Market Overview

The India on‑board connectivity market is significantly influenced by the global on‑board connectivity sector, which was valued at USD ~ billion based on a recent historical assessment, reflecting widespread adoption of technologies such as onboard Wi‑Fi, satellite communication, and real‑time data services that enhance passenger experience and operational efficiency across transport modes. Robust investments in digital infrastructure, coupled with increasing passenger demand for uninterrupted internet access and smart communication systems, are core factors driving this market’s expansion and technological integration within transport ecosystems.

Major metropolitan regions, including Delhi, Mumbai, and Bengaluru, exhibit heightened adoption of on‑board connectivity solutions because of advanced transportation networks, strong digital infrastructure, and concentrated passenger volumes that amplify the need for reliable connectivity in aviation, rail, and road transit. These cities benefit from government digital initiatives and private sector investments that foster enhanced technological ecosystems, making them focal points for implementation of connectivity solutions. Their established technology ecosystems and strategic transport hubs position them as dominant regions for adoption and ongoing innovation in on‑board connectivity.

Market Segmentation

By Product Type

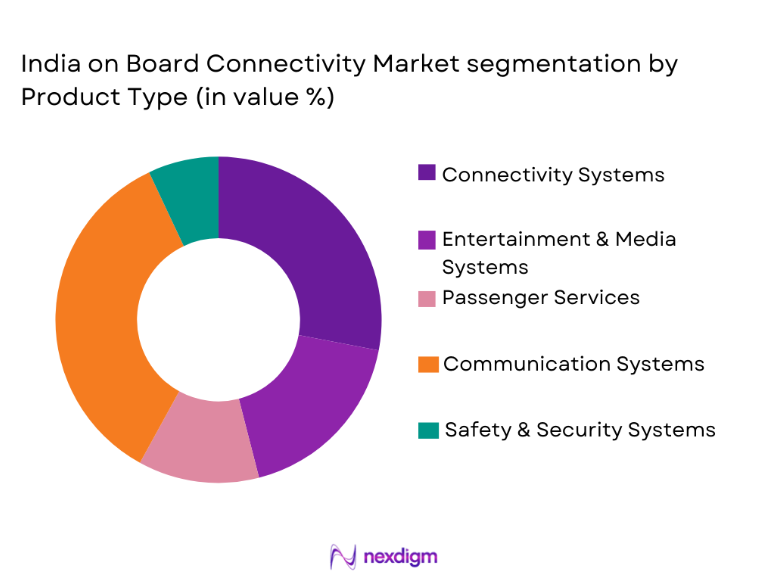

The India on-board connectivity market is segmented by product type into connectivity systems, entertainment & media systems, passenger services, communication systems, and safety & security systems. Communication systems dominate this segment due to the growing demand for seamless and reliable communication during transit. This is particularly important in the aviation and railway sectors, where passengers increasingly expect high-speed internet, real-time data services, and access to entertainment and communication platforms. As transportation providers seek to enhance passenger experiences, they are investing heavily in advanced communication infrastructure. Additionally, the increasing reliance on cloud-based solutions and satellite communication systems for consistent connectivity in remote areas further contributes to the dominance of communication systems in the market. The demand for connectivity systems across all forms of transportation, from cars to airplanes, continues to grow, pushing the adoption of robust communication technologies, thus solidifying the leadership of this sub-segment in the market.

