Market Overview

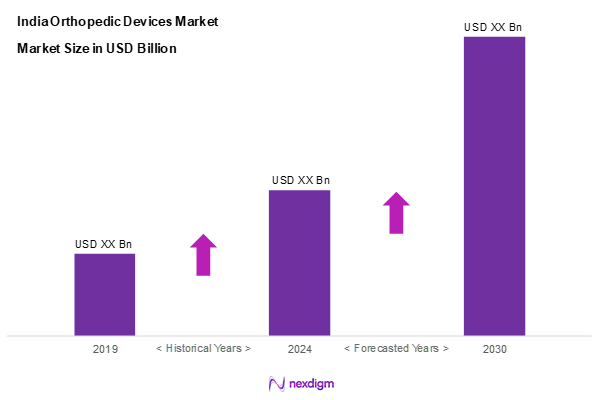

As of 2024, the India orthopedic devices market is valued at USD 1.7 billion, with a growing CAGR of 7.5% from 2024 to 2030, driven by increasing healthcare access and advancements in medical technology. The market growth is primarily influenced by rising orthopedic disorders due to lifestyle changes and an aging population requiring specialized devices for joint repairs and replacements.

Cities like Delhi, Mumbai, and Bengaluru dominate the orthopedic devices landscape due to their robust healthcare infrastructure and concentration of major hospitals and clinics. These urban centres are pivotal as they host numerous specialized orthopedic facilities offering advanced treatments and attract patients from across the country, further propelling market demand.

Market Segmentation

By Device Type

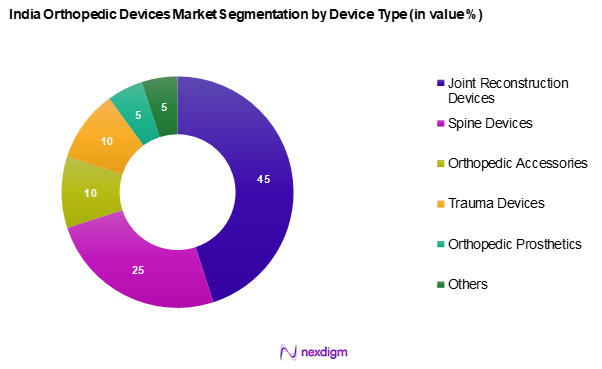

The India orthopedic devices market is segmented into joint reconstruction devices, spine devices, orthopedic accessories, trauma devices, orthopedic prosthetics, and others. Joint reconstruction devices currently hold the largest market share due to their extensive application in hip and knee replacement surgeries. This segment’s dominance stems from the prevalence of osteoarthritis and other degenerative joint diseases among the aging population, coupled with increased awareness of surgical options. Major players continuously innovate, leading to the introduction of advanced devices that improve patient outcomes and drive demand within this sub-segment.

By End User

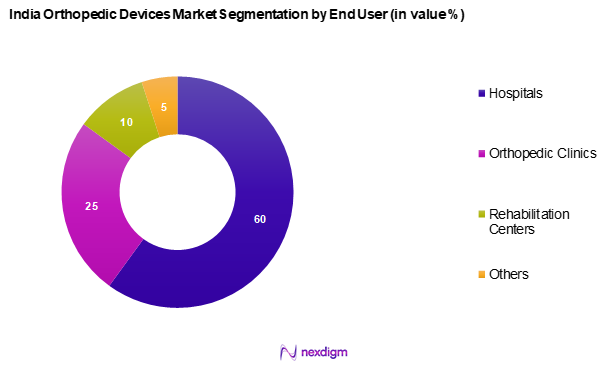

The India orthopedic devices market is segmented into hospitals, orthopedic clinics, rehabilitation centers, and others. Hospitals are the primary end-users, commanding a significant market share due to their capacity to provide comprehensive care and specialized orthopedic departments. The integration of latest surgical technologies and procedures within hospitals enhances patient treatment options, leading to increased surgical case volumes for orthopedic surgeries which in turn fuels the demand for orthotic devices.

