Market Overview

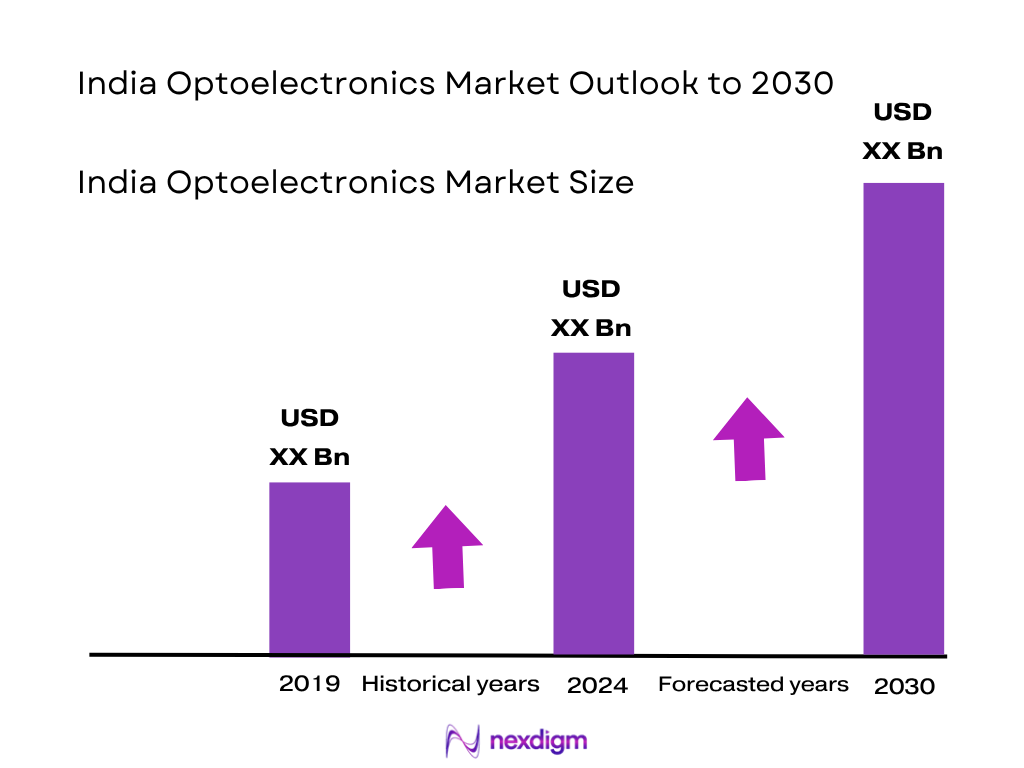

The India optoelectronics market is valued at approximately USD 2.45 bn in 2024 based on regional Asia‑Pacific proportions. Growth is driven by rising adoption in consumer devices, automotive LEDs, optical telecommunications equipment, and industrial machine‑vision systems. Government initiatives such as PLI schemes and domestic component manufacturing further elevate demand across segments like sensors, laser diodes, and LEDs.

Major dominance stems from cities like Bengaluru, Hyderabad and Pune, due to their robust electronics clusters, semiconductor fabs, and strong R&D ecosystems. These hubs host multinational optoelectronic component manufacturers and integrators, benefiting from government incentives, established supply chains, and access to skilled engineering talent, making them focal points for optoelectronics growth across India.

