Market Overview

The India Online Furniture and Leasing market current size stands at around USD ~ million, supported by expanding urban mobility and digital consumption behavior. Demand growth during 2024 and 2025 was driven by increased rental adoption among younger demographics and professionals. Subscription-based furniture models gained traction due to flexible tenure options and reduced upfront commitments. The market witnessed rising platform penetration across metropolitan regions supported by logistics network expansion. Increased preference for furnished rental housing contributed to consistent transaction volumes. Platform-based leasing also benefited from improved payment infrastructure and app-based user engagement.

The market is primarily concentrated across major urban centers with high residential mobility and strong rental housing demand. Cities with large student populations and technology workforces exhibit higher platform usage intensity. Southern and western regions show stronger ecosystem maturity due to startup density and logistics readiness. Northern urban clusters demonstrate increasing adoption driven by co-living expansion. Policy frameworks supporting digital commerce and logistics modernization continue strengthening regional market participation.

Market Segmentation

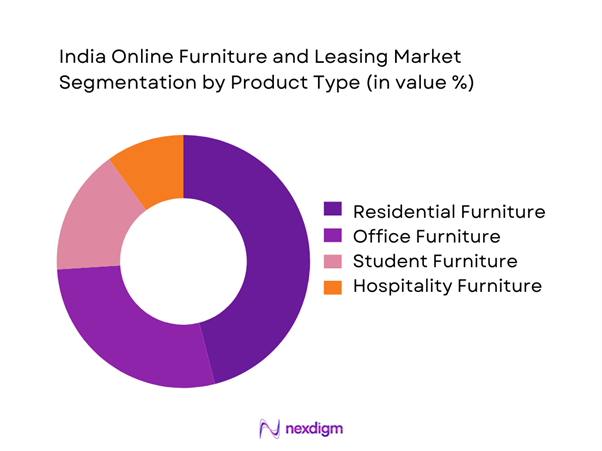

By Product Type

The market is dominated by residential furniture categories due to high rental demand from urban migrants and young professionals. Beds, sofas, wardrobes, and workstations account for significant leasing volumes owing to recurring replacement cycles. Office furniture leasing has grown steadily with hybrid working trends and startup expansion. Short-term rental furniture demand has risen due to flexible living arrangements and relocation frequency. Product standardization and modular design have improved asset utilization rates across platforms. Increased consumer preference for bundled furniture packages continues to influence product-level demand patterns across cities.

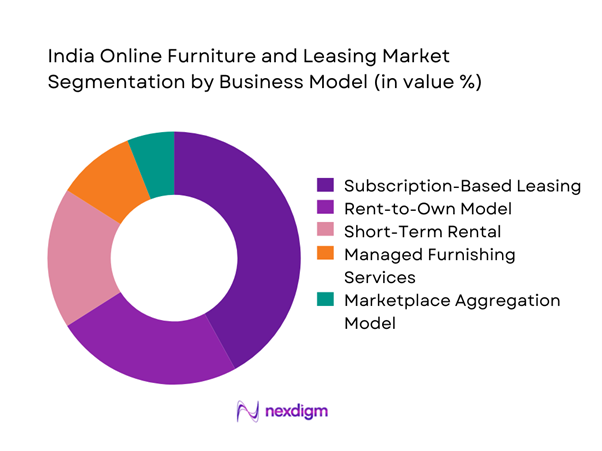

By Business Model

The market is increasingly shaped by differentiated business models that determine asset ownership, pricing flexibility, and service scalability. Subscription-based models dominate due to predictable monthly billing and high customer retention, particularly among urban renters and young professionals. Rent-to-own models attract price-sensitive consumers seeking eventual ownership without high upfront commitments. Pure rental models continue to serve short-term users such as students and temporary professionals. Managed furnishing solutions are gaining traction among co-living operators and enterprises requiring turnkey deployment. Platform-led aggregation models enable faster geographic expansion with lower capital intensity, strengthening market reach and operational flexibility.

Competitive Landscape

The competitive landscape is characterized by platform-driven service models and asset management capabilities. Market participants focus on logistics efficiency, product variety, and subscription flexibility to strengthen positioning.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Rentomojo | 2014 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Furlenco | 2012 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Pepperfry | 2012 | Mumbai | ~ | ~ | ~ | ~ | ~ | ~ |

| Urban Ladder | 2012 | Bengaluru | ~ | ~ | ~ | ~ | ~ | ~ |

| Cityfurnish | 2015 | Gurugram | ~ | ~ | ~ | ~ | ~ | ~ |

India Online Furniture and Leasing Market Analysis

Growth Drivers

Rising urban mobility and rental culture

Urban migration levels exceeded 30 percent of total population in 2023, increasing demand for flexible furniture solutions. Over 65 percent of urban households reported rental occupancy preferences during 2024 due to employment mobility. Government urbanization programs expanded housing availability across more than 100 smart cities nationwide. Rising student enrollments above 40 million increased short-term accommodation requirements significantly. Workforce mobility across technology hubs rose by over 18 percent during 2024. Rental housing registrations increased across eight major metropolitan regions in 2025. Urban housing supply constraints encouraged shared living arrangements across multiple income groups. Digital rental platforms processed millions of transactions supporting rapid adoption. Policy focus on urban development enhanced rental ecosystem stability. Changing lifestyle patterns continue reinforcing rental furniture acceptance.

