Market Overview

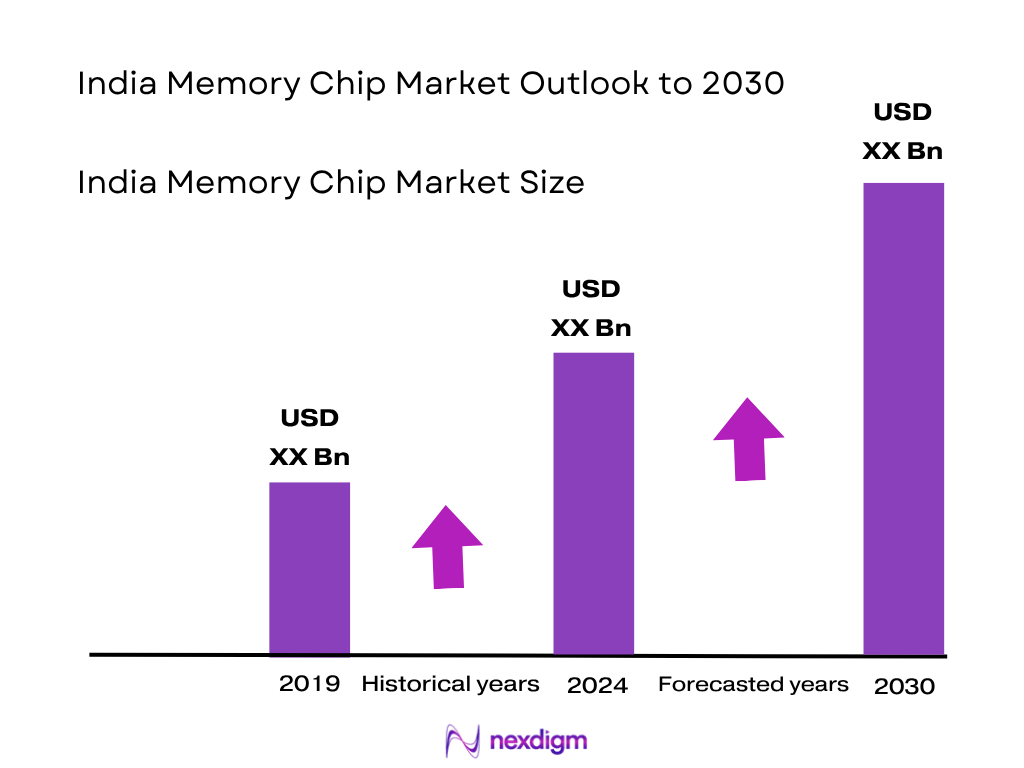

The India memory chip market is valued at USD 3,830 million in 2024, driven by expansion in smartphone manufacturing, increasing data centre deployments, and growth in automotive electronics demand. Major hubs such as Bengaluru, Hyderabad, and Pune dominate owing to their established semiconductor design centres, R&D clusters, and growing foundry and OSAT investments, while Gujarat and Assam emerge strong due to new wafer fabrication and assembly units backed by government’s Semicon India Programme.

The India memory chip market generated revenue of USD 3,160.3 million in 2023 and grew to approximately USD 3,830 million in 2024 (interpolated from reported CAGR). Forecasted CAGR for 2024–2030 is 21.2%, with an expected valuation of around USD 12,133.2 million by 2030.

