Market Overview

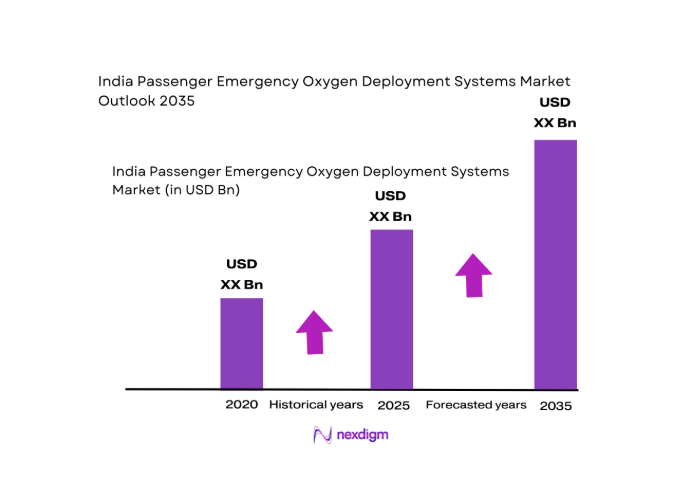

The India passenger emergency oxygen deployment systems market is valued at USD ~ based on a recent historical analysis. This growth is driven by the increasing air passenger traffic, with India’s civil aviation industry expected to carry over ~ passengers by 2024. Government regulations and airline safety standards further propel demand, ensuring that airlines install and upgrade emergency oxygen systems. Manufacturers like Linde Group and Air Liquide benefit from long-term contracts with commercial and private aircraft operators, fostering market stability.

The dominant cities and countries driving the market include major aviation hubs like New Delhi, Mumbai, and Bengaluru. These locations are key due to their robust aviation infrastructure, high passenger traffic, and regional hubs for international airlines. India’s favorable government policies for airport modernization and increasing investments in airline fleets ensure that these regions remain at the forefront. The growing number of air travel routes and the expansion of low-cost carriers in these areas have further solidified their dominance in the market.

Market Segmentation

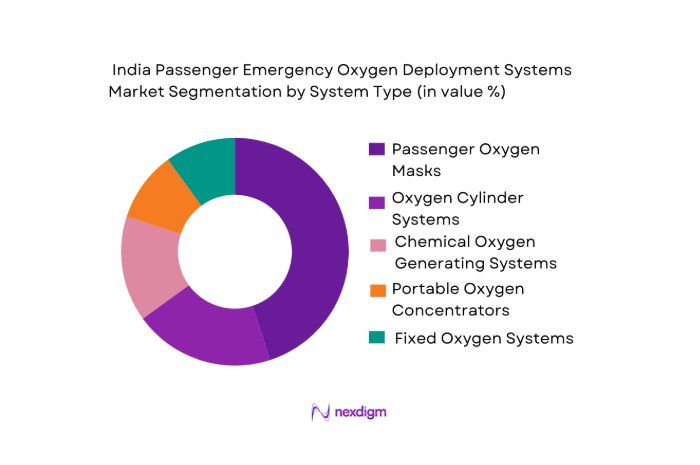

By System Type

India’s passenger emergency oxygen deployment systems market is segmented by system type into passenger oxygen masks, oxygen cylinder systems, chemical oxygen generating systems, portable oxygen concentrators, and fixed oxygen systems. Among these, passenger oxygen masks dominate the market share in 2024. This dominance is driven by strict regulatory requirements mandating their presence in every commercial aircraft. The widespread use of oxygen masks across various aircraft models ensures their market leadership. As a safety essential for air travel, the demand for these systems remains steady, particularly in both new aircraft and retrofit markets.

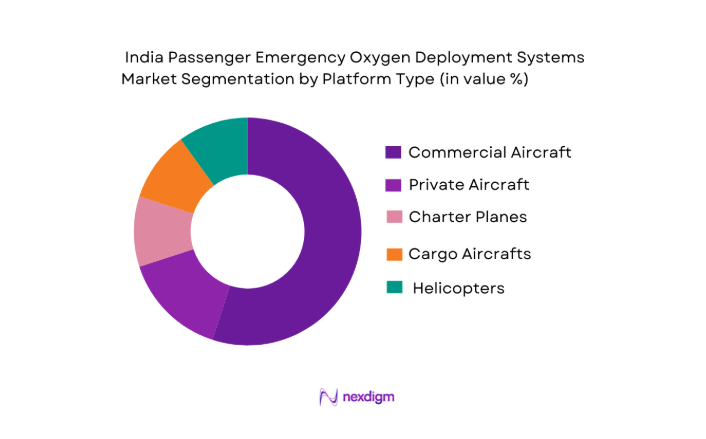

By Platform Type

The market is also segmented by platform type, including commercial airliners, private aircrafts, charter planes, cargo aircrafts, and helicopters. Commercial airliners account for the largest share in 2024, largely due to the increasing volume of both domestic and international air traffic in India. Airlines like Air India and IndiGo continue to expand their fleets, particularly with new aircraft models that require modernized emergency oxygen systems. The rapid growth of low-cost carriers in India further intensifies the demand for such systems, ensuring continued market dominance of commercial airliners.

