Market Overview

The India Military Satellite Market market current size stands at around USD ~ million, supported by recent program allocations of USD ~ million and active operational deployments exceeding ~ systems across multiple defense missions. Annual procurement commitments have crossed ~ units in combined payload and platform contracts, while lifecycle support spending has reached nearly USD ~ million. These indicators reflect a steadily expanding defense space ecosystem, driven by secure communications, intelligence operations, and navigation resilience requirements across strategic and tactical environments.

The market shows strong geographic concentration around key aerospace and defense clusters in southern and western India, supported by proximity to launch infrastructure, satellite integration facilities, and defense R&D hubs. These regions benefit from dense supplier ecosystems, mature testing and validation capabilities, and sustained government focus on indigenous defense production. Demand concentration is further reinforced by command headquarters and operational units located in major metropolitan defense corridors, creating a tightly integrated procurement, deployment, and support environment.

Market Segmentation

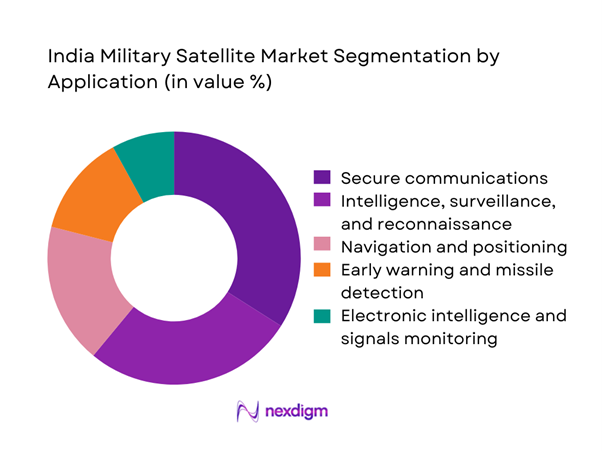

By Application

Secure military communications dominates the India Military Satellite Market due to its critical role in ensuring encrypted, jam-resistant connectivity across land, air, and naval forces. The growing emphasis on network-centric warfare has increased reliance on satellite-based command and control systems, especially for operations in remote and contested regions. Intelligence, surveillance, and reconnaissance applications follow closely, driven by persistent border monitoring and maritime domain awareness needs. Navigation and early warning functions are also gaining traction as strategic planners prioritize redundancy and resilience in positioning and threat detection systems. Collectively, these applications define the operational backbone of India’s evolving defense space architecture.

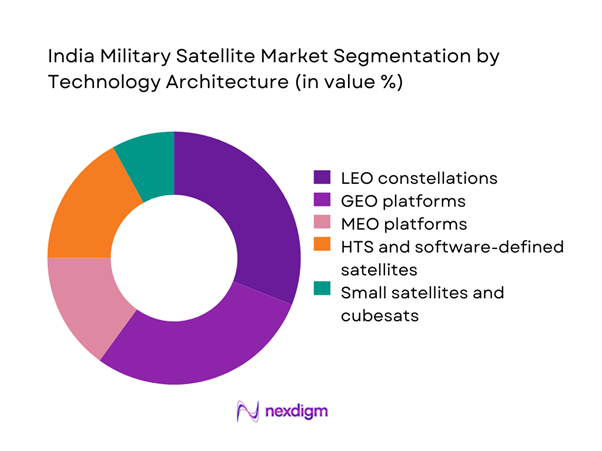

By Technology Architecture

LEO-based constellations are emerging as the most influential architecture segment due to their lower latency, faster deployment cycles, and suitability for distributed military operations. These platforms support tactical communications and near-real-time ISR missions, making them increasingly attractive for responsive defense strategies. GEO platforms continue to retain importance for strategic communications and wide-area coverage, particularly for naval and overseas operations. Meanwhile, software-defined satellites and high-throughput systems are gaining adoption for their flexibility in reconfiguring payloads based on mission needs. The combined evolution of these architectures is reshaping India’s military satellite procurement priorities toward agility and resilience.

