Market Overview

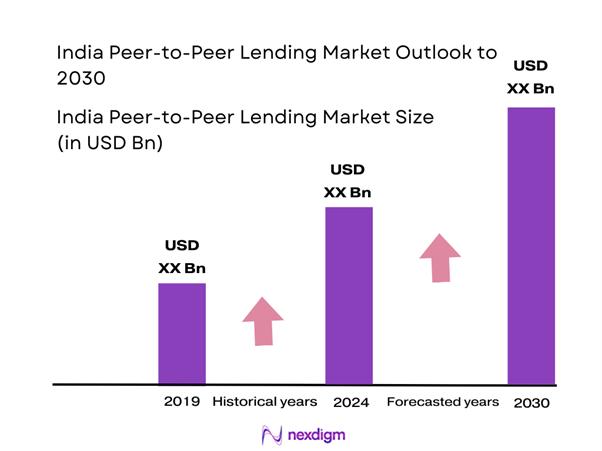

The India Peer-to-Peer (P2P) Lending Market is valued at USD 2.78 billion in 2024 with an approximated compound annual growth rate of 15% from 2024-2030, based on a five-year historical analysis. The rapid rise of digital financial services, increased smartphone penetration, and a growing need for alternative financing solutions among underserved segments are driving this growth. Factors such as government initiatives promoting digital payments and modernization of the financial sector further augment the market potential.

Cities like Mumbai, Bengaluru, and Delhi dominate the P2P lending market due to their burgeoning start-up ecosystems, which facilitate innovation and attract venture capital investments. The concentration of tech-savvy populations and a significant number of small and medium enterprises (SMEs) creates a fertile ground for P2P lending platforms to flourish, leading to enhanced financial accessibility in these metropolitan areas.

Regulatory frameworks established by the Reserve Bank of India (RBI) have fostered a supportive environment for P2P lending platforms. The RBI issued comprehensive guidelines that define the operational scope for P2P entities, aiming to enhance transparency and protect consumer interests. For example, the minimum capital requirement for P2P lending platforms is INR 2 crore, which is intended to ensure financial stability. By providing clear operational guidelines, the government empowers platforms to innovate while ensuring user safety and market integrity.

Market Segmentation

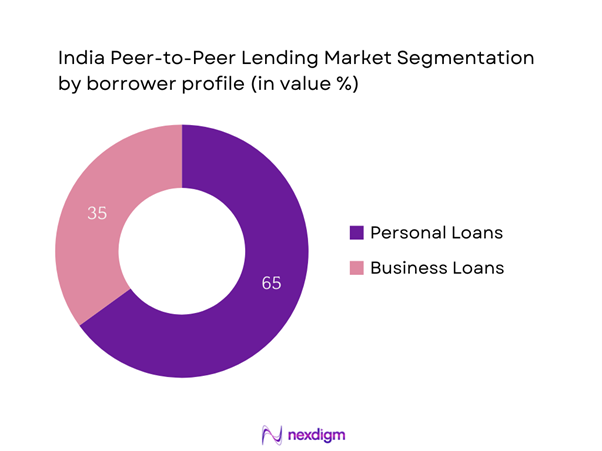

By Borrower Profile

The India P2P lending market is segmented by borrower profile into personal loans and business loans. Personal loans have a dominant market share, primarily due to the increasing financial independence among young professionals who prefer quick and hassle-free access to funds. As various platforms offer competitive interest rates and minimal documentation, personal loans have captured the interest of consumers seeking immediate financial support for discretionary spending, emergencies, or debt consolidation. The ease of accessing these loans through mobile apps further amplifies their appeal.

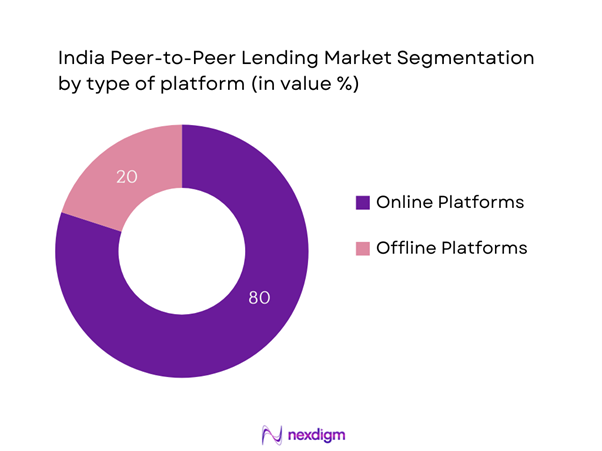

By Type of Platform

The market is also segmented by the type of platform, classified into online platforms and offline platforms. Online platforms exhibit dominance in market share, driven by the growing trend of digitalization and convenience. These platforms offer user-friendly interfaces, quick processing times, and the ability to reach a wider borrower base, which includes tech-savvy millennials and entrepreneurs. With lower operating costs, online P2P lending platforms can also provide more attractive rates, making them more appealing than traditional offline models.