Competitive Landscape

The India orthopedic devices market is characterized by a competitive landscape dominated by several established players, including global corporations and local manufacturers. Major companies such as Johnson & Johnson and Stryker Corporation lead the market, highlighting the influence of their extensive product portfolios and strong distribution networks. This consolidation promotes innovation and strategic partnerships amongst competitors to broaden market reach and enhance service delivery.

| Major Player | Establishment Year | Headquarters | Annual Revenue | Strength | Weakness | Revenue by Device Type |

| Johnson & Johnson | 1886 | New Brunswick, NJ, USA | – | – | – | – |

| Stryker Corporation | 1941 | Kalamazoo, MI, USA | – | – | – | – |

| Smith & Nephew | 1856 | London, UK | – | – | – | – |

| Medtronic | 1949 | Dublin, Ireland | – | – | – | – |

| Zimmer Biomet | 1927 | Warsaw, IN, USA | – | – | – | – |

India Orthopedic Devices Market Analysis

Growth Drivers

Increasing Geriatric Population

India is witnessing a significant demographic shift, with the proportion of the elderly population projected to reach approximately 158 million by 2025 and could be around 319 million by 2050 according to the UNFPA. Individuals aged 60 and above are particularly vulnerable to orthopedic disorders, making them a key demographic for orthopedic devices. The increase in life expectancy, rising from 70 years in 2022 to an anticipated 73 years by 2025, further augments the demand for orthopedic solutions. This growth trajectory in the geriatric population signals a burgeoning market for orthopedic devices catering specifically to age-related conditions.

Rising Incidence of Orthopedic Disorders

The incidence of orthopedic disorders in India is experiencing a notable increase, influenced by factors such as sedentary lifestyles and a rise in road traffic accidents. Recent reports indicate that orthopedic injuries were responsible for nearly 60% of all trauma cases in urban areas in 2022. This growing burden of orthopedic diseases heightens the demand for medical interventions, subsequently enhancing the market for orthopedic devices.

Market Challenges

High Cost of Devices

Despite technological advancements, the high costs associated with orthopedic devices remain a significant barrier to market entry and growth. For instance, the average cost of hip replacement surgery in India can range from USD 1,744.1 to USD 4,651.1 a considerable expenditure for many families. The financial burden is compounded by the fact that many insurance policies do not cover orthopedic procedures comprehensively, impacting accessibility. This financial challenge significantly narrows the patient base able to afford these devices, thereby constraining market growth potential.

Regulatory Barriers

The Indian orthopedic devices market faces considerable regulatory hurdles that can delay market entry for new products. The device approval process, overseen by the Central Drugs Standard Control Organization (CDSCO), requires extensive clinical trials and compliance with Indian Medical Device regulations. In 2023, the average time for product approval was approximately 24 months. These stringent regulations are intended to ensure safety and efficacy, but they can be a deterrent for manufacturers looking to introduce innovative solutions swiftly, ultimately affecting market dynamics.

Opportunities

Growth in Medical Tourism

India’s medical tourism sector is flourishing, with the country attracting over 500,000 international patients in 2022 seeking orthopedic treatments. Factors contributing to this growth include the availability of high-quality care at competitive pricing, with many procedures costing up to 60-80% less than in Western countries. Government initiatives aimed at promoting medical tourism are also in place, which could further bolster this market segment, providing a sustainable revenue stream for orthopedic devices as international patients require a range of orthopedic solutions post-operative care.

Expansion of Healthcare Infrastructure

The ongoing expansion of healthcare infrastructure in India presents a promising opportunity for the orthopedic devices market. As of 2022, government initiatives have led to the addition of over 100 new hospitals and surgical centres focusing on orthopedic treatments. This expansion is complemented by public-private partnerships that are enhancing service quality and accessibility.

Future Outlook

Over the next five years, the India orthopedic devices market is expected to exhibit substantial growth, driven by the increasing geriatric population and rising incidence of orthopedic disorders necessitating advanced medical interventions. As healthcare infrastructure expands and the government promotes medical tourism, the demand for orthopedic services will likely enhance market dynamics. The introduction of innovative products and technological advancements will further position the market for significant progress.