Increasing penetration of digital commerce

Internet penetration exceeded 65 percent nationally in 2024, supporting digital platform adoption. Smartphone usage crossed 750 million active users enabling mobile-based service access. Digital payment adoption rose above 85 percent for urban consumer transactions. Government digital infrastructure programs strengthened e-commerce reliability nationwide. App-based customer onboarding reduced service access time significantly. Digital logistics tracking improved fulfillment transparency across major cities. Cloud-based platforms enhanced inventory and order management efficiency. Consumer trust in online services increased steadily across income groups. Digital literacy initiatives supported wider participation in rental ecosystems. Platform scalability improved operational consistency across multiple locations.

Challenges

High logistics and reverse logistics costs

Urban congestion increased delivery time averages by over 25 percent during 2024. Fuel price volatility impacted transportation efficiency across metropolitan logistics networks. Reverse logistics volumes rose significantly due to short rental tenures. Storage infrastructure shortages increased asset handling complexity. Warehousing costs rose across tier one cities due to limited space availability. Damage rates increased with frequent asset relocation cycles. Maintenance turnaround time extended across high-demand regions. Fleet utilization inefficiencies reduced operational productivity levels. Last-mile delivery reliability remained inconsistent across dense urban areas. Cost pressures continued affecting service scalability.

Asset damage and depreciation risks

Average asset utilization cycles shortened significantly during high-demand periods. Furniture refurbishment frequency increased due to intensive consumer usage patterns. Damage rates rose across high-mobility customer segments. Asset tracking inefficiencies affected lifecycle management accuracy. Inventory depreciation accelerated under continuous deployment conditions. Replacement requirements increased operational expenditure pressures. Insurance coverage gaps limited financial risk mitigation. Asset recovery challenges impacted long-term value retention. Maintenance infrastructure expansion lagged asset deployment growth. Depreciation management remains a core operational concern.

Opportunities

Expansion into tier II and tier III cities

Rising urbanization in smaller cities creates new demand for rental furniture solutions. Migration to emerging economic hubs increases short-term housing requirements. Lower competition levels allow faster customer acquisition opportunities. Digital penetration supports platform-based service expansion beyond metros. Affordable housing projects encourage furnished rental adoption. Local logistics networks are improving steadily in smaller cities. Consumer awareness of rental benefits continues to increase. Flexible pricing models attract first-time renters effectively. Regional partnerships can accelerate market penetration. Untapped demand potential remains substantial across emerging urban clusters.

Corporate and B2B leasing growth

Corporate workspace expansion drives demand for scalable furniture leasing solutions. Hybrid working models increase short-term office setup requirements. Startups prefer leasing to preserve capital expenditure flexibility. Large enterprises adopt leasing for project-based operations. Customized furniture packages support enterprise-level deployment efficiency. Service-level agreements enhance reliability and long-term engagement. B2B contracts ensure stable recurring revenue streams. Workspace optimization trends boost furniture turnover rates. Leasing supports rapid business expansion needs. Corporate adoption strengthens overall market stability.

Future Outlook

The market is expected to maintain strong momentum driven by urbanization and digital consumption patterns. Platform innovation and service integration will define competitive differentiation. Expansion into non-metro regions will broaden customer bases. Sustainability and asset optimization will gain importance. Long-term growth will be supported by evolving lifestyle preferences.

Major Players

- Rentomojo

- Furlenco

- Pepperfry

- Urban Ladder

- Cityfurnish

- Rentickle

- Guarented

- Featherlite

- Godrej Interio

- Wakefit

- HomeLane

- IKEA India

- Flipkart Furniture

- Amazon Furniture

- Livspace

Key Target Audience

- Urban residential renters

- Co-living space operators

- Corporate offices and enterprises

- Real estate developers

- Property management firms

- Startup incubators and coworking spaces

- Investments and venture capital firms

- Ministry of Housing and Urban Affairs

Research Methodology

Step 1: Identification of Key Variables

Market scope was defined using product types, end users, and platform models. Key demand drivers and usage patterns were mapped. Regional adoption dynamics were identified based on urbanization trends.

