Market Overview

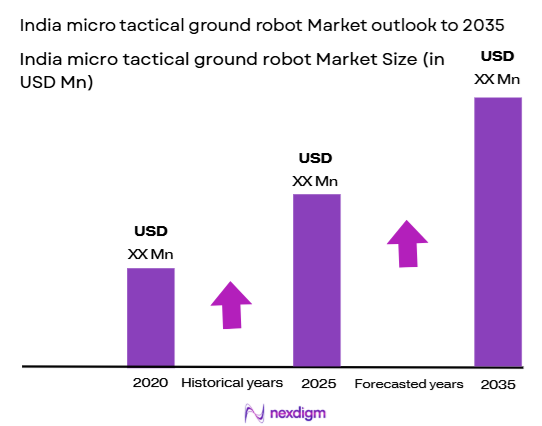

The India Micro Tactical Ground Robot market is valued at USD ~million in 2024. This market is primarily driven by the increasing demand for advanced security and surveillance technologies, particularly in defense, law enforcement, and industrial applications. Government initiatives to modernize defense forces, coupled with rising investments in research and development, are contributing to robust market growth. The Indian government’s focus on autonomous systems for border security and surveillance has significantly accelerated demand for micro tactical robots. These robots are deployed for critical applications such as reconnaissance, explosive ordnance disposal (EOD), and logistical support, pushing the market’s expansion.

India is the dominant country in the micro tactical ground robot market due to its growing defense sector, substantial military expenditure, and an increasing focus on autonomous robotic technologies. The cities leading this market include Delhi, Mumbai, and Bangalore. Delhi and Mumbai are major hubs for defense research and procurement, housing key defense contractors and government bodies. Bangalore, known as India’s “Silicon Valley,” plays a vital role in the development of advanced robotics and AI technologies. The defense ministries and strategic military operations in these regions heavily influence the market’s trajectory, making them key players in driving the demand for micro tactical ground robots.

Market Segmentation

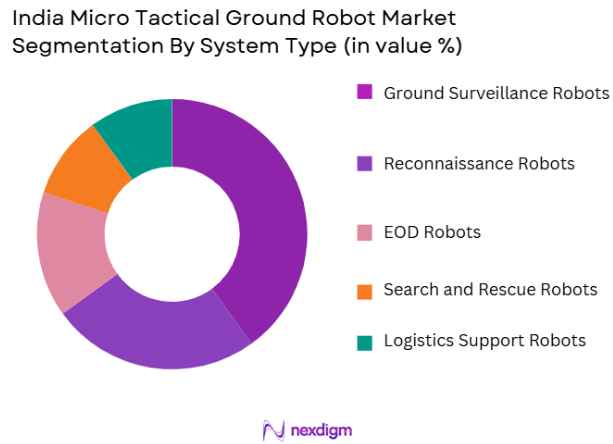

By System Type

The India Micro Tactical Ground Robot market is segmented by system type into ground surveillance robots, reconnaissance robots, explosive ordnance disposal (EOD) robots, search and rescue robots, and logistics support robots.Ground surveillance robots dominate this segment due to the increasing need for enhanced security in military and law enforcement operations. Surveillance robots are increasingly used in border patrols, high-security areas, and critical infrastructure monitoring, offering real-time data transmission, environmental awareness, and autonomous operation. This system’s popularity is attributed to the government’s strategic push for autonomous surveillance systems, particularly in areas with high security risks. Furthermore, with advancements in AI and remote sensing, these robots are becoming more sophisticated, increasing their adoption in various defense and civilian sectors.

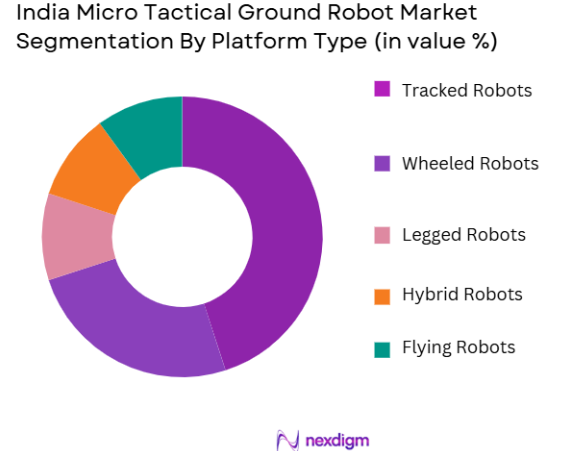

By Platform Type

The market is segmented by platform type into tracked robots, wheeled robots, legged robots, hybrid robots, and flying robots.Tracked robots lead this segment due to their superior mobility and stability in rough terrains, which are essential for military applications and hazardous environments. Their ability to navigate through difficult conditions, such as forests, rocky landscapes, and urban areas with debris, makes them particularly suitable for tactical operations. Additionally, tracked robots are highly preferred for explosive ordnance disposal (EOD) missions and reconnaissance, where stability and rugged performance are crucial. Their durability and ability to carry heavy payloads further enhance their utility in critical military and defense operations.