Competitive Landscape

The India Military Satellite Market is moderately concentrated, with a small group of state-led organizations and specialized private defense manufacturers dominating satellite development, integration, and mission support. Entry barriers remain high due to security clearances, long procurement cycles, and the need for proven spaceflight heritage, resulting in limited but stable competitive intensity.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Indian Space Research Organisation | 1969 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited | 1954 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems Limited | 2007 | Hyderabad | ~ | ~ | ~ | ~ | ~ | ~ |

| Larsen and Toubro Defence | 2012 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Ananth Technologies | 1992 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

India Military Satellite Market Analysis

Growth Drivers

Rising national security and border surveillance requirements

The India Military Satellite Market has seen accelerated deployment of space-based assets as border monitoring systems expand to cover remote and high-risk zones. Recent operational planning has included the activation of ~ systems dedicated to persistent ISR and secure communications, supported by budgetary allocations of USD ~ million across multiple defense programs. Fleet modernization initiatives have added ~ units of satellite-enabled terminals for frontline formations, improving real-time situational awareness. These investments have strengthened the role of satellites in strategic deterrence, maritime surveillance, and counter-infiltration missions, making space infrastructure a central pillar of national security planning.

Expansion of network-centric warfare doctrine

The transition toward network-centric warfare has driven the integration of satellite communications into command, control, and intelligence frameworks. Defense forces have operationalized ~ systems linking airborne, naval, and ground units through encrypted satellite channels, supported by infrastructure spending of USD ~ million. The deployment of ~ units of portable SATCOM terminals has enabled rapid coordination during joint exercises and border operations. This doctrinal shift has increased reliance on resilient space networks, positioning military satellites as essential enablers of integrated battlefield management and real-time decision support.

Challenges

High capital intensity of military satellite programs

Military satellite development requires sustained financial commitment, with recent platform and payload programs involving investments of USD ~ million per mission cycle. The integration of hardened components and secure communication technologies has driven per-system expenditure beyond USD ~ million, limiting the number of platforms that can be fielded simultaneously. Program planners have had to balance the deployment of ~ systems against competing defense priorities, creating pressure on long-term budget sustainability. This capital-intensive nature constrains rapid fleet expansion and places greater emphasis on lifecycle optimization and reuse strategies.

Long development and procurement cycles

Extended design, testing, and certification timelines continue to affect the speed at which new satellite capabilities reach operational readiness. Typical development cycles now exceed ~ months, with procurement approvals involving multiple defense and security stakeholders. During recent modernization efforts, only ~ units progressed from contract award to launch readiness within planned schedules, reflecting procedural and technical bottlenecks. These prolonged cycles reduce responsiveness to emerging threats and complicate alignment with rapidly evolving space and communication technologies.

Opportunities

Indigenization under defense manufacturing initiatives

The push for indigenous defense production has opened new avenues for domestic satellite subsystem development, with recent programs allocating USD ~ million toward local payload electronics and propulsion technologies. Indigenous suppliers have delivered ~ units of critical components for military satellites, reducing dependency on external sources and improving supply chain security. This shift supports long-term cost optimization while strengthening domestic technical expertise, positioning the India Military Satellite Market to benefit from sustained policy-driven demand for homegrown space capabilities.

Development of LEO military constellations

The emergence of LEO-based defense constellations presents a significant growth avenue, enabling rapid deployment of distributed satellite networks. Current planning frameworks include proposals for ~ systems in multi-orbit configurations, supported by phased investments of USD ~ million. These constellations promise lower latency, improved redundancy, and faster refresh cycles compared to traditional platforms. As operational doctrines increasingly favor agility and resilience, LEO military constellations are expected to redefine the structure and scalability of India’s defense space architecture.

Future Outlook

The India Military Satellite Market is set to evolve into a more agile and resilient defense space ecosystem through the coming decade. Greater emphasis on indigenous manufacturing, responsive launch capabilities, and multi-orbit constellations will reshape procurement strategies. Policy alignment with national security objectives and sustained investment in secure communication and ISR platforms will continue to strengthen space as a core operational domain for India’s armed forces.

Major Players

- Indian Space Research Organisation

- NewSpace India Limited

- Bharat Electronics Limited

- Tata Advanced Systems Limited

- Larsen and Toubro Defence

- Alpha Design Technologies

- Astra Microwave Products

- Data Patterns India

- Ananth Technologies

- Centum Electronics

- Godrej Aerospace

- MTAR Technologies

- Paras Defence and Space Technologies

- Hughes Communications India

- Thales India

Key Target Audience

- Ministry of Defence procurement divisions

- Defence Space Agency and tri-services command units

- Defence Research and Development Organisation laboratories

- Satellite manufacturers and payload integrators

- Launch service and ground infrastructure providers

- Investments and venture capital firms focused on aerospace and defense

- Government and regulatory bodies such as IN-SPACe and Department of Space

- Homeland security and intelligence agencies

Research Methodology

Step 1: Identification of Key Variables

Key demand drivers, procurement cycles, and technology adoption indicators were identified across defense communication, ISR, and navigation applications. Program-level investment patterns and deployment priorities were mapped to understand structural market dynamics. Regulatory and security compliance variables were also incorporated to reflect entry and execution constraints.

