Market Overview

India MCU market is valued at USD 30.36 billion in 2024, driven by surging demand from consumer electronics, automotive electronics, industrial automation and smart IoT adoption. Market acceleration is fueled by Make‑in‑India semiconductor policies and growing in‑vehicle electronics usage in EVs and smart appliances

Regional dominance in Asia‑Pacific, particularly India, China and Japan, stems from their massive electronics manufacturing bases, strong OEM ecosystems, and rapid growth in consumer device consumption. India benefits from government semiconductor incentives, localized manufacturing clusters and booming automotive electronics supply chains.

Market Segmentation

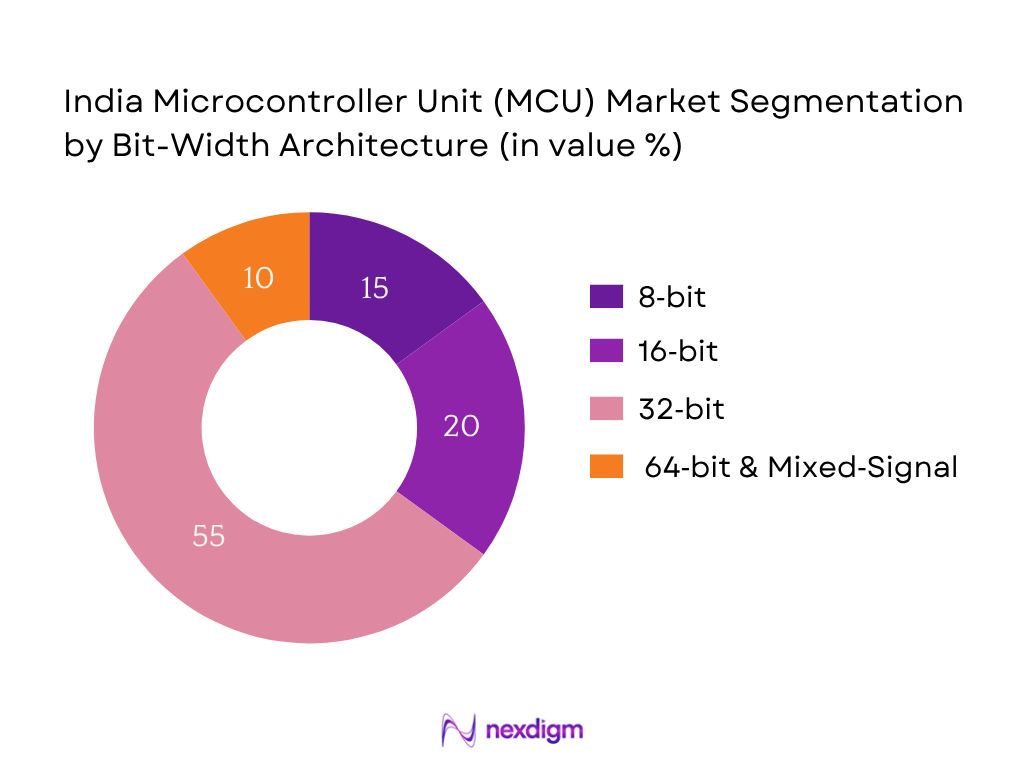

By Bit‑Width Architecture

India MCU market is segmented by bit‑width into 8‑bit, 16‑bit, 32‑bit and 64‑bit/mixed‑signal variants. The 32‑bit MCU segment is dominant, accounting for roughly 55 % of revenues. This dominance is attributed to their versatility in handling edge AI tasks, automotive electronic control, and industrial automation use cases. As OEMs and IoT integrators increasingly require high processing speeds and richer feature sets, 32‑bit architectures offer the optimal balance of performance and cost, fueling strong adoption across automotive, smart appliances and metering systems.

