Market Overview

The India Multi Launch Rocket Systems market is driven by the increasing modernization of defense technologies and strategic defense investments. The market size is estimated at USD ~ in 2025, underpinned by continued government spending on defense systems and technological advancements. The rising demand for advanced multi-launch systems for defense applications, particularly in border defense and national security, is significantly driving this market. Robust investment in R&D, collaborations with global defense contractors, and a focus on indigenous capabilities are key contributors to market growth. India’s defense budget allocation is expected to further support this growth trajectory.

Dominant countries in the India Multi Launch Rocket Systems market include India, with its strong defense sector and emphasis on military modernization. As one of the largest defense markets in the world, India is increasingly investing in multi-launch rocket systems to enhance its defense capabilities, particularly for border security. Geopolitical factors, such as tensions with neighboring countries, and a focus on expanding indigenous defense technologies make India the leading force in this market. Additionally, countries with advanced defense infrastructure, such as the U.S. and Russia, play a crucial role in shaping the global market, with ongoing collaborations and defense technology transfers influencing India’s multi-launch rocket system landscape.

Market Segmentation

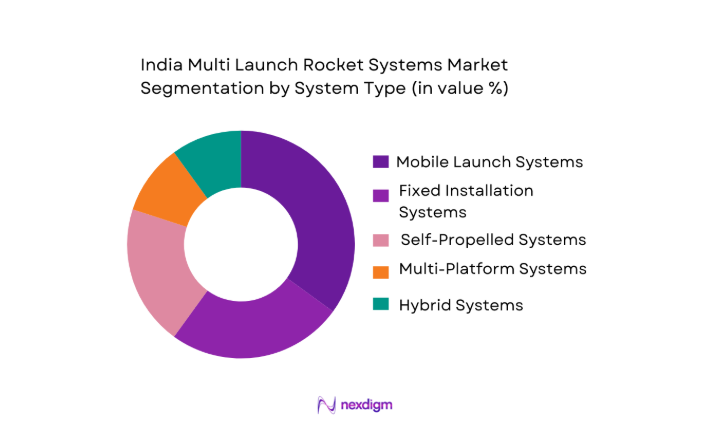

By System Type

The India Multi Launch Rocket Systems market is segmented by system type into mobile launch systems, fixed installation systems, self-propelled systems, multi-platform systems, and hybrid systems. Among these, mobile launch systems hold a dominant market share in India. This dominance is primarily driven by their versatility and ease of deployment in varied terrains. Mobile systems are highly valued for their flexibility in operations, allowing rapid deployment and repositioning based on battlefield requirements. Additionally, mobile launchers are often equipped with enhanced mobility, which is crucial for border security and defense applications, where agility and quick response are vital. The development of indigenous mobile systems by companies such as Bharat Dynamics Limited (BDL) further bolsters this segment’s growth, positioning it as a dominant player in the market.

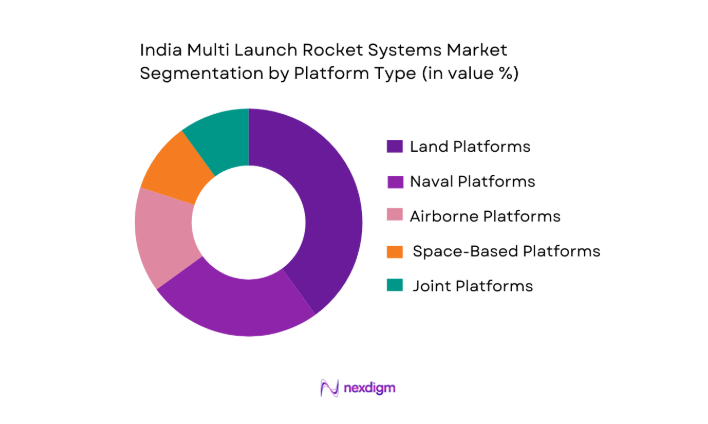

By Platform Type

The India Multi Launch Rocket Systems market is also segmented by platform type, including land-based platforms, naval platforms, airborne platforms, space-based platforms, and joint platforms. Land-based platforms dominate the market, with a market share of ~ in 2024. The focus on land-based defense operations, particularly in regions with ongoing security challenges like Kashmir, leads to the popularity of land-based platforms. These platforms offer cost-effectiveness and ease of integration with existing military infrastructure. Furthermore, the Indian Army continues to prioritize land-based multi-launch rocket systems for strategic defense operations, contributing to the platform’s dominance. Key collaborations with global suppliers and indigenous manufacturing of land-based systems by Indian defense agencies further strengthens this segment.

