Market Overview

The India optical satellite communication market has grown significantly, driven by the increasing demand for high-speed, low-latency communication services. The market size is valued at approximately USD ~ billion, underpinned by the surge in satellite launches and advancements in optical communication technologies. As industries like telecommunications, defense, and aerospace increasingly rely on enhanced satellite communication for faster, more reliable services, the demand for optical satellite communication continues to rise. The expanding global need for seamless connectivity plays a pivotal role in shaping market dynamics.

India’s dominance in the optical satellite communication market is fueled by its strong space capabilities, led by ISRO. Major cities like Bengaluru, Hyderabad, and Delhi have become hubs for satellite communication research and development, driven by both government initiatives and private sector investments. India’s growing participation in global satellite programs and its robust infrastructure have solidified its position in the optical satellite communication space. Increased collaboration with international space agencies further strengthens India’s market leadership.

Market Segmentation

By Product Type

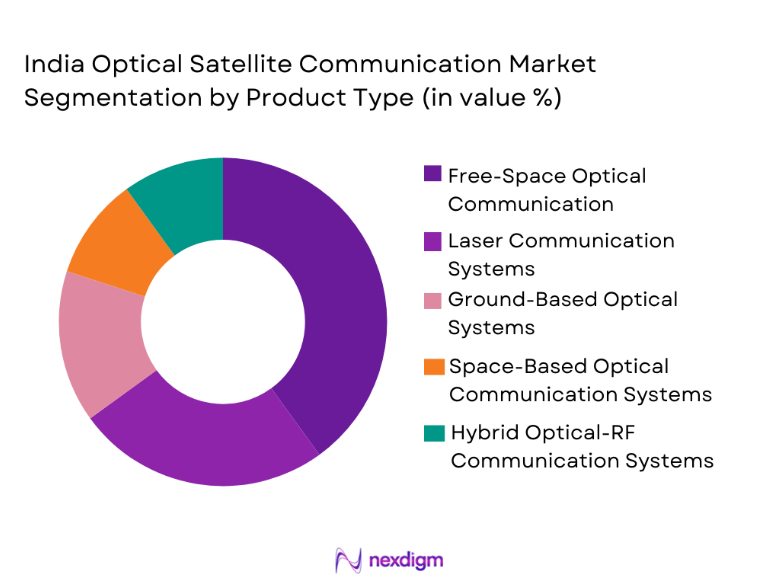

India optical satellite communication market is segmented by product type into free-space optical communication, laser communication systems, ground-based optical systems, space-based optical communication systems, and hybrid optical-RF communication systems. Among these, free-space optical communication systems have a dominant market share due to their ability to provide high-speed, secure communication over long distances. Their growing adoption in both commercial and defense sectors is attributed to their cost-effectiveness, as they eliminate the need for traditional communication cables, reducing infrastructure costs. These systems are particularly advantageous for remote areas where establishing conventional communication networks is impractical. Additionally, the increasing deployment of low Earth orbit (LEO) satellites has further amplified the demand for free-space optical communication, as these systems offer lower latency and greater bandwidth. The use of free-space optical communication systems is also projected to grow as more industries, particularly telecommunications and aerospace, adopt this advanced technology for faster and more secure data transmission.