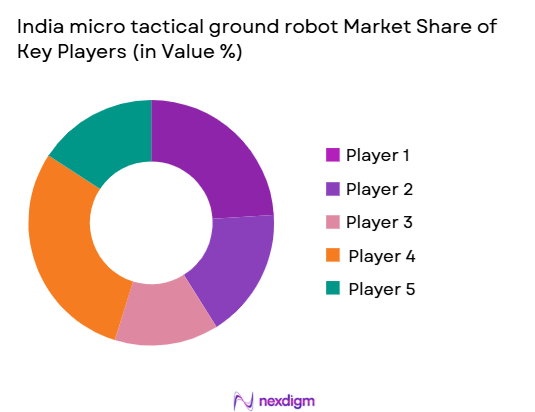

Competitive Landscape

The India Micro Tactical Ground Robot market is dominated by a few key players with a strong presence in defense and robotics technology. The consolidation of these players reflects their significant influence in shaping the market. Companies like Lockheed Martin, QinetiQ Group, and Boston Dynamics are making notable advancements in the development of tactical robots and securing long-term contracts with defense agencies. Their ability to innovate and offer customized robotic solutions tailored to the needs of defense and security agencies gives them a competitive edge.

| Company | Establishment Year | Headquarters | Product Range | Technological Innovation | Defense Contracts | Market Reach | Robotics Expertise |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| QinetiQ Group | 2001 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Boston Dynamics | 1992 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Endeavor Robotics | 2016 | Boston, USA | ~ | ~ | ~ | ~ | ~ |

| Textron Systems | 1923 | Providence, USA | ~ | ~ | ~ | ~ | ~ |

India Micro Tactical Ground Robot Market Analysis

Growth Drivers

Urbanization

Urbanization is one of the significant growth drivers for the India Micro Tactical Ground Robot market. As India’s urban population grows, the need for advanced surveillance and security solutions escalates. The urban population in India was estimated to be around ~% of the total population in 2024, and it is expected to continue increasing as more cities expand and urbanize. With urban areas facing rising security concerns due to higher population density, government and private sector investments in autonomous robotics, such as micro tactical ground robots, are expanding. Urban areas, particularly Delhi and Mumbai, are central hubs for deploying advanced surveillance systems. Increased urbanization accelerates demand for micro tactical robots for applications like border security, industrial surveillance, and urban policing.

Industrialization

Industrialization plays a crucial role in the growth of the micro tactical ground robot market in India. As India’s industrial output continues to grow, there is a strong need for automation and autonomous systems to manage risks and enhance operational efficiency. The Indian manufacturing sector’s contribution to GDP was around ~% in 2024, and with increasing industrialization, the demand for robotic systems for industrial surveillance, security, and maintenance is on the rise. For example, robotic systems are being used in hazardous environments like mines and chemical plants, where they can minimize human exposure to danger. The industrial growth in sectors such as defense, logistics, and infrastructure development is directly increasing the adoption of micro tactical robots for various applications.

Restraints

High Initial Costs

A significant restraint for the India Micro Tactical Ground Robot market is the high initial costs associated with these advanced robotic systems. Developing and manufacturing micro tactical robots involves high research and development costs, specialized components, and complex integration of artificial intelligence, which makes them expensive to produce. As of 2024, the cost of a typical micro tactical robot is estimated to be over USD ~ depending on the complexity of the system. The high costs make it difficult for many smaller defense contractors and local law enforcement agencies to adopt these technologies, thereby limiting the market growth. This issue is especially challenging for smaller cities or municipalities that lack the budget to invest in high-cost robotics systems.

Technical Challenges

Micro tactical ground robots face significant technical challenges that can hinder their widespread adoption. These challenges include the need for advanced navigation capabilities in complex environments, integration of real-time data processing, and reliable communication systems in remote areas. In 2024, India’s defense research institutions are facing difficulties in developing AI algorithms that can operate in unpredictable environments. Despite these advancements, robots often struggle with tasks like real-time decision-making, obstacle avoidance, and terrain adaptability, especially in combat or emergency situations. These technical hurdles increase the development cycle and add to the cost of the technology, thereby acting as a restraint for the market.

Opportunities

Technological Advancements

Technological advancements in AI, machine learning, and robotics are a major opportunity for the India Micro Tactical Ground Robot market. In 2024, India is seeing significant investments in the development of autonomous systems, and these advancements are directly benefiting the robotic systems used in military, defense, and industrial applications. The increasing use of AI algorithms for improved decision-making and enhanced navigation capabilities in complex environments is opening up new opportunities for micro tactical robots. Additionally, advancements in energy efficiency and miniaturization are making these robots more affordable and capable, fostering market growth. As AI and robotics technologies continue to improve, there will be even greater adoption of micro tactical robots.

