Market Overview

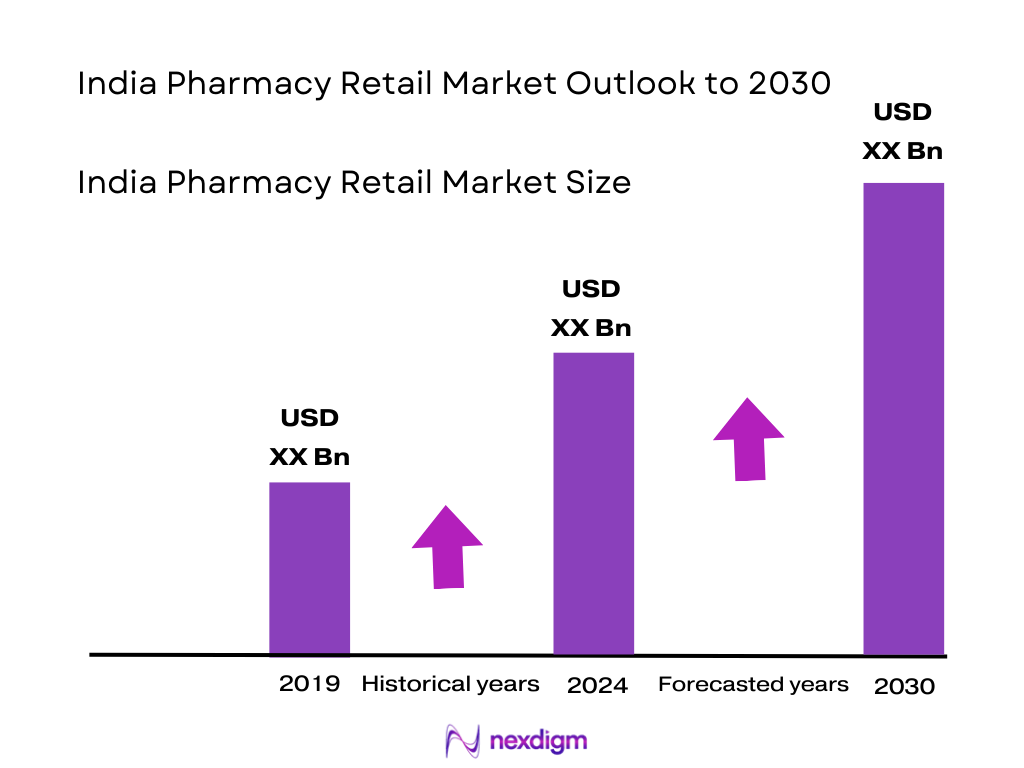

The India pharmacy retail market is valued at USD 27,383.6 million, reflecting comprehensive revenue from both physical and digital outlets. It is driven by a rising demand for prescription medicines across urban and rural regions, the swift expansion of online and offline pharmacy chains, and increasing prevalence of chronic ailments such as diabetes, hypertension, and cardiovascular disorders. Moreover, growing healthcare awareness and improved insurance penetration have significantly contributed to this market base.

Major urban centres like Mumbai, Bangalore, Delhi NCR, and Hyderabad dominate the market, owing to their high population density, robust healthcare infrastructure, and higher per capita income, which bolster consumer spending on healthcare and pharmaceuticals. Additionally, manufacturing hubs such as Vadodara, Ahmedabad, and Baddi are industry strongholds due to their dense pharmaceutical production ecosystems and well-developed supply-chain networks. The India pharmacy retail market is projected to grow at 10% CAGR from 2025 to 2030.