Market Segmentation

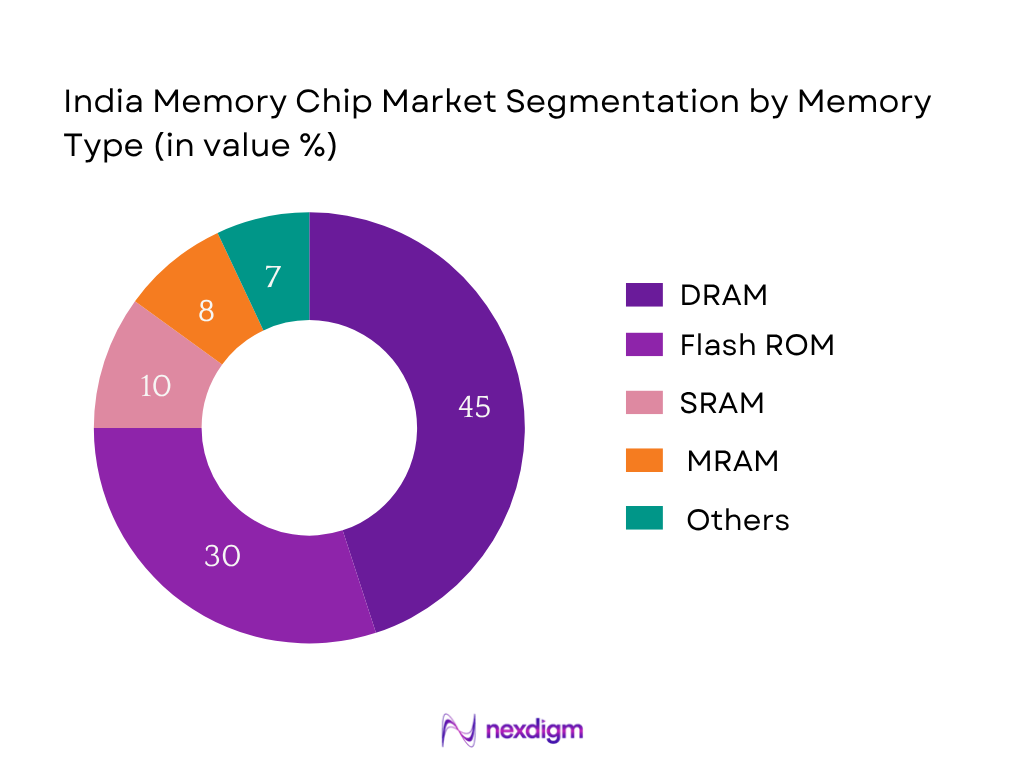

By Memory Type

India memory chip market is segmented by memory type into DRAM, Flash ROM, SRAM, MRAM and others. DRAM is the dominant segment, supported by its critical use in server-grade modules, growing telecom equipment demand and enterprise data‑centre deployments. Established import pipelines and limited domestic production make DRAM crucial. Flash ROM (including NAND) is the fastest‑growing sub‑segment, driven by widespread smartphone manufacturing, consumer electronics, and automotive applications requiring persistent onboard storage.

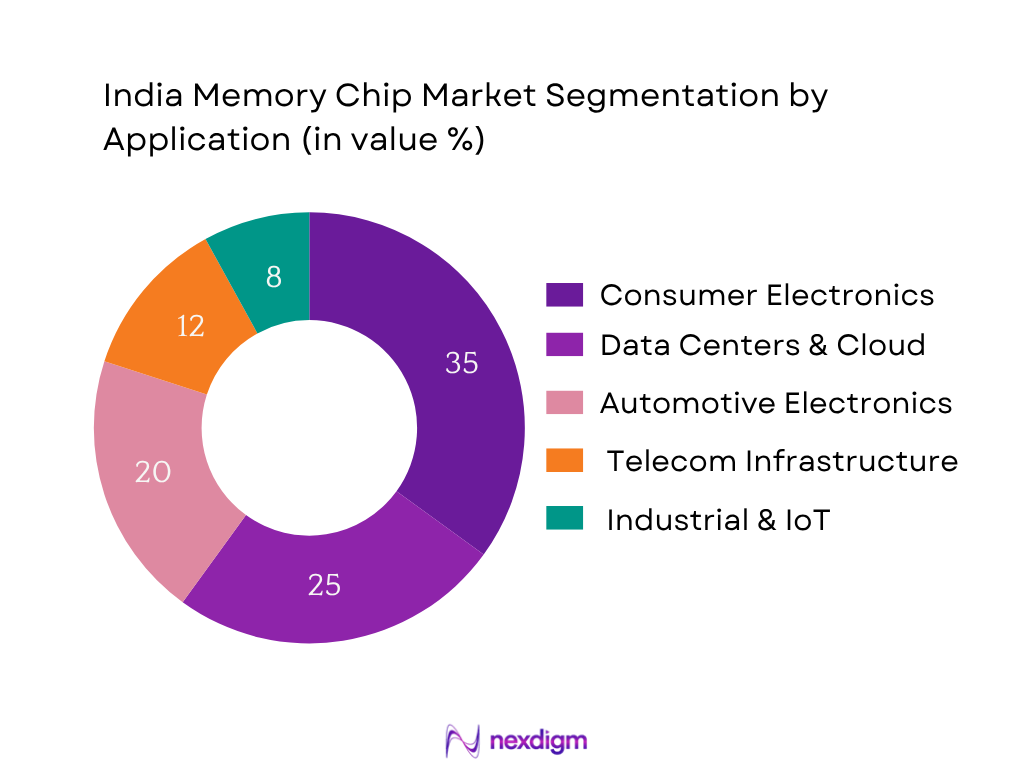

By Application

India memory chip market is segmented into consumer electronics, data centres & cloud, automotive electronics, telecom infrastructure, and industrial & IoT. Consumer electronics dominates with the largest revenue share, supported by sustained demand from smartphone and PC OEMs. Data centres & cloud segment accounts for significant share due to hyperscale facility roll‑outs and enterprise storage needs. Automotive electronics – especially ADAS and infotainment – also contributes strongly, high‑lighting memory chip penetration in EV and connected vehicles.

