Market Overview

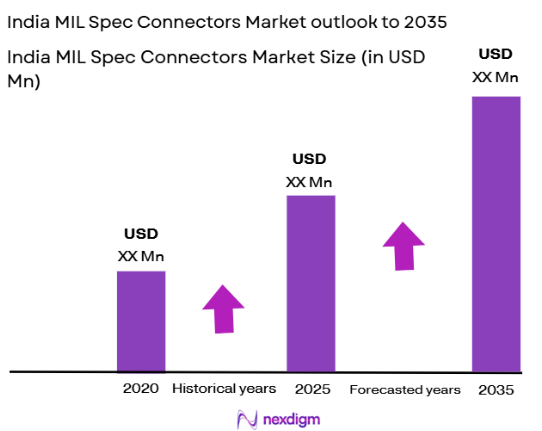

The India MIL Spec Connectors market is valued at USD ~million in 2024. This growth is primarily driven by the increasing demand for rugged and reliable connectors used in military, aerospace, and defense sectors. The market’s size has been significantly influenced by government defense budgets and modernization initiatives, leading to a rise in the adoption of military-grade electronic components. Technological advancements in aerospace and defense communication systems also contribute to market growth, further strengthening the demand for MIL spec connectors.India’s key cities such as New Delhi, Mumbai, and Bangalore dominate the MIL spec connectors market due to their strong presence in defense manufacturing and aerospace industries. The country’s growing defense and aerospace sectors have attracted substantial investments, and these cities serve as major hubs for military procurement. Additionally, Bangalore’s status as an IT and aerospace technology center further amplifies the demand for high-performance connectors. Moreover, government initiatives and defense modernization strategies are increasingly concentrated in these regions, strengthening their dominance.

Market Segmentation

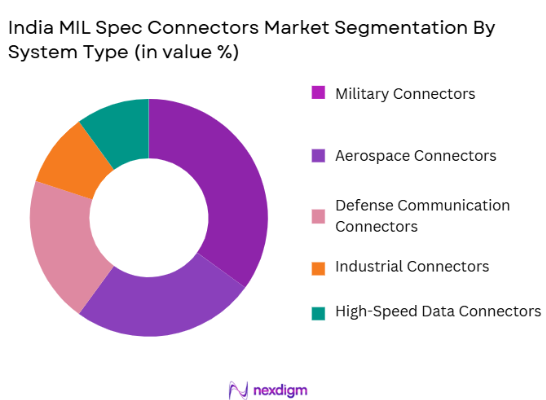

By System Type

The India MIL Spec Connectors market is segmented by system type into military connectors, aerospace connectors, defense communication connectors, industrial connectors, and high-speed data connectors. Among these, military connectors are the dominant segment in the Indian market. This dominance can be attributed to the Indian government’s significant focus on defense modernization and the increased demand for military-grade connectors capable of withstanding harsh environments. The military connectors segment holds the largest share, as these components are critical for ensuring reliability and performance in defense applications, including weapon systems, radars, and communication equipment.

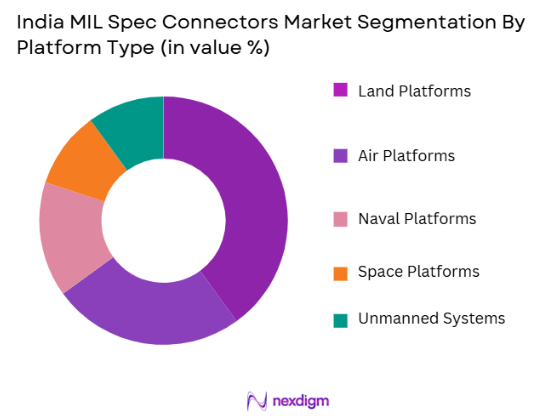

By Platform Type

The India MIL Spec Connectors market is also segmented by platform type, which includes land platforms, air platforms, naval platforms, space platforms, and unmanned systems. Among these, land platforms dominate the market, driven by the increasing use of military vehicles and ground-based defense systems that require robust connectors for their complex electronics. The land platform segment is growing rapidly due to modernization programs and the procurement of military vehicles and communication systems, where connectors play a crucial role in maintaining system integrity and performance under extreme conditions.

