Market Overview

The India parachute market is valued at USD ~ in 2024, driven by a combination of growing defense budgets and rising interest in recreational activities such as skydiving. The demand for advanced military-grade parachutes and the expansion of air rescue operations are major factors propelling this market. Additionally, government initiatives and technological advancements in parachute materials have positively impacted the growth of this industry. These elements combine to strengthen the market, positioning it for a steady growth trajectory in the coming years.

India’s dominance in the parachute market is largely attributed to its expanding defense sector and increasing demand for adventure sports. The country’s robust defense procurement policies and modernization programs, such as the defense offset policy and the strengthening of military forces, create a significant need for high-quality parachutes. Moreover, cities like Bengaluru and Delhi, which are centers for both defense research and recreational aviation, are leading the market due to the presence of key aerospace companies and recreational sport facilities.

Market Segmentation

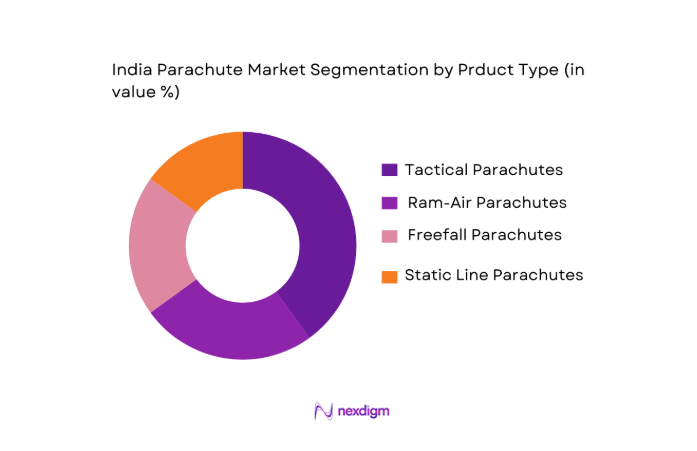

By Product Type

The India parachute market is segmented by product type into tactical parachutes, ram-air parachutes, freefall parachutes, and static line parachutes. Tactical parachutes dominate the market share in India. This segment benefits from the increasing demand for military parachutes driven by defense modernization and new airborne military operations. The rise in airlift capabilities and airborne tactical units enhances the need for such specialized equipment. Brands like Airborne Systems and Para-Flite are integral to supplying these high-performance products to the Indian military.

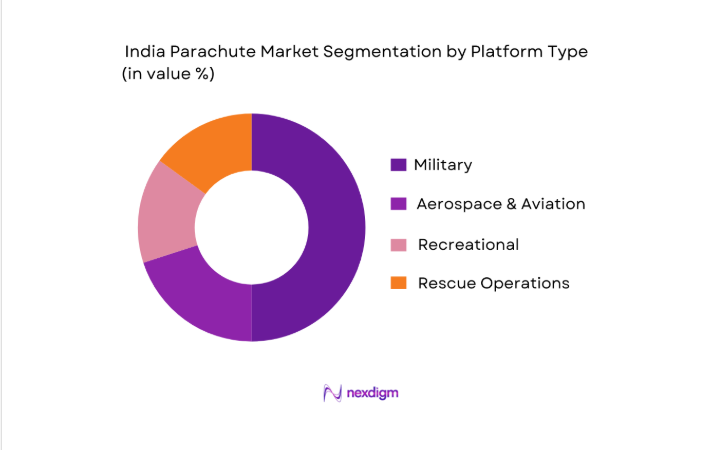

By Platform Type

The parachute market in India is segmented by platform type into military, aerospace & aviation, recreational, and rescue operations. The military segment holds a major share due to the ongoing modernization and expansion of India’s defense forces. As India invests more in its military capabilities, the demand for high-quality parachutes for combat, air-drop, and parachute training has increased. Additionally, the growing interest in skydiving and extreme sports contributes to the dominance of recreational parachutes in the market.

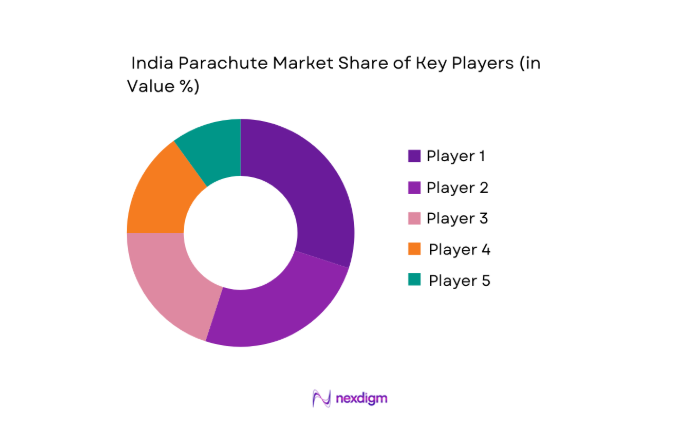

Competitive Landscape

The India parachute market is dominated by key players like Airborne Systems, Para-Flite, and Indigen Defense Systems, alongside international manufacturers like Aerodyne and Skydive Dubai. These companies hold a significant market presence due to their consistent product innovation, global reach, and strong relationships with defense and aviation authorities. The competitive landscape is marked by advancements in materials technology, lightweight parachute systems, and the ongoing expansion of recreational and military applications.