Step 2: Market Analysis and Construction

A detailed framework was developed to assess platform types, orbit architectures, and end-use defense segments. Supply-side capabilities were aligned with demand scenarios to construct a realistic representation of the current and near-term market structure.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were validated through structured consultations with defense procurement professionals, satellite engineers, and policy specialists. Feedback was used to refine assumptions on deployment timelines, capability gaps, and adoption barriers.

Step 4: Research Synthesis and Final Output

All qualitative and quantitative insights were consolidated into an integrated analytical model. The final output reflects a balanced view of strategic, operational, and industrial dimensions shaping the India Military Satellite Market.

- Executive Summary

- Research Methodology (Market definitions and scope boundaries, military satellite taxonomy across communication navigation and ISR missions, market sizing logic by constellation size and launch cadence, revenue attribution across satellite manufacturing launch and ground segment services, primary interview program with defense agencies ISRO OEMs and integrators, data triangulation validation assumptions and limitations)

- Definition and Scope

- Market evolution of India’s defense space capabilities

- Operational and mission usage pathways

- Defense space ecosystem structure

- Satellite manufacturing and launch supply chain structure

- Regulatory and national security environment

- Growth Drivers

Rising national security and border surveillance requirements

Expansion of network-centric warfare doctrine

Increased defense space budget allocation

Growing dependence on secure communication networks

Advancement in indigenous satellite manufacturing

Strategic focus on space-based ISR capabilities - Challenges

High capital intensity of military satellite programs

Long development and procurement cycles

Technology dependence on select foreign components

Regulatory and security clearance complexities

Limited launch cadence for dedicated defense missions

Cybersecurity and space asset vulnerability risks - Opportunities

Indigenization under defense manufacturing initiatives

Development of LEO military constellations

Public-private partnerships in defense space

Export potential of defense satellite subsystems

Dual-use satellite platforms for cost optimization

Integration of AI-enabled onboard processing - Trends

Shift toward smallsat and responsive launch systems

Adoption of software-defined payloads

Growing role of commercial space firms in defense

Increased focus on space situational awareness satellites

Integration of satellite data with battlefield networks

Expansion of anti-jamming and secure waveform technologies - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Fleet Type (in Value %)

Dedicated military satellites

Dual-use civil-military satellites

Hosted payload platforms

Leased commercial defense satellites - By Application (in Value %)

Secure communications

Intelligence, surveillance, and reconnaissance

Navigation and positioning

Early warning and missile detection

Electronic intelligence and signals monitoring - By Technology Architecture (in Value %)

GEO platforms

MEO platforms

LEO constellations

HTS and software-defined satellites

Small satellites and cubesats - By End-Use Industry (in Value %)

Indian Armed Forces

Defence Space Agency

Defence Research and Development Organisation

Intelligence agencies

Homeland security forces - By Connectivity Type (in Value %)

SATCOM narrowband

Broadband military SATCOM

Inter-satellite links

Ground-to-space tactical links

Hybrid satellite-terrestrial networks - By Region (in Value %)

North India defense command zones

South India space and launch corridor

West India industrial defense cluster

East India emerging aerospace hubs

- Market structure and competitive positioning

Market share snapshot of major players - Cross Comparison Parameters (satellite payload capability, launch integration expertise, secure communication technology, ISR system depth, indigenous content ratio, lifecycle support capability, compliance with defense standards, program execution track record)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Indian Space Research Organisation

NewSpace India Limited

Bharat Electronics Limited

Tata Advanced Systems Limited

Larsen and Toubro Defence

Alpha Design Technologies

Astra Microwave Products

Data Patterns India

Ananth Technologies

Centum Electronics

Godrej Aerospace

MTAR Technologies

Paras Defence and Space Technologies

Hughes Communications India

Thales India

- Demand and utilization drivers across defense services

- Procurement and tender dynamics within MoD

- Buying criteria and vendor qualification norms

- Budget allocation and long-term program funding models

- Implementation barriers and operational risk factors

- Post-purchase service, upgrade, and lifecycle expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035