By Platform Type

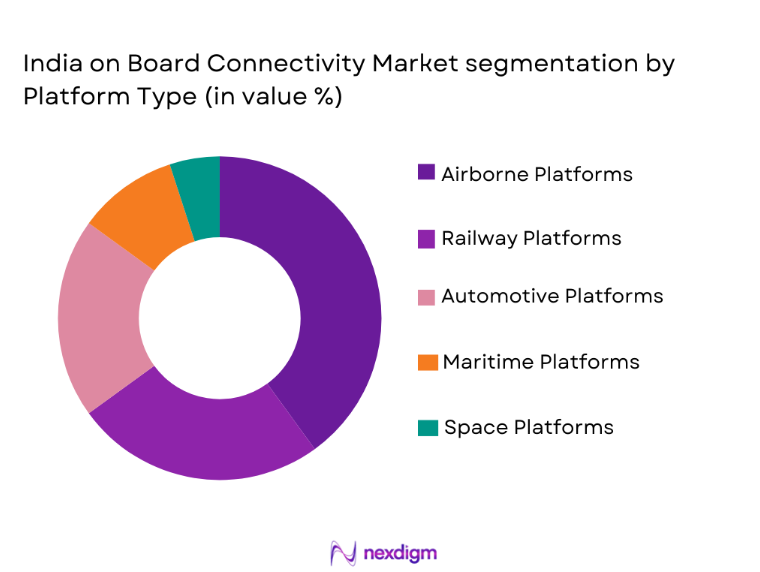

The India on-board connectivity market is segmented by platform type into airborne platforms, railway platforms, automotive platforms, maritime platforms, and space platforms. Airborne platforms currently dominate the market due to the increasing demand for in-flight connectivity services. Airlines are investing in satellite communication systems and Wi-Fi services to meet passengers’ expectations for fast, reliable internet and entertainment during flights. The aviation sector, particularly with the rise of low-cost carriers and domestic travel, is witnessing rapid growth in demand for these services. Additionally, technological advancements in satellite communications, such as low-earth orbit satellites, are helping to enhance connectivity even in remote and underserved regions. With airlines pushing for a better customer experience and regulatory bodies easing restrictions on in-flight connectivity, airborne platforms are expected to continue leading this market segment. As the demand for connected flights rises, this segment will likely see consistent growth in the coming years.

Competitive Landscape

The competitive landscape of the India on-board connectivity market is dynamic, with several large players dominating the space. These companies are continuously innovating and collaborating with transport providers to offer advanced connectivity solutions that meet the evolving demands of passengers and operators alike. Consolidation is evident in the market, as players seek to expand their market presence through strategic partnerships, mergers, and acquisitions. Additionally, key players are increasingly investing in satellite technology, 5G infrastructure, and other next-generation communication solutions to stay competitive and cater to the rising demand for on-board connectivity.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Harris Corporation | 1895 | USA | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~

|

~

|

~

|

~

|

~

|

| Thales Group | 1893 | France | ~

|

~

|

~

|

~

|

~

|

| Rockwell Collins | 1933 | USA | ~

|

~

|

~

|

~

|

~

|

| Panasonic Avionics Corp | 1979 | Japan | ~

|

~

|

~

|

~

|

~

|

India On-Board Connectivity Market Analysis

Growth Drivers

Technological Advancements in Connectivity

Technological advancements in connectivity, particularly in the areas of 5G, satellite communication, and the Internet of Things (IoT), have emerged as key growth drivers in the India on-board connectivity market. The rapid deployment of 5G networks is poised to revolutionize how passengers interact with transportation systems, offering faster, more reliable connectivity and enabling high-bandwidth applications like real-time data streaming, video conferencing, and cloud-based services. For passengers, this means improved internet speeds, greater stability in connections, and the ability to access a broader range of services while traveling, whether for business or leisure. On-board systems equipped with IoT technologies enable vehicles, trains, and airplanes to exchange data in real time, enhancing operational efficiency, improving safety protocols, and providing an overall better passenger experience. For instance, IoT-powered monitoring systems allow for predictive maintenance in real time, reducing downtime and enhancing the reliability of transport modes. Furthermore, satellite communication systems are increasingly relied upon to provide connectivity in remote or hard-to-reach areas, such as in-flight or maritime vessels. These technologies are expected to dramatically increase connectivity coverage across India’s vast transportation network, from high-speed trains to buses in rural regions. As a result, the adoption of advanced connectivity solutions is accelerating across various modes of transport, and technological innovation continues to fuel growth in the on-board connectivity market, providing a solid foundation for its expansion in India. The integration of these advanced technologies into the transport sector aligns with the increasing demand for seamless, uninterrupted communication and enhanced travel experiences, positioning India as a key player in the global on-board connectivity landscape.