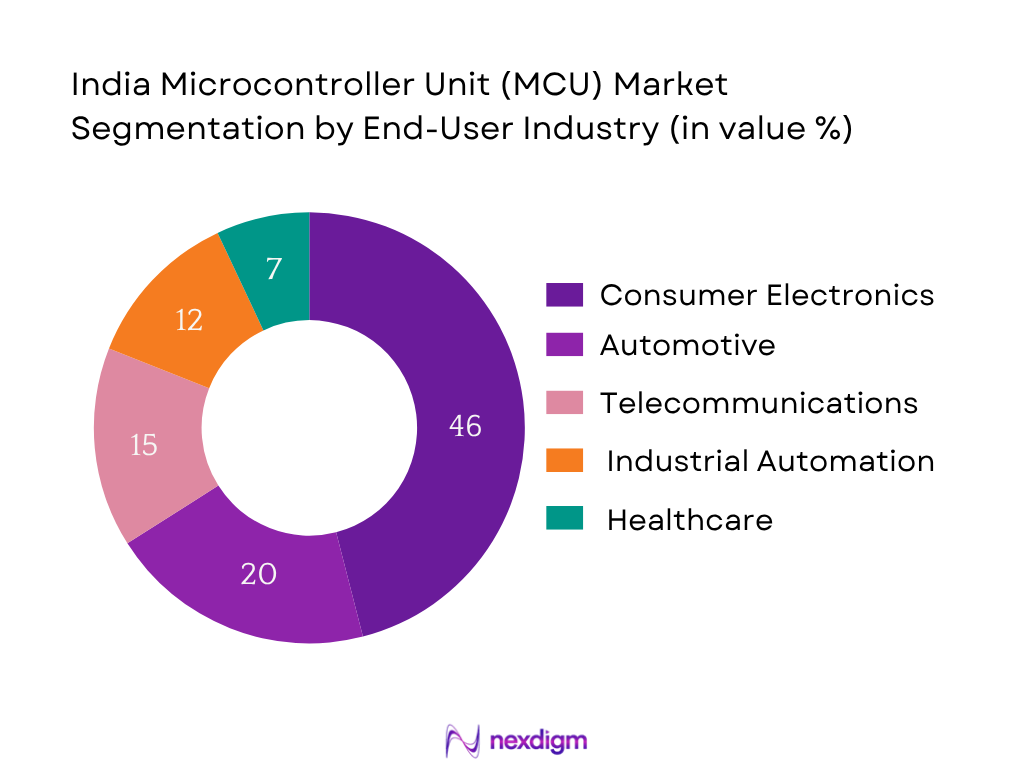

By Application

India’s MCU landscape is segmented into consumer electronics, automotive electronics, industrial automation, medical devices and smart/energy‑IoT. Automotive electronics leads with about 35 % share of market value, driven by rapid expansion of electric vehicles, increasing integration of advanced driver assistance systems (ADAS), battery management modules, and rising localization by OEMs. Additionally, consumer electronics follows close behind, propelled by strong demand for smart appliances, set‑top boxes, wearables and home automation—each embedding MCUs to deliver connectivity, energy efficiency and user interfaces.

Competitive Landscape

India’s MCU market is consolidated around a mix of global semiconductors with local presence and domestic design houses. Major global players such as Microchip, STMicroelectronics, NXP, Renesas and Texas Instruments dominate due to extensive portfolios, strong customer relationships across automotive and industrial sectors, and local R&D or distribution operations.

| Company | Est. Year | Headquarters | MCU Portfolio Breadth | Distribution Partners in India | Automotive OEM Tie‑ups | Local R&D/Design Teams | India Sales Revenue Focus |

| Microchip Technology | 1989 | US | – | – | – | – | – |

| STMicroelectronics | 1957 | Switzerland/US | – | – | – | – | – |

| NXP Semiconductors | 1953 | Netherlands | – | – | – | – | – |

| Renesas Electronics | 2003 | Japan | – | – | – | – | – |

| Texas Instruments | 1930 | US | – | – | – | – | – |

India MCU Market Analysis

Growth Drivers

Industry 4.0 Penetration

India’s manufacturing value added reached approximately USD 490,404 million in 2024, with manufacturing composing 12.53 % of GDP. The government estimates that manufacturing GVA grew 9.9 % in FY 2023‑24, recovering from a –2.2 % contraction in the prior year. This uptick reflects strong industrial digitalisation—smart factories leveraging robotics, PLCs, sensors and MCUs for automation. The rising automation footprint in automotive plants, electronics assembly lines and smart meter production is driving significant demand for microcontroller units across fabs and OEM lines.