International Collaborations

International collaborations are opening up new opportunities for the growth of the India Micro Tactical Ground Robot market. India has been increasingly collaborating with global leaders in robotics and defense technologies. In 2024, India signed several defense agreements with countries like the United States and Russia, focusing on the joint development and procurement of advanced robotic systems. These collaborations not only provide access to cutting-edge technology but also allow Indian defense manufacturers to integrate international expertise into their product offerings. As these collaborations expand, the Indian market will benefit from advanced robotics technologies, fostering future growth.

Future Outlook

Over the next decade, the India Micro Tactical Ground Robot market is expected to show substantial growth driven by continuous defense modernization, increased adoption of autonomous technologies, and rising investments in security infrastructure. The demand for advanced robotic solutions for military operations, including surveillance, reconnaissance, and bomb disposal, will significantly fuel market expansion. As technological advancements continue, we anticipate the development of more sophisticated, cost-effective robotic systems that can operate in complex environments, further driving adoption across various sectors. The Indian government’s increasing emphasis on self-reliance in defense manufacturing is also expected to provide a boost to local players, enhancing competition and innovation in the robotics market.

Major Players

- Lockheed Martin

- QinetiQ Group

- Boston Dynamics

- Endeavor Robotics

- Textron Systems

- Harris Corporation

- iRobot Corporation

- Cobham Plc

- Northrop Grumman

- Rheinmetall AG

- Thales Group

- AeroVironment

- General Dynamics

- FLIR Systems

- Clearpath Robotics

Key Target Audience

- Defense Agencies

- Law Enforcement Agencies

- Robotics Manufacturers

- OEMs in Defense and Security Technologies

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- National Security Agencies

- System Integrators and Robotics Technology Providers

Research Methodology

Step 1: Identification of Key Variables

In this phase, we construct an ecosystem map to encompass all stakeholders within the India Micro Tactical Ground Robot market. This is achieved through extensive secondary research and the use of proprietary industry databases to gather data. We define key variables such as system types, platform types, and procurement channels, which significantly influence market trends.

Step 2: Market Analysis and Construction

We analyze historical data from various sources, focusing on the growth trajectory and market penetration of micro tactical robots in India. This includes studying the deployment of robots in defense, law enforcement, and industrial sectors, alongside an evaluation of the overall demand for autonomous robotic solutions.

Step 3: Hypothesis Validation and Expert Consultation

We develop hypotheses regarding market dynamics and validate them through consultations with industry experts, including defense contractors, robotics manufacturers, and government officials. These discussions provide a deeper understanding of the challenges, opportunities, and technology advancements within the market.

Step 4: Research Synthesis and Final Output

The final phase involves cross-referencing our data with direct feedback from robotic manufacturers and key defense agencies to ensure the market insights are comprehensive and accurate. This includes validating our findings using interviews, expert opinions, and secondary research, ensuring a holistic and reliable final report.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets and investments in military robotics

Rising demand for security and surveillance applications

Technological advancements in autonomous robotic systems - Market Challenges

High development and maintenance costs of robotic systems

Technological complexities in autonomous navigation

Regulatory hurdles in adopting military-grade robotics - Trends

Adoption of AI and machine learning in robotic systems

Growing demand for autonomous vehicles and robots

Integration of IoT in robotic solutions for real-time data collection

- Market Opportunities

Growth in defense modernization programs

Potential in commercial applications beyond defense

Strategic international partnerships and collaborations - Government regulations

Compliance with international defense trade regulations

Certification for autonomous systems in military applications

Export control laws affecting robotic systems - SWOT analysis

Strength in military contracts and defense innovation

Weakness in high production and R&D costs

Opportunities in expanding commercial markets and non-defense applications

Threats from geopolitical instability and changing defense priorities - Porters 5 forces

High bargaining power of suppliers for advanced technologies

Threat of substitutes from traditional manual labor

Moderate threat of new entrants due to high R&D costs

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Ground Surveillance Robots

Reconnaissance Robots

Explosive Ordnance Disposal (EOD) Robots

Search and Rescue Robots

Logistics Support Robots - By Platform Type (In Value%)

Tracked Robots

Wheeled Robots

Legged Robots

Hybrid Robots

Flying Robots - By Fitment Type (In Value%)

Custom Fitment

Modular Fitment

Standard Fitment

Integrated Systems

Retrofit Systems - By EndUser Segment (In Value%)

Defense & Military

Law Enforcement

Search & Rescue Operations

Industrial & Commercial

Civilian Applications - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

Commercial Procurement

OEM Partnerships

Third-Party Resellers

- Market Share Analysis

- CrossComparison Parameters(System Type, Platform Type, Fitment Type, Procurement Channel, EndUser Segment)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Oshkosh Defense

Clearpath Robotics

Endeavor Robotics

QinetiQ Group

Harris Corporation

iRobot Corporation

Boston Dynamics

Textron Systems

Lockheed Martin

Northrop Grumman

Cobham Plc

Hughes Network Systems

Rheinmetall AG

Thales Group

AeroVironment

- Rising demand for unmanned systems in the defense sector

- Increasing adoption of tactical robots by law enforcement agencies

- Expanding use in disaster response and search and rescue

- Demand for non-lethal robotic systems in civilian applications

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035