Market Overview

The India military satellite market is valued at approximately USD~ billion, driven by significant investments in defense and space technology. The Indian government has been increasing its focus on strengthening its defense infrastructure, with projects like the Indian National Satellite System (INSAT) contributing to the market’s growth. Furthermore, the demand for satellite-based communication, surveillance, and reconnaissance is on the rise, supporting this market’s expansion. The market is also driven by the government’s push for self-reliance in defense technologies under the “Atmanirbhar Bharat” initiative.

The market is dominated by India due to its strong government-backed defense programs and the strategic importance of space-based defense assets. The Indian Space Research Organisation (ISRO) plays a pivotal role in driving the development of military satellites, with a focus on enhancing communication, surveillance, and navigation systems. Additionally, India’s significant defense budget allocation for satellite systems and its growing space industry contribute to its dominance in the region.

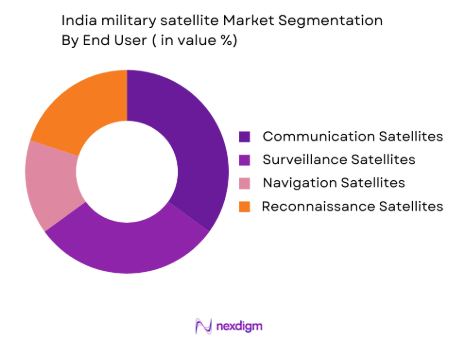

Market Segmentation

By System Type

India military satellite market is segmented by system type into communication satellites, surveillance satellites, navigation satellites, and reconnaissance satellites. Among these, communication satellites dominate the market share. This is primarily due to the crucial role they play in ensuring reliable and secure communication channels for the Indian Armed Forces. The strategic importance of satellite communication systems for military operations, such as secure transmissions and battlefield communication, has made this segment a dominant force. The Indian government’s continuous investment in communication satellites for defense purposes further cements this segment’s position in the market.

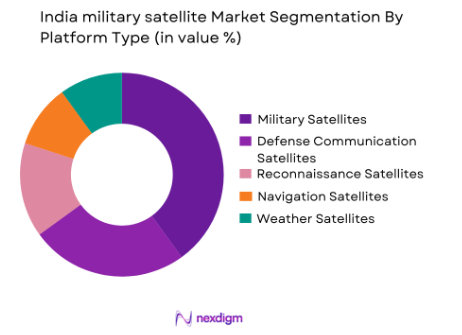

By Platform Type

The market is also segmented by platform type, which includes military satellites, defense communication satellites, reconnaissance satellites, navigation satellites, and weather satellites. Military satellites dominate the platform segment due to their critical role in securing national defense. These satellites are responsible for communication, intelligence gathering, and strategic surveillance, providing real-time data to decision-makers. The increasing number of defense satellites launched by the Indian government, such as the GSAT series, highlights the growing reliance on military satellites, which makes this platform segment dominant.

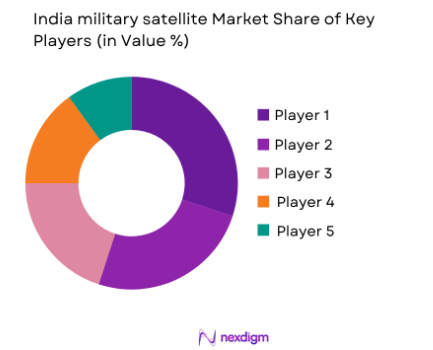

Competitive Landscape

The India military satellite market is highly competitive, with both government-backed organizations and private players contributing to the growth. The Indian Space Research Organisation (ISRO) is a dominant player, with a long-standing reputation for developing space-based defense technologies. The market is also influenced by key global companies that collaborate with ISRO, providing satellite technologies and services. These players, both domestic and international, contribute to the consolidation of the market.