Competitive Landscape

The India P2P lending market is dominated by several key players, including established firms and emerging startups. Major players include Faircent, Lendbox, and RupeeCircle, all of which leverage technology to streamline the lending process. This consolidation highlights the significant influence of these key companies, as they continue to shape market dynamics through innovative solutions and competitive pricing strategies.

| Company | Establishment Year | Headquarters | User Base | Key Offerings | Regulatory Compliance |

| Faircent | 2014 | New Delhi | – | – | – |

| Lendbox | 2016 | Gurugram | – | – | – |

| RupeeCircle | 2016 | Bengaluru | – | – | – |

| i2iFunding | 2015 | Gurgaon | – | – | – |

| IndiaLends | 2015 | New Delhi | – | – | – |

India Peer-to-Peer Lending Market Analysis

Growth Drivers

Increase in Digital Financial Services

The rapid expansion of digital financial services in India is a significant driver for the P2P lending market. As of 2024, the number of digital financial service users has surged to 600 million, driven by increasing smartphone penetration and improved internet access. This growth aligns with India’s goal to further boost its digital economy, projected to reach USD 1 trillion by 2025. The digitization of financial services is facilitating seamless transactions and trust, which encourages individuals and businesses to explore P2P lending as an accessible financing option.

Growing Credit Demand among Retail Borrowers

Retail credit demand in India has shown a consistent upward trajectory, particularly in urban centers. The total outstanding retail credit grew to approximately INR 28 trillion in 2023, with personal loans being a prominent component. Factors contributing to this growth include rising disposable incomes and changing consumer behavior that prioritizes convenience and speedy access to funds. As individuals increasingly seek quick financial solutions for personal and small business needs, P2P lending offers an efficient alternative within the broader lending market.

Market Challenges

Trust and Credit Risk Management

Trust issues and credit risk management remain significant challenges for the P2P lending market. A report revealed that approximately 20% of borrowers in the unsecured loan segment tend to default, primarily due to a lack of rigorous credit assessment protocols. As of 2023, around 35% of P2P lenders report difficulties in accurately assessing borrower risk, which can lead to increased defaults. Addressing these challenges is essential for fostering confidence among lenders and borrowers, which is crucial for sustainable market growth.

Competition from Traditional Financial Institutions

The threat of competition from traditional financial institutions remains a notable challenge for the P2P lending market. According to estimates, as of 2023, public and private sector banks cumulatively reported retail loan disbursements of over INR 30 trillion, reflecting their robust presence and established customer base. These institutions often have greater financial resources to invest in advanced technology and customer service, making it difficult for P2P platforms to carve out a significant niche. Maintaining a competitive edge necessitates continuous innovation and adaptability among P2P lenders.

Opportunities

Development of Innovative Financial Products

The development of innovative financial products offers a robust opportunity for differentiation and growth in the P2P lending market. As consumer preferences evolve, platforms that introduce tailored financial solutions—such as flexible repayment options and customized loan products—are likely to succeed. Notably, the Fintech industry in India is projected to reach a valuation of USD 150 billion by 2025, driven by advancements in technology and increasing digital adoption. This environment encourages P2P lenders to innovate, allowing them to meet the diverse needs of borrowers more effectively.

Integration of AI and Big Data Analytics

The integration of artificial intelligence (AI) and big data analytics presents a transformative opportunity for P2P lending platforms. By 2023, the AI market in India was valued at USD 7.8 billion, with expectations for substantial growth due to its applications in financial decision-making. Utilizing AI for credit scoring, risk analysis, and personalized customer service can improve operational efficiencies and enhance user experiences. By leveraging data insights, P2P platforms can make informed lending decisions, mitigate risks, and tailor offerings to individual customer profiles.