Government Support for Smart Transportation and Infrastructure

Government initiatives play a significant role in driving the growth of the India on-board connectivity market. India’s government has placed considerable emphasis on building smart cities and modernizing its transportation networks, both of which rely heavily on advanced connectivity systems to operate efficiently. The government’s push for smart cities under the Smart Cities Mission has encouraged the development of digitally connected infrastructure, including transportation systems that rely on real-time data exchange. This digital transformation, which includes the integration of on-board connectivity solutions, allows transportation providers to enhance operational efficiency, improve passenger experience, and reduce costs through smarter systems. Additionally, the Indian government has launched several initiatives to encourage the modernization of public transport, including the installation of high-speed internet, Wi-Fi services, and other connectivity systems in public transport vehicles. These initiatives are helping to meet the growing passenger demand for seamless connectivity and are expected to continue to drive market expansion. India’s urbanization also contributes significantly to the need for enhanced transportation infrastructure that supports connectivity. With cities becoming more populated and transportation networks increasingly congested, the demand for advanced systems to streamline operations and improve passenger experience is surging. The government’s support in providing funding for public transportation projects, alongside its regulatory framework encouraging digitalization, has fostered the integration of cutting-edge technologies in transport systems. As these efforts progress, the demand for on-board connectivity services is expected to continue rising, making the Indian market a critical player in the development of global smart transportation solutions. The government’s initiatives are thus essential in laying the groundwork for the on-board connectivity market’s sustained growth in India.

Market Challenges

High Implementation and Maintenance Costs

One of the most significant challenges faced by the India on-board connectivity market is the high cost of implementation and ongoing maintenance. The development and deployment of advanced connectivity solutions, such as in-flight Wi-Fi, satellite communication, and IoT-powered monitoring systems, require substantial initial investments in infrastructure and technology. For transportation providers, these high costs can be a considerable barrier, especially for smaller operators or those in less-developed regions with limited budgets. For instance, installing communication systems on buses, trains, or aircraft requires upgrading existing infrastructure to support these advanced technologies, which entails significant financial resources. Additionally, the installation process can be time-consuming, often requiring transportation vehicles to be taken out of service, which can result in operational downtime and revenue loss. Beyond the initial costs, ongoing maintenance expenses also pose a challenge. Connectivity systems require frequent software updates, hardware repairs, and system upgrades to remain functional and efficient. This continuous need for maintenance further elevates the overall operational costs, which can be a burden for transportation companies that are already facing rising costs across other areas of their business. Moreover, the costs associated with ensuring that these systems comply with the regulations and certifications imposed by aviation, rail, and maritime authorities only add to the financial burden. While the demand for on-board connectivity is strong, the inability of smaller transport operators to absorb these high costs can slow down the pace of adoption, particularly in regions with lower levels of financial support or government funding. This challenge needs to be addressed through cost-effective solutions, government subsidies, or financial support to allow for the widespread integration of connectivity services across the transportation sector.

Regulatory and Certification Hurdles

Another significant challenge faced by the India on-board connectivity market is the complex regulatory landscape. India’s transportation sector, including aviation, railways, and maritime, operates under a set of stringent regulations that vary across industries, each with specific requirements for safety, communication, and data management. These regulatory complexities can delay the rollout of on-board connectivity solutions, especially as these systems must comply with local, national, and international standards. For example, in the aviation sector, airlines must adhere to a range of aviation-specific regulations to offer in-flight Wi-Fi or satellite communication services, including certification processes for equipment and compliance with data privacy laws. The certification process can be lengthy, requiring numerous tests and audits to ensure that the connectivity systems meet the required safety standards. This regulatory complexity often results in extended approval timelines, hindering the speed of implementation and adding additional layers of bureaucracy to the process. Similarly, railways and maritime transport systems must comply with different regulatory frameworks that govern the installation and use of on-board communication systems. For instance, Indian Railways must adhere to safety standards regarding the installation of Wi-Fi and communications equipment on trains, which can differ significantly from regulations in other countries. Furthermore, as technology evolves, transportation systems must also meet new and emerging regulatory requirements, which can add to the cost and complexity of upgrading existing infrastructure. The difficulty in navigating these regulations and obtaining necessary certifications can discourage investment in on-board connectivity solutions, especially for smaller or regional transport providers. To overcome this challenge, more harmonized and standardized regulations across the transportation sector would be beneficial, as it would help streamline the approval and implementation process for connectivity systems and reduce compliance-related delays.

