Market Overview

The India Network Centric Warfare (NCW) market has seen consistent growth, driven by an increasing focus on technological advancements in defense systems. In 2023, the market was valued at approximately USD ~billion, with projections for 2024 placing it at around USD ~ billion. This growth is primarily fueled by the Indian government’s emphasis on modernizing its military infrastructure and enhancing its cybersecurity capabilities. Additionally, the rising adoption of network-based communication systems, artificial intelligence (AI), and satellite technologies in defense operations has been a key driver. Investments in defense technologies and strategic initiatives aimed at strengthening India’s defense systems are pushing the market toward further expansion.

India’s dominance in the Network Centric Warfare market is concentrated in key defense hubs such as New Delhi, Bengaluru, and Hyderabad. These cities are home to major defense establishments, research institutions, and government bodies like the Ministry of Defence (MoD). New Delhi, being the capital, plays a pivotal role as the policymaking hub for defense procurement and technology development. Bengaluru and Hyderabad, with their significant technological and industrial presence, are at the forefront of defense technology development, housing leading companies and research centers that specialize in the advancement of network-centric systems. India’s focus on strategic defense modernization, aligned with its geopolitical ambitions in the Indo-Pacific, cements its dominance in the NCW market.

Market Segmentation

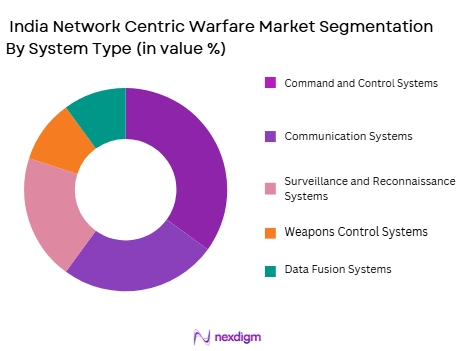

By System Type

India’s Network Centric Warfare market is segmented by system type into Command-and-Control Systems, Communication Systems, Surveillance and Reconnaissance Systems, Weapons Control Systems, and Data Fusion Systems. Among these, Communication Systems dominate the market share, primarily due to their critical role in ensuring seamless, secure, and real-time information exchange between military units. The rising adoption of satellite-based communication systems and secure networks is making communication systems the backbone of NCW in India. These systems facilitate joint operations, increase operational efficiency, and improve the accuracy of military strategies, making them indispensable in modern warfare.

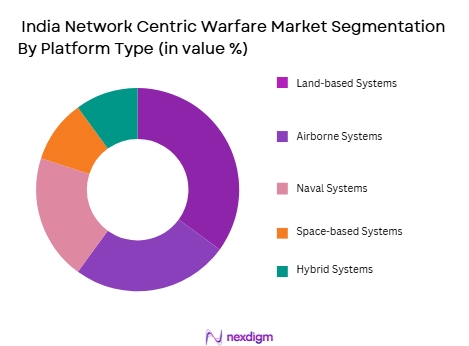

By Platform Type

The India Network Centric Warfare market is also segmented by platform type into Land-based Systems, Airborne Systems, Naval Systems, Space-based Systems, and Hybrid Systems. Airborne Systems have a dominant share in the market. This segment includes technologies like UAVs and other aerial surveillance systems, which are gaining prominence due to their ability to provide real-time data and enhance situational awareness in warfare. India’s increased focus on UAVs and aerial reconnaissance platforms for defense purposes has made airborne systems the leading contributor to the NCW market. These systems offer a high degree of mobility and flexibility, making them crucial for operations in diverse terrains.

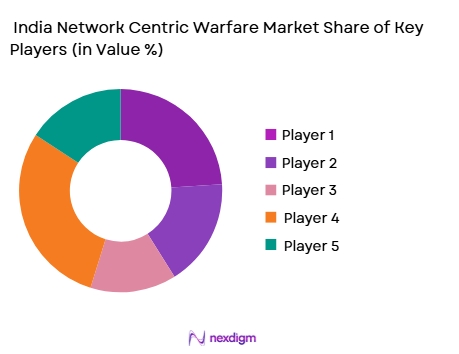

Competitive Landscape

The India Network Centric Warfare market is dominated by a mix of international defense giants and domestic companies specializing in high-tech solutions for military applications. These players offer advanced systems for communication, surveillance, and real-time data exchange that are critical in network-centric warfare operations. The competitive landscape is shaped by the ongoing technological advancements and the increasing demand for secure, interoperable systems.

