Market Overview

The India Military Aerospace Simulation and Training Market is a rapidly growing sector, valued at approximately USD ~ in 2025. The market growth is driven by the Indian government’s robust defense modernization plans, the increasing demand for advanced pilot training, and the focus on reducing operational costs while enhancing mission preparedness. The ongoing developments in simulation technologies, such as virtual and augmented reality-based training systems, are pushing the market further. Government initiatives like “Make in India” have also catalyzed local production and indigenization of aerospace training systems, contributing significantly to the market size.

India dominates the military aerospace simulation and training market due to its large-scale defense modernization program. Key cities like New Delhi, Bengaluru, and Hyderabad are the central hubs for the market due to their proximity to major defense organizations, such as the Indian Air Force (IAF), Hindustan Aeronautics Limited (HAL), and various private sector players. These cities house defense establishments that engage in procurement, production, and R&D of training technologies. Furthermore, the Indian government’s continued investment in indigenous aerospace capabilities and its strategic defense partnerships with global aerospace leaders foster a conducive environment for growth.

Market Segmentation

By Simulation Type

India’s military aerospace simulation and training market is segmented into several simulation types, including Full‑Flight Simulators (FFS), Flight Training Devices (FTD), Virtual and Augmented Reality (VR/AR), Desktop Simulators, and Mission Rehearsal Systems. Among these, Full-Flight Simulators (FFS) have the largest market share in 2024. FFS systems dominate due to their unparalleled ability to replicate realistic flight conditions, offering high-fidelity training essential for both fighter and transport aircraft pilots. The integration of motion platforms and realistic cockpit replicas makes FFS the preferred choice for pilot training, which is backed by a significant demand from the Indian Air Force (IAF) and commercial flight training institutions. Additionally, full-flight simulators are crucial in addressing the shortage of trained pilots by allowing a larger number of trainees to undergo repetitive, high-quality training in a controlled and cost-effective manner.

By Application

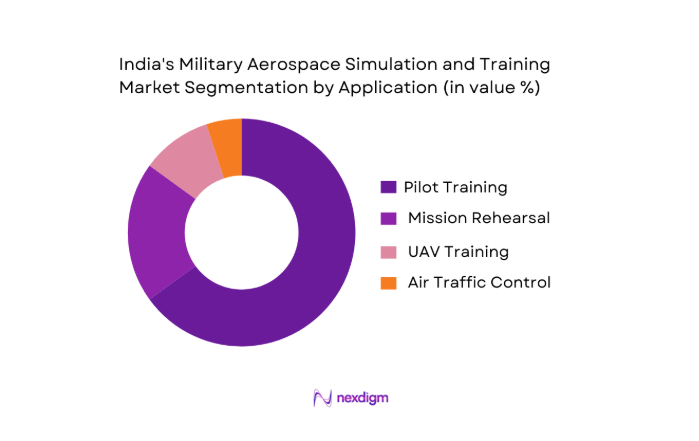

The military aerospace simulation market in India is also segmented by its applications, including pilot training, mission rehearsal, air traffic control, and UAV training. Among these, pilot training holds the dominant share due to the expanding fleet of fighter jets, transport aircraft, and helicopters in India’s defense forces. The need for comprehensive and realistic pilot training has led to significant investments in simulators and training devices to ensure pilots are fully prepared for real-world operations. The IAF’s focus on enhancing its fleet and training capabilities, particularly with the induction of advanced aircraft such as the Rafale, has significantly increased the demand for realistic pilot training solutions, making this sub-segment the largest contributor to the market.