Market Segmentation

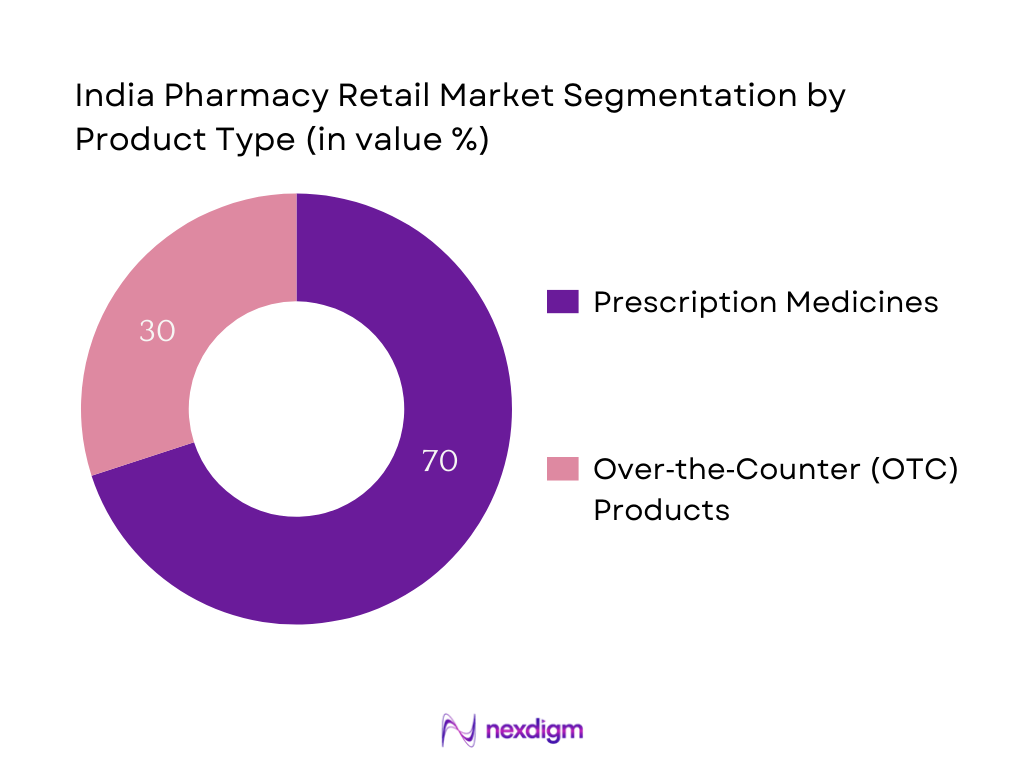

By Product Type

The India pharmacy retail market is segmented by product type into Prescription Medicines and Over‑the‑Counter (OTC) Products. Prescription Medicines hold the dominant market share at 70%, which is attributable to the rising prevalence of chronic and acute diseases requiring regulated, doctor-prescribed treatments. Consumers rely on pharmacy chains and trusted providers to procure these medications, while regulatory and healthcare infrastructure support ensures consistent prescription drug demand. The dominance is thus driven by trust, repeat use, and necessity, outweighing growth in OTC categories focused on symptomatic relief and wellness.