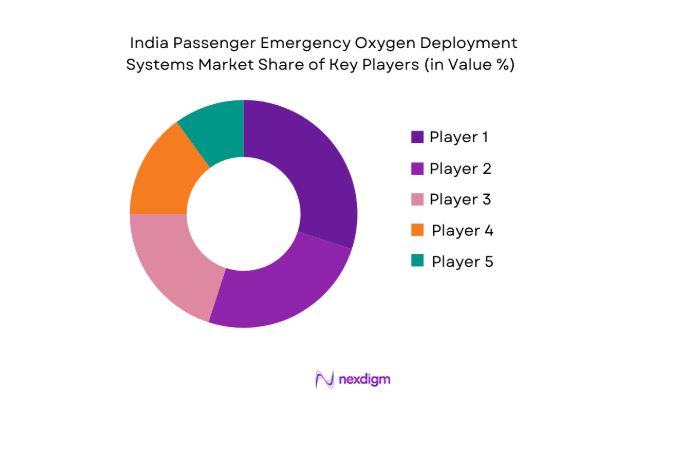

Competitive Landscape

The India passenger emergency oxygen deployment systems market is dominated by a few major players. Key companies, including global players like Linde Group and Air Liquide, as well as local manufacturers such as Aviation Oxygen Supply Co. and VTI Oxygen Systems, play a critical role in shaping market trends. These companies have been successful due to their established distribution networks, ongoing R&D investments, and strong customer relationships with Indian airline operators and government bodies. The market remains competitive with continued innovation in oxygen generation and delivery technologies.

| Company Name | Establishment Year | Headquarters | Product Focus | Market Focus | Distribution Network | R&D Investment | Regulatory Compliance |

| Linde Group | 1879 | Germany | ~ | ~ | ~ | ~ | ~ |

| Air Liquide | 1902 | France | ~ | ~ | ~ | ~ | ~ |

| Aviation Oxygen Supply Co. | 1990 | India | ~ | ~ | ~ | ~ | ~ |

| VTI Oxygen Systems | 2000 | India | ~ | ~ | ~ | ~ | ~ |

| Collins Aerospace | 1932 | USA | ~ | ~ | ~ | ~ | ~ |

India Passenger Emergency Oxygen Deployment Systems Market Analysis

Growth Drivers

Increase in air travel demand and passenger safety regulations

India’s air traffic has seen substantial growth, with over ~ domestic passengers traveling by air in 2023, according to the Directorate General of Civil Aviation (DGCA). The government of India aims to expand this number as part of its National Civil Aviation Policy, which is focused on increasing air travel accessibility. The growing demand for air travel, coupled with stringent passenger safety regulations set by the DGCA and international bodies, ensures continuous market expansion. As the number of passengers increases, the need for upgraded emergency oxygen systems remains a top priority for airlines.

Rising incidents of in-flight medical emergencies

In-flight medical emergencies have been on the rise, with the Indian airline industry reporting over 500 medical emergency cases in the first quarter of 2024 alone, according to the Ministry of Civil Aviation (MoCA). The increasing frequency of such emergencies has prompted airlines to enhance their emergency response protocols, leading to higher demand for oxygen deployment systems. Regulatory bodies have also mandated stricter health and safety standards to address these concerns, creating a stable growth trajectory for oxygen-related systems in passenger aircraft.

Market Challenges

High cost of advanced oxygen deployment systems

The high cost associated with advanced oxygen systems continues to challenge widespread adoption in the aviation sector. The advanced oxygen concentrators and chemical oxygen generating systems, while more efficient, are significantly more expensive than traditional oxygen systems. This cost barrier is a major issue, particularly for smaller airlines and private aircraft owners who face difficulties in upgrading their existing systems. According to the International Civil Aviation Organization (ICAO), the cost of retrofitting aircraft with the latest emergency oxygen systems is a significant financial burden for carriers operating under strict budget constraints.

Stringent regulatory compliance and certification processes

The regulatory framework for emergency oxygen systems is extremely stringent, with compliance requirements from both Indian authorities and international aviation bodies such as ICAO. These regulations necessitate regular safety checks, certifications, and equipment upgrades, which add to operational costs. Airlines must also maintain detailed records to demonstrate adherence to these standards, which can be both time-consuming and expensive. Such processes, although necessary for passenger safety, pose significant hurdles to smooth implementation and system upgrades in the market.

Opportunities

Government investments in aviation safety programs

The Indian government has been actively increasing its investments in aviation safety programs, particularly as part of its broader “Ude Desh ka Aam Naagrik” (UDAN) initiative. This program aims to make air travel more accessible by enhancing safety infrastructure at smaller airports. The government’s push to improve airport safety and operational efficiency has directly resulted in an increase in demand for emergency oxygen deployment systems. Additionally, India’s aviation sector has received over USD ~ in government funding for modernization, a portion of which is allocated towards improving passenger safety systems, including oxygen-related technologies.