Market Segmentation

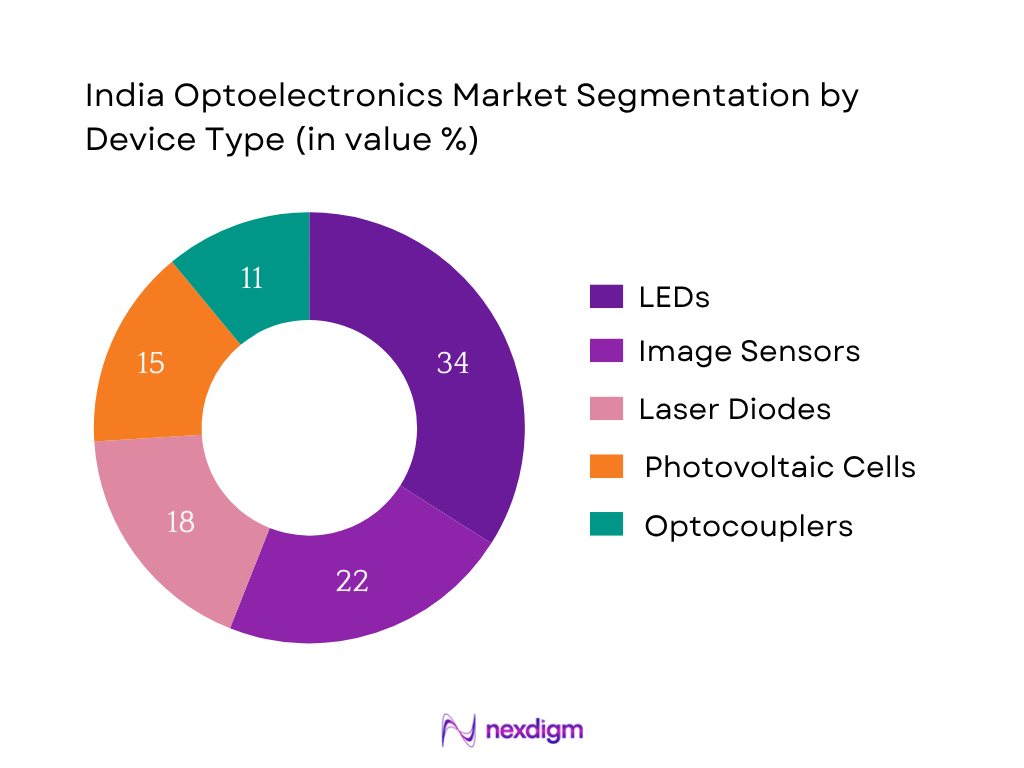

By Device Type

India optoelectronics is segmented into LEDs, laser diodes, image sensors, photovoltaic cells and optocouplers. LEDs lead with approximately 34% market share in 2024, owing to their widespread use in automotive lighting, consumer display backlighting and energy-efficient infrastructure lighting. Domestic and global LED manufacturers have established strong channels across utility, automotive, and industrial sectors, reinforcing LED dominance.