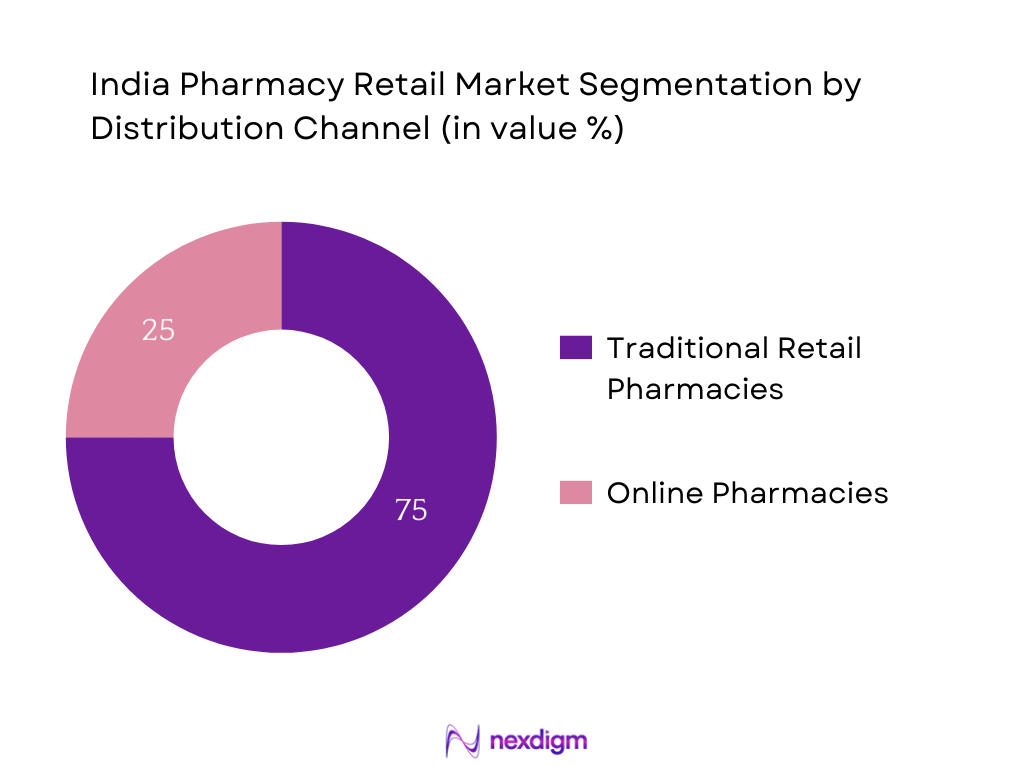

By Distribution Channel

The India pharmacy retail market is segmented by distribution channel into Traditional Retail Pharmacies and Online Pharmacies. Traditional Brick‑and‑Mortar pharmacies dominate with a 75% share in 2024, as they continue to serve as trusted, accessible points for immediate purchases, personalized advice, and spontaneous needs—especially in semi-urban and rural areas. Despite digital convenience, physical outlets remain preferred for urgent requirements and by demographics less comfortable with digital platforms. Their extensive geographical presence and customer trust reinforce their prevailing dominance over emerging e-pharmacy models.