Competitive Landscape

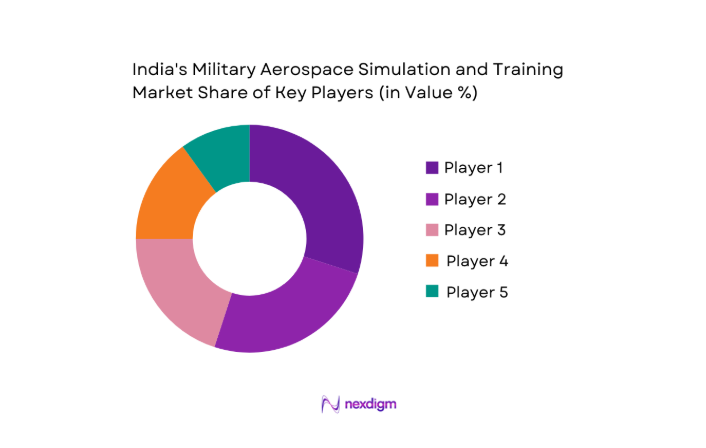

The India military aerospace simulation and training market is dominated by a few key players, including both global giants and local manufacturers. Major players such as CAE Inc., L3Harris Technologies, and Thales Group have established themselves as leaders due to their advanced simulation solutions and deep ties with the Indian defense sector. Local manufacturers like Zen Technologies and HAL also play a critical role, with their focus on indigenization and fulfilling the Indian government’s “Make in India” mandate. These key players contribute significantly to shaping the market’s competitive landscape by providing cutting-edge technologies tailored to the Indian military’s unique needs.

| Company Name | Establishment Year | Headquarters | Product Offerings | Market Focus | Strategic Partnerships | Technological Edge |

| CAE Inc. | 1947 | Canada | ~ | ~ | ~ | ~ |

| L3Harris Technologies | 2019 | USA | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| Zen Technologies | 1993 | India | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Ltd. (HAL) | 1940 | India | ~ | ~ | ~ | ~ |

India Military Aerospace Simulation and Training Market Analysis

Growth Drivers

Defense Modernization

India’s defense modernization program has been a critical driver of the aerospace simulation and training market. The Indian government allocated approximately INR ~ to defense spending for 2024-2025, marking a significant increase from previous years. The government’s strategic intent is to modernize and enhance the capabilities of the Indian Armed Forces through the acquisition of advanced platforms like fighter jets, UAVs, and helicopters. As part of this modernization, investment in high-fidelity simulators for pilot and crew training is essential for cost-effective training and mission readiness. The overall defense budget is expected to see steady increases, which will directly contribute to the demand for simulation and training systems.

Pilot Throughput Requirements

India faces a significant pilot shortage, with the Indian Air Force (IAF) and Navy seeking to meet increasing requirements due to fleet expansions and operational needs. The IAF has been authorized to procure 83 additional Tejas aircraft and modernize its fleet of fighter jets. This expansion necessitates a significant increase in the number of trained pilots. To meet these needs, India is investing in aerospace simulators that allow more trainees to be trained in a shorter time frame. The IAF plans to increase its pilot training throughput by ~ by 2025. This operational need will drive the adoption of simulation-based training solutions.

Market Challenges

Cost of High-Fidelity Simulators

One of the major challenges facing the India military aerospace simulation and training market is the high cost of advanced simulators, particularly Full-Flight Simulators (FFS) and Flight Training Devices (FTDs). These simulators often cost between INR ~ to INR ~ per unit. Despite the demand for high-fidelity training solutions, the high initial investment required for procurement and maintenance remains a significant barrier, particularly for local and smaller defense establishments. Although the Indian government is investing in defense modernization, the cost of these technologies remains a limiting factor, especially in the context of competing demands for defense budgets.

Interoperability

The integration of different simulation and training technologies from various vendors presents an ongoing challenge for India’s defense forces. Many of the country’s military systems, both legacy and new, are not fully compatible with newer simulation systems. As the IAF and other defense branches modernize their fleets and equipment, ensuring that their simulation systems are interoperable with their operational systems becomes a critical task. According to the Indian Ministry of Defence, one of the hurdles in adopting new simulation technologies is achieving smooth interoperability between new platforms like the Rafale fighter jets and existing systems, which impacts overall operational efficiency.

Market Opportunities

AI-Powered Training

Artificial Intelligence is a transformative technology that is already beginning to play a pivotal role in military training in India. AI is being used to enhance the realism of training environments by enabling real-time decision-making scenarios for pilots and operators. AI-based adaptive learning systems are being integrated into simulation systems, allowing for personalized training experiences. The Indian government’s commitment to AI integration into defense training systems, particularly within the Ministry of Defence’s AI Task Force, has led to greater adoption of AI-powered training solutions. This opportunity is expected to expand as AI continues to enhance training outcomes and operational readiness.

Digital Twin Integration

The concept of digital twins—virtual replicas of physical systems—has garnered significant interest in the military aerospace sector. By integrating digital twin technology into training programs, India’s defense forces can create highly realistic training environments that mirror real-world aircraft, UAVs, and mission systems. The Indian Air Force (IAF) is experimenting with digital twins for flight simulators, allowing for precise aircraft system modeling and performance testing. As digital twins become more integrated with real-time operational data, the military training market is expected to benefit from more immersive and data-driven training systems, ultimately improving operational efficiency.