| Company | Establishment Year | Headquarters | Product Innovation | Defense Partnerships | Manufacturing Capacity | Recreational Products | Global Reach |

| Airborne Systems | 1980 | USA | ~ | ~ | ~ | ~ | ~ |

| Para-Flite | 1960 | USA | ~ | ~ | ~ | ~ | ~ |

| Indigen Defense Systems | 2015 | India | ~ | ~ | ~ | ~ | ~ |

| Aerodyne | 1994 | USA | ~ | ~ | ~ | ~ | ~ |

| Skydive Dubai | 2006 | UAE | ~ | ~ | ~ | ~ | ~ |

India Parachute Market Analysis

Growth Drivers

Increase in military modernization programs

India’s defence expenditure has been on an upward trajectory, with the Government allocating ₹~ to the Ministry of Defence in the 2025–26 fiscal year, up from previous allocations, to strengthen armed forces and modernise capabilities. This budget supports procurement of advanced airborne equipment, repair, refit and store expenditures across the Army, Navy and Air Force, reflecting a sustained focus on upgrading tactical and logistics platforms. The capital outlay component of the defence budget, which includes spending on acquisition of modern weapons and equipment, has also increased to ₹~, signalling enhanced demand for airborne systems such as military parachutes. India maintains one of the world’s largest active military forces with ~ active-duty personnel, underscoring the scale of strategic preparedness and technology upgrades driving parachute procurement.

Expansion of adventure sports and skydiving activities

Domestic tourism statistics for 2023 report ~ domestic tourist visits across India, and ~ international tourist arrivals, indicating a robust travel ecosystem conducive to adventure sports. Adventure and experiential tourism, which includes activities like paragliding and potentially skydiving, benefits from this overall surge in travel participation. The Ministry of Tourism’s data further shows states such as Uttar Pradesh with ~ domestic visits and Tamil Nadu with ~, reflecting high activity levels in regions that support outdoor and adventure sports infrastructure. This broad increase in travel engagement suggests rising participation in adventure-related activities and a corresponding rise in demand for sport parachutes and training services, as more individuals seek high‑adrenaline recreational experiences within India’s expanding tourism sector.

Market Challenges

High manufacturing costs of advanced parachute systems

The development and production of sophisticated parachute systems for both military and civilian applications require high‑end materials and precision engineering, resulting in inherently high manufacturing costs. Advanced systems often employ lightweight fabrics, reinforced suspension lines and integrated deployment mechanisms that necessitate specialised manufacturing facilities. In India, such technologies are supported through budgets like the ₹~ crore allocated to Defence Research and Development Organisation (DRDO) in 2025–26, which aims to foster new technology but still highlights the capital intensity of defence‑grade equipment production. High production costs are compounded by the need for rigorous testing and certification protocols to meet safety standards, increasing unit costs relative to simpler parachute designs. These factors can result in higher entry barriers for domestic manufacturers and limit the competitiveness of locally produced advanced parachutes against imports with larger economies of scale.

Regulatory barriers for civilian applications

Civilian parachute operations, including tandem skydiving and sport parachuting, are subject to multiple tiers of regulatory oversight in India, including certification requirements from aviation authorities and compliance with safety protocols under the Directorate General of Civil Aviation (DGCA). These regulatory frameworks, while essential for ensuring participant safety, can contribute to extended approval timelines and additional compliance costs for operators seeking to expand services. The Ministry of Tourism’s broad classification of adventure tourism activities and safety guidelines underscores the regulated nature of outdoor activities in India, with operators often required to meet state and central safety norms before offering parachute‑based experiences. This regulatory complexity can slow market entry for new adventure sport providers and limit the availability of licensed skydiving facilities, indirectly restraining the growth of segments reliant on civilian parachute usage.

Opportunities

Growing defence budgets in India

The Indian government’s fiscal prioritisation of defence is evident in the ₹~ crore allocation to the Ministry of Defence in the Union Budget for 2025–26, accounting for roughly ~ of total government expenditure. This sustained financial commitment provides opportunities for parachute system manufacturers to engage in long‑term contracts supporting airborne operations and personnel deployment across military branches. The consistent capital outlay increases, including funds earmarked for procurement and equipment modernisation, create a conducive environment for domestic firms to participate in defence supply chains. With India’s forces comprising ~ active military personnel, there is ongoing demand for replacement and specialised parachute equipment for training and operational use, presenting a stable procurement base. Additionally, the government’s focus on indigenisation under the “Make in India” initiative encourages partnerships that can transfer technology and improve local manufacturing capabilities, expanding opportunities for growth within the parachute systems segment.

