Market Overview

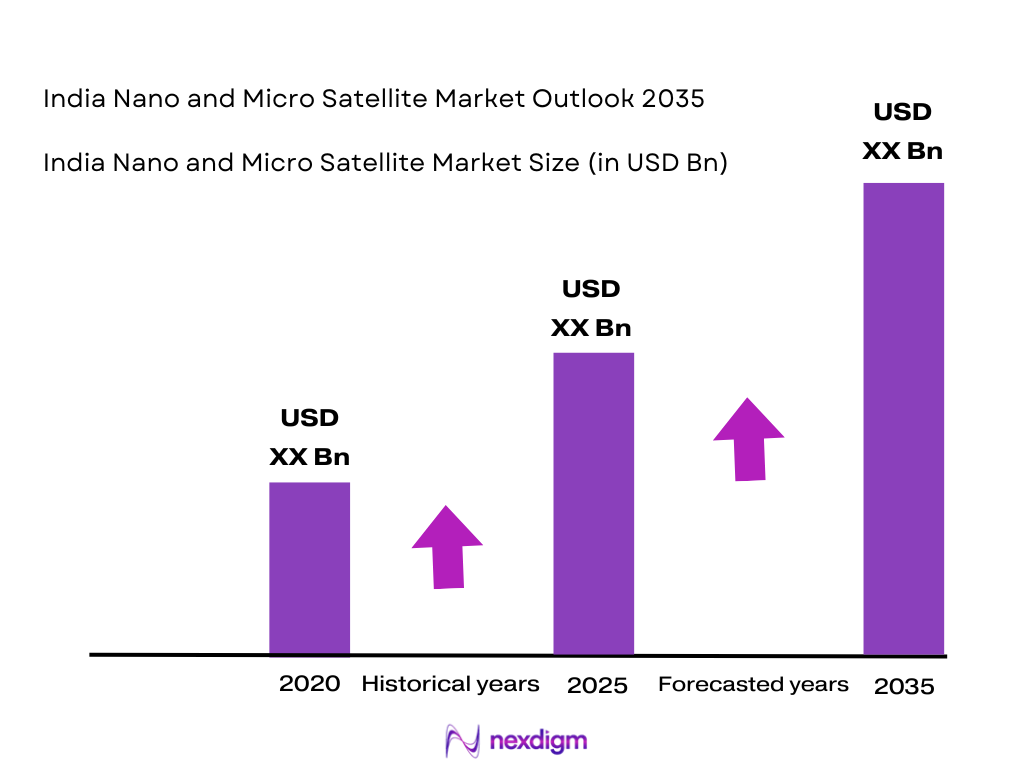

The India Nano and Micro Satellite market is valued at approximately USD ~ million, driven by the growing demand for small satellite platforms in sectors such as communication, Earth observation, and scientific research. The market’s expansion is supported by both governmental efforts (e.g., ISRO’s space missions and small satellite launch vehicles) and the increasing involvement of private players. These advancements, along with technological innovations such as miniaturized payloads and reduced launch costs, are driving the market’s growth. The development of satellite constellations, particularly for broadband and Earth monitoring, is also a critical contributor to the market’s robust growth trajectory.

India leads the market due to its robust space infrastructure, primarily driven by the Indian Space Research Organisation (ISRO), which has significantly advanced satellite technology and launch capabilities. Cities like Bengaluru, the hub of India’s aerospace industry, and Hyderabad, with its growing number of space tech startups, are crucial for satellite development and manufacturing. Additionally, regions such as Chennai and Delhi are witnessing a surge in satellite-related businesses. Globally, while India maintains a strong domestic position, the growing interest from international entities seeking cost-effective satellite solutions and launch services further positions India as a key player in the global nano and micro satellite market.