| Company Name | Establishment Year | Headquarters | Key Product Categories | Market Focus | R&D Investment | Government Contracts |

| Bharat Electronics Limited | 1954 | Bengaluru, India | ~ | ~ | ~ | ~ |

| Larsen & Toubro Limited | 1946 | Mumbai, India | ~ | ~ | ~ | ~ |

| HCL Technologies | 1976 | Noida, India | ~ | ~ | ~ | ~ |

| Boeing India | 1996 | Bengaluru, India | ~ | ~ | ~ | ~ |

| Lockheed Martin India | 1994 | New Delhi, India | ~ | ~ | ~ | ~ |

India Network Centric Warfare Market Analysis

Growth Drivers:

Technological Advancements in Communication and AI

One of the primary drivers of growth in the India Network Centric Warfare (NCW) market is the rapid advancement in communication technologies and artificial intelligence (AI). The integration of AI with network-centric systems is revolutionizing real-time data processing, improving situational awareness, and enhancing decision-making capabilities for defense forces. AI-powered analytics and machine learning algorithms help in predictive analysis, reducing response times, and providing actionable intelligence. Similarly, enhanced communication systems, such as secure satellite communications and 5G networks, enable seamless and secure data sharing across military units, ensuring effective coordination during operations. This technological integration is essential for India’s defense modernization agenda, fostering the widespread adoption of NCW systems.

Increased Defense Spending and Strategic Initiatives

India’s growing defense budget is another significant driver of the NCW market. The country is prioritizing the modernization of its military infrastructure as part of its broader defense strategy to safeguard its interests in the Indo-Pacific region. This includes substantial investments in advanced technologies, such as network-centric warfare systems, to enhance operational efficiency, interoperability, and real-time intelligence sharing. The government’s emphasis on self-reliance in defense production and its long-term plans to boost indigenous defense capabilities are likely to increase demand for local NCW solutions, stimulating the market further.

Market Challenges:

Cybersecurity and Vulnerability of Networked Systems

As India continues to adopt network-centric warfare systems, the risk of cyber threats targeting these interconnected platforms is becoming more significant. Securing communication channels, data storage, and military networks is critical for maintaining the integrity of defense operations. With cyberattacks becoming more sophisticated, the vulnerability of India’s NCW systems to hacking, espionage, and data breaches presents a major challenge. These cybersecurity concerns demand continuous investment in advanced encryption, intrusion detection systems, and secure network protocols to safeguard sensitive information and ensure the resilience of military operations.

High Cost of Integration and Maintenance

Another significant challenge faced by the Indian Network Centric Warfare market is the high cost associated with the integration, maintenance, and continuous upgrading of NCW systems. The process of integrating new technologies into existing defense infrastructure requires significant capital investment. Additionally, the complexity of maintaining these advanced systems, ensuring compatibility with legacy technologies, and handling regular updates can further strain financial resources. For India, balancing these costs while keeping within the confines of defense budgets remains a challenge, particularly as defense expenditure is spread across various modernization initiatives.

Opportunities:

Public-Private Partnerships for Technological Advancements

Public-private partnerships (PPPs) present a significant opportunity to drive innovation in the India Network Centric Warfare market. Collaborations between the Indian government and private tech companies can expedite the development and deployment of cutting-edge NCW technologies. This can include areas such as AI, cybersecurity, and secure communication systems. By leveraging the expertise of private sector players, India can reduce the financial burden of defense procurement and ensure that the military receives advanced, cost-effective solutions tailored to specific needs. These partnerships can also stimulate local manufacturing and innovation, contributing to the growth of India’s defense technology sector.

Rising Demand for Autonomous Systems and AI Integration

The increasing reliance on autonomous systems and artificial intelligence (AI) in military operations presents significant growth opportunities for the Indian NCW market. Technologies such as unmanned aerial vehicles (UAVs), drones, and autonomous ground systems are gaining traction due to their ability to enhance surveillance, reconnaissance, and precision strikes. Additionally, AI-based decision support systems are poised to become an integral part of the Indian defense strategy, improving battlefield intelligence and decision-making processes. The demand for these systems is expected to rise, as they not only reduce risks to human personnel but also offer enhanced operational capabilities and effectiveness, providing significant opportunities for market growth.

