Market Overview

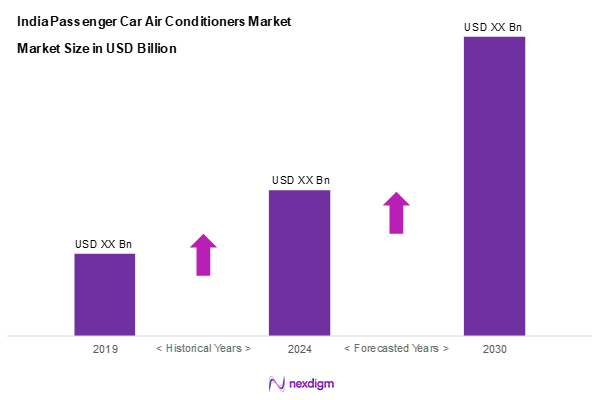

As of 2024, the India passenger car air conditioners market is valued at USD ~ billion, with a growing CAGR of 12.4% from 2024 to 2030, bolstered by the rising consumer demand for comfortable driving experiences and improved vehicle standards. Factors such as increasing disposable income and rapid urbanization are driving sales, alongside a focus on fuel efficiency and sustainability in vehicle designs. With technological advancements, automakers are more inclined to incorporate advanced air conditioning systems, contributing to market growth.

Major cities like Delhi, Mumbai, and Bangalore dominate the Indian passenger car air conditioners market due to their dense populations, high vehicle penetration rates, and larger disposable incomes. These urban centres serve as automotive hubs where numerous leading vehicle manufacturers are based. The concentration of consumers in metropolitan areas drives demand for passenger vehicles equipped with enhanced comfort features like air conditioning systems.

Market Segmentation

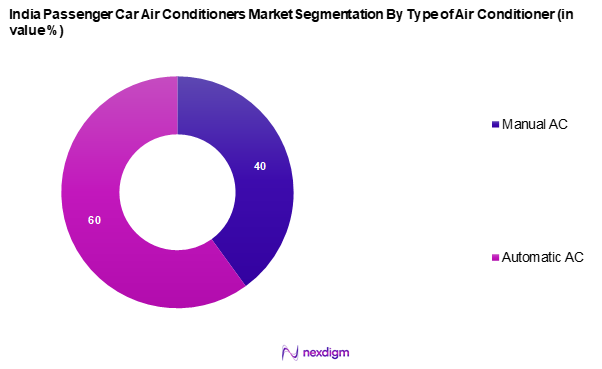

By Type of Air Conditioner

The India passenger car air conditioners market is segmented into manual AC and automatic AC. Currently, the Automatic AC segment holds a dominant market share due to its superior functionality and consumer preference for convenience. Automatic air conditioners provide enhanced comfort through temperature regulation and increased efficiency, aligning with customer expectations for luxury and convenience in modern vehicles. Popular automobile brands are increasingly integrating automatic AC to cater to the demands of tech-savvy consumers, thereby accentuating its market dominance.

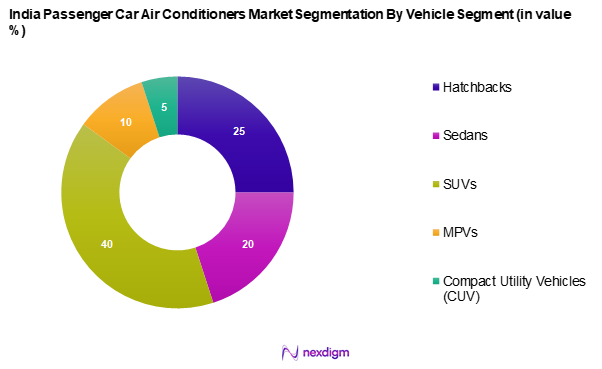

By Vehicle Segment

The India passenger car air conditioners market is segmented into hatchbacks, sedans, SUVs, MPVs, and Compact Utility Vehicles (CUV). The SUV segment commands a significant share of the market, primarily due to rising consumer preferences for larger vehicles that offer more comfort and space. The versatility and perceived safety benefits of SUVs have spurred demand, particularly in urban and suburban environments, where a higher number of consumers are choosing these models for family and recreational use. Manufacturers are responding to this trend by equipping new SUV models with sophisticated air conditioning systems as standard features.