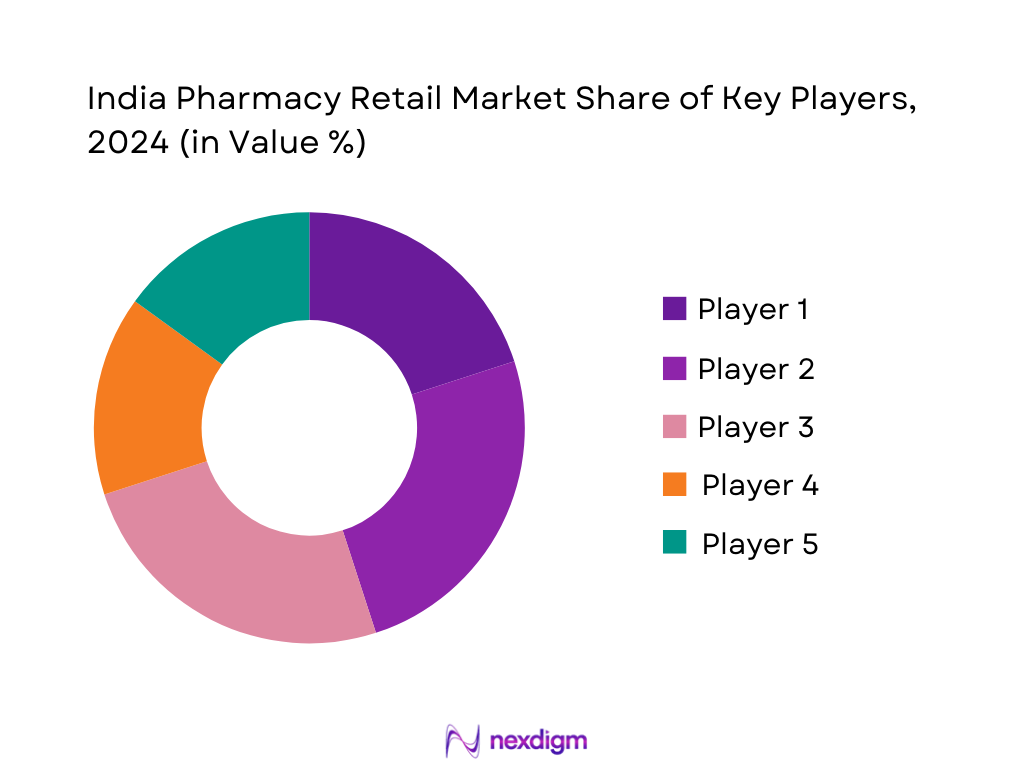

Competitive Landscape

The competitive landscape is characterized by a few key national players with extensive networks. The India pharmacy retail market is dominated by several major players, including Apollo Pharmacy and MedPlus, which boast expansive store networks and integrated digital platforms. This consolidation underscores the significant market influence wielded by these established chains, even as e-pharmacy platforms like 1mg and PharmEasy emerge rapidly.

| Company Name | Establishment Year | Headquarters | Store Network | Digital Platform Presence | Vertical Integration | Logistics Infrastructure | Home Delivery Capability | Strategic Differentiator |

| Apollo Pharmacy | 1987 | Chennai | – | – | – | – | – | – |

| MedPlus | 2006 | Hyderabad | – | – | – | – | – | – |

| 1mg (Tata Digital) | 2015 | Gurugram | – | – | – | – | – | – |

| PharmEasy | 2014 | Mumbai | – | – | – | – | – | – |

| Wellness Forever | 2008 | Mumbai | – | – | – | – | – | – |

India Pharmacy Retail Market Analysis

Growth Drivers

Increasing Chronic Disease Prevalence

India currently has an estimated 77 million adults with type 2 diabetes, with an additional 25 million prediabetics, as per WHO data, while more than 50% remain undiagnosed, intensifying the chronic treatment demand. A 2025 study focusing on adults aged 45 and above cites that 19.8%, or approximately 50.4 million individuals, are diabetic. Together, these indicate that over 100 million individuals need ongoing medication and pharmacy support, reinforcing sustained revenue channels. The sheer number of patients requiring long-term pharmacotherapy underscores the essential role pharmacies play in supply and adherence, thereby solidifying the chronic‑disease‑driven demand as a robust backbone for the pharmacy retail market.

Insurance Penetration

India’s total insurance premium penetration reached 3.76% of GDP in 2024, with an industry turnover of USD 134,344 million, and an insurance density (per capita premium) of USD 93.29. Life insurance alone accounted for 2.8% of GDP, surpassing emerging‑markets average, with 74% of premiums attributable to life policies. Government-sponsored schemes like Ayushman Bharat extend health coverage to over 30 crore individuals, while employer-driven group insurance covers 20 crore people, significantly outpacing retail insurance at 5 crore individuals. This expanding insurance footprint—especially via public health insurance and employer-based group plans—enhances affordability of medicines and stimulates demand at pharmacy outlets through cashless or reimbursable models, ensuring recurring pharmacy patronage driven by broader insurance coverage.

Market Challenges

Unorganised Sector Dominance

The Indian pharmacy retail landscape remains heavily skewed toward unorganised outlets, with these local medical stores comprising approximately 88.70% of total retail pharmacies in 2021, while organised and licensed retail chains accounted for just 8.50%, and online pharmacies made up a minimal 2.80% of the segment. This concentration highlights the persistence of traditional, independent chemists across diverse geographies—from rural villages to peri‑urban areas—coupled with limited penetration by formal retail chains. Their ubiquity limits the scalability of standardized quality controls, inventory systems, and digital integrations, posing a significant impediment to efficient, regulated expansion of pharmacy retail.