| Company | Establishment Year | Headquarters | Satellite Expertise | Export Orientation | Integration Capability | R&D Intensity | Strategic Alliances |

| Indian Space Research Organisation (ISRO) | 1969 | Bengaluru, India | High | ~ | ~ | ~ | ~ |

| Antrix Corporation | 1992 | Bengaluru, India | High | ~ | ~ | ~ | ~ |

| Bharat Electronics Limited (BEL) | 1954 | Bengaluru, India | Medium | ~ | ~ | ~ | ~ |

| Lockheed Martin India | 1997 | Bengaluru, India | High | ~ | ~ | ~ | ~ |

| Airbus Defence and Space India | 2006 | Bengaluru, India | High | ~ | ~ | ~ | ~ |

India military satellite Market Analysis

Growth Drivers

Government Investments in Defense and Space Programs

The Indian government’s increased allocation of funds to defense and space programs is a significant driver of the military satellite market. With an eye on enhancing national security and promoting self-reliance in defense technology, the government has ramped up investments in satellite development and related infrastructure. Initiatives such as the “Make in India” program and defense modernization efforts emphasize the importance of space-based capabilities, driving demand for communication, surveillance, and reconnaissance satellites. Additionally, government-backed organizations like ISRO play a central role in the development of military satellites, further boosting market growth. By ensuring a reliable satellite communication system, India aims to improve its defense readiness, border security, and surveillance capabilities.

Strategic Importance of Space-Based Communication and Surveillance

Space-based communication and surveillance are critical for modern military operations, and India is investing heavily to enhance its satellite capabilities. The growing need for secure and real-time communication between defense units across land, air, and sea platforms has increased the reliance on military satellites. These satellites are vital for intelligence gathering, disaster management, navigation, and tactical communications. Furthermore, the rise in cross-border security concerns and the increasing use of satellite-based surveillance in defense strategies have made military satellites an essential part of India’s defense infrastructure. This growing demand for secure and advanced satellite communication is expected to be a key driver for the market’s continued expansion.

Market Challenges

High Development and Launch Costs

A significant challenge facing the India military satellite market is the high cost associated with the development, manufacturing, and launch of satellites. Developing advanced military satellites with state-of-the-art technologies, such as communication, surveillance, and reconnaissance systems, requires substantial investment. The cost of launching these satellites into space, particularly through heavy-lift rockets, is also a major expense. As India aims for greater self-reliance in satellite technology, managing these high costs remains a key hurdle. Despite government investments, the prohibitive costs could limit the pace of satellite development and deployment, potentially slowing market growth.

Regulatory and Security Concerns

Regulatory issues and security concerns present another challenge in the India military satellite market. The deployment of military satellites is heavily regulated due to concerns over national security, space debris management, and international space treaties. Space-based assets are also vulnerable to cyberattacks and anti-satellite weapons, which can disrupt operations. International regulations and the need for compliance with space treaties can delay satellite programs, particularly when considering collaborative efforts with other countries. These security and regulatory challenges may affect the speed and efficiency of deploying military satellites, impacting market growth and innovation.

Opportunities

Private Sector Participation and Public-Private Partnerships

The growing interest and participation of private companies in India’s space sector present a significant opportunity for the military satellite market. Through public-private partnerships (PPPs), the Indian government can leverage the capabilities of private companies in satellite manufacturing, satellite launches, and space technology development. This collaboration can help reduce costs, improve innovation, and increase satellite production. As India seeks to meet its growing defense and communication needs, such partnerships with private sector players can accelerate the development of military satellites and ensure faster deployment of critical defense infrastructure.

Advancements in Satellite Miniaturization and Technology

Technological advancements in satellite miniaturization and the development of low-cost, high-performance satellites present a major opportunity for the India military satellite market. Smaller, more efficient satellites, such as those used in Low Earth Orbit (LEO) constellations, offer cost-effective alternatives to traditional satellite systems while maintaining high performance in terms of data transmission and surveillance. These miniaturized satellites are easier and cheaper to manufacture and launch, which can significantly reduce the barriers to entry in the defense satellite market. As technology continues to improve, India can enhance its satellite capabilities with more flexible, faster, and lower-cost solutions for military operations.

