Market Overview

The India pet care market is valued at USD 720 million, based on a five-year historical analysis. This growth trajectory is primarily driven by increased pet adoption among urban households, higher disposable incomes, and a cultural shift toward the humanization of pets. According to the India International Pet Trade Fair, the market saw significant growth from USD 585 million, driven largely by the rising demand for premium pet food, personalized veterinary services, and growing awareness around pet wellness, including grooming and accessories.

India’s pet care market is majorly dominated by metros and Tier-1 cities, such as Delhi NCR, Mumbai, Bengaluru, Hyderabad, and Chennai. These regions are witnessing a surge in nuclear families and working professionals, who are increasingly adopting pets for companionship. The dominance of these cities is also attributed to the presence of organized veterinary clinics, retail pet stores, online pet product platforms, and grooming service providers, which collectively support a robust urban pet ecosystem.

Market Segmentation

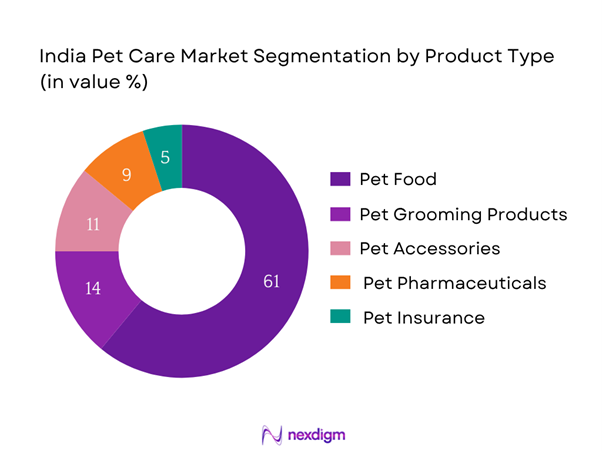

By Product Type

India Pet Care market is segmented by product type into pet food, pet grooming products, pet accessories, pet pharmaceuticals, and pet insurance. Recently, pet food has a dominant market share in India under this segmentation, largely due to the increasing focus on pet nutrition and wellness. The emergence of premium and specialized diets such as grain-free, breed-specific, and organic food offerings is further bolstering this segment. Leading brands such as Pedigree, Drools, and Royal Canin have strengthened distribution across both online and offline channels, ensuring availability across metro and Tier-1 markets.

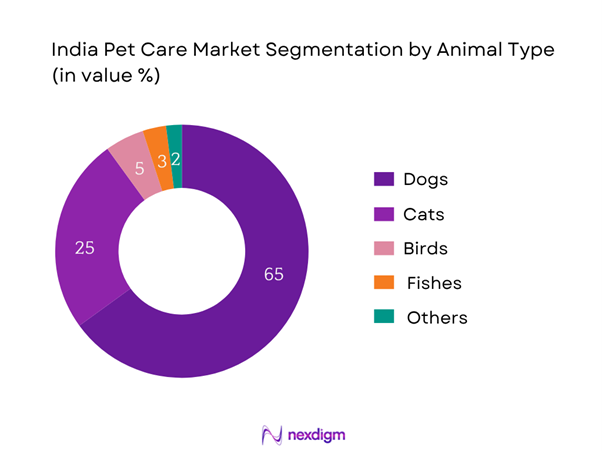

By Animal Type

India Pet Care market is segmented by animal type into dogs, cats, birds, fishes, and others (including rabbits and hamsters). Currently, dogs dominate the market, accounting for the largest share, driven by their wide acceptance across urban households and their role as protectors and companions. The dominance is also backed by tailored offerings in the pet food and grooming segments that cater specifically to dog breeds, age groups, and dietary requirements. Dog adoption rates are also significantly higher in both urban and semi-urban India, boosting demand across related categories.

Competitive Landscape

The India Pet Care market is currently influenced by a mix of domestic innovators and global giants. Multinational companies like Mars and Nestlé Purina lead in the premium food segment, while homegrown startups like Heads Up for Tails and Dogsee Chew are innovating with D2C and natural ingredient-based offerings. The market’s structure reflects a dual dynamic—traditional retail presence alongside a fast-expanding digital ecosystem for pet products and services.

| Company | Year Established | Headquarters | Product Range | Online Presence | Distribution Reach | Vet Partnerships | Private Label Brands | Subscription Model |

| Mars International | 1911 | McLean, USA | – | – | – | – | – | – |

| Drools (IB Group) | 2010 | Chhattisgarh, India | – | – | – | – | – | – |

| Heads Up For Tails | 2008 | Delhi, India | – | – | – | – | – | – |

| Royal Canin India | 1968 (Global) | Mumbai, India | – | – | – | – | – | – |

| Wiggles.in | 2018 | Pune, India | – | – | – | – | – | – |

India Pet Care Market Analysis

Growth Drivers

Rising Disposable Income & Nuclear Families

India’s disposable personal income rose from ₹273,365 billion in 2022 to ₹296,383 billion in 2023, reflecting increased household purchasing power. Concurrently, the share of nuclear families grew from 37% in 2008 to around 50% by 2022, with smaller households spending more per capita. This dual shift—more disposable income and preference for smaller family units—fuels spending on pet food, grooming, and healthcare, as pet owners view animals as companions requiring lifestyle-quality products and services.