Opportunities

Growth of Smart City Projects

The ongoing development of smart cities in India presents a significant opportunity for the on-board connectivity market. With the government’s push under the Smart Cities Mission, there has been a substantial increase in investments aimed at modernizing urban infrastructure and improving public services. A key component of this transformation is the integration of advanced technologies like 5G, IoT, and smart transportation systems, which require robust connectivity solutions. Public transportation networks, such as buses, metro trains, and commuter rail, are at the core of these smart city projects, and the demand for seamless connectivity is growing in tandem with urbanization. Smart city initiatives create a unique opportunity for on-board connectivity providers to offer integrated solutions that connect transport systems with urban management infrastructure. These connectivity solutions can enable features such as real-time passenger information systems, predictive maintenance, smart ticketing, and data-driven traffic management. Additionally, IoT-enabled devices can provide valuable insights for optimizing public transport operations, enhancing safety, and improving passenger experience. The rapid expansion of smart cities, along with the focus on sustainable and efficient public transport systems, is driving the demand for on-board connectivity solutions, offering a lucrative market for technology providers. Moreover, as more cities embrace digitalization, the potential for integrating on-board connectivity into urban transport systems will continue to grow. This represents an excellent opportunity for companies to invest in research and development to offer innovative solutions tailored to the specific needs of smart city transportation networks. For operators and authorities, the integration of connectivity solutions into public transport infrastructure aligns with broader goals of reducing congestion, improving efficiency, and offering better services to citizens, making the adoption of on-board connectivity systems a strategic necessity.

Increased Demand for 5G Connectivity in Transportation

The rollout of 5G technology is one of the most promising opportunities for the on-board connectivity market in India. 5G promises to revolutionize how passengers connect to the internet while traveling, providing faster download and upload speeds, lower latency, and more reliable connections compared to previous generations of wireless technology. With the Indian government’s focus on advancing digital infrastructure and ensuring nationwide 5G coverage, transportation providers are increasingly turning to 5G technology to meet the growing demand for high-speed, uninterrupted connectivity. For passengers, the promise of 5G means enhanced experiences such as faster internet for entertainment, high-definition video streaming, and more reliable communication for professional needs. For transportation companies, 5G opens up the possibility for more efficient operations, such as the integration of autonomous vehicles, real-time tracking, and smart fleet management solutions that rely on fast, stable networks. Furthermore, 5G enables more efficient data management and analysis, allowing operators to collect and process vast amounts of real-time data from connected vehicles, trains, or aircraft. This data can be used to optimize routes, predict maintenance needs, and ensure smoother operations, all of which contribute to better overall service quality. The widespread implementation of 5G in transportation systems will also support innovations in areas like telematics, augmented reality for navigation, and advanced safety features such as collision avoidance systems in autonomous vehicles. As India continues to roll out 5G, the demand for on-board connectivity will expand exponentially, creating a massive market opportunity for companies offering 5G-powered connectivity solutions. This growth in demand will be fueled not only by passengers seeking better connectivity but also by transportation providers eager to improve operational efficiency and service delivery.

Future Outlook

The future outlook for the India on-board connectivity market is positive, with expected continued growth over the next five years. The demand for high-speed internet, seamless communication, and enhanced passenger experiences will drive the adoption of advanced connectivity solutions across various transportation platforms. Technological advancements, particularly in 5G, IoT, and satellite communication, will further support the market’s expansion. As the Indian government continues to invest in smart city infrastructure and digitalization, the need for integrated, real-time connectivity solutions will become increasingly vital for the transportation sector.

Major Players

- Harris Corporation

- Collins Aerospace

- Thales Group

- Rockwell Collins

- Panasonic Avionics Corporation

- Gogo Inc.