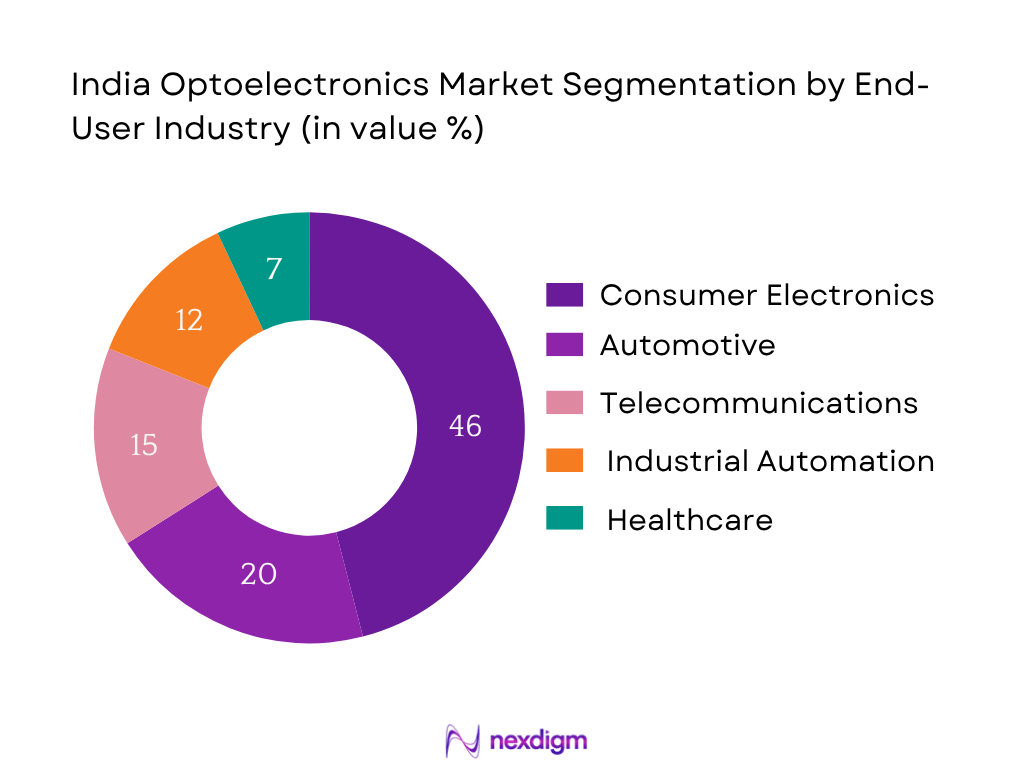

By End‑User Industry

The industry breakdown includes consumer electronics, automotive, telecommunications, healthcare and industrial automation. Consumer electronics accounts for about 46% in 2024, driven by strong smartphone, wearable and display device adoption where image sensors, LEDs and photodiodes are essential. Indian manufacturing ramp‑up of smartphones, coupled with high domestic consumption and export orientation, underpins this dominance.

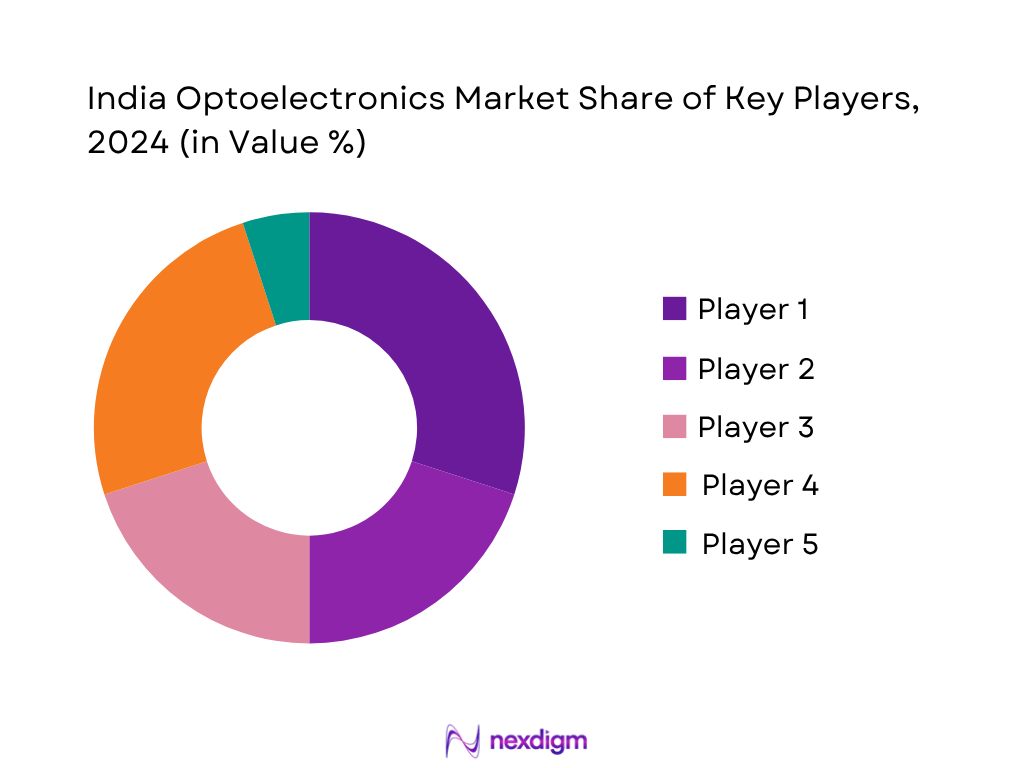

Competitive Landscape

India’s optoelectronics market is shaped by a mix of global component suppliers and domestic integrators and assemblers. Major international vendors supply LEDs, sensors and laser diodes into India, while local players integrate these into telecom equipment, lighting systems, automotive modules and healthcare instruments, reflecting moderate market consolidation and clear leadership by a handful of large firms.