By Platform Type

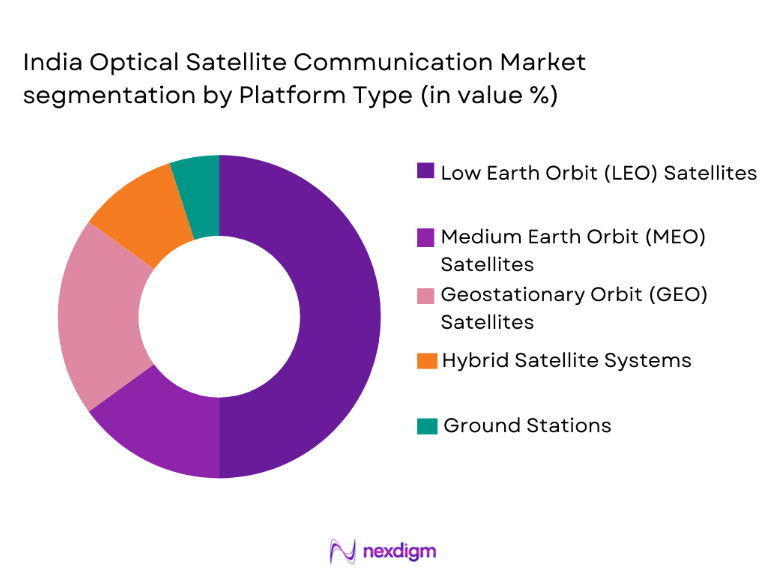

India optical satellite communication market is segmented by platform type into low Earth orbit (LEO) satellites, medium Earth orbit (MEO) satellites, geostationary orbit (GEO) satellites, hybrid satellite systems, and ground stations. The dominant sub-segment in this category is LEO satellites, which have gained significant traction due to their lower latency and cost-effectiveness compared to MEO and GEO satellites. LEO satellites operate at a lower altitude, allowing them to provide real-time communication with minimal delay. This is particularly important for applications such as satellite broadband, where speed and reliability are paramount. LEO satellites are also more affordable to launch and maintain, making them a preferred choice for many telecommunications companies and satellite operators. The cost-efficiency and ability to deliver high-speed data communication make LEO satellites the ideal choice for expanding internet coverage in rural and underserved areas. Furthermore, the growing investment in LEO satellite constellations by companies such as SpaceX and OneWeb further strengthens the dominance of LEO satellites in the optical satellite communication market.

Competitive Landscape

The India optical satellite communication market is competitive, with both public and private players contributing to its expansion. The market is characterized by a growing interest in satellite communication systems, leading to mergers, partnerships, and increased investment in technological advancements. Leading players are leveraging their technical expertise, infrastructure, and regulatory support to maintain market leadership. With ISRO at the forefront, the government continues to play a crucial role in shaping the market’s direction, promoting innovation and fostering collaboration with private and international entities. Additionally, global companies like SpaceX and OneWeb are increasing their presence in India, further intensifying competition. These developments are creating opportunities for both established companies and emerging players to compete for market share and secure partnerships that will drive growth in the sector.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Satellite Launch Capacity |

| ISRO | 1969 | Bengaluru | ~ | ~ | ~ | ~ | ~ |

| SpaceX | 2002 | Hawthorne | ~

|

~

|

~

|

~

|

~

|

| Hughes Communications | 1971 | Maryland | ~

|

~

|

~

|

~

|

~

|

| SES S.A. | 1985 | Luxembourg | ~

|

~

|

~

|

~

|

~

|

| OneWeb | 2012 | London | ~

|

~

|

~

|

~

|

~

|

India Optical Satellite Communication Market Analysis

Growth Drivers

Rising Demand for High-Speed Broadband

The increasing demand for high-speed broadband services in India is a significant growth driver for the optical satellite communication market. The government’s Digital India initiative, aimed at transforming India into a digitally empowered society, is pushing for improved broadband access across the country. With a focus on bridging the urban-rural divide, these efforts are especially targeted at underserved and remote areas, where laying terrestrial broadband infrastructure is often impractical or too expensive. Optical satellite communication systems provide a viable solution, offering high-speed internet connectivity via satellites without requiring physical cables. The country’s expanding internet user base, driven by the growing number of smartphones, digital services, and mobile internet subscriptions, has created an increasing need for reliable and high-speed internet access. Demand for data-intensive applications, such as online education, telemedicine, cloud computing, and e-commerce, has surged across India, especially in rural and remote areas. As the internet becomes a crucial tool for economic and social development, the need for seamless connectivity grows. Optical satellite communication is poised to meet this demand as it provides not only high bandwidth but also low latency and secure communication channels, making it ideal for applications where high-speed and reliable connections are essential. Moreover, the government’s emphasis on satellite broadband initiatives, such as the BharatNet and PM-WANI schemes, is helping to catalyze the adoption of optical communication technologies. As these initiatives gain momentum, the optical satellite communication market is poised for rapid growth, with increased government support and private investments facilitating the expansion of broadband services across India. As more remote and underserved regions gain access to high-speed satellite-based internet, the overall demand for optical satellite communication will continue to accelerate, making it a major driver of market growth.