- ZyXEL Communications

- Inmarsat Plc

- Viasat Inc.

- Ericsson

- Iridium Communications Inc.

- Kymeta Corporation

- Satcom Direct

- Gilat Satellite Networks

- Huawei Technologies

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airlines

- Railway companies

- Automotive manufacturers

- Public transport authorities

- Infrastructure development agencies

- Transportation technology developers

Research Methodology

Step 1: Identification of Key Variables

In this initial step, key market variables such as market size, growth drivers, challenges, and segmentation criteria are identified. These variables form the foundation for the entire research process. The focus is to define the scope and boundaries of the market under study. Additionally, relevant data sources and research objectives are aligned to ensure comprehensive coverage.

Step 2: Market Analysis and Construction

This step involves detailed data collection from both primary and secondary sources, such as market reports, company profiles, and expert interviews. The gathered data is analyzed to identify trends, consumer behavior, and competitive landscape. Segmentation of the market by product type, platform, and other variables is carried out. Insights are then synthesized to form a clear picture of the current market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

The insights and assumptions derived from the market analysis are validated through expert consultations. Industry leaders, analysts, and stakeholders provide valuable feedback on the findings, helping to refine the research. This step ensures the accuracy and relevance of the data. Expert validation is critical in confirming or adjusting hypotheses and improving the credibility of the report.

Step 4: Research Synthesis and Final Output

After validating the research findings, the data is synthesized into a cohesive report. Key conclusions, insights, and market forecasts are drawn, with a focus on actionable recommendations. The final report is structured to provide a comprehensive understanding of the market dynamics and trends. The outcome is presented in a clear, structured format, ready for dissemination to stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for High-speed Connectivity

Expansion of Commercial Air Travel

Advancements in Satellite Communication Technology

Government Initiatives for Smart Transportation Systems

Rising Demand for In-flight Entertainment - Market Challenges

High Installation & Maintenance Costs

Data Security & Privacy Concerns

Complex Regulatory Compliance

Technological Integration with Legacy Systems

High Competition and Market Fragmentation - Market Opportunities

Growth of Low-cost Airline Market

Introduction of 5G in Aviation

Development of Next-gen Connectivity Solutions - Trends

Increasing Adoption of IoT in Aircraft Systems

Enhanced Passenger Experience Focus

Shift Towards Autonomous Aircraft Communication Systems

Integration of AI for Network Optimization

Demand for Real-time Data Communication - Government Regulations & Defense Policy

Aviation Connectivity Policy Updates

Regulations for Satellite Communication

Aerospace Safety Standards - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Satellite-Based Connectivity

Wi-Fi Solutions

Mobile Data Solutions

Broadband Access Systems

Satellite Communication Systems - By Platform Type (In Value%)

Aerospace Platforms

Marine Platforms

Rail Platforms

Automotive Platforms

Land-based Platforms - By Fitment Type (In Value%)

Linefit

Retrofit

Mobile Connectivity Solutions

Standalone Connectivity Units

Integrated Systems - By EndUser Segment (In Value%)

Aerospace Industry

Railways & Transportation

Defense & Military

Commercial Airlines

Private Jet Operators - By Procurement Channel (In Value%)

Direct Sales

Third-party Integrators

Online Marketplaces

OEM Channel

Government Contracts - By Material / Technology (in Value%)

Satellites and Antennas

Modems & Routers

Signal Processing Units

Software and Control Systems

Power Amplifiers

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Pricing, Technology, Market Share, Product Offerings, Distribution Channels)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

Honeywell Aerospace

Gogo Inc.

Satcom Direct

Viasat Inc.

Inmarsat

Thales Group

Panasonic Avionics

Rockwell Collins

Zodiac Aerospace

Global Eagle Entertainment

Cobham plc

L3 Technologies

Sitaonair

MTU Aero Engines

Iridium Communications

- Focus on Seamless Passenger Connectivity

- Growth in Private Jet and Charter Services

- Increased Use of Connectivity in Military Aircraft

- Adoption of Smart Transport Technologies in Railways

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035