| Company | Establishment Year | Headquarters | Device Portfolio | Domestic Wafer Fabrication | R&D Centres in India | Patent Filings (India) | Price Positioning | Supply‑chain Integration |

| Sony Corporation | 1946 | Japan | – | – | – | – | – | – |

| Samsung Electronics | 1938 | South Korea | – | – | – | – | – | – |

| OSRAM Opto Semiconductors | 1919 | Germany | – | – | – | – | – | – |

| Rohm Semiconductor | 1958 | Japan | – | – | – | – | – | – |

| Hamamatsu Photonics | 1953 | Japan | – | – | – | – | – | – |

India Optoelectronics Market Analysis

Growth Drivers

Adoption of Advanced Imaging Systems

India recorded 162 import consignments under HSN code 90279090 (advanced imaging systems) between October 2023 and September 2024, ranking among the top global importers of such systems, as per import data platforms. Concurrently, nearly 80 percent of India’s high‑end medical imaging equipment is imported, reflecting strong reliance on foreign supply for CT scanners, MRI, and industrial imaging machinery. These numbers underpin demand for optoelectronic subsystems—sensors, cameras, photodiodes—in healthcare and industrial automation.

LED Penetration in Automotive

In FY 2023‑24, India produced 28.4 million vehicles (2.84 crore), up from 25.9 million in FY 2022‑23, indicating rising automotive output. The automotive industry accounts for 6 percent of GDP and 35 percent of Indian manufacturing GDP. LED modules—for exterior lighting and cabin illumination—are increasingly standard in mid-to-premium vehicles, generating significant demand for optoelectronic lighting components.

Market Challenges

Dependency on Imports for Raw Materials

India imported 18.43 billion semiconductor chips valued at ₹1.71 lakh crore in FY 2023‑24, underscoring high reliance on foreign sourcing for semiconductors and optoelectronic materials. Additionally, telecom and sensor artifacts imports reached USD 20 billion for integrated circuits alone in 2023‑24. This dependency impedes cost competitiveness and supply stability for domestic optoelectronics assembly players.

Low Domestic Wafer Fabrication Capacity

Despite high semiconductor imports, India currently hosts minimal wafer fabrication facilities. While the Semicon India programme (₹76,000 crore) aims to establish legacy fabs at 28 nm or above, no operational domestic fab existed through FY 2023‑24. Until local ATP and fab units materialize, India remains dependent on imports for core optoelectronic front-end substrates.

Market Opportunities

PLI Schemes

Under India’s Semicon India scheme (₹76,000 crore outlay), investment incentives are extended to companies setting up semiconductor and display fabrication and assembly facilities. This policy fosters domestic manufacturing of optoelectronic chips and components, offering capital subsidies and tax incentives that support manufacturing localization.

Surge in EVs

India produced 28.4 million vehicles in FY 2023‑24, with rising electrification trends. Electric vehicles increasingly deploy advanced optoelectronic modules: LiDAR sensors, high‑intensity LEDs, image-based ADAS systems. This rising EV production volume offers growing outlet for optoelectronic component suppliers.

Future Outlook

Over the next six years, the India optoelectronics market is projected to maintain strong momentum, driven by continued expansion in consumer electronics manufacturing, rapid automotive electrification, 5G and optical network deployment, and strong policy impetus under ‘Make in India’. Technology upgrades in sensors and LEDs, as well as rising exports of electronic modules, will sustain growth. Deepening of local fabrication capabilities and R&D investments will position India as a regional optoelectronics hub.

Major Players

- Vishay Intertechnology

- Osram Opto Semiconductors

- ON Semiconductor

- Sony Corporation

- Samsung Electronics

- Rohm Semiconductor

- Hamamatsu Photonics

- Broadcom Inc

- STMicroelectronics

- Lumentum

- Excelitas Technologies

- Teledyne Technologies

- Tata Elxsi (Integration)

- Everlight Electronics

- Panasonic Corporation.