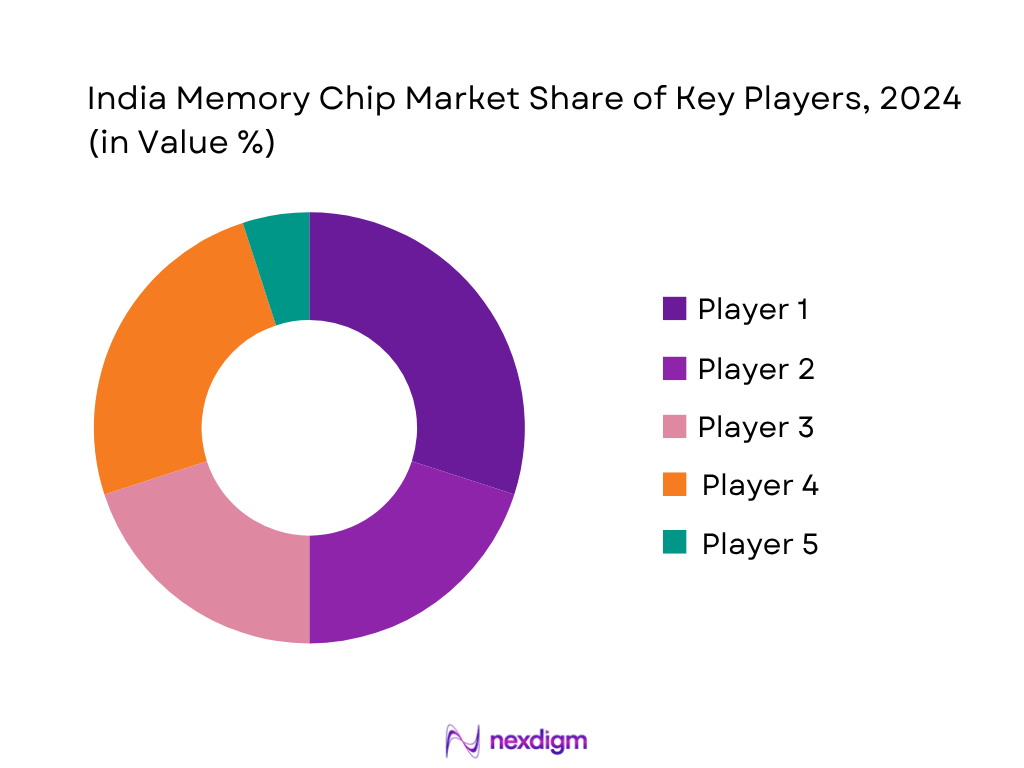

Competitive Landscape

The India memory chip market is shaped by a handful of global and domestic players. Memory chip reliance on imports has historically meant dominance by global leaders, though recent investments into local assembly/test ecosystem are enabling new entrants.

| Company | Year Established | Headquarters | India Revenue Share (%) | R&D / Design Centres | OSAT / Assembly Capacity | India OEM Clients | Strategic Advantage |

| Micron Technology | 1978 | Boise, USA | – | – | – | – | – |

| Samsung Semiconductor | 1969 | Suwon, South Korea | – | – | – | – | – |

| SK Hynix | 1983 | Icheon, S. Korea | – | – | – | – | – |

| Western Digital / Kioxia | 1991 | San Jose, USA / Japan | – | – | – | – | – |

| Kingston Technology | 1987 | Fountain Valley, USA | – | – | – | – | – |

India Memory Chip Market Analysis

Growth Drivers

Data Localization Policies

India’s enactment of the Digital Personal Data Protection Act, 2023 (DPDP Act), and the release of its draft Rules in early 2025 mandate that certain types of personal data must be stored and processed within Indian territory. In July 2024, a breach incident in a state-run telecom firm managing localization-mandated servers prompted a sector-wide audit, highlighting infrastructure gaps in domestic storage environments and strengthening policy resolve to build local data centres for compliance. The Government’s regulations require data fiduciaries to implement secure, domestically-located processing facilities. This has created surging demand for memory chips in Indian data centre hardware procurement and domestic computing infrastructure build-out. As a result, enterprises and government agencies are investing heavily in onshore data storage capacity, directly boosting requirements for DRAM and NAND memory modules at the hardware level.