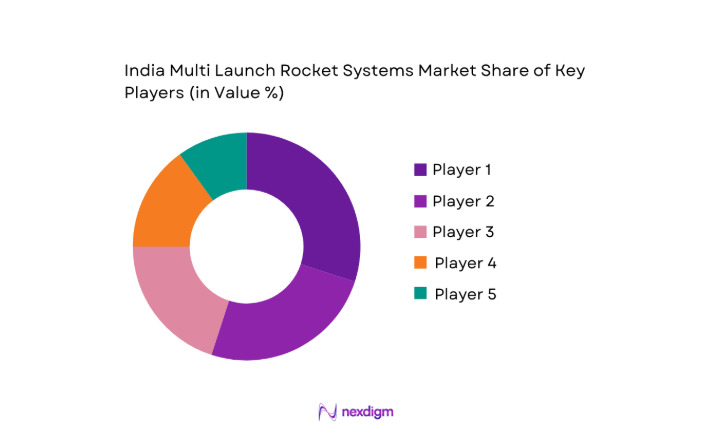

Competitive Landscape

The India Multi Launch Rocket Systems market is dominated by a few key players, including domestic manufacturers and global defense companies. Companies such as Bharat Dynamics Limited (BDL), Larsen & Toubro, and Hindustan Aeronautics Limited (HAL) play an instrumental role in the market due to their strong presence in the defense sector and continued investments in rocket system technologies. The market also sees significant contributions from international players like Lockheed Martin and Boeing, which collaborate with the Indian government for defense technology transfers.

| Company | Establishment Year | Headquarters | Product Type | Platform Type | Market Focus | Strategic Partners |

| Bharat Dynamics Limited (BDL) | 1970 | Hyderabad, India | ~ | ~ | ~ | ~ |

| Larsen & Toubro | 1938 | Mumbai, India | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited (HAL) | 1940 | Bangalore, India | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

India Multi Launch Rocket Systems Market Dynamics

Growth Drivers

Increasing demand for multi-role defense systems

The growing demand for multi-role defense systems can be attributed to increasing geopolitical tensions and security challenges, particularly in border regions. In 2024, India’s defense budget allocation stands at approximately USD ~, with a significant portion directed toward enhancing its multi-role defense capabilities. The Indian Ministry of Defense (MOD) has earmarked substantial funding for advanced rocket systems, which is driving the demand for versatile defense systems. This increase is part of India’s broader strategy to modernize its defense forces, evidenced by the enhancement of India’s defense capabilities across land, sea, and air platforms. Moreover, India’s growing defense trade relations with countries such as the United States and Russia emphasize the rising demand for multi-role systems, with a focus on integrated multi-platform launchers.

Technological advancements in rocket system capabilities

Technological advancements in rocket systems are a major driver for the market’s growth. The Indian government has heavily invested in R&D, with the Indian Space Research Organisation (ISRO) and the Defence Research and Development Organisation (DRDO) leading the way. In 2024, India has invested over USD ~ in advancing rocket technology, enhancing the range, precision, and efficiency of its multi-launch systems. These innovations allow for increased payload capacity, better targeting accuracy, and improved interoperability with existing defense systems. The recent success of ISRO’s GSLV Mk III, which successfully launched satellites into geosynchronous transfer orbit, showcases the advanced technological capabilities that India is harnessing for its defense sector, directly impacting the development of multi-launch rocket systems.

Market Challenges

High cost of development and deployment

The high cost associated with the development and deployment of multi-launch rocket systems remains a significant challenge for the market. In 2024, the estimated cost of a single multi-launch rocket system in India can range from USD ~ to USD ~, depending on the complexity and technology involved. This cost is further exacerbated by the need for ongoing maintenance, testing, and the infrastructure required for integration with military forces. While India continues to increase its defense budget, the high cost of these advanced systems, coupled with a reliance on imported technologies, poses a financial burden on the defense sector. Furthermore, maintaining the operational readiness of these systems requires a robust logistics and support network, which adds to the overall cost burden.

Geopolitical tensions and regional defense regulations

Geopolitical tensions and regional defense regulations often complicate the procurement and deployment of multi-launch rocket systems. In 2024, India faces ongoing challenges with its neighboring countries, particularly Pakistan and China, which impacts defense planning. These tensions lead to complex regulatory frameworks for military procurements, including the acquisition of advanced systems. Additionally, international defense agreements often include restrictions and limitations on the types of weapons that can be exported or imported, which adds a layer of complexity to India’s defense procurement strategies. Such geopolitical factors also result in delays and diplomatic hurdles, impacting the timely development and deployment of multi-launch systems.

Market Opportunities

Increased collaboration with international defense agencies

India’s ongoing collaboration with international defense agencies presents a significant opportunity for growth in the multi-launch rocket systems market. In 2024, India has entered into multiple defense agreements with countries like the United States, Russia, and Israel, focusing on technology transfers and joint development of defense systems. These collaborations not only provide access to advanced technologies but also help India build its indigenous defense capabilities. The Indian defense sector’s collaboration with these global powers offers new avenues for the development of cutting-edge multi-launch rocket systems, which can enhance India’s defense infrastructure while simultaneously boosting its global defense positioning. These partnerships create an opportunity for India to acquire new systems and integrate global best practices into its defense sector.