EV Expansion

Electric vehicle registrations in India approached 100,000 units in 2024, up from approximately ~50,000 in 2023. Furthermore, all EV sales across vehicle types in FY 2023 reached 2,337,761 units, with two-wheelers accounting for 60%. EV penetration accelerated with sales poised to rise 66% in 2024 over 2023 volumes as state subsidies and charging infrastructure expand. Each EV system—battery management, ADAS, infotainment—integrates multiple MCUs, creating significant embedded demand aligned with EV growth.

Market Challenges

Semiconductor Shortages

Persistent global chip supply constraints since 2021 continue affecting MCU availability. India’s manufacturing GVA was hit in FY 2022‑23 with a –2.2% decline, tied partly to supply-dependent industries such as automotive and smart device production. With semiconductor imports dominating advanced node procurement, MCU rollout in embedded designs faces delays—slowing manufacturing recovery and dampening demand for MCU-heavy integrations in smart equipment.

Dependency on Imports

India remains highly import-dependent for MCUs, especially higher-end ARM‑based 32‑bit and RISC‑V designs. In FY 2023‑24, manufacturing accounted for 12.53% of GDP while domestic semiconductor fabrication contributes minimal share. This reliance exposes MCU supply chains to global geopolitical risks, foreign exchange volatility and lead time uncertainties—restricting timely deployment in automotive control units and industrial automation.

Opportunities

IoT Startups

India’s IoT devices market generated USD 2,885.5 million in 2024 and Android-based digital IDs reached 1.3 billion biometric IDs issued. Rising IoT startup activity across logistics, agriculture, healthcare and energy is fueling demand for low-cost yet capable MCUs. Edge device rollouts—smart metering, remote monitoring—are driving adoption by startups embedding microcontrollers in sensor nodes. This ecosystem creates clear demand for scalable MCU variants featuring wireless connectivity, edge processing and minimal power consumption.

Localized Production

States like Uttar Pradesh committed over 2,000 acres for EV and component manufacturing and installed 207 charging stations under FAME II in nine cities. The revival in manufacturing GVA at 9.9 % growth in FY 2023‑24 indicates rising infrastructure momentum. As manufacturing clusters host electronics assembly and packaging units, integrated MCU production or module assembly becomes viable—reducing import dependency and shortening supply chains for embedded device makers.

Future Outlook

Over the next six years, the India MCU market is expected to sustain strong momentum, propelled by semiconductor manufacturing incentives, expansion of EV and smart automotive ecosystems, rapid deployment of smart meters and grids, and rising demand from local IoT and consumer electronics design houses. Continued localization of MCU production and increasing RISC‑V and edge AI adoption will create strategic opportunities and spur innovation among local and international players.

Major Players

- Microchip Technology

- STMicroelectronics

- NXP Semiconductors

- Renesas Electronics

- Texas Instruments

- Infineon Technologies

- Silicon Labs

- Analog Devices

- GigaDevice Semiconductor

- Cypress Semiconductor (Infineon)

- Nordic Semiconductor

- Toshiba Electronics

- Arm Holdings

- On Semiconductor

- Realtek Semiconductor

Key Target Audience

- Chief Technology Officers at automotive OEM R&D centres

- Electronics system design leads at industrial automation firms

- Product development heads at consumer electronics manufacturers

- Edge device architects at IoT startups

- Procurement heads at EMS companies sourcing MCUs

- Investments and Venture Capitalist Firms (semiconductor & embedded startups)

- Government and Regulatory Bodies (Ministry of Electronics & IT, Department of Telecommunications)

- Strategic sourcing managers at EV component suppliers

Research Methodology

Step 1: Identification of Key Variables

We first map all major stakeholders in India’s MCU space—OEMs, design houses, distributors, government agencies—and leverage secondary databases, trade statistics, and industry publications to define variables such as demand drivers, price trends and adoption across verticals.