Market Segmentation

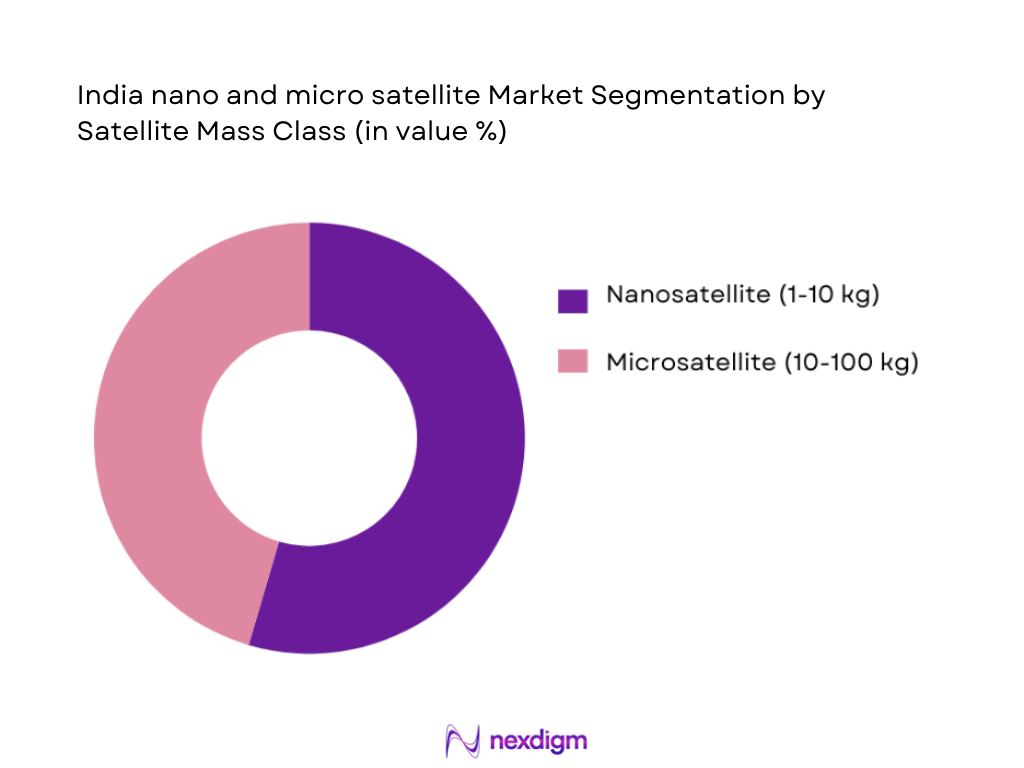

By Satellite Mass Class

The India Nano and Micro Satellite market is segmented by satellite mass class into Nanosatellites (1-10 kg) and Microsatellites (10-100 kg). In this segment, the Nanosatellite class holds a dominant market share, driven by its versatility, affordability, and growing demand in various applications, including communication, Earth observation, and scientific research. The light weight and low cost of Nanosatellites have made them attractive for both governmental and commercial entities, especially for startups and academic institutions. These satellites are increasingly used in constellations for tasks such as monitoring the environment, tracking climate change, and providing global connectivity.