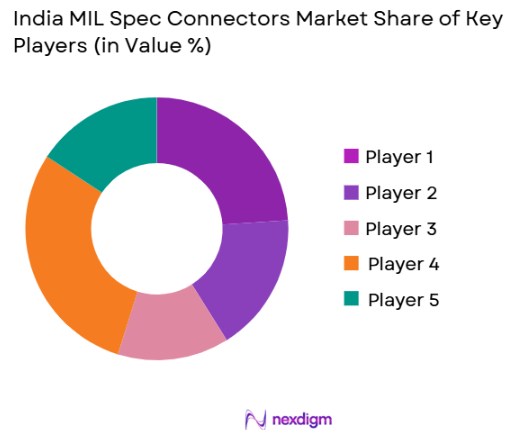

Competitive Landscape

The India MIL Spec Connectors market is characterized by a few dominant players who significantly influence the market landscape. These players include global companies like TE Connectivity and Amphenol, which hold strong positions in the market due to their technological expertise, strong distribution networks, and longstanding relationships with defense contractors. Other companies such as Smiths Interconnect and ITT Inc. also contribute to the competition by providing innovative solutions for the aerospace and defense industries. The market is becoming increasingly competitive, with players continuously focusing on technological advancements and product diversification.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Technological Innovation | R&D Investments | Distribution Network | Customer Base |

| TE Connectivity | 2007 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Amphenol Corporation | 1932 | USA | ~ | ~ | ~ | ~ | ~ |

| Smiths Interconnect | 1851 | UK | ~ | ~ | ~ | ~ | ~ |

| ITT Inc. | 1920 | USA | ~ | ~ | ~ | ~ | ~ |

| Radiall | 1952 | France | ~ | ~ | ~ | ~ | ~ |

India MIL Spec Connectors Market Analysis

Growth Drivers

Urbanization

Urbanization is a significant driver for the growth of the India MIL Spec Connectors market. As more people migrate to urban areas, the demand for advanced infrastructure and technologies increases. With India’s urban population projected to reach ~million by 2031 (UN), urban areas are witnessing rapid development in defense, aerospace, and telecommunications sectors, all of which are major consumers of MIL spec connectors. This surge in urbanization directly fuels the demand for reliable and high-performance connectors that are essential for military vehicles, communication systems, and infrastructure.

Industrialization

India’s industrialization, particularly in the defense, aerospace, and telecommunications sectors, is another key driver. The Indian government’s focus on “Make in India” and self-reliance initiatives is promoting the growth of local manufacturing capabilities, leading to an increase in demand for MIL spec connectors. According to the Ministry of Defense, India’s defense production increased by ~% year-on-year, with defense electronics manufacturing becoming a key sector. This growth is directly contributing to the demand for advanced connectors, which are crucial components in various military and aerospace systems.

Restraints

High Initial Costs

One of the major restraints hindering the growth of the MIL spec connectors market in India is the high initial costs associated with manufacturing and procurement. The military-grade connectors require strict quality controls, certification processes, and extensive testing, which increases their overall cost. With India being a price-sensitive market, these high costs can deter potential customers, especially for small- and medium-sized enterprises involved in the defense and aerospace sectors. This poses a significant challenge to the widespread adoption of MIL spec connectors in cost-conscious markets.

Technical Challenges

The highly specialized nature of MIL spec connectors presents several technical challenges. As technologies evolve, connectors must meet increasingly stringent specifications for performance in harsh environments, which often leads to complex designs and manufacturing processes. In India, technical expertise required to develop these advanced connectors remains limited. This gap in technical skill, particularly in design, testing, and certification, presents challenges in meeting the growing demands of the defense and aerospace sectors. Additionally, continuous innovation in connector technology requires sustained R&D investment, which many players find difficult to secure.

Opportunities

Technological Advancements

Technological advancements in materials science, miniaturization, and high-speed data transfer are opening up new opportunities for the MIL spec connectors market. The increasing demand for more compact, reliable, and high-performance connectors, especially in military and aerospace systems, is driving innovation in connector designs. For instance, advancements in fiber optic and wireless connectors are creating new opportunities for manufacturers to expand their product offerings. As India continues to invest in defense modernization and aerospace expansion, these technological advancements will drive the demand for cutting-edge MIL spec connectors.

International Collaborations

India’s strategic defense partnerships and international collaborations with countries such as the United States, Russia, and France provide significant opportunities for the MIL spec connectors market. As India increases its defense collaborations with foreign countries, there is a growing need to integrate advanced technologies, including MIL spec connectors, into its systems. These collaborations open up new avenues for Indian manufacturers to supply components to global defense projects, thereby increasing market access and revenue potential.