Technological Advancements in Satellite Communication

Technological advancements in satellite communication systems have played a crucial role in driving the growth of the optical satellite communication market in India. Innovations in laser communication systems, free-space optical communication, and hybrid radio frequency-optical communication systems have dramatically improved satellite communication capabilities. Optical communication systems, utilizing laser technology to transmit data through space, offer much higher data transmission rates compared to traditional radio frequency systems, allowing for greater bandwidth and faster speeds. These technologies are essential in meeting the increasing demand for real-time, high-speed data transmission for applications such as telemedicine, online education, and IoT systems. Furthermore, optical communication systems are becoming more efficient and cost-effective, thanks to advancements in miniaturization and the reduction of manufacturing costs. As these systems become more affordable, their adoption across industries such as telecommunications, defense, and aerospace has accelerated. The development of low Earth orbit (LEO) satellites, which operate closer to Earth and provide lower latency, has been another significant advancement in optical satellite communication. LEO satellites are ideally suited for optical communication as they offer faster data transmission with minimal signal degradation, making them perfect for applications requiring real-time communication. The continued improvement in satellite infrastructure, coupled with the advancements in optical communication technologies, positions India to benefit greatly from these innovations. In particular, India’s space agency, ISRO, has made strides in optical satellite communication, with various satellite programs and projects aimed at advancing communication systems. The country’s growing involvement in global space initiatives and its collaboration with private players further enhance its ability to implement cutting-edge optical communication technologies. As optical communication systems continue to evolve, their implementation in satellite networks will drive growth in the Indian market, making them a key factor in meeting the country’s digital connectivity demands.

Market Challenges

High Infrastructure Costs

One of the most significant challenges facing the India optical satellite communication market is the high cost of infrastructure development. Establishing a comprehensive optical satellite communication system requires substantial investments in both ground-based infrastructure and satellite technology. These systems involve complex equipment and technology, such as laser communication devices, ground stations, and the development of LEO (Low Earth Orbit) satellites, all of which demand significant capital. The infrastructure to support optical communication systems, especially in rural and underserved areas, can be particularly costly. The construction of ground stations and the installation of optical communication systems require specialized infrastructure and maintenance, which are often difficult to finance. Additionally, the high costs of launching and maintaining satellites exacerbate this challenge, as India needs to ensure that the satellites are capable of providing continuous service across vast geographical areas. The complexity of these optical systems, including precise alignment and calibration to ensure reliable communication, adds another layer of financial difficulty. For smaller companies or startups in the optical satellite communication space, these high initial and operational costs can be a barrier to entry. Even for established players, the scale of investment required can limit the pace at which they can expand and deploy these systems. While large corporations like ISRO and global private companies like SpaceX and OneWeb have the financial resources to invest in these systems, smaller competitors may struggle. The high cost of infrastructure development can also slow down the pace of technological adoption and hinder the overall market growth in India, particularly in remote areas where investments are less likely to see immediate returns. Overcoming this challenge requires increased funding from both public and private sectors, as well as international collaboration to share the costs associated with the development of optical satellite communication infrastructure.

Regulatory Hurdles and Spectrum Management

The optical satellite communication market in India faces significant regulatory challenges, particularly in the areas of spectrum management and the approval of satellite launches. As optical satellite communication systems become more prevalent, the demand for spectrum, which is a limited resource, is growing. The regulatory environment in India, which governs the allocation of satellite frequencies, plays a crucial role in determining the pace at which optical satellite communication can expand. However, the complexity of spectrum allocation and the competition for frequencies between different satellite operators and communication technologies can create bottlenecks that delay the development and deployment of optical communication systems. Optical communication requires specific frequency bands for the transmission of data, and as more players enter the market, there is growing pressure on the available spectrum. In some cases, the allocation process can be slow and cumbersome, hindering the ability of companies to deploy their optical communication systems in a timely manner. Furthermore, the lack of a streamlined and transparent regulatory framework for optical communication technologies in India further complicates the process. Satellite operators often face challenges when trying to obtain the necessary licenses and approvals to deploy their optical communication systems. These regulatory hurdles can be particularly problematic for new entrants, who may find it difficult to navigate India’s complex regulatory environment. The situation is further complicated by the global nature of satellite communication, which requires coordination with international regulatory bodies and adherence to international standards. The lack of clear guidelines for optical satellite communication systems could discourage investment in the sector and slow the pace of market growth. To address these challenges, India will need to modernize its regulatory framework to accommodate emerging satellite communication technologies and establish more efficient spectrum management practices to facilitate the growth of the optical satellite communication market.