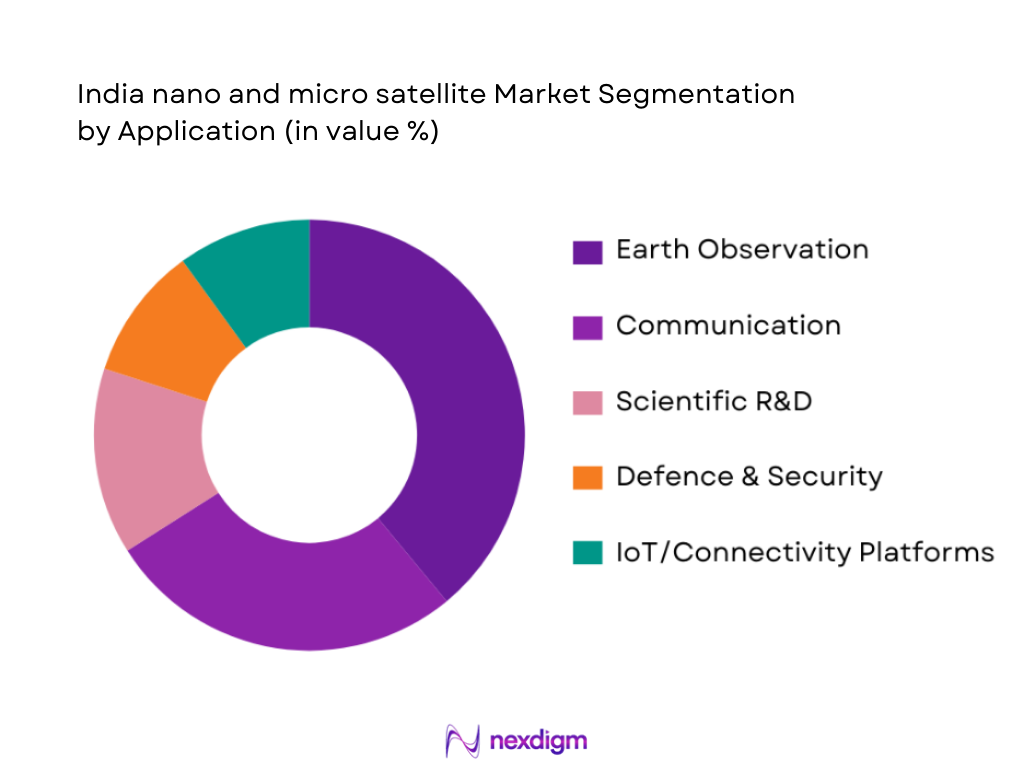

By Application

The Indian Nano and Micro Satellite market is segmented into applications such as Earth Observation, Communication, Scientific R&D, Defence & Security, and IoT/Connectivity Platforms. Among these, Earth Observation holds the largest market share due to India’s increasing reliance on small satellites for climate monitoring, natural disaster management, and agricultural development. Earth Observation satellites provide critical data for weather forecasting, resource management, and environmental monitoring, making them essential for both governmental and commercial sectors. Additionally, Earth Observation platforms support India’s goals of enhancing its agricultural productivity and monitoring urban expansion.

Competitive Landscape

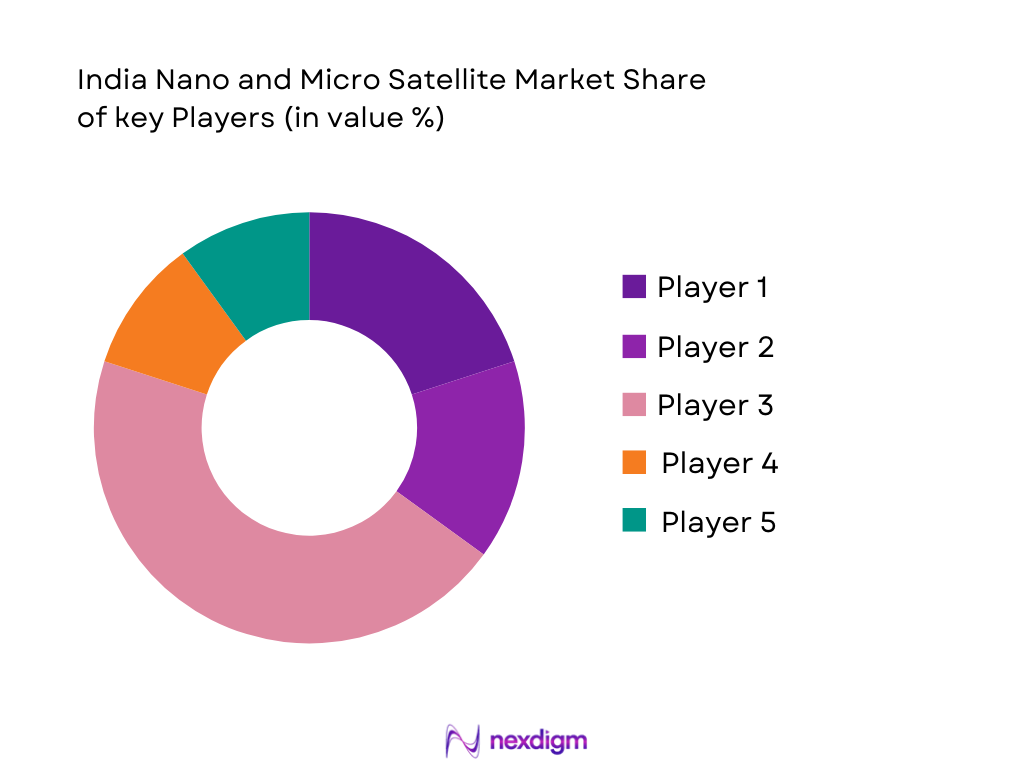

The Indian Nano and Micro Satellite market is dominated by several key players, both domestic and international. Companies such as ISRO (Indian Space Research Organisation) and NewSpace India Ltd. (NSIL) play a significant role in satellite manufacturing and launch services. In addition, private players like Pixxel, Skyroot Aerospace, and Agnikul Cosmos are gaining prominence with their innovative small satellite platforms and cost-effective launch solutions. The competition is intense, as these players seek to address the growing demand for small, cost-efficient satellites across various sectors.