Competitive Landscape

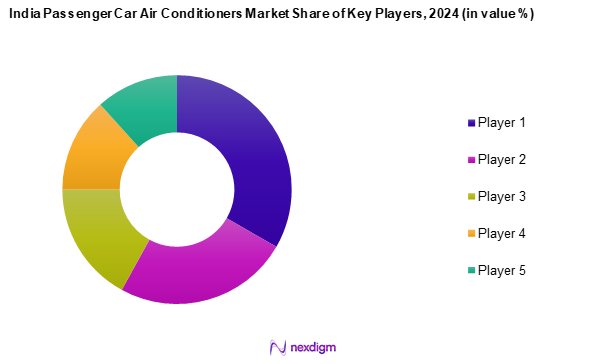

The India passenger car air conditioners market is characterized by significant competition among a few key players including TATA Motors, Mahindra&Mahindra Ltd. , and MARUTI SUZUKI INDIA LIMITED, which dominate the landscape. This consolidation highlights the influence of these companies, which have established strong local market connections and offer a range of air conditioning solutions that meet consumer demands.

| Major Players | Establishment Year | Headquarters | Revenue

(USD Mn) |

Market Share (%) | Product Offerings |

| TATA Motors | 1945 | Mumbai, India | – | – | – |

| Mahindra&Mahindra Ltd. | 1945 | Mumbai, India | – | – | – |

| MARUTI SUZUKI INDIA LIMITED | 1981 | New Delhi, India | – | – | – |

| Hyundai Motor India | 1996 | Haryana, India | – | – | – |

| Toyota Kirloskar Motor Motor | 1997 | Bangalore, India | – | – | – |

India Passenger Car Air Conditioners Market Analysis

Growth Drivers

Rising Disposable Income

India’s disposable income is projected to experience robust growth, reaching approximately USD 3 trillion in 2024, up from USD 2.7 trillion in 2022, according to World Bank data. With the rise in disposable income, consumers are increasingly willing to invest in comfort features for their vehicles, including advanced air conditioning systems. The middle class is expanding, leading to a surge in vehicle ownership and a greater preference for passenger cars equipped with effective air conditioning. This trend supports the demand for air conditioning systems that enhance the driving experience, especially in urban areas where temperatures can soar.

Increasing Urbanization

India is witnessing rapid urbanization, with more than 600 million people projected to live in urban areas by 2025, based on data from the United Nations. This urban influx drives the demand for passenger vehicles equipped with standard air conditioning, as urban dwellers seek comfort during commutes in heavily congested city environments. Enhanced infrastructure and an increasing number of vehicles on the road in urban areas lead to a higher demand for reliable and efficient air conditioning systems in cars, as consumers prioritize comfort amidst rising temperatures in cities.

Market Challenges

Regulatory Compliance

The automotive industry in India is subject to stringent regulatory frameworks regarding environmental standards and vehicle emissions. Compliance with the Bharat Stage VI (BS-VI) norms, which are being enforced more rigorously, adds financial pressure on manufacturers to upgrade their technology. As a result, companies may struggle to meet compliance deadlines while maintaining production output, leading to increased costs and operational challenges. The Government of India’s initiative to reduce pollution levels is causing manufacturers to invest heavily in advanced air conditioning technologies that align with these regulations, straining their budgets.

High Competition

The India Passenger Car Air Conditioners market is characterized by significant competition featuring established players with robust distribution networks and brand loyalty. There are over 20 automotive manufacturers in India, which drives intense rivalry for market share. This competitive landscape pressures companies to reduce prices while maintaining quality, potentially impacting profit margins. As new entrants emerge, coupled with existing players expanding their product offerings, market competition becomes even more intense. Enhanced competition often leads to aggressive marketing strategies and innovations, further complicating the market dynamics.

Opportunities

Adoption of Environment-Friendly Technologies

The transition towards sustainable and environment-friendly vehicles is gaining traction in India, with the current registered electric vehicle count exceeding 1.2 million. The government’s focus on promoting electric vehicles (EVs) through incentives and subsidies forms a solid basis for this growth. As consumers increasingly opt for EVs, there emerges a significant market opportunity for air conditioning systems designed specifically for these vehicles. This not only supports consumer preferences for green solutions but also creates a demand for efficient, eco-friendly air conditioning systems that resonate with environmentally conscious consumers.

