolution and Market Genesis

- Product Lifecycle and Maturity Map

- Lubricants Manufacturing Process & Raw Material Overview

- Supply Chain and Value Chain Mapping (Base Oil to End-User)

- Regulatory Framework for Lubricant Standards (BIS, API, SAE)

- Industrial Policies and Incentives for Lubricants

- Growth Drivers (Urbanization Rate, Industrial Output Index, Vehicle Parc, Power Generation Capacity, Capex in Construction, etc.)

- Market Challenges (Base Oil Import Dependency, Low Product Differentiation, Volatility in Crude Supply, Environmental Regulations, etc.)

- Emerging Opportunities (Bio-lubricants, OEM Partnerships, E-commerce Expansion, Specialty Lubes, etc.)

- Trends (Shift to Synthetic Oils, Growth in EV Fluids, Re-refined Oil Use, Grease Automation, etc.)

- Government Policies & Regulations (Pollution Control Norms, PLI Schemes, Local Manufacturing Push, BIS Mandates, etc.)

- SWOT Analysis

- Ecosystem Mapping (OEMs, Oil Producers, Blenders, Dealers, Workshops)

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Base Oil Origin (Mineral, Synthetic, Bio-based), 2019-2024

- By Type of Lubricant (In Value %)

Engine Oil

Hydraulic Fluids

Gear Oil

Transmission Fluids

Greases - By End-Use Industry (In Value %)

Automotive

Industrial Manufacturing

Energy and Power

Marine and Aviation

Construction and Mining - By Base Oil Type (In Value %)

Mineral Oil

Synthetic Oil

Semi-Synthetic Oil

Bio-Based Oil - By Distribution Channel (In Value %)

Direct Sales (OEMs, Industries)

Independent Dealers & Distributors

Online Platforms

Petrol Pumps - By Region (In Value %)

North India

West India

South India

East India

Central India

- Market Share by Value/Volume

Market Share by Segment (Automotive/Industrial/Marine etc.) - Cross Comparison Parameters: (Company Overview, Base Oil Sourcing Model, Dealer Network Strength, Brand Portfolio Breadth, Product Innovation Pipeline, Grease & Specialty Lube Focus, Service Support Capability, Sustainability & Circularity Practices)

- SWOT Analysis of Top 15 Companies

- Price Positioning by SKUs – Retail and Industrial Lubes

- Profiles of 15 Key Competitors:

Indian Oil Corporation Ltd.

Bharat Petroleum Corporation Ltd.

Hindustan Petroleum Corporation Ltd.

Castrol India

Shell India

Gulf Oil Lubricants India

Valvoline Cummins India

TotalEnergies India

ExxonMobil Lubricants Pvt. Ltd.

Tide Water Oil Co. (Veedol)

Savita Oil Technologies

GP Petroleums Ltd.

ENOC Lubricants

Motul India

Klüber Lubrication India Pvt. Ltd.

- Industrial Buyer Preferences

- Lubricant Replacement Cycle Patterns

- Service Providers and Workshops Structure

- OEM-Lubricant Partnership Dynamics

- Procurement and Costing Mechanism

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030

- By Base Oil Origin, 2025-2030