Future Outlook

Over the next decade, the India military satellite market is expected to experience significant growth driven by India’s defense strategy, which prioritizes self-reliance and technological advancement. Increased investments in satellite communication, surveillance, and reconnaissance will be key drivers. Moreover, government initiatives such as the “Make in India” program will encourage domestic manufacturing and development of military satellite technology, supporting India’s goal of enhancing its defense capabilities and establishing a robust space defense system.

Major Players

- Indian Space Research Organisation

- Antrix Corporation

- Bharat Electronics Limited

- Lockheed Martin India

- Airbus Defence and Space India

- Northrop Grumman India

- Boeing India

- Thales Group

- L3 Technologies India

- Maxar Technologies

- Hughes Communications India

- Viasat India

- SES Networks

- Eutelsat India

- Ball Aerospace India

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Indian Armed Forces

- Ministry of Defence, Government of India

- Space agencies and defense contractors

- Satellite communication service providers

- Aerospace technology developers

- Private sector defense contractors

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying and defining key variables that influence the India military satellite market. The process includes thorough secondary research to gather data from industry reports, government publications, and defense policy documents. The primary goal is to establish a comprehensive understanding of the market’s structure.

Step 2: Market Analysis and Construction

In this phase, historical data is analysed to assess the market’s growth trajectory, key drivers, and potential barriers. Key factors such as technological advancements, government initiatives, and defense expenditure are evaluated to build accurate market models.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are validated through consultations with industry experts, government officials, and defense specialists. These consultations provide insights into the practical challenges and opportunities within the market, enhancing the accuracy of the forecast.

Step 4: Research Synthesis and Final Output

The final step involves integrating insights from primary research with secondary data. A comprehensive market report is developed, incorporating forecasts and future outlooks based on real-world data from defense operations and satellite missions.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense budget allocation for space programs

Advancements in satellite miniaturization technology

Strategic importance of space-based intelligence and communication - Market Challenges

High cost of satellite development and launch

Regulatory hurdles and international space treaties

Technical challenges in satellite integration and operation - Market Opportunities

Emerging private sector collaborations for satellite development

Growing demand for space-based surveillance and reconnaissance

Potential for satellite export to allied nations - Trends

Shift towards Low Earth Orbit (LEO) satellite systems

Increased demand for dual-use military and commercial satellite applications

Rising adoption of satellite constellations for global coverage

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Geostationary Satellites

Low Earth Orbit (LEO) Satellites

Medium Earth Orbit (MEO) Satellites

Communication Satellites

Surveillance Satellites - By Platform Type (In Value%)

Military Satellites

Defense Communication Satellites

Reconnaissance Satellites

Navigation Satellites

Weather Satellites - By Fitment Type (In Value%)

Ground-based Stations

Satellite Platforms

Integration with Airborne Systems

Integration with Naval Platforms

Integration with Unmanned Systems - By End User Segment (In Value%)

Indian Armed Forces

Indian Space Research Organisation (ISRO)

Private Sector Collaborators

International Defense Clients

Research Institutions - By Procurement Channel (In Value%)

Direct Procurement by Government

Private Sector Collaborations

Third-party Vendors

International Acquisitions

Public-Private Partnerships

- Market Share Analysis

- Cross Comparison Parameters (Price, Innovation, System Reliability, Integration Capability, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

ISRO

Antrix Corporation

Bharat Electronics Limited (BEL)

Indian Space Research Organisation (ISRO)

Indian National Space Promotion and Authorization Centre

Hindustan Aeronautics Limited (HAL)

Larsen & Toubro

Boeing India

Lockheed Martin India

Northrop Grumman India

Airbus Defence and Space India

Thales Group

Reliance Defence and Aerospace

Sukhoi Aviation India

Eutelsat India

- Expansion of satellite communication capabilities for military

- Rising demand for real-time intelligence and reconnaissance

- Growth of space-based GPS navigation systems in defense

- Increased focus on satellite-based cybersecurity for defense

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035