| Company | Establishment Year | Headquarters | Market Segment | Technology Focus | Product Portfolio | Annual Revenue |

| ISRO | 1969 | Bengaluru, India | ~ | ~ | ~ | ~ |

| Pixxel | 2019 | Bengaluru, India | ~ | ~ | ~ | ~ |

| Skyroot Aerospace | 2018 | Hyderabad, India | ~ | ~ | ~ | ~ |

| Agnikul Cosmos | 2017 | Chennai, India | ~ | ~ | ~ | ~ |

| NewSpace India Ltd. | 2020 | New Delhi, India | ~ | ~ | ~ | ~ |

India Nano and Micro Satellite Market Analysis

Market Drivers

Government Space Reform & Commercial Policy Initiative

India’s government has implemented several policies to promote the growth of its space industry. Initiatives like the Indian National Space Promotion and Authorization Center (IN-SPACe) and NewSpace India Ltd. (NSIL) have been established to facilitate private sector participation in satellite manufacturing and space exploration. These reforms allow private companies to leverage government infrastructure and expertise while reducing regulatory hurdles. The government’s “Make in India” initiative and the push to create an entrepreneurial space ecosystem have spurred innovation in satellite technology, leading to cost-efficient solutions. Additionally, ISRO’s development of Small Satellite Launch Vehicles (SSLVs) and the facilitation of low-cost satellite launches have opened up new opportunities for both domestic and international players. Government backing not only strengthens domestic capabilities but also attracts foreign investment into India’s growing space market, fueling its future growth.

Surging Private Sector Participation & Startup Ecosystem

The entry of private players and startups into the Indian Nano and Micro Satellite market is a significant growth driver. Companies like Pixxel, Skyroot Aerospace, and Agnikul Cosmos are playing an increasingly important role in satellite manufacturing and launch services. India’s burgeoning startup ecosystem, particularly in Bengaluru and Hyderabad, has seen innovative solutions in satellite technologies such as Earth observation, hyperspectral imaging, and modular satellite systems. The private sector’s ability to innovate at lower costs and quickly deploy satellite constellations is contributing to the demand for small satellites across various industries, from telecommunications to defense. These startups also bring in venture capital and collaborate with global entities, thus boosting India’s position in the global space market.

Market Challenges & Restraints

Infrastructure Gaps in High-Volume Production

While India has made significant strides in satellite technology, challenges remain in scaling up the manufacturing infrastructure for high-volume production of small satellites. Currently, the facilities for mass production of small satellite components are limited. This results in delays, increased production costs, and potential bottlenecks in meeting the growing demand for satellites. The infrastructure for end-to-end satellite manufacturing, from assembly to testing and integration, is not yet at the scale required to fully support the projected growth. To address this, the establishment of more dedicated satellite production hubs and the integration of automated manufacturing processes will be key. Expanding and modernizing infrastructure will also enable India to compete effectively on a global scale for both commercial and government contracts.

Talent & Specialized Manufacturing Constraints

A shortage of skilled workforce in advanced satellite technologies, including satellite design, payload integration, and propulsion systems, is another restraint for the Indian market. There is a significant need for engineers, scientists, and technicians with specialized knowledge to design, develop, and manufacture cutting-edge small satellite systems. Moreover, the space industry demands high-quality precision manufacturing and highly specialized equipment, which are not always readily available in India. This talent gap limits the speed at which companies can scale up their operations and meet the growing demand for small satellites. Bridging this gap through education and training programs, as well as attracting skilled professionals from abroad, is critical for the industry to reach its full potential.

Market Opportunities

In-Orbit Servicing & On-Orbit Assembly Platforms

In-orbit servicing and on-orbit assembly present exciting growth opportunities in the Indian Nano and Micro Satellite market. As satellite constellations and on-orbit operations increase, the demand for in-orbit satellite servicing, such as refueling, repairing, or upgrading satellite components, is expected to rise. Indian companies can tap into this market by developing technologies for servicing satellites during their operational life, thus extending their lifespan and improving overall efficiency. Additionally, on-orbit assembly platforms that can assemble larger structures in space—using smaller components launched by Nano and Micro Satellites—could revolutionize space infrastructure. India’s position as a space leader, supported by its low-cost satellite technology, positions the country to play a critical role in the development of such services, which will be in high demand as the space economy expands.

Satellite Constellation Services (Broadband, Earth Data)

The growing demand for global broadband connectivity and Earth data services presents a vast opportunity for satellite constellations. Companies in India are increasingly focusing on deploying small satellite constellations for global communications, remote sensing, and IoT data collection. These constellations provide global coverage at a fraction of the cost of traditional satellites, making them ideal for both commercial enterprises and governmental agencies. The Indian market is well-positioned to capitalize on this trend, with innovations like low Earth orbit (LEO) constellations offering reliable internet and data transmission across underserved areas, particularly in rural and remote regions. Additionally, Earth observation constellations are crucial for monitoring environmental changes, agriculture, urban development, and defense applications. India’s emerging role in providing these satellite services, combined with its cost-effective manufacturing capabilities, allows it to cater to both domestic and international customers in these sectors.

Future Outlook

Over the next few years, the India Nano and Micro Satellite market is poised for substantial growth, driven by advancements in satellite miniaturization, the increasing demand for cost-effective space services, and the government’s emphasis on expanding space infrastructure. With key players like ISRO, along with a rising number of private players entering the market, India’s position as a leader in the global small satellite market will continue to strengthen. Additionally, the development of new launch vehicles and satellite constellations will open new opportunities, especially for international customers looking for affordable space solutions. The increasing focus on Earth observation, communication, and defense applications will further fuel market growth.

Major Players in the Market

- ISRO (Indian Space Research Organisation)

- Pixxel

- Skyroot Aerospace

- Agnikul Cosmos

- Ananth Technologies

- HAL (Hindustan Aeronautics Limited)

- Bellatrix Aerospace

- NewSpace India Ltd. (NSIL)

- L&T – Space Systems

- Digantara

- OneWeb

- Planet Labs

- Satellize

- SpaceX

- Airbus Defence and Space

Key Target Audience

- Government agencies (e.g., ISRO, Department of Space, Ministry of Defence)

- Satellite manufacturers and integrators

- Satellite launch service providers

- Aerospace companies and suppliers

- Investment and venture capital firms

- Private space exploration companies

- Defence and national security agencies (e.g., Indian Armed Forces, Ministry of Defence)

- Regulatory bodies (e.g., IN-SPACe, Department of Space)

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping out the major variables influencing the Nano and Micro Satellite market. We leverage secondary data from satellite manufacturers, space agencies, and technology providers to define key parameters, such as satellite mass, launch modes, and market applications. Desk research and publicly available databases like ISRO reports and market insights from satellite companies guide this process.

Step 2: Market Analysis and Construction

Data from multiple sources are consolidated and analyzed to understand market trends, growth patterns, and demand for various satellite types. This includes the examination of revenue streams, launch frequencies, and technological advancements. We analyze the distribution of market segments and their growth dynamics, focusing on Earth observation, communication, and scientific R&D applications.

Step 3: Hypothesis Validation and Expert Consultation

To refine hypotheses, expert consultations will be conducted with professionals in satellite technology, space startups, and government agencies. Interviews will focus on validating assumptions regarding satellite usage, demand drivers, and future growth areas. These consultations help validate market data and provide insights into technological developments and regulatory shifts.

Step 4: Research Synthesis and Final Output

Data from both secondary research and expert consultations will be synthesized to provide a comprehensive market overview. This phase also includes direct engagement with key players to validate the data and ensure that the final output reflects the current market situation. This final analysis will serve as the foundation for the market report, ensuring that it is robust and data-driven.

- Executive Summary

- Research Methodology (Market Definitions and Nanosatellite/Microsatellite Segment Thresholds, Abbreviations, India Market Data Sources, Satellite Mass & Payload Standards, Primary & Secondary Research Approach, Forecast Modelling, Data Validation Protocols, Limitations and Assumptions)

- Definition and Market Scope

- Industry Genesis & Historical Milestones

- Market Ecosystem & Value Chain

- Technology Evolution in Nanosatellite and Microsatellite Platforms

- Regulatory & Policy Landscape in India

- Satellite Launch Infrastructure & India’s Global Positioning

- Market Drivers

Government Space Reform & Commercial Policy Initiative

Surging Private Sector Participation & Startup Ecosystem

Cost Economy of Small Satellites vs Traditional Platforms

Advances in Miniaturized Payloads & Software Services

International Launch and Export Opportunities - Market Challenges & Restraints

Infrastructure Gaps in High‑Volume Production

Talent & Specialized Manufacturing Constraints

Export Controls & Data‐Sharing Governance

Competition with Global Small Satellite Providers - Market Opportunities

In‑Orbit Servicing & On‑Orbit Assembly Platforms

Satellite Constellation Services (Broadband, Earth Data)

AI‑Enabled Payload Monetization & Big Data Services

Space‑Based IoT Platforms & Machine‑Level Autonomy - Market Trends

Commercial Launch Services & SSLV Commercialization Trends

Vertical Integration by Indian Space Startups

Satellite Constellation Emergence & Hyperspectral Imaging Services

Strategic Partnerships with Global Space Firms - Technology & Innovation Landscape

Payload Miniaturization Technologies

Modular Satellite Architecture Standards

On‑Board Autonomy & Edge Processing

Green Propulsion & End‑of‑Life De‑Orbit Technology

- Market Value, 2020-2025

- Volume Consumption Across Subsegments, 2020-2025

- Composite Adoption Intensity, 2020-2025

- By Satellite Mass Class (In Value %)

Nanosatellite (1‑10kg)

Microsatellite (10‑100kg) - By Application (In Value %)

Earth Observation

Communication

Scientific R&D

Defence & Security

IoT/Connectivity Platforms - By Orbit Type (In Value %)

Low Earth Orbit (LEO)

Medium Earth Orbit (MEO)

Geostationary Orbit (GEO)

Beyond LEO / Deep Space Micro Platforms - By End-Use Sector (In Value %)

Government

Commercial & Enterprise

International Space Customers - By Technology Stack (In Value %)

Bus Type

Payload Class

Propulsion Systems

Communications Band - By Launch Mode (In Value %)

Dedicated Small Satellite Launch Vehicle (SSLV)

Rideshare PSLV

International Launch Partnerships

- Market Share by Revenue and Unit Volume

Competitive Positioning by Technology Capabilities

Go‑to‑Market Models (Services, Data, Platform Sales)

Customer Segment Reach & Distribution Strategy - Cross‑Company Comparison Parameters (Company Overview (Global + India Operations), Business Strategy (Tech Roadmap, Market Entry), Recent Developments & Strategic Partnerships, Financial Metrics (Revenue, Growth Trajectory, Profitability Benchmarks), Product/Platform Portfolio Breadth (Nano/Micro Satellite Configurations), Technology, Differentiators (Payload, Propulsion, Connectivity Systems), Manufacturing & Assembly, Capabilities (In‑House vs Outsourced), Launch & Ground Infrastructure Capacity)

- Company Profiles

SpaceX (Global Commercial Launch + Constellations)

Pixxel (Indian Hyperspectral Constellation)

ISRO / NewSpace India Ltd. (NSIL) (Government + Commercial Launch/Sat Manufacture)

Bellatrix Aerospace (Propulsion & Satellite Tech)

Digantara (Space Situational Awareness)

Ananth Technologies (Assembly & Integration)

HAL – Small Satellite Launch Vehicle Production

Larsen & Toubro (L&T) – Space Systems

Agnikul Cosmos (Launch Services)

Skyroot Aerospace (Launch Technology)

NanoAvionics (Modular Platforms)

Planet Labs (Global EO Constellations)

Blue Canyon Technologies (Micro Platform Supplier)

Terran Orbital (Satellite Platforms)

Airbus Defence & Space

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- Forecast by Value & Growth Scenarios, 2026-2035

- Forecast by Volume & Composite Penetration, 2026-2035

- Future Demand by Aircraft Segment, 2026-203