Humanization of Pets

India is home to an estimated 31 million pet dogs as of end‑2023, and approximately 600,000 pets were newly adopted in that year. Pet ownership frequency—3–4 veterinary visits per year per pet—underscores owners’ willingness to invest in animal wellness. As pets increasingly become family members, demand has surged for premium diets, grooming, healthcare, and lifestyle products, underpinning market expansion across food and non-food segments.

Market Challenges

Unstructured Supply Chain for Non-Food Segments

India imported 21,133 pet food shipments between Oct 2023–Sep 2024 yet imports of grooming products and accessories remain largely fragmented. Unlike food items tracked by the Ministry of Commerce, non-food segments are supplied through unorganized local manufacturers and small retailers with no unified tracking—resulting in inconsistent product quality and variable availability. This distribution gap limits scale and standardization across grooming and accessory categories.

Limited Insurance Penetration for Pets

Although India’s overall insurance penetration dropped from 4% in FY23 to 3.7% in FY24, pet insurance is even more niche. Estimates suggest the market generated USD 662.1 million in 2024, yet compared to 31 million pet dogs, insured pets are significantly fewer. Low awareness, perceived complexity, and limited policy offerings constrain uptake, creating friction between health-conscious owners and available solutions.

Opportunities

Emergence of Pet Tech Startups

India’s quick-commerce sector, valued at USD 6–7 billion in 2024, fulfilled two-thirds of e-grocery orders, showcasing fast-delivery capabilities. Similar infrastructure can support pet-care tech startups offering tele‑vet consultations, AI-driven health monitoring, and subscription-based pet supplies. With over 800 million smartphone users, technology-savvy pet owners can adopt pet-tech solutions, marking a transition from traditional to tech-augmented pet care.

Growing Interest in Plant-Based Pet Diets

While India’s pet food imports grew strongly, 1,139 new pet food products launched between 2018–Oct 2023. Consumers, especially in urban India, are experimenting with plant-based and grain-free diets as part of pet humanization. Although still nascent, the launch of such 1,000+ niche variants highlight a growing trend toward wellness-centric diets. Early adoption in metro areas suggests potential for larger domestic markets, offering opportunities for innovators.

Future Outlook

Over the next few years, the India Pet Care market is expected to witness robust growth, driven by increasing urban pet ownership, the entry of new D2C brands, and greater awareness around pet wellness. Evolving pet preferences—from traditional dogs and cats to exotic pets—are also likely to diversify demand across segments. Digital transformation will continue to revolutionize the sector, with subscription services, AI-led pet tracking solutions, and telemedicine for veterinary care gaining traction. With continued investments and policy advocacy for pet insurance, the industry is also likely to see formalization in pet healthcare financing. As per industry forecasts, the market is projected to grow at a CAGR of 17.3% from 2024 to 2030, positioning India among the fastest-growing pet care markets in Asia.

Major Players

- Mars International (Pedigree, Whiskas)

- Nestlé Purina

- Drools (IB Group)

- Himalaya Companion Care

- Heads Up For Tails

- Just Dogs

- Goofy Tails

- PetSutra

- Royal Canin India

- Capt Zack

- Pawfectly Made

- Supertails

- Dogsee Chew

- Fabled Foods

Key Target Audience

- Veterinary Clinic Chains

- Organized Pet Retail Chains

- Pet Food Manufacturers

- Private Equity & Investment Firms

- Government and Regulatory Bodies (Animal Welfare Board of India, FSSAI)

- D2C Petcare Startups

- Pet Health & Insurance Providers

- Pet Grooming & Boarding Franchise Businesses

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Pet Care Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the India Pet Care Market. This includes assessing pet ownership trends, average spending patterns, retail availability, and revenue distribution across online and offline segments. Further, we examine service accessibility, particularly veterinary and grooming services.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through structured interviews with veterinarians, pet product manufacturers, and retail franchise owners. These consultations provide deep insights into market behavior, trends, challenges, and opportunity areas.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing findings into a validated market model. Inputs from field experts and proprietary databases help corroborate the segmented revenue streams, regional trends, pricing strategies, and brand performance across product lines.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Evolution of the Pet Care Ecosystem in India