Opportunities

Expansion of Satellite Broadband Services in Rural Areas

One of the most significant opportunities in the India optical satellite communication market lies in the expansion of satellite broadband services, particularly in rural and remote areas. Despite the rapid urbanization and growth of internet connectivity in India, a large portion of the rural population still lacks access to reliable, high-speed internet. The government’s Digital India initiative has been instrumental in promoting broadband connectivity, but a significant gap remains, particularly in areas where traditional broadband infrastructure, such as fiber optic cables, is not feasible due to geographical challenges. Optical satellite communication offers a viable solution to bridge this gap by providing high-speed internet connectivity to rural and remote regions. Optical communication systems, which offer low-latency, high-bandwidth data transmission, are ideal for delivering high-speed internet in areas with limited infrastructure. Satellite broadband services are becoming increasingly popular in these regions, where terrestrial networks often fail to meet demand. The Indian government’s commitment to increasing internet penetration through initiatives like BharatNet and PM-WANI is creating significant growth opportunities for optical satellite communication providers. With these initiatives, the government plans to connect thousands of villages and towns to high-speed broadband networks using satellite technology, which could have a substantial impact on India’s digital transformation. Additionally, private companies like SpaceX and OneWeb are already investing in satellite constellations to deliver broadband connectivity in underserved regions, further boosting the market’s growth potential. The demand for satellite broadband services is expected to increase as more individuals and businesses in rural India require internet access for various activities, such as e-commerce, telemedicine, and online education. This expansion of satellite broadband presents a massive opportunity for optical satellite communication providers to grow their market share, providing fast and affordable internet services to millions of people.

Collaboration with Global Satellite Agencies and Private Players

Another key opportunity for the India optical satellite communication market lies in the potential for collaboration with global satellite agencies and private sector players. As India continues to develop its space infrastructure and capabilities, partnerships with international space agencies, such as NASA, the European Space Agency (ESA), and private companies like SpaceX, OneWeb, and Amazon’s Project Kuiper, could unlock significant market growth. These collaborations can foster the exchange of knowledge, technology, and resources, driving advancements in optical satellite communication systems. India’s space agency, ISRO, already has a strong track record in satellite communication and is involved in several international collaborations. These partnerships can facilitate the sharing of advanced technologies in optical satellite communication, which can be critical for enhancing the country’s existing satellite networks and systems. Global partnerships also enable Indian players to tap into the international market, expanding the reach of their optical satellite communication technologies beyond the domestic landscape. For example, ISRO’s successful deployment of the GSAT series of satellites and the Gaganyaan space mission provides a foundation for further advancements in optical communication systems. Additionally, collaborations can help streamline regulatory processes, enabling faster approvals for satellite launches and communication deployments. Partnerships with private satellite companies like SpaceX, which is deploying large-scale low Earth orbit (LEO) satellite constellations for broadband services, can also help integrate optical communication systems into these networks, ensuring high-speed, low-latency communication. With the increasing demand for global broadband connectivity and the growing need for secure, high-speed data transmission, India’s participation in global satellite initiatives presents a significant opportunity to develop cutting-edge optical satellite communication systems and expand its influence in the global market.

Future Outlook

The future outlook for the India optical satellite communication market is highly promising, with continued advancements in satellite technology and increased government support. Over the next five years, the market is expected to see substantial growth, driven by the expansion of satellite broadband services, technological innovation in optical communication systems, and further regulatory support. Key trends such as the miniaturization of satellites and the continued development of LEO satellites will provide additional opportunities for the market to thrive. Additionally, the increasing need for secure, high-speed communication systems will ensure the continued relevance and importance of optical satellite communication technologies in India.

Major Players

- ISRO

- SpaceX

- Hughes Communications

- SES S.A.