Rising interest in civilian and commercial skydiving

India’s robust tourism activity, with ~ domestic tourist visits recorded in 2024 along with ~ international arrivals, indicates a large and engaged population participating in travel and experiential activities. Adventure tourism segments, which include scenic flights and skydiving experiences in states with strong domestic tourism like Uttar Pradesh and Tamil Nadu, are gaining traction as part of broader leisure offerings. Increased disposable incomes among urban populations and government efforts to promote adventure tourism circuits support the expansion of commercial skydiving facilities. As interest in adventure sports grows, so does the demand for civilian‑grade parachutes tailored for training and commercial use. This expanding base of adventure participants presents a compelling opportunity for manufacturers and service providers to develop offerings that cater to non‑military parachute applications while aligning with safety standards and regulatory compliance.

Future Outlook

Over the next decade, the India parachute market is expected to witness substantial growth driven by increasing defense investments, expanding military forces, and growing participation in recreational skydiving. Furthermore, technological advancements in materials and safety features are anticipated to fuel demand for innovative parachute solutions. India’s rising focus on air rescue operations and the expanding aerospace sector will also play a pivotal role in the market’s growth trajectory.

Major Players

- Airborne Systems

- Para-Flite

- Indigen Defense Systems

- Aerodyne

- Skydive Dubai

- ParaSport India Pvt Ltd

- Moog Inc.

- Satec Aerospace

- General Aeronautics

- Leonardo

- Zodiak

- Cirrus Aircraft

- Lockheed Martin

- Northrop Grumman

- Honeywell Aerospace

Key Target Audience

- Investments and venture capitalist firms

- Ministry of Defence

- Indian Air Force

- Indian Army

- Indian Navy

- Indian Coast Guard

- Skydiving Associations

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out key stakeholders in the parachute market in India, focusing on both the defense and recreational sectors. This step involves gathering secondary data from government publications, defense reports, and industry sources to identify major market drivers.

Step 2: Market Analysis and Construction

In this step, historical data regarding defense and recreational parachute sales will be analyzed to identify growth patterns. Key market segments will be evaluated based on sales volume, customer preferences, and product penetration.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations through interviews with military personnel and parachute manufacturers will provide insights into market drivers and barriers. These consultations will help validate assumptions and refine market forecasts.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data and developing comprehensive forecasts. Direct engagement with parachute manufacturers and suppliers will allow for the verification of data, ensuring the accuracy of the market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Increase in military modernization programs

Expansion of adventure sports and skydiving activities

Rising demand for air rescue operations - Market Challenges

High manufacturing costs of advanced parachute systems

Regulatory barriers for civilian applications

Dependency on foreign suppliers for raw materials - Opportunities

Growing defense budgets in India

Rising interest in civilian and commercial skydiving

Technological advancements in parachute materials - Trends

Emerging lightweight and compact parachute designs

Integration of smart technologies for enhanced safety - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Tactical Parachutes

Ram-Air Parachutes

Static Line Parachutes

Freefall Parachutes

Multi-purpose Parachutes - By Platform Type (In Value%)

Military

Aerospace & Aviation

Recreational

Sport

Rescue Operations - By Fitment Type (In Value%)

Personal Parachutes

Airborne Military Parachutes

Cargo Parachutes

Specialty Parachutes

Training Parachutes - By EndUser Segment (In Value%)

Defense Forces

Civilian Aviation Operators

Aerospace & Defense Contractors

Recreational & Sport Enthusiasts

Emergency Response Units - By Procurement Channel (In Value%)

Direct Procurement

Online Procurement

Distributor/Wholesaler Network

- Market Share Analysis

- Cross Comparison Parameters (Cost-effectiveness, Technology Integration, Safety Standards, Product Innovation, Distribution Reach)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

Skydiving Equipment International

Indo-Russian Joint Venture

Lloyd’s Parachutes

Sarkar Industries

General Aeronautics

Airborne Systems Inc.

Axel Technologies

Indigen Defence Systems

Parasport India Pvt Ltd

Parachute Industries Limited

Aerospace Technologies Pvt Ltd

Mosaic Aerospace

Techsystems Parachutes

Boeing Defence India

Royal Dynamics Pvt Ltd

- Military and defense agencies driving demand

- Aerospace sector’s reliance on parachutes for cargo drops

- Growing participation in recreational parachuting activities

- Government agencies enhancing air rescue capabilities

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035