IoT Expansion

The number of connected IoT devices globally surpassed 16.6 billion by end‑2023, growing to 18.8 billion by end‑2024 according to IoT Analytics. Within India, the IoT penetration trend mirrors global momentum: enterprise spending increased by approximately 10% year‑on‑year in 2024, reaching nearly USD 298 billion globally in IoT investment. Indian industries such as manufacturing, logistics, and smart cities are rolling out sensors and edge computing equipment, each device embedding DRAM, Flash, or SRAM chips. India’s integration of NB‑IoT and 5G mMTC is expected to support millions of smart nodes for industrial automation and consumer IoT deployments. The proliferation of these connected devices significantly increases aggregate memory chip demand along the value chain—from module design to OEM supply purchases within India.

Market Challenges

Fabless Ecosystem

India’s semiconductor ecosystem is still nascent in fabless design, with major efforts beginning in late‑2024 under the government’s US $10 billion semiconductor initiative. For example, Larsen & Toubro announced a US $300 million investment for a chip design firm targeting production of 15 products by 2027; Tata Electronics committed INR 910 billion (approx. US $10.84 billion) to build wafer fabrication in Gujarat and INR 270 billion (US $3.21 billion) for assembly and test units in Assam. Despite these investments, India still lacks mature in-country DRAM/NAND wafer facility capabilities. Reliance on imported memory chips persists, limiting domestic upstream fabrication and pushing dependency on global suppliers. This absence of a complete fabless-to-fab pipeline constrains integration of India-designed memory IP and limits cost competitiveness.

IP Restrictions

Under the Digital Personal Data Protection Act, 2023, data processed in India must be handled under specified conditions, and foreign entities are subject to additional compliance regimes, including restriction on outsourcing personal data processing abroad. These rules limit the ability of global memory chip vendors to manage design files, firmware or key IP across borders freely. Companies must adapt with India-based secure design servers and local data storage. The administrative burden and localization overhead heighten design and compliance costs for memory chip customizations and restrict cross-border design collaboration with international R&D centres.

Opportunities

Chip Design Hubs

India’s focused investments into semiconductor design infrastructure under the US $10 billion semiconductor initiative, including Tata Electronics’ INR 910 billion Gujarat fab investment and INR 270 billion Assam assembly-unit funding, supports establishment of design hubs for memory and logic chip design in India. These hubs can attract local and global semiconductor design talent, enabling the development of Indian IP for DRAM, NOR, NAND, and emerging memories. The emergence of multiple design centres in Bengaluru and Hyderabad enhances technology localization. As government subsidy schemes roll out, design houses can partner with foundries for joint development of memory chip solutions tailored to Indian markets—creating future-forward opportunities in memory IP innovation.

Strategic JV Opportunities

Publicly announced investments such as L&T’s US $300 million fabless venture and Tata Electronics’ multi‑billion‑dollar projects signal joint venture potential in India’s ecosystem. Foreign memory firms or fabless IP licensors have opportunities to co-invest with Indian conglomerates in design and test units. With the government offering incentives under the Production Linked Incentive (PLI) scheme, JVs can mitigate localization compliance and leverage India’s engineering workforce to co-develop memory modules. These strategic partnerships position India as a potential regional memory chip manufacturing node within Asia.

Future Outlook

Over the next six years, the India memory chip market is expected to demonstrate robust growth, driven by continued expansion of cloud infrastructure, government‑spearheaded semiconductor fab and OSAT investments, and surging demand from emerging AI, 5G and EV applications. Consumer electronics volumes will remain high, while industrial IoT and automotive memory usage will accelerate. Localization efforts under the India Semiconductor Mission will reduce import dependency and foster ecosystem resilience.