Step 2: Market Analysis and Construction

Historical shipment and revenue figures are compiled from global benchmarks and India-specific customs/import data. We assess penetration in automotive, industrial and consumer segments and calculate India-specific revenue estimates via bottom‑up modelling.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions, such as growth rates and local demand curves, are validated through structured interviews (CATI/CATI‑like) with executives from OEMs, semiconductor distributors and embedded design centres operating in India.

Step 4: Research Synthesis and Final Output

We engage directly with major MCU vendors and local EMS/OEM groups to vet data points on product mix, regional presence, customer segments and price levels. Combined with triangulation, this ensures robust, vetted market sizing and trend mapping.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Methodology, Data Triangulation Approach, Forecasting Model, Primary and Secondary Research Details, Limitations and Assumptions)

- Definition and Scope

- Industry Evolution & Milestones

- MCU Integration Across Key End-Use Sectors

- Value Chain & Supply Chain Analysis

- Component-Level Market Contribution

- Import-Export and Custom Duty Impact

- Growth Drivers

Industry 4.0 Penetration

EV Expansion

IoT Adoption

Make in India

Government PLI Schemes - Market Challenges

Semiconductor Shortages

Dependency on Imports

High R&D Cost

Talent Gap - Opportunities

IoT Startups

Localized Production

Automotive Electrification

Edge AI MCU Demand - Key Trends

RISC-V Adoption

Integration of AI/ML

Increasing Edge Computing Demand

Automotive SoCs - Regulatory Framework

PLI Scheme for Semiconductors

Customs Duty Trends

RoHS Compliance

E-Waste Rules - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value (INR Billion), 2019-2024

- By Volume (Million Units), 2019-2024

- By Average Selling Price (INR per Unit), 2019-2024

- By Bit Size (In Value %)

8-bit

16-bit

32-bit

64-bit

Mixed Signal MCUs - By Core Architecture (In Value %)

ARM-based

AVR-based

MIPS-based

Others (RISC-V, etc.) - By Application (In Value %)

Consumer Electronics

Automotive (ADAS, ECU, Powertrain, Infotainment)

Industrial Automation

Medical Devices

Smart Grid and Energy Systems

Aerospace & Defense - By End-User Industry (In Value %)

OEMs (Original Equipment Manufacturers)

EMS Providers (Electronics Manufacturing Services)

Tier 1 & Tier 2 Automotive Suppliers

Government & PSUs

Startups and Fabless Design Houses - By Region (In Value %)

North India

South India

West India

East India

- Market Share of Leading Players (By Value, By Volume)

- Cross Comparison Parameters (Company Overview, MCU Portfolio Breadth, Manufacturing Location (Domestic vs Import), Sales & Distribution Network in India, Industry Penetration (Automotive, IoT, Medical), Revenue by Bit Size, Client Base in India, Integration with Foundries / OEMs, R&D Capability and Ips)

- SWOT Analysis of Top Players

- Pricing Comparison (MCU by Bit Size, Application, and Vendor)

- Detailed Company Profiles

Microchip Technology

STMicroelectronics

NXP Semiconductors

Texas Instruments

Renesas Electronics

Infineon Technologies

Cypress Semiconductor (Infineon)

Analog Devices

Silicon Labs

Toshiba Electronics

Nordic Semiconductor

Arm Holdings

ON Semiconductor

Realtek Semiconductor

GigaDevice Semiconductor

- Adoption Rate by Industry

- Use Case Deep-Dive (e.g., EV Control, Smart Appliances, Robotics)

- Procurement Channels and Supply Networks

- Price Sensitivity and Design Flexibility Needs

- Decision-Making and Sourcing Patterns

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Selling Price, 2025-2030