Regulatory Oversight Shortcomings

Regulatory mechanisms for pharmacy retail are showing critical gaps: recent inspections of 400 drug-manufacturing units revealed that over 36% were ordered to shut down due to non-compliance and serious quality issues, including cases linked to contaminated cough syrups that resulted in child fatalities abroad. Simultaneously, Indian authorities have yet to implement a mandatory drug recall framework, despite deliberations since 1976, leaving unsafe or substandard medicines without an effective withdrawal mechanism. These systemic regulatory deficiencies compromise product safety, erode consumer trust, and place organized pharmacies under heightened scrutiny or liability when sourcing from manufacturers with inconsistent quality compliance.

Opportunities

ePharmacy Consolidation

While granular figures on consolidation aren’t available, the Ayushman Bharat Digital Mission has since inception facilitated creation of over 67 crore ABHA (digital health IDs) and linked more than 42 crore health records, with over 1.3 lakh health facilities ABDM‑enabled, of which 17,000+ are private healthcare facilities. Additionally, a leading health‑tech platform, Eka Care, has digitized 110 million health records and serves 50 million users, powered by AI and ABHA infrastructure. These data points signal a rapidly scaling digital backbone that endorses e-pharmacy consolidation by streamlining patient identity, prescription access, and record interoperability. The growing digital ecosystem thereby lays a firm foundation for unified pharmacy platforms, enabling mergers, acquisitions, integrations, and network economies supported by robust digital health infrastructure.

Ayushman Bharat Integration

As of December 2023, 28.45 crore Ayushman Cards have been issued, with 9.38 crore issued in that year, and the scheme has facilitated 6.11 crore hospital admissions, of which 1.7 crore occurred that year, totaling Rs 78,188 crore authorized hospitalization, including Rs 25,000 crore in 2023 alone. Additionally, MoHFW reports Ayushman Bharat has benefited over 8 crore people, with government health funding reaching approximately Rs 95,957 crore, and medical colleges expanding from 307 to 730 as of 2024. This integration into a national health assurance system, covering tens of millions and enabling high‑value prescriptions and hospital encounters, positions pharmacy chains to benefit from increased formal demand, better reimbursement mechanisms, and enhanced prescription flows originating from covered healthcare episodes. Ayushman Bharat thus helps institutionalize pharmacy purchases across public and private eligible cohorts through improved funding and health infrastructure expansion.

Future Outlook

Over the next six years, the India pharmacy retail market is poised for robust expansion, powered by rapid digital health adoption, rural penetration of trusted retail chains, and supportive government policies enhancing access to affordable medicines. E-pharmacy platforms will further enhance convenience, while brick‑and‑mortar outlets continue to secure customer trust. Technology-driven models, such as telepharmacy and home delivery, will redefine service expectations and competitive differentiation.

Major Players

- Apollo Pharmacy

- MedPlus

- PharmEasy

- 1mg (Tata Digital)

- Wellness Forever

- NetMeds (Reliance Retail)

- SastaSundar

- Frank Ross

- Zeno Health

- Trust Chemists

- Guardian Pharmacy

- Noble Plus

- EasyMedico

- Ayush Pharma

- Neolife Pharmacy

Key Target Audience

- Pharmaceutical Retail Chains (e.g., Apollo Pharmacy, MedPlus)

- E‑Pharmacy Platforms (e.g., PharmEasy, 1mg)

- Hospital‑based Pharmacy Units

- Investment and Venture Capitalist Firms

- Large Pharmaceutical Manufacturers (domestic and multinational)

- Drug Wholesalers and Distributors

- Government and Regulatory Bodies

- Healthcare Delivery Networks (clinics with pharmacy integration)

Research Methodology

Step 1: Secondary Data Gathering & Market Validation

We aggregated quantitative data from reputable sources to establish baseline market size, segmentation, and growth projections. Triangulation ensured consistency across published figures and forecasts.

Step 2: Stakeholder Mapping & Supply‑Chain Assessment

We mapped key stakeholders in the pharmacy retail ecosystem—including retailers, e-pharma platforms, healthcare regulators, and logistics providers—to understand distribution dynamics and regional dominance across metros and production hubs.