Future Outlook

Over the next five years, the India Peer-to-Peer lending market is expected to experience substantial growth, driven by technological advancements, changing consumer preferences, and increasing integration of regulatory frameworks that support digital lending. The demand for alternative financing solutions is surging, particularly among urban professionals and small businesses facing liquidity challenges. This environment offers significant opportunities for both new entrants and existing players to innovate and expand their offerings.

Major Players

- Faircent

- Lendbox

- RupeeCircle

- i2iFunding

- IndiaLends

- Cashkumar

- LoanTap

- OMLP2P

- LenDenClub

- Fincash

- Kiva

- ZestMoney

- SpringRole

- Credy

- NIRA

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Reserve Bank of India, Ministry of Finance)

- Financial Institutions

- Small and Medium Enterprises (SMEs)

- Consumer Finance Platforms

- Digital Payment Solution Providers

- Non-Banking Financial Companies (NBFCs)

- Technology Providers for Financial Services

Research Methodology

Step 1: Identification of Key Variables

The first stage involves developing an ecosystem map that encompasses all relevant stakeholders in the India Peer-to-Peer Lending Market. This step relies heavily on thorough desk research, utilizing a blend of secondary and proprietary databases to collect detailed industry-level insights. The aim is to pinpoint and clarify the vital variables influencing market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data related to the India Peer-to-Peer Lending Market will be assembled and scrutinized. This includes evaluating market penetration, the ratio of lenders to borrowers, and the resulting revenue generation. Additionally, an assessment of platform efficiency indicators will be conducted to ensure the accuracy and dependability of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through structured interviews with industry experts across various P2P lending platforms. These consultations will yield critical operational insights and financial data, allowing for a more informed understanding of market conditions and trends. Expert feedback will be essential for refining the information collected.

Step 4: Research Synthesis and Final Output

The concluding phase involves engaging with multiple P2P lending companies to gather in-depth insights about product offerings, user adoption rates, and other relevant factors. This interaction aims to validate and enhance the statistics obtained from the previous steps, ensuring a comprehensive, accurate, and validated analysis of the India Peer-to-Peer Lending Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Evolution and Growth

- Key Regulatory Developments

- Supply Chain and Value Chain Analysis

- Timeline of Key Players

- Growth Drivers

Increasing Internet Penetration

Evolving Consumer Behavior

Financial Inclusion Initiatives - Market Challenges

Regulatory Uncertainty

Credit Risk Management - Opportunities

Growth of Fintech Innovations

Increasing Demand for Alternative Financing - Trends

Rise of AI and Data Analytics

Shift Towards Sustainable Lending Models - Government Regulation

Licensing and Compliance Requirements

Consumer Protection Laws - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Default Rate, 2019-2024

- By Average Lending Rate, 2019-2024

- By Borrower Profile (In Value %)

Personal Loans

– Salaried Individuals

– Self-Employed Individuals

Business Loans

– Micro and Small Enterprises (MSEs)

– Startups and Freelancers - By Type of Platform (In Value %)

Online Platforms

– Pure-Play P2P Platforms

– Fintech Aggregators offering P2P

Offline Platforms

– Agent-Led P2P Models (limited use, mostly hybrid)

– NBFC + P2P Tie-ups - By Loan Amount (In Value %)

Small Loans (Under ₹50,000)

Medium Loans (₹50,000 – ₹500,000)

Large Loans (Above ₹500,000) - By Purpose of Loan (In Value %)

Education Funding

Home Renovation

Medical Expenses - By Region (In Value %)

North India

South India

East India

West India

- Market Share of Major Players on the Basis of Value, 2024

Market Share of Major Players by Type of Peer-to-Peer Lending Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Funding Sources, Average Loan Size, Customer Acquisition Cost, Customer Retention Rate, Unique Value offering and others)

- SWOT Analysis of Major Players

- Detailed Profiles of Major Companies

Faircent

Lendbox

IndiaLends

RupeeCircle

Finzy

LenDenClub

CashKaro

Groww

KreditBee

Fyntech

iLoan

Kiva India

MobiKwik

KreditBee

Indifi

- Market Demand and Utilization Patterns

- Borrower and Investor Profile Analysis

- Regulatory and Compliance Factors

- Decision-Making Process

- By Value, 2025-2030

- By Default Rate, 2025-2030

- By Average Lending Rate, 2025-2030