Rising demand for retrofitted and customizable systems

With the rise of low-cost airlines and the expansion of private aviation, there is a growing demand for retrofitted oxygen systems that can be customized to suit specific aircraft types. The flexibility offered by modern oxygen systems, such as portable oxygen concentrators and adaptable chemical oxygen generators, caters to the need for cost-effective safety upgrades in older aircraft. The flexibility and cost-effectiveness of these systems provide a significant opportunity in the Indian market, especially as airlines seek to modernize their fleets in line with passenger safety demands and regulatory compliance.

Future Outlook

Over the next decade, the India passenger emergency oxygen deployment systems market is expected to witness robust growth. This will be fueled by the ongoing expansion of the aviation industry, particularly with the increase in domestic air travel. The Indian government’s focus on aviation safety regulations and airport infrastructure development will further support the growth of emergency systems. Additionally, technological advancements in oxygen generation systems, such as lighter and more efficient devices, will drive further demand from both commercial airlines and private operators.

The market is forecasted to grow at a compound annual growth rate (CAGR) of ~ from 2026 to 2035, supported by increasing passenger traffic, fleet modernization, and a continued focus on safety regulations in the aviation sector.

Major Players

- Linde Group

- Air Liquide

- Aviation Oxygen Supply Co.

- VTI Oxygen Systems

- Collins Aerospace

- UTC Aerospace Systems

- Zodiac Aerospace

- Air Products and Chemicals

- Honeywell Aerospace

- Chart Industries

- Beijing Aerospace Automatic Control Institute

- Envisage Aerospace

- Airborne Systems

- TALON Aerospace

- Oxygen Equipment Manufacturers Inc.

Key Target Audience

- Investments and venture capitalist firms

- Ministry of Civil Aviation

- Airlines and Aircraft Operators

- Private Aircraft Owners

- Airport Authorities

- Emergency Medical Services

- Aviation Maintenance, Repair, and Overhaul providers

- Aviation Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key stakeholders and variables influencing the India passenger emergency oxygen deployment systems market. Using secondary data from government reports, industry publications, and proprietary databases, we identify trends and regulatory frameworks that shape the market.

Step 2: Market Analysis and Construction

The next phase entails analyzing market data from 2020 to 2025, evaluating industry trends, and assessing customer demands for emergency oxygen systems. We analyze the shift towards more efficient systems and the technological innovations that have impacted the sector.

Step 3: Hypothesis Validation and Expert Consultation

To refine the market data, we consult with industry experts and key players in the oxygen deployment system sector through interviews. This helps validate hypotheses related to product demand and market dynamics.

Step 4: Research Synthesis and Final Output

We consolidate the data, drawing insights from both the top-down and bottom-up approaches to finalize our analysis. The final output includes an in-depth understanding of market trends, challenges, opportunities, and future outlooks for India’s emergency oxygen deployment systems.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Definition and Scope

- Market dynamics

- Historical overview

- Timeline

- Growth Drivers

Increase in air travel demand and passenger safety regulations

Rising incidents of in-flight medical emergencies

Technological advancements in oxygen deployment systems - Market Challenges

High cost of advanced oxygen deployment systems

Stringent regulatory compliance and certification processes

Limited infrastructure for emergency oxygen supply in some regions - Opportunities

Government investments in aviation safety programs

Rising demand for retrofitted and customizable systems

Collaborations with aircraft manufacturers for innovative oxygen solutions - Trends

Increased focus on lightweight, efficient oxygen delivery systems

Adoption of integrated oxygen solutions with other emergency systems - Government Regulations

- SWOT Analysis

- Porters 5 forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By System Type (In Value%)

Passenger Oxygen Mask

Oxygen Cylinder Systems

Chemical Oxygen Generating Systems

Portable Oxygen Concentrators

Fixed Oxygen Systems - By Platform Type (In Value%)

Commercial Airliners

Private Aircrafts

Charter Planes

Cargo Aircrafts

Helicopters - By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Upgraded Systems

Custom Fitments

Retrofitting Solutions - By EndUser Segment (In Value%)

Airline Operators

Private Aircraft Owners

Government Agencies

Emergency Medical Services

Aviation Maintenance, Repair, and Overhaul - By Procurement Channel (In Value%)

Direct Sales

Online Sales

Third-Party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Fitment Type, Procurement Channel, End User Segment)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Key Players

Linde Group

Air Liquide

Oxygen Equipment Manufacturers Inc.

Zodiac Aerospace

UTC Aerospace Systems

AeroBreeze

Chart Industries

Collins Aerospace

Air Products and Chemicals

Beijing Aerospace Automatic Control Institute

Aviation Oxygen Supply Co.

VTI Oxygen Systems

Envisage Aerospace

Airborne Systems

TALON Aerospace

- Increasing demand for emergency medical systems in commercial aviation

- Growth in private and charter aviation sectors

- Government safety regulations for oxygen systems

- Rising interest from EMS for retrofitted oxygen deployment solutions

- By Market Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035