Future Outlook

Over the next decade, the India Military Aerospace Simulation and Training Market is poised for significant expansion. This growth will be fueled by the Indian government’s strategic focus on modernizing its defense infrastructure, the increasing demand for highly skilled pilots, and the integration of next-generation training technologies. The adoption of AI, VR, and AR in training solutions is expected to revolutionize how the defense sector trains personnel, offering more immersive and cost-effective methods. Furthermore, India’s defense export market will also drive demand for simulation solutions to be used in training personnel for foreign defense forces, positioning India as a global leader in military simulation training.

Major Players

- CAE Inc.

- L3Harris Technologies

- Thales Group

- Zen Technologies

- Hindustan Aeronautics Ltd.

- FlightSafety International

- Collins Aerospace

- Elbit Systems Ltd.

- Rheinmetall AG

- Bharat Electronics Ltd.

- Honeywell Aerospace

- Adani Defence

- Leonardo S.p.A.

- Boeing Defense

- Rockwell Collins

Key Target Audience

- Government and Regulatory Bodies

- Military and Aerospace Contractors

- Indian Armed Forces

- Aerospace OEMs

- Private Defense Sector Investors

- Venture Capital Firms specializing in Defense Technologies

- Defense Equipment Suppliers and Distributors

- Indian Defense Research and Development Organizations

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we identify the critical variables driving the market, including defense modernization policies, technological advancements, and defense spending. This is achieved through secondary research and interviews with key stakeholders in India’s military aerospace sector.

Step 2: Market Analysis and Construction

This phase includes collecting data on the market’s size, key players, product trends, and demand-supply dynamics. We analyze defense budgets, procurement cycles, and local industry developments to validate our estimates.

Step 3: Hypothesis Validation and Expert Consultation

We validate our market hypotheses through consultations with subject matter experts (SMEs) in the aerospace and defense sectors. These consultations allow us to gain insights from industry professionals, OEMs, and military personnel about the operational realities and upcoming training needs.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all gathered data, including company-specific performance, product trends, and strategic initiatives. We collaborate with defense agencies to validate our findings, ensuring that our forecast is accurate and actionable.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Market Growth Context

- Strategic Timeline

- Growth Drivers

Defense Modernization

Pilot Throughput Requirements

Policy on Indigenization - Market Challenges

Cost of High‑Fidelity Simulators

Interoperability

Standardization - Opportunities

AI‑Powered Training

Digital Twin Integration

Export Potential - Market Trends

AI/ML

VR/AR Adoption

Real‑Time Debrief - Government Policies & Regulation

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Base, 2020-2025

- By Average Contract Price, 2020-2025

- By Simulation Type (In Value %)

Full‑Flight Simulators

Flight Training Devices

Virtual / Immersive Training

AI‑Enabled Adaptive Learning Systems - By Technology (In Value %)

Hardware

Software

Services - By Application (In Value %)

Pilot Training

UAV & Remote Pilot Simulation

Air Traffic & Air Defense Training - By End‑User (In Value %)

Indian Air Force

Navy Aviation

Army Aviation - By Procurement Mode (In Value %)

Government Sponsored

OEM‑Supplied

PPP Models

- Market Share Analysis

- Cross‑Comparison Parameters (Simulation Fidelity , AI / Adaptive Scenario Capability, Training Ecosystem Integration, Local Content % / Make‑in‑India Compliance, Life‑Cycle Support & Upgradability, Interoperability with Defense Networks)

- SWOT of Key Players

- Pricing Analysis

- Detailed Profiles of Major Players

CAE Inc.

L3Harris Technologies, Inc.

RTX Corporation

Thales Group

FlightSafety International Inc.

Zen Technologies Limited

Tecknotrove

Rheinmetall AG

Elbit Systems Ltd.

BAE Systems

Honeywell Aerospace

Collins Aerospace

HAL

Adani Defence Systems & Technologies

Bharat Electronics Limited

- Training Requirements & Qualification Benchmarks

- Total Cost of Ownership Impact on Decision Making

- Technology Adoption Readiness

- Support & Logistics Influence on Procurement Choices

- By Market Value, 2026-2035

- By Installed Base, 2026-2035

- By Average Contract Price, 2026-2035