Future Outlook

Over the next decade, the India MIL Spec Connectors market is expected to show strong growth driven by ongoing defense modernization programs, technological advancements in connector designs, and increasing demand from the aerospace and telecommunications industries. The Indian government’s focus on self-reliance in defense production and the growth of indigenous defense systems will further augment the demand for MIL spec connectors. Furthermore, the increasing adoption of unmanned systems and advanced communication platforms in defense will contribute significantly to market growth, making this an attractive segment for investment.

Major Players

- TE Connectivity

- Amphenol Corporation

- Smiths Interconnect

- ITT Inc.

- Radiall

- Molex

- Souriau-Sunbank

- JAE Electronics

- Phoenix Contact

- LEMO

- Harris Corporation

- Fischer Connectors

- Rosenberger

- DDK Ltd.

- Samtec

Key Target Audience

- Defense and Aerospace Manufacturers

- Military Procurement Agencies

- Aerospace Research and Development Units

- Investment and Venture Capitalist Firms

- Defense Contractors and System Integrators

- Government and Regulatory Bodies

- OEMs for Military Systems

- Electronic Component Distributors

Research Methodology

Step 1: Identification of Key Variables

The first step involves constructing an ecosystem map for the India MIL Spec Connectors market by identifying key stakeholders including manufacturers, suppliers, government agencies, and end-users. Secondary research through industry reports and proprietary databases will be utilized to define critical variables that influence market growth, such as technological advancements, regulations, and customer demands.

Step 2: Market Analysis and Construction

Data pertaining to the MIL Spec Connectors market in India will be compiled and analyzed. This includes assessing the historical performance of connectors in different sectors (e.g., defense, aerospace, industrial), and the corresponding revenue generation. Service quality assessments will also be made to determine how these connectors meet industry standards, ensuring reliable and accurate market size estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding trends and growth drivers will be validated through consultations with industry experts and practitioners via Computer-Assisted Telephone Interviews (CATI). These experts will be sourced from key defense contractors, connector manufacturers, and aerospace companies, providing firsthand insights into market dynamics, technological innovations, and growth potential.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data collected through both secondary research and expert consultations. Insights from manufacturers and key stakeholders will be integrated into the final report, ensuring that market forecasts, segmentation, and competitive landscape details are well-validated. This will result in a comprehensive and accurate analysis of the India MIL Spec Connectors market.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets and modernization initiatives

Rising demand for high-performance and rugged connectors

Growth in aerospace and space industry applications - Market Challenges

High production costs

Complexity in certification and compliance requirements

Supply chain disruptions - Trends

Miniaturization of connectors

Emerging demand for wireless MIL spec connectors

Focus on sustainability and eco-friendly materials

- Market Opportunities

Expansion of military and defense collaborations

Advancement in connector technology

Increasing demand for unmanned vehicles and robotic systems - Government regulations

Compliance with MIL-STD-810 for environmental testing

Government mandates on defense procurement

Aerospace safety and quality certifications - SWOT analysis

Strong growth in defense spending but faced with high competition

Technological advancements driving demand for new connector types

Supply chain challenges impacting timely delivery - Porters 5 forces

High bargaining power of suppliers due to specialized components

Moderate threat of substitutes with few alternatives in critical applications

High industry rivalry driven by several established key players

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Military Connectors

Aerospace Connectors

Defense Communication Connectors

Industrial Connectors

High-Speed Data Connectors - By Platform Type (In Value%)

Land Platforms

Air Platforms

Naval Platforms

Space Platforms

Unmanned Systems - By Fitment Type (In Value%)

Embedded Fitments

Surface-Mounted Fitments

Through-Hole Fitments

Rack-Mount Fitments

Panel-Mount Fitments - By EndUser Segment (In Value%)

Defense Industry

Aerospace Industry

Telecommunications

Automotive

Industrial Equipment - By Procurement Channel (In Value%)

Direct Sales

Distributors & Resellers

Online Channels

Government Procurement

OEMs (Original Equipment Manufacturers)

- Market Share Analysis

- CrossComparison Parameters(Price Point, Technology Innovation, Supplier Relationship, Product Customization, Market Reach)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Amphenol Corporation

TE Connectivity

Mouser Electronics

Souriau – Sunbank

Smiths Interconnect

ITT Inc.

Samtec

JAE Electronics

Eagle Industry Co., Ltd.

Phoenix Contact

Harris Corporation

LEMO

Radiall

Rosenberger

Dart Aerospace

Fischer Connectors

- Increasing defense modernization driving demand for advanced connectors

- Aerospace companies looking for connectors that meet high reliability standards

- Telecommunications industry expanding, driving demand for robust connections

- Automotive manufacturers seeking miniaturized and rugged connectors

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035