Key Target Audience

- Chief Hardware Officers of Consumer Electronics OEMs

- Heads of Procurement at Automotive Component Manufacturers

- CTOs of Optical and Photonic Startups

- Heads of Telecom Equipment R&D Divisions

- Heads of Manufacturing Units in Industrial Vision Systems

- Investment and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Electronics & IT; IESA)

- Heads of Medical Device Manufacturing Companies

Research Methodology

Step 1: Identification of Key Variables

Initial phase involved mapping India optoelectronics ecosystem, including device types, materials, applications and geographies using secondary data from credible global/regional market sources and public policy databases to define critical variables affecting market dynamics.

Step 2: Market Analysis and Construction

Compiled historical data for India from regional reports, import-export databases, domestic production trends and device consumption across verticals to estimate market value and build segmentation by device type and industry usage.

Step 3: Hypothesis Validation and Expert Consultation

Key market assumptions were validated via structured interviews with industry experts in semiconductor components, OEMs in consumer electronics and automotive lighting, and executives within telecom infrastructure firms to refine projections.

Step 4: Research Synthesis and Final Output

Final outputs were prepared by cross‑referencing bottom‑up estimates with import/export trade reports, aligning them against Asia‑Pacific trends to ensure consistency and accuracy in India‑specific market sizing and growth forecasts.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Methodology, Top-Down & Bottom-Up Approach, Forecasting Techniques, Primary and Secondary Research Approaches, Data Triangulation, Limitations & Future Outlook)

- Definition and Scope

- Industry Genesis and Evolution

- Timeline of Technological Advancements and Key Players

- Optoelectronics Ecosystem (Fabrication to Integration)

- Value Chain and Supply Chain Analysis

- Import-Export Trade Flow (Components, Materials)

- Growth Drivers

Adoption of Advanced Imaging Systems

LED Penetration in Automotive

Telecom Expansion

Government Make-in-India Push

Miniaturization Trend

Rise in Solar Projects - Market Challenges

Thermal Management in High-Power Devices

Dependency on Imports for Raw Materials

Low Domestic Wafer Fabrication Capacity - Market Opportunities

PLI Schemes

Surge in EVs

Expanding Photonics Startups

Demand in IoT Devices - Key Market Trends

3D Imaging Sensors

Wearable Optoelectronics

Optical Interconnects

AI Integration - Regulatory Landscape

BIS Standards

E-Waste Management Rules

Electronic Manufacturing Policies - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Unit Price, 2019-2024

- By Device Type (In Value %)

LEDs (Light Emitting Diodes)

Photovoltaic Cells (Solar Cells)

Image Sensors (CMOS, CCD)

Laser Diodes

Optocouplers - By Material Type (In Value %)

Gallium Arsenide (GaAs)

Silicon

Indium Phosphide (InP)

Gallium Nitride (GaN)

Others - By Application (In Value %)

Consumer Electronics

Automotive (ADAS, LiDAR, Lighting)

Industrial Automation and Robotics

Telecommunications (Fiber Optics, 5G)

Healthcare (Imaging, Biophotonics) - By End-User Industry (In Value %)

Automotive

Consumer Electronics

Industrial & Manufacturing

Healthcare & Medical Devices

Defense & Aerospace - By Region (In Value %)

North India

South India

West India

East India

- Market Share by Player (Based on Value)

- Cross Comparison Parameters (Company Overview, Device Portfolio, Core Technologies, Product Launches, Licensing/Patents, R&D Capabilities, Pricing Strategy, Supply Chain Integration, Manufacturing Units, Go-to-Market Strategy)

- SWOT Analysis of Major Players

- Pricing Analysis by Device Type and Use Case

- Detailed Profiles of Key Players

Vishay Intertechnology

Osram Opto Semiconductors

ON Semiconductor

Broadcom Inc.

Renesas Electronics

Rohm Semiconductor

Hamamatsu Photonics

Excelitas Technologies

Teledyne Technologies

STMicroelectronics

Sharp Corporation

Everlight Electronics

Panasonic Corporation

Lite-On Technology

Tata Elxsi (India-based Optoelectronic Integration)

- Procurement Preferences and Demand Mapping

- Regulatory and Compliance Requirements

- Purchase Volume and Budgeting Trends

- Use Case Scenarios and Case Adoptions

- Key Adoption Barriers and Drivers

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Unit Price, 2025-2030