Market Overview

As of 2024, the India phenolic resins market is valued at USD 980 million, with a growing CAGR of 4.3% from 2024 to 2030, showcasing robust growth fuelled by increasing demand in sectors such as construction, automotive, and electrical and electronics. The market is primarily driven by a surge in infrastructure development and the expansion of the automotive industry, alongside the rising need for high-performance materials. The penetration of eco-friendly and sustainable products further propels the market, reflecting a clear pivot towards advanced manufacturing technologies.

Dominance in the market can largely be attributed to major industrial hubs such as Maharashtra, Gujarat, and Tamil Nadu, which serve as critical centres for automotive and construction activities. These regions host numerous manufacturing facilities and are supported by a well-established supply chain network. Additionally, government initiatives promoting infrastructure development and regulatory frameworks focusing on sustainable materials contribute significantly to market leadership, creating an enabling environment for phenolic resin production.

Market Segmentation

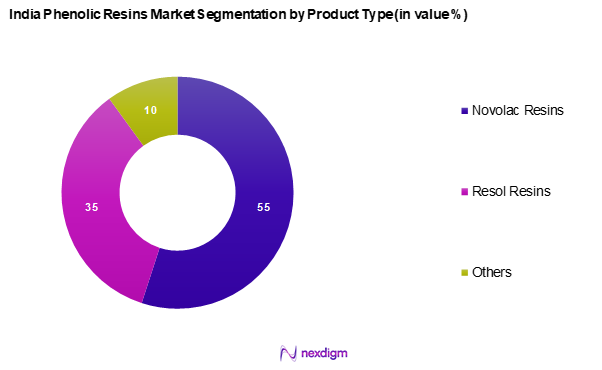

By Product Type

The India phenolic resins market is segmented into novolac resins, resol resins, and others. Novolac resins command a significant market share due to their superior thermal stability and mechanical properties, making them highly suitable for applications in electrical and automotive industries. Their excellent insulation properties and ability to withstand high temperatures enable manufacturers to leverage them in critical applications, thereby enhancing overall product performance.

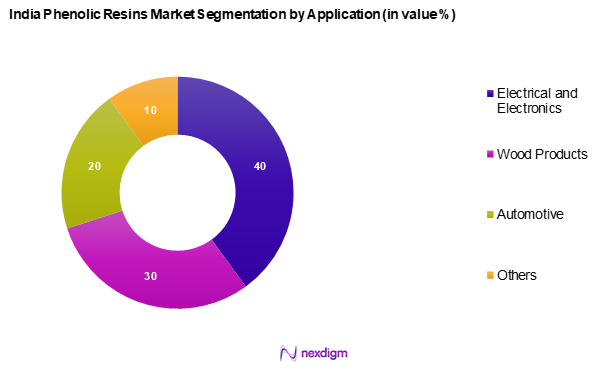

By Application

The India phenolic resins market is segmented into wood products, electrical and electronics, automotive, and others. The Electrical and electronics segment is the dominant player, accounting for a substantial share due to the increasing usage of phenolic resins in the production of circuit boards, connectors, and insulators. The demand for lightweight, durable materials that provide excellent insulation and heat resistance has led to significant growth in this segment, driving manufacturers to adopt phenolic resins as a viable choice for high-performance applications.

Competitive Landscape

The India phenolic resins market is characterized by a consolidated environment dominated by key players in the market. Major players include chemical giants like Kanoria Chemicals & Industries, Bakelite Hylam Ltd., Atul Ltd., Aditya Birla Chemicals, and Sumitomo Bakelite Co., Ltd. which leverage their extensive technological capabilities and established distribution networks to maintain competitive advantages. This consolidation highlights the significant influence these companies have on shaping market dynamics, product innovation, and pricing strategies.

| Major Players | Establishment Year | Headquarters | Revenue ( USD Mn) | Product Range | Market Share | Strength | Weakness |

| Kanoria Chemicals & Industries | 1960 | Kolkata, India | – | – | – | – | – |

| Bakelite Hylam Ltd. | 1947 | Hyderabad, India | – | – | – | – | – |

| Atul Ltd. | 1947 | Valsad, India | – | – | – | – | – |

| Aditya Birla Chemicals | 1996 | Mumbai, India | – | – | – | – | – |

| Sumitomo Bakelite Co., Ltd. | 1955 | Tokyo, Japan | – | – | – | – | – |

India Phenolic Resins Market Analysis

Growth Drivers

Increasing Demand from Automotive Industry

The automotive sector is experiencing a surge in demand for phenolic resins due to their superior properties such as high thermal resistance and excellent adhesion. In India, vehicle production reached approximately 4.4 million units in 2022, showcasing a robust growth trajectory. The automotive industry is projected to contribute significantly to the country’s GDP, estimated at around USD 219 billion in 2025, as per government projections. Additionally, the push for electric vehicles is expected to further increase the need for high-performance materials, including phenolic resins, as these materials are essential for lightweight and durable components.

Expanding Building and Construction Sector

India’s building and construction sector is witnessing substantial growth, propelled by urbanization and infrastructural development. The construction output of India grew to approximately USD 1 trillion in 2023 and is anticipated to reach around USD 1.2 trillion by 2025, fueled by government initiatives like the Smart Cities Mission. Phenolic resins, known for their insulation properties and resistance to moisture, are increasingly favored in construction applications. The rising demand for energy-efficient buildings is expected to see a stronger adoption of these materials in various construction projects, thereby supporting continued sector growth.

Market Challenges

Volatile Raw Material Prices

The production of phenolic resins largely depends on raw materials like phenol and formaldehyde, whose prices are subject to significant fluctuