Market Overview

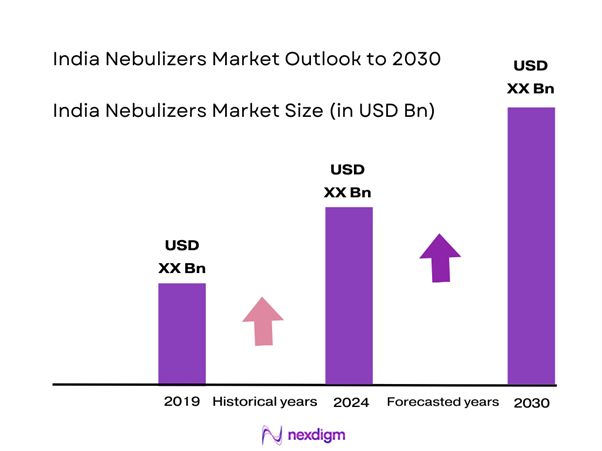

The India Nebulizers Market is projected to reach a valuation of USD 74.0 million in 2024 with an approximated compound annual growth rate (CAGR) of 7.8% from 2024-2030, fueled by an increase in respiratory illnesses such as asthma and chronic obstructive pulmonary disease (COPD). Key factors driving this growth include rising awareness regarding health and well-being, advancements in nebulizer technology, and an expansion in home healthcare solutions. Notably, the urgent need for effective inhalation therapy, particularly post-COVID-19, has further accentuated market growth.

Dominant cities contributing to the Indian nebulizers market include metropolitan areas like Delhi, Mumbai, and Bengaluru. These cities are hubs for healthcare services and pharmaceuticals, with numerous hospitals, clinics, and pharmacies. Their advanced healthcare infrastructure and high population density contribute significantly to the demand for nebulizers, aided by increased health awareness and improved access to medical technology.

The World Bank reported that India’s public healthcare expenditure was approximately USD 139 billion in 2023, which is about 2.1% of its GDP. Increased spending on healthcare reflects the growing prioritization of health services, including respiratory therapies. With rising healthcare budgets, both government and private sectors are increasingly investing in better medical devices and treatments, which supports the adoption of nebulizers as essential therapeutic tools.

Market Segmentation

By Product Type

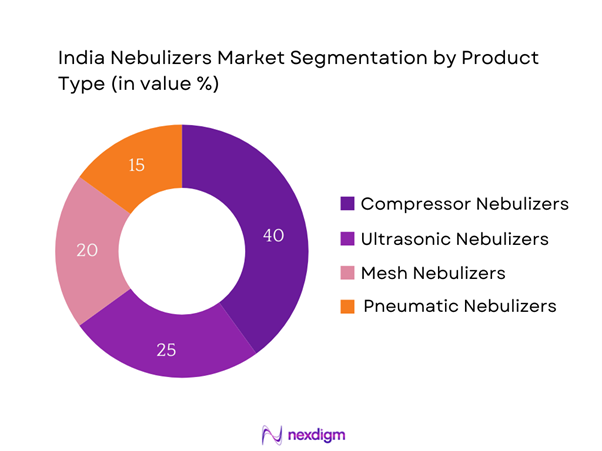

The India Nebulizers Market is segmented by product type into compressor nebulizers, ultrasonic nebulizers, mesh nebulizers, and pneumatic nebulizers. Among these, compressor nebulizers hold a dominant share in the market due to their widespread usage and affordability. Their mechanical design responds to increased demand in hospitals and home settings. Compressor nebulizers are known for their efficiency in converting liquid medication into aerosol, making them highly effective for patients with severe respiratory conditions. The portability, ease of use, and reliability of compressor nebulizers have kept them popular among healthcare professionals and patients alike.

By Application

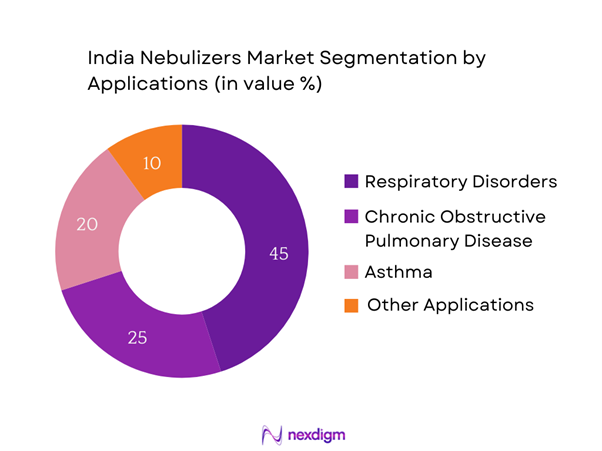

The India Nebulizers Market is further segmented by application into respiratory disorders, chronic obstructive pulmonary disease (COPD), asthma, and other applications. The segment addressing respiratory disorders is the most significant, primarily due to the increasing prevalence of respiratory issues across various demographics. Particularly in urban areas with high pollution levels, there’s an augmented incidence of respiratory diseases, which boosts the need for nebulizers as a critical treatment method. Furthermore, healthcare providers are increasingly recommending nebulizers for effective and efficient medication delivery, solidifying this segment’s leadership.

Competitive Landscape

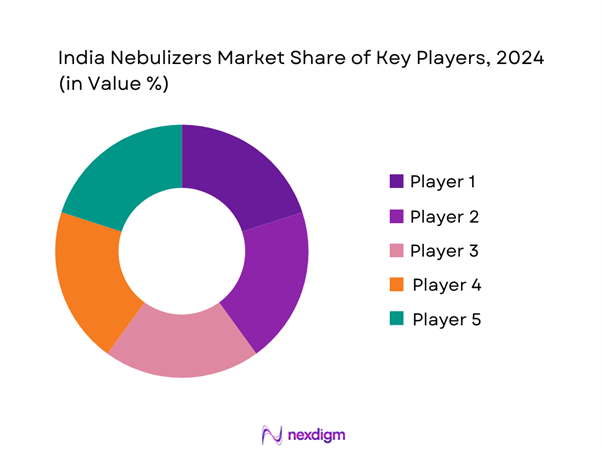

The India Nebulizers Market is dominated by several major players, creating a competitive environment characterized by innovation and strategic partnerships. This consolidation highlights the influence of key companies that lead in technology, distribution, and market reach.

| Company | Establishment Year | Headquarters | Product Offerings | R&D Investment | Market Distribution Channels | Certifications |

| Philips Healthcare | 1891 | Amsterdam, Netherlands | – | – | – | – |

| Omron Healthcare | 1933 | Kyoto, Japan | – | – | – | – |

| Pari Respiratory Equipment | 1900 | Griesheim, Germany | – | – | – | – |

| GE Healthcare | 1892 | Chicago, USA | – | – | – | – |

| Invacare Corporation | 1885 | Elyria, USA | – | – | – | – |

India Nebulizers Market Analysis

Growth Drivers

Rising Prevalence of Respiratory Diseases

The rising prevalence of respiratory diseases in India is a significant growth driver for the nebulizers market. According to the Global Burden of Disease Study, over 55 million Indians suffered from asthma and COPD in 2022, and projections suggest an annual increase due to factors such as air pollution and smoking. The Health Ministry of India reports that 20% of the population is at risk of developing respiratory disorders, which necessitates effective inhalation treatments, including the use of nebulizers. This alarming trend highlights the urgent need for nebulization therapy in managing chronic respiratory conditions.

Aging Population

India’s demographic transition shows that the aging population, which reached 138 million people aged 60 and older in 2022, is expected to significantly impact the healthcare landscape. By end of 2025, it is projected that about 10% of the Indian population will be over 60 years old. The elderly are more susceptible to chronic respiratory diseases, necessitating a greater demand for nebulizers and other pulmonary care devices. With government initiatives aimed at improving healthcare facilities for senior citizens, the nebulizers market is poised for expansion as part of broader healthcare solutions targeted at this demographic.

Market Challenges

High Cost of Devices

One of the key challenges facing the nebulizers market in India is the high cost of devices. In 2022, the average price for a high-quality nebulizer was around INR 6,000, which can be prohibitive for low and middle-income families. Despite government initiatives to promote healthcare accessibility, a significant portion of the population remains unable to afford these essential medical devices. Consequently, the financial burden on patients may restrict market growth as many potential users opt for alternatives or forgo treatment altogether, hindering the overall improvement in respiratory health management.

Lack of Awareness Among Consumers

Lack of consumer awareness regarding the benefits and effectiveness of nebulizers presents a significant market challenge. A survey conducted by the Indian Chest Society in 2022 revealed that nearly 40% of patients with respiratory problems did not know about nebulizer therapy as a treatment option. This lack of information can prevent timely and effective treatment, leading to adverse health outcomes. Educational campaigns by healthcare providers and organizations are essential to improve awareness and encourage the usage of nebulizers in managing respiratory illnesses effectively.

Opportunities

Growth of Home Healthcare

The home healthcare market in India is rapidly expanding, valued at around USD 5 billion in 2023, reflecting a significant shift towards non-hospital-based care. With the ongoing trend of patients opting for at-home treatments, driven by convenience and cost-effectiveness, the demand for nebulizers as part of home healthcare solutions is increasing. Home healthcare allows patients, especially those with chronic conditions, to manage their respiratory issues better while reducing the necessity for frequent hospital visits. This trend positions nebulizers as a critical component of home treatment regimens for patients with respiratory disorders.

Technological Advancements in Nebulizers

Technological advancements in nebulizer design and functionality are opening new avenues for market growth. Innovations, such as battery-operated portable nebulizers and more efficient aerosol delivery systems, are gaining popularity among consumers. As of 2023, approximately 30% of nebulizers sold in India are portable models, catering to patients seeking mobility and ease of use. Enhanced features such as quieter operation and faster medication delivery times are improving user experience, while research and development in nebulization technology continue to flourish. This trend is expected to drive increased adoption of nebulizers and expand market growth.

Future Outlook

The India Nebulizers Market is expected to experience significant growth, driven by advancements in nebulizer technologies, increasing health awareness, and rising respiratory disease incidences. Government initiatives promoting better healthcare access and the recent focus on home healthcare solutions have further fueled this market. The renewable interest in nebulizers post-COVID-19 indicates a continued and robust market expansion, with a projected CAGR of around 7.8% from the current period through 2030.

Major Players

- Philips Healthcare

- Omron Healthcare

- Pari Respiratory Equipment

- GE Healthcare

- Invacare Corporation

- Drive DeVilbiss Healthcare

- Breathe Technologies

- Meyer Medical

- McKesson Corporation

- CareFusion (BD)

- Trudell Medical International

- NIDEK Co., Ltd.

- Rossmax International

- Aercap

- Medical Technology Industries

Key Target Audience

- Healthcare Providers

- Pharmaceutical Companies

- Retail Pharmacies

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health and Family Welfare, CDSCO)

- Home Healthcare Service Providers

- Medical Equipment Distributors

- Insurance Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Nebulizers Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including regulatory considerations, technological advancements, and market demand metrics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Nebulizers Market. This includes assessing market penetration, the ratio of nebulizer devices to users, the resultant revenue generation, and consumer spending patterns on healthcare products. An evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of revenue estimates, which forms the basis for understanding current market performance versus historical trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data. Additionally, insights regarding consumer behavior and preferences will be gathered to ensure comprehensive analysis.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers and distributors in the nebulizer market to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Nebulizers Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Prevalence of Respiratory Diseases

Aging Population

Increased Healthcare Expenditure - Market Challenges

High Cost of Devices

Lack of Awareness Among Consumers - Opportunities

Growth of Home Healthcare

Technological Advancements in Nebulizers - Trends

Rising Demand for Portable Nebulizers

Shift Toward Personalized Medicine - Government Regulation

Regulatory Framework for Medical Devices

Quality Standard Compliance - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Compressor Nebulizers

– Piston-Type Compressor Nebulizers

– Portable Compressor Nebulizers

Ultrasonic Nebulizers

– Tabletop Ultrasonic Nebulizers

– Handheld Ultrasonic Nebulizers

Mesh Nebulizers

– Vibrating Mesh Nebulizers

– Static Mesh Nebulizers

Pneumatic Nebulizers

– Jet Nebulizers

– Venturi-Type Pneumatic Nebulizers - By Application (In Value %)

Respiratory Disorders

– Cystic Fibrosis

– Bronchiectasis

Chronic Obstructive Pulmonary Disease (COPD)

– Acute Exacerbation Management

– Maintenance Therapy

Asthma

– Pediatric Asthma

– Adult-Onset Asthma

Other Applications

– Pulmonary Infections

– Allergic Rhinitis - By Distribution Channel (In Value %)

Hospitals and Clinics

– Government Hospitals

– Private Multispecialty Hospitals

– ENT and Pulmonology Clinics

Retail Pharmacies

– Independent Chemist Stores

– Hospital-Affiliated Pharmacies

Online Sales

– E-commerce Platforms

– Medical Device Portals - By Region (In Value %)

North Region

South Region

East Region

West Region - By End User (In Value %)

Pediatric

– Home-Based Use

– Hospital-Based Pediatric Pulmonology

Adult

– Chronic Disease Management

– Elderly and Geriatric Respiratory Care

- Market Share of Major Players on the Basis of Value/Volume, 2024

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths and Weaknesses, Organizational Structure, Revenues, Innovation and R&D Investment, Customer Base and Target Audience, Quality Certifications & Regulatory Approvals, Production Capacity & Manufacturing Footprint, Product Portfolio Breadth, Distribution Channels, After-Sales Support & Warranty Offerings, Market Reach & Geographic Presence, Unique Value Offering, Customer Satisfaction Metrics & User Reviews, Others)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Philips Healthcare

Omron Healthcare

Pari Respiratory Equipment

GE Healthcare

Invacare Corporation

Drive DeVilbiss Healthcare

Meyer Medical

Breathe Technologies

NIDEK Co., Ltd.

Rossmax International

McKesson Corporation

CareFusion (BD)

Aercap

Trudell Medical International

Medical Technology Industries

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030