Major Players

- Johnson & Johnson

- Stryker Corporation

- Smith & Nephew

- Medtronic

- Zimmer Biomet

- B. Braun

- Abbott Laboratories

- Orthofix

- Conmed Corporation

- NuVasive

- Amedica Corporation

- LimbO

- Arthrex

- DePuy Synthes

- Rays Medical Devices

Key Target Audience

- Investors and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Health and Family Welfare)

- Hospitals

- Orthopedic Clinics

- Rehabilitation Centers

- Insurance Companies

- Medical Device Distributors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India orthopedic devices market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics, including market drivers, challenges, and competitive forces.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India orthopedic devices market. This includes assessing market penetration and revenue generation while evaluating service quality statistics to ensure reliability. The analysis incorporates various datasets from credible sources such as industry reports and financial disclosures to construct accurate market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through interviews with industry experts representing a diverse array of companies and sectors. These consultations provide valuable operational and financial insights directly from practitioners, helping to refine the data and corroborate market dynamics.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple orthopedic device manufacturers to acquire detailed insights into product segments, sales performance, and consumer preferences. These interactions verify and complement statistics derived from previous analytical phases, ensuring a comprehensive and validated analysis of the India orthopedic devices market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Geriatric Population

Rising Incidence of Orthopedic Disorders - Market Challenges

High Cost of Devices

Regulatory Barriers - Opportunities

Growth in Medical Tourism

Expansion of Healthcare Infrastructure - Trends

Adoption of Minimally Invasive Procedures

Use of Advanced Materials - Government Regulations

Device Approval Processes

Quality and Safety Standards - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Device Type (In Value %)

Joint Reconstruction Devices

– Knee Replacement Implants

– Hip Replacement Implants

– Shoulder Replacement Implants

– Elbow and Ankle Joint Implants

Spine Devices

– Spinal Fusion Devices

– Non-Fusion Devices

– Artificial Discs

– Vertebral Compression Fracture (VCF) Devices

Orthopedic Accessories

– Bone Cement

– Casting and Splinting Materials

– Orthopedic Braces and Support

– Surgical Instruments and Tools

Trauma Devices

– Intramedullary Nails

– Plates and Screws

– External Fixation Devices

– Pins and Wires

Orthopedic Prosthetics

– Upper Extremity Prosthetics

– Lower Extremity Prosthetics

– Myoelectric Prosthetics

– Cosmetic Prosthetics

Others

– Arthroscopic Devices

– Bone Grafts and Substitutes

– Craniomaxillofacial Devices - By End User (In Value %)

Hospitals

– Government Hospitals

– Private Multi-specialty Hospitals

– Orthopedic Specialty Hospitals

Orthopedic Clinics

– Independent Clinics

– Chain Clinics

Rehabilitation Centers

– Physical Therapy Centers

– Post-Surgical Recovery Clinics

Others

– Homecare Settings

– Academic and Research Institutes - By Geography (In Value %)

North India

South India

East India

West India - By Procedure Type (In Value %)

Surgical Procedures

– Joint Replacement Surgeries

– Spine Surgery

– Trauma Fixation Surgeries

– Arthroscopy Procedures

Non-Surgical Procedures

– Physiotherapy and Bracing

– Pain Management Injections

– Orthotic Device Fittings - By Distribution Channel (In Value %)

Online Sales

– E-commerce Portals

– Manufacturer Websites

Direct Sales

– Direct Manufacturer-to-Hospital Supply

– In-house Sales Teams

Distributors

– Medical Equipment Distributors

– Regional Distribution Networks

- Market Share of Major Players on the Basis of Value Volume

- Market Share of Major Players by Device Type

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Device Type, Distribution Channels, Number of Touchpoints, Unique Value Offerings and more)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

Johnson and Johnson

Stryker Corporation

Smith and Nephew

Medtronic

Zimmer Biomet

B Braun

Abbott Laboratories

Orthofix

Conmed Corporation

NuVasive

Amedica Corporation

LimbO

Arthrex

DePuy Synthes

Rays Medical Devices

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs Desires and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030