Expansion of Electric Vehicles

The number of electric vehicles is projected to rise sharply in India, with more than 10% of total vehicle sales expected to be electric by 2025. This is driven by government policies promoting EV adoption and the anticipated growth of charging infrastructure. With this surge, the demand for air conditioning systems tailored for electric vehicles is likely to increase as they often have unique cooling requirements due to their design. Hence, manufacturers that focus on innovative and adaptive air conditioning technologies can leverage this market opportunity, positioning them for future growth in a key segment of the automotive industry.

Future Outlook

Over the next five years, the India passenger car air conditioners market is poised for significant growth, primarily fuelled by increasing vehicle production rates, heightened consumer expectations for comfort, and advancements in air conditioning technology. Moreover, factors such as rising environmental consciousness among consumers and government policies promoting eco-friendly practices are expected to drive innovation and market expansion.

Major Players

- TATA Motors

- Mahindra&Mahindra Ltd.

- MARUTI SUZUKI INDIA LIMITED

- Hyundai Motor India

- Honda Cars India

- Toyota Kirloskar Motor

- Kia India Pvt. Limited

- Ford Motor Company

- Nissan

- Renault

- Volkswagen

- JSW MG Motor India Pvt. Ltd.

- Isuzu Motors India Private Limited

- BMW AG

- Others

Key Target Audience

- Automotive OEMs

- Tier-1 and Tier-2 component manufacturers

- Automotive aftermarket retailers

- Distributors and wholesalers

- Investments and venture capitalist firms

- Government and regulatory bodies (Ministry of Heavy Industries, Department of Industrial Policy & Promotion)

- Industry associations

- Automotive technology and innovation firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase focuses on creating a comprehensive ecosystem map encompassing all major stakeholders within the India passenger car air conditioners market. This step involves extensive desk research, utilizing secondary and proprietary databases to gather in-depth industry-level information. The primary objective is to identify and define the key variables that influence market dynamics, such as technological advancements, regulatory frameworks, and consumer preferences.

Step 2: Market Analysis and Construction

In this phase, historical data is compiled and analyzed concerning the India passenger car air conditioners market. The analysis includes assessing market penetration rates, understanding the ratio of original equipment manufacturers (OEMs) to aftermarket players, and evaluating revenue generation patterns. Market quality statistics will also be examined to ensure reliable revenue estimates based on actual sales and consumer demand.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through consultations conducted via structured interviews with industry experts representing various automotive companies. This key step allows for the collection of operational and financial insights directly from decision-makers. The insights gained from these consultations are critical for refining market data, ensuring it accurately reflects the competitive landscape and consumer behaviour trends.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple passenger car air conditioner manufacturers to gather detailed insights into specific product segments, sales performance, consumer preferences, and other pertinent factors. This interaction verifies and complements statistics derived from the bottom-up analysis, ensuring a comprehensive and validated understanding of the India passenger car air conditioners market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain & Value Chain Analysis

- Growth Drivers

Rising Disposable Income

Increasing Urbanization - Market Challenges

Regulatory Compliance

High Competition - Opportunities

Adoption of Environment-Friendly Technologies

Expansion of Electric Vehicles - Trends

Smart AC Technology

Integrated Climate Control Systems - Government Regulation

Environmental Regulations

Energy Efficiency Standards - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type of Air Conditioner, (In Value %)

Manual AC

Automatic AC - By Vehicle Segment, (In Value %)

Hatchbacks

Sedans

SUVs

MPVs

Compact Utility Vehicle (CUV) - By Region, (In Value %)

North India

South India

West India

East India - By Component, (In Value %)

Compressor

Condenser

Evaporator

Expansion Valve

Receiver/Drier - By End User, (In Value %)

OEMs

Aftermarket - By Compressor Type, (In Value %)

Variable Displacement

Fixed Displacement

- Market Share of Major Players by Value/Volume, 2024

Market Share of Major Players by Type of Air Conditioner Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenue Sources, Distribution Channels, Production Capacity, Unique Value Proposition, R&D Investments)

- SWOT Analysis of Major Players

- Pricing Analysis by SKU for Major Players

- Detailed Profiles of Major Companies

TATA Motors

Mahindra&Mahindra Ltd.

MARUTI SUZUKI INDIA LIMITED

Hyundai Motor India

Honda Cars India

Toyota Kirloskar Motor

Kia India Pvt. Limited

Ford Motor Company

Nissan

Renault

Volkswagen

JSW MG Motor India Pvt. Ltd.

Isuzu Motors India Private Limited

BMW AG

Others

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory & Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030