- OneWeb

- Boeing

- Lockheed Martin

- Thales Alenia Space

- Viasat

- Iridium Communications

- Intelsat

- Telesat

- Airbus

- Northrop Grumman

- China Aerospace Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite manufacturers and service providers

- Telecommunications service providers

- Defense agencies and military contractors

- Aerospace companies

- Broadband service providers

- Technology integrators

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key variables that influence the optical satellite communication market in India, including technological advancements, market trends, government regulations, and customer demand. A thorough examination of these variables helps establish the foundations for the market analysis. Key factors such as satellite communication capabilities, demand for broadband services, and infrastructure development are prioritized for evaluation. The impact of these variables on market growth is assessed through both qualitative and quantitative research methods.

Step 2: Market Analysis and Construction

In this phase, both primary and secondary research methodologies are used to construct a comprehensive market model. This includes gathering data from industry reports, government publications, and expert interviews to assess the market size, growth rate, and competitive landscape. Analysis of historical trends, technological evolution, and regional disparities in connectivity is conducted to provide a detailed view of the market. The information gathered is synthesized into a cohesive model that forecasts potential growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy of the findings, hypotheses and assumptions derived from initial research are validated through consultations with industry experts, satellite operators, and regulatory bodies. This process provides additional insights and confirmation on the factors affecting the market, including technological barriers and government initiatives. Expert feedback helps refine the research approach and validate conclusions, ensuring the reliability of market projections. This collaborative approach enriches the analysis and adds depth to the findings.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing all collected data into actionable insights that are presented in a structured report. The research findings are analyzed and compiled into a comprehensive report detailing market opportunities, challenges, and forecasts. The final output includes a strategic overview, market segmentation, growth drivers, and key trends. The report is designed to provide stakeholders with a clear understanding of the market’s current state and future prospects, aiding in decision-making processes.

- Executive Summary

- India Optical Satellite Communication Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased demand for high-speed internet in remote regions

Government investments in space infrastructure

Growing adoption of LEO satellites for global coverage

Rising need for secure military communication systems

Technological advancements in optical communication systems - Market Challenges

High cost of optical communication infrastructure

Regulatory challenges in spectrum allocation

Technical limitations in maintaining communication quality over long distances

Limited availability of skilled workforce in optical communication technologies

Geopolitical tensions affecting cross-border satellite communication - Market Opportunities

Expansion of satellite internet networks in rural areas

Advancement of optical communication technology for faster data transmission

Integration of optical communication systems in military applications - Trends

Growth in hybrid satellite communication platforms

Shift towards LEO satellite constellations

Increasing collaboration between governments and private sectors in space technologies

Advancements in quantum communication for secure data transfer

Growth in demand for small satellite systems - Government Regulations & Defense Policy

Satellite communication policies in India

Defense ministry guidelines on secure satellite communications

Regulations on optical spectrum and frequency allocation - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Free-Space Optical Communication

Laser Communication Systems

Ground-Based Optical Systems

Space-Based Optical Communication Systems

Hybrid Optical-RF Communication Systems - By Platform Type (In Value%)

Low Earth Orbit Satellites

Medium Earth Orbit Satellites

Geostationary Orbit Satellites

Hybrid Satellite Systems

Ground Stations - By Fitment Type (In Value%)

Commercial satellites

Military satellites

Government satellites

Private sector satellites

Research and development satellites - By EndUser Segment (In Value%)

Telecommunications

Defense

Broadcasting

Space agencies

Private enterprises - By Procurement Channel (In Value%)

Direct procurement from manufacturers

Procurement through defense contracts

Government procurement channels

Third-party procurement services

Commercial sales through satellite operators - By Material / Technology (in Value%)

Optical fiber cables

Laser communication systems

Photonic crystals

Quantum communication technologies

Integrated circuits for optical communication

- Market structure and competitive positioning

- Market share snapshot of major players

- CrossComparison Parameters (Regulatory environment, Technological innovation, Cost structure, Market adoption, Competitive rivalry, Service offerings, Consumer trust, Infrastructure development, Geographic reach)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Key Players

SpaceX

OneWeb

Tata Communications

ISRO

Optus

Hughes Network Systems

Intelsat

SES S.A.

Global Invacom

Airbus Defence and Space

Inmarsat

Thales Alenia Space

Avanti Communications

Viasat

L3Harris Technologies

- Telecommunication companies increasingly adopting optical communication for efficiency

- Government organizations focusing on optical communication for national security

- Defense agencies seeking secure and fast satellite communication systems

- Private sector space companies investing in optical satellite technology

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035