Future Outlook

Over the next 5 years, the India Network Centric Warfare market is expected to show significant growth, driven by continuous technological advancements, increasing defense spending, and India’s strategic initiatives aimed at enhancing military capabilities. The growing adoption of AI, cloud computing, and satellite technologies in defense applications is expected to expand the role of network-centric warfare systems. Additionally, collaborations with private sector tech companies and the modernization of the Indian military will further push market growth. As India strengthens its defense capabilities and maintains its strategic stance in the Indo-Pacific, the demand for advanced NCW systems will continue to rise.

Major Players

- Bharat Electronics Limited

- Larsen & Toubro Limited

- HCL Technologies

- Boeing India

- Lockheed Martin India

- Thales Group

- Raytheon Technologies

- General Dynamics

- Northrop Grumman

- Saab India

- Rheinmetall Defence

- BAE Systems

- Tata Advanced Systems

- Airbus Defence and Space India

- Dassault Aviation India

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Defence, India)

- Indian Armed Forces

- Indian Defense Contractors

- Defense System Integrators

- Cybersecurity Firms specializing in defense systems

- Defense Technology Manufacturers

- Public Sector Undertakings in Defense

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the critical factors influencing the India Network Centric Warfare market, including key technological advancements, market demand, and geopolitical dynamics. The goal is to map out the various market stakeholders and understand the variables that impact market growth. This is done using secondary research and proprietary industry reports.

Step 2: Market Analysis and Construction

We analyze historical market data, trends, and growth patterns to understand the current market state. This step includes evaluating technological innovations, the ratio of suppliers to demand, and service-based revenue generation. Insights are derived from industry journals, government publications, and defense reports.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth are validated through consultations with industry experts and key players in the field. These consultations help refine assumptions and validate the trends observed in the data.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data and expert feedback. We focus on the validation of key market figures and refine our understanding of current and future market dynamics. Primary research and expert interviews supplement secondary research, ensuring the accuracy of the final report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in AI, 5G, and cloud computing

Increase in defense budget allocations for modernization

Geopolitical tensions driving investment in advanced warfare systems - Market Challenges

Cybersecurity threats to interconnected military systems

High costs associated with system integration and maintenance

Resistance to rapid technology adoption within traditional military structures - Market Opportunities

Collaboration with private sector tech companies for innovation

Growth in autonomous systems and AI for defense applications

Opportunities in regional defense partnerships and alliances - Trends

Increasing demand for data-driven decision-making in military operations

Adoption of advanced unmanned aerial and underwater systems

Focus on enhancing cybersecurity infrastructure within networked defense systems - Government regulations

Indian Ministry of Defence (MoD) procurement policies for defense technologies

Cybersecurity frameworks mandated by the National Critical Information Infrastructure Protection Centre (NCIIPC)

Defense export control regulations and compliance requirements - SWOT analysis

- Porters 5 forces

- By Market Value,2020-2025

- By Installed Units,2020-2025

- By Average System Price,2020-2025

- By System Complexity Tier,2020-2025

- By System Type (In Value%)

Command and Control Systems

Surveillance and Reconnaissance Systems

Communication Systems

Weapons Control Systems

Data Fusion Systems - By Platform Type (In Value%)

Land-based Systems

Airborne Systems

Naval Systems

Space-based Systems

Hybrid Systems - By Fitment Type (In Value%)

New Installations

Upgrades

Retrofits

Modular Systems

Custom Integrations - By End-User Segment (In Value%)

Military

Defense Contractors

Government Agencies

Intelligence Agencies

Private Sector / Civilian Applications - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Resellers

Online Platforms

Government Tenders

OEMs

- Cross Comparison Parameters (Cybersecurity readiness, Technology adoption rate, Regional defense spending, System complexity, Supply chain dynamics)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Bharat Electronics Limited

Larsen & Toubro Limited

HCL Technologies

Wipro Limited

Boeing India

Lockheed Martin India

Thales Group

Raytheon Technologies

General Dynamics

Northrop Grumman

Saab India

Rheinmetall Defence

BAE Systems

Tata Advanced Systems

Airbus Defence and Space India

- Military forces’ growing reliance on real-time data for operations

- Government agencies’ need for secure, reliable communication systems

- Private sector investment in defense and security technologies

- Intelligence agencies’ increasing demand for advanced surveillance solutions

- Forecast Market Value,2026-2035

- Forecast Installed Units,2026-2035

- Price Forecast by System Tier,2026-2035

- Future Demand by Platform,2026-2035