Step 3: Expert Interviews & Ground‑Level Insights

Engagements with pharmacy executives, supply-chain managers, and regulatory consultants provided qualitative corroboration of trends such as consumer behavior, digital adoption, and infrastructure challenges, enriching the quantitative base.

Step 4: Forecast Modeling & Segmentation Analysis

We applied bottom‑up and top‑down modeling techniques to project revenue growth across segments (product type, channel). Scenarios considered regulatory shifts, digital adoption rates, and healthcare policy impacts to ensure defensible forecasts.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Market Sizing Approach, Primary Research Insights, Secondary Data Validation, Consolidated Data Triangulation, Limitations and Analyst Forecast Framework)

- Definition and Market Scope

- Industry Evolution and Historical Trajectory

- Business Model Typologies (Traditional, Chain-based, Digital-First, Hybrid Models)

- Pharmacy Retail Value Chain Mapping

- Timeline of Market Transformations and Regulatory Milestones

- Strategic Role in India’s Healthcare Ecosystem

- Growth Drivers (Increasing Chronic Disease Prevalence, Insurance Penetration, Digital Health Adoption, Rise in Generic Drug Sales)

- Market Challenges (Regulatory Uncertainty, Unorganised Sector Dominance, Inventory Management, Return Policies)

- Opportunities (ePharmacy Consolidation, Ayushman Bharat Integration, Tier-II/III Expansion, AI/ML for Inventory & Diagnosis Support)

- Consumer Trends (DTC Health Products, Subscription Refills, Preventive Wellness)

- Government Regulations (Pharmacy Council Guidelines, FDI Norms, Telemedicine Act, Drug Price Control Order)

- SWOT Analysis

- Stakeholder Ecosystem (Retail Chains, Wholesalers, PBMs, Insurance, Aggregators)

- Porter’s Five Forces Analysis

- By Value, 2019-2024

- By Volume (Prescriptions Fulfilled, OTC Units Sold), 2019-2024

- By Average Price per Prescription, 2019-2024

- By Store Type (In Value %)

Independent Pharmacies

Organized Retail Chains

Hospital-based Pharmacies

Online/E-Pharmacies

Franchise Pharmacies - By Product Category (In Value %)

Prescription Medicines

Over-the-Counter (OTC) Drugs

Nutraceuticals and Dietary Supplements

Wellness & Personal Care

Medical Devices and Consumables - By Payment Method (In Value %)

Cash

UPI/Wallets

Insurance-Based Reimbursements

Credit/Debit Cards

Government Schemes (Ayushman Bharat, CGHS, etc.) - By Distribution Mode (In Value %)

Physical In-store

Online (Web-based/E-Pharma Apps)

Tele-Pharmacy/Call-based Ordering

Home Delivery

Click-and-Collect - By Region (In Value %)

North India

South India

East India

West India

Central & North-East India

- Market Share of Major Players by Revenue

- Cross Comparison Parameters: (Company Overview, Operating Model, Retail Network (Number of Stores, Cities Covered), Average Basket Size, Monthly Order Volume, Repeat Order Rate, App Downloads and Web Traffic, Inventory Model (Own Stock vs Marketplace))

- SWOT Analysis of Major Players

- Pricing and Discounting Strategies Comparison

- Detailed Profiles of Major Competitors

Apollo Pharmacy

MedPlus

1mg (Tata Digital)

NetMeds (Reliance Retail)

PharmEasy

Wellness Forever

SastaSundar

Frank Ross

Zeno Health

Trust Chemists

Guardian Pharmacy

Noble Plus

EasyMedico

Ayush Pharma

Neolife Pharmacy

- Purchase Decision Criteria (Proximity, Discounts, Brand Trust, Digital Convenience)

- Awareness and Knowledge about Brands/Drugs

- Digital Literacy and App Usage for Medicine Purchase

- Income Profile and Spending Thresholds

- Healthcare Professional Influence

- Regional Disparities in Buying Behavior

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price per Prescription, 2025-2030