Expansion of indigenous manufacturing capabilities

India’s emphasis on “Atmanirbhar Bharat” (self-reliant India) presents a significant opportunity for growth in the multi-launch rocket systems market. In 2024, India has made considerable investments in expanding its indigenous defense manufacturing capabilities. The Defense Procurement Policy (DPP) emphasizes the need for indigenization of defense systems, including multi-launch rocket systems. By increasing domestic production, India aims to reduce dependency on foreign suppliers and strengthen its defense sector. This shift is evident in the ongoing efforts of state-owned defense companies like Bharat Dynamics Limited (BDL) and private players such as Larsen & Toubro, which are working to develop and manufacture multi-launch rocket systems locally. As these capabilities continue to expand, India will be better positioned to meet its defense needs independently, leading to further growth in the market.

Future Outlook

Over the next 5-10 years, the India Multi Launch Rocket Systems market is expected to exhibit significant growth driven by continuous advancements in rocket system technology, strategic defense requirements, and the Indian government’s focus on military modernization. The need for enhanced security along the borders, combined with a growing emphasis on indigenization and self-reliance, is expected to fuel the demand for more advanced, cost-effective, and adaptable multi-launch systems. Furthermore, collaborative defense agreements with global powers and the ongoing transformation of the Indian defense industry will continue to create opportunities for the market’s expansion.

Major Players

- Bharat Dynamics Limited

- Larsen & Toubro

- Hindustan Aeronautics Limited

- Lockheed Martin

- Boeing

- Tata Advanced Systems

- ISRO

- Mahindra Defence Systems

- Reliance Defence

- Godrej & Boyce

- Kalyani Group

- DRDO

- BAE Systems

- Saab Group

- Rosoboronexport

Key Target Audience

- Defense Ministry

- Indian Army

- Indian Air Force

- Indian Navy

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace & Defense Contractors

- Space Agencies

Research Methodology

Step 1: Identification of Key Variables

The research process begins by mapping the major stakeholders within the India Multi Launch Rocket Systems market, including government agencies, defense contractors, and military forces. Extensive desk research, along with secondary data from reputable sources such as government reports, defense publications, and market databases, is conducted to identify the critical market variables and trends. This phase also involves setting the scope of the study and defining parameters like product types, platform types, and procurement channels.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on the India Multi Launch Rocket Systems market, considering factors like military expenditure, technological advancements, and defense procurement strategies. We assess market penetration levels, the role of defense ministries, and the integration of new technologies into existing defense systems. This helps in building a comprehensive understanding of market structure and growth potential.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses regarding growth drivers, technology trends, and demand-supply dynamics are tested through consultations with industry experts. These include conversations with defense officials, senior personnel in aerospace and defense companies, and market analysts. The goal is to validate the initial hypotheses and gain insights into the operational challenges and emerging opportunities within the multi-launch rocket systems sector.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the data and insights gathered from previous phases, ensuring the results reflect an accurate representation of the market’s present status and future outlook. This includes direct consultations with manufacturers, service providers, and defense agencies to refine forecasts and address potential discrepancies. The final output incorporates all findings into a cohesive report that provides a comprehensive analysis of the India Multi Launch Rocket Systems market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for multi-role defense systems

Technological advancements in rocket system capabilities

Growing defense budgets and military modernization plans - Market Challenges

High cost of development and deployment

Geopolitical tensions and regional defense regulations

Integration complexity with existing defense infrastructure - Market Opportunities

Increased collaboration with international defense agencies

Expansion of indigenous manufacturing capabilities

Emerging private sector investment in aerospace technologies - Trends

Rise in autonomous rocket launching systems

Adoption of advanced guidance and targeting technologies

Shift toward more compact and cost-effective launch systems

- SWOT Analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Mobile launch systems

Fixed installation systems

Self-propelled systems

Multi-platform systems

Hybrid systems - By Platform Type (In Value%)

Land-based platforms

Naval platforms

Airborne platforms

Space-based platforms

Joint platforms - By Fitment Type (In Value%)

Integrated systems

Modular systems

Custom-fit systems

Retrofitted systems

Off-the-shelf systems - By EndUser Segment (In Value%)

Defense forces

Research & development agencies

Space exploration agencies

Private aerospace companies

International defense contractors - By Procurement Channel (In Value%)

Government defense contracts

Private defense procurement

International collaborations

- Market Share Analysis

- CrossComparison Parameters (System complexity, platform compatibility, cost-effectiveness, geographic range, technological innovation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porters 5 forces

- Key Players

BrahMos Aerospace

Tata Advanced Systems

Larsen & Toubro

Reliance Defence

ISRO

Indian Ordnance Factories

Mahindra Defence Systems

Astra Microwave Products

Adani Defence

Hindustan Aeronautics Limited

Godrej & Boyce

Kalyani Group

DRDO

Boeing India

Lockheed Martin India

- Defense forces focusing on multi-role systems

- Space agencies exploring new platforms for payload delivery

- R&D agencies looking to integrate advanced testing capabilities

- Private companies investing in satellite and payload delivery systems

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035