Step 2: Market Analysis and Construction

Data points were structured through platform activity assessment and service penetration analysis. Segmentation logic was developed using operational and consumption indicators.

Step 3: Hypothesis Validation and Expert Consultation

Industry participants and operational stakeholders were consulted to validate assumptions. Feedback helped refine growth drivers and challenge areas.

Step 4: Research Synthesis and Final Output

Insights were consolidated through cross-validation techniques. Findings were structured to ensure consistency, accuracy, and market relevance.

- Executive Summary

- Research Methodology (Market Definitions and online furniture leasing scope mapping, Digital platform and asset ownership taxonomy development, Bottom-up revenue estimation from rental contracts and order volumes, Pricing and subscription revenue modeling across tenure types, Primary interviews with platform operators and logistics partners, Data triangulation using platform metrics and financial disclosures, Assumptions on asset lifecycle, refurbishment cycles, and utilization rates)

- Definition and Scope

- Market evolution

- Usage and consumption patterns across rental and ownership models

- Ecosystem structure including platforms and logistics partners

- Supply chain and fulfillment model

- Regulatory and compliance environment

- Growth Drivers

Rising urban mobility and rental culture

Increasing penetration of digital commerce

Growing millennial and student population

Flexible workspaces and hybrid work adoption

Lower upfront cost compared to ownership

Expansion of co-living and managed housing - Challenges

High logistics and reverse logistics costs

Asset damage and depreciation risks

Customer churn and contract defaults

Inventory utilization inefficiencies

Price sensitivity and margin pressure

Regulatory ambiguity in rental taxation - Opportunities

Expansion into tier II and tier III cities

Corporate and B2B leasing growth

Smart furniture and IoT-enabled assets

Partnerships with real estate developers

Subscription bundling with appliances

Green and refurbished furniture demand - Trends

Shift toward asset-light business models

AI-driven pricing and demand forecasting

Growth of furniture-as-a-service offerings

Integration of financing and BNPL options

Focus on sustainability and circular economy

Increased app-based customer engagement - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Average Revenue per Order, 2020–2025

- By Fleet Type (in Value %)

Residential furniture

Beds and mattresses

Sofas and seating units

Wardrobes and storage units

Dining tables and chairs

Study tables and workstations

Office and corporate furniture

Workstations and cubicles

Office chairs and ergonomic seating

Conference tables

Storage and filing units

Reception and lounge furniture

Student housing furniture

Single beds and bunk beds

Study tables and chairs

Wardrobes and compact storage

Shared seating furniture

Hospitality and co-living furniture

Beds and headboards

Sofas and lounge seating

Side tables and utility furniture

Wardrobes and modular storage

Common area furniture - By Business Model

Subscription-based leasing

Rent-to-own model

Short-term rental model

Managed furnishing services

Marketplace-led aggregation model - By End-Use Industry (in Value %)

Residential consumers

SMEs and startups

Large enterprises

Co-living and co-working operators - By Connectivity Type (in Value %)

Mobile application-based platforms

Web-based platforms

Omnichannel models - By Region (in Value %)

North India

Delhi NCR

Haryana

Punjab

Uttar Pradesh

Rajasthan

South India

Karnataka

Tamil Nadu

Telangana

Andhra Pradesh

Kerala

West India

Maharashtra

Gujarat

Rajasthan

Goa

East India

West Bengal

Odisha

Bihar

Jharkhand

North Eastern States

- Market structure and competitive positioning

Market share on the basis of GMV

Market share on the basis of Number of Transactions - Cross Comparison Parameters Cross Comparison Parameters (Business model, Asset ownership structure, Product portfolio depth, Geographic footprint, Logistics capability, Customer segment focus, Subscription flexibility, Service turnaround time, Technology integration, Brand positioning, After-sales and maintenance support, Corporate and B2B focus, Partnerships and ecosystem integration, Brand positioning and recall)

- Operational Cross Comparison Parameters (GMV, GMV split by type of product, number of orders, average order value, best selling product, sourcing, target audience, focus region, GMV split by states, traffic, conversion rate, EBITDA, EBITDA margin, number of employees, average duration of rental, orders by rental duration)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Rentomojo

Furlenco

Pepperfry

Urban Ladder

Rentickle

Cityfurnish

Guarented

IKEA India

Flipkart Furniture

Amazon Furniture

Wakefit

Godrej Interio

Featherlite

HomeLane

Livspace

- Urban renters and migrant professionals

- Students and shared accommodation residents

- Co-living and managed housing operators

- Startups and SMEs

- Large corporate offices

- Hospitality and serviced apartment operators

- By Value, 2026–2032

- By Volume, 2026–2032

- By Average Revenue per Order, 2026–2032