- Pet Adoption and Ownership Trends

- Timeline of Major Developments

- Pet Care Value Chain and Stakeholder Mapping

- Pet Care Business Lifecycle in India

- Growth Drivers

Rising Disposable Income & Nuclear Families

Humanization of Pets

Expansion of Online Retail Ecosystem

Entry of Organized Pet Healthcare Chains - Market Challenges

Unstructured Supply Chain for Non-Food Segments

Limited Insurance Penetration for Pets

High Import Dependency for Premium Products - Opportunities

Emergence of Pet Tech Startups

Growing Interest in Plant-Based Pet Diets - Trends

Subscription Models for Food & Grooming

Increasing Vet-Tech Adoption (Teleconsultation, AI-based Diagnosis)

Regional Brands Launching Ayurvedic Pet Products - Regulatory Overview

FSSAI Guidelines for Pet Food

Pet Shop Licensing Rules

Import & Customs Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- By Value (2019-2024)

- By Volume (2019-2024)

- By Average Spend per Pet Household (2019-2024)

- By Product Type (In Value %)

Pet Food

– Dry Food (Kibble)

– Wet/Canned Food

– Treats and Chews

– Customized or Prescribed Diets

– Organic/Natural Pet Food

Pet Grooming

– Shampoos and Conditioners

– Brushes and Combs

– Nail Clippers and Trimmers

– Perfumes and Deodorizers

– Grooming Kits and Tools

Pet Accessories

– Collars, Leashes & Harnesses

– Beds and Mats

– Toys

– Feeding Bowls and Water Dispensers

– Clothing and Shoes

Pet Pharmaceuticals

– Anti-parasitics (fleas, ticks, worms)

– Antibiotics and Supplements

– Vaccines and Injections

– Joint Health and Skin Medications

– Herbal and Ayurvedic Products

Pet Insurance

– Accident Coverage

– Comprehensive Medical Insurance

– OPD Reimbursements

– Breed-Specific Plans

– Third-Party Liability Coverage - By Animal Type (In Value %)

Dogs

– Small Breeds

– Medium Breeds

– Large Breeds

Cats

– Persian

– Siamese

– Indigenous/Street Cats

Birds

– Parakeets

– Cockatiels

– Finches and Canaries

– Exotic Birds (Macaws, African Greys)

Fishes

– Freshwater Fishes (Goldfish, Betta, Tetra)

– Saltwater Fishes

– Aquarium Plants and Ecosystems

Others

– Rabbits

– Hamsters

– Turtles

– Guinea Pigs - By Distribution Channel (In Value %)

Specialty Pet Stores

– Franchise Pet Stores

– Local Independent Pet Shops

Online Retail

– E-commerce Platforms

– Pet-Specific Platforms

Veterinary Clinics

– On-site Clinics with Pet Product Shelves

– Chain Veterinary Hospitals

Supermarkets & Hypermarkets

– Organized Retail

– Local Grocery Chains with Pet Sections

Pet Pharmacies

– Physical Pet Medical Stores

– Online Pet Medicine Platforms - By Ownership Demographics (In Value %)

Metro Cities

Tier 1 Cities

Tier 2 and Beyond - By End-Use (In Value %)

Individual Pet Owners

– Single or Family Households

– Urban Professionals and Elderly Owners

Veterinary Hospitals

– Government and Private Multi-specialty Pet Clinics

– Animal Rescue Organizations

Pet Boarding/Daycare

– Luxury Pet Hotels

– Daycare Facilities in Tier 1 & Metro Cities

Pet Grooming Services

– Mobile Grooming Vans

– Salon-Style Pet Spa Chains

– At-Home Grooming Startups

- Market Share by Revenue Contribution (Food, Services, Accessories, Insurance)

- Cross Comparison Parameters (Company Overview, Pet Category Focus, Number of SKUs, Retail Touchpoints, Online Presence, Import vs Local Manufacturing, Vet Network, Subscription Models, Pricing Structure)

- SWOT Analysis of Major Players

- Comparative Pricing Analysis by SKUs

- Profiles of Major Market Players

Mars International (Pedigree, Whiskas)

Nestlé Purina

Drools (IB Group)

Himalaya Companion Care

Heads Up For Tails

Just Dogs

Goofy Tails

PetSutra

Royal Canin India

Capt Zack

Pawfectly Made

Supertails

Dogsee Chew

Wiggles.in

Fabled Foods

- Urban vs Rural Pet Owner Profiles

- Average Spending per Pet by City Tier

- Usage Patterns – Food, Grooming, Accessories, Vet Services

- Behavioral Trends & Brand Loyalty Factors

- Decision Making: Influencers and Triggers for Purchase

- By Value (2025-2030)

- By Volume (2025-2030)

- By Average Spend per Pet Household (2025-2030)