Major Players

- Micron Technology

- Samsung Semiconductor

- SK Hynix

- Western Digital / Kioxia

- Kingston Technology

- Intel (memory division)

- Nanya Technology

- GigaDevice

- Cypress Semiconductor

- Winbond Electronics

- Greenliant Systems

- Adesto Technologies

- Alliance Memory

- STMicroelectronics (memory products)

- Etron Technology

Key Target Audience

- Chief Technology Officers (semiconductor companies)

- Heads of Procurement (OEMs in consumer electronics and automotive)

- Strategy & Investment Divisions at investment and venture capital firms

- Senior Leadership at Government and regulatory bodies (Ministry of Electronics & IT; India Semiconductor Mission)

- Heads of Supply Chain and Procurement (Data centre operators)

- VP R&D (telecom infrastructure providers)

- Heads of Product Development (AI/data centre OEMs)

- Directors of Manufacturing and OSAT operations

Research Methodology

Step 1: Identification of Key Variables

Initial phase maps stakeholders across memory design houses, OEMs, assembly/test units, and policymakers—leveraging secondary databases and industry publications to define critical variables.

Step 2: Market Analysis and Construction

Historical and current year (2023–2024) revenue data compiled from credible sources; segmentation by memory type and application was analysed; ASP, volume shipments and pricing trends assessed for accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses around demand drivers, import dependency, and growth projections were validated via interviews with industry experts, supply‑chain managers, and R&D leads at leading memory manufacturers.

Step 4: Research Synthesis and Final Output

Insights from policy initiatives (Semicon India Mission), OSAT projects, and OEM demand patterns were synthesized with bottom‑up revenue modelling to deliver a validated standalone India memory chip market forecast and strategy insights.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Methodology, Primary and Secondary Research Sources, Limitations and Future Projections)

- Definition and Scope

- Industry Genesis and Evolution

- Technology Roadmap and Lifecycle (DRAM, NAND, NOR, SRAM, MRAM, etc.)

- Manufacturing and Supply Chain Dynamics (Raw Wafer to Final Assembly)

- Regulatory Landscape and Import Dependency

- India’s Position in the Global Memory Value Chain

- Major Policy Initiatives (PLI Scheme, Make in India, Semiconductor Mission)

- Growth Drivers

Data Localization Policies

IoT Expansion

EV Penetration - Market Challenges

Fabless Ecosystem

IP Restrictions

Supply Volatility - Opportunities

Chip Design Hubs

Strategic JV Opportunities

Defense Chip Applications - Trends

HBM Integration

Neuromorphic Computing Chips

In-Memory AI Processing - Government Regulations

Incentives

Tax Benefits

Import Duties - Value Chain and Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- SWOT Analysis

- Pricing Trends and Cost Component Breakdown

- By Value (USD Million), 2019-2024

- By Volume (Units Shipped), 2019-2024

- By Average Selling Price (in USD), 2019-2024

- By Memory Type (In Value %)

Dynamic Random-Access Memory (DRAM)

Static Random-Access Memory (SRAM)

NAND Flash

NOR Flash

Magnetoresistive RAM (MRAM)

Phase-Change Memory (PCM) - By Application (In Value %)

Consumer Electronics (Smartphones, Laptops, Wearables)

Automotive (ADAS, Infotainment, ECU Storage)

Industrial Equipment

Telecommunication Infrastructure (Data Centers, 5G Devices)

Enterprise Storage (SSD, NAS, SAN) - By Technology Node (In Value %)

Above 45nm

22nm to 45nm

14nm to 22nm

Below 14nm - By End-User Type (In Value %)

OEMs

ODMs

Semiconductor Foundries

Research & Defense Institutes

Retail & Aftermarket Distributors - By Region (In Value %)

North India

South India

West India

East India

Central India

- Market Share of Major Players by Value and Volume

- Cross Comparison Parameters (Company Overview, Business Strategy, India Revenue Share, R&D Spend, Technology Licensing, Distribution Channels, Packaging Partnerships, Number of Indian OEM Clients, SKUs, ASP Trends, Foundry Collaboration, Innovation Edge)

- SWOT Analysis of Major Competitors

- Pricing Benchmarking Across Key Product SKUs

- Detailed Company Profiles

Samsung Semiconductor India

Micron Technology India

SK Hynix

Western Digital

Winbond Electronics

Cypress Semiconductor

Kingston Technology

Greenliant Systems

Adesto Technologies

Nanya Technology

Alliance Memory

STMicroelectronics

GigaDevice Semiconductor

Etron Technology

- End-User Demand Patterns

- Procurement Preferences and Supplier Selection Criteria

- Adoption Trends by Use Case

- Regulatory Compliance Requirements by Industry

- B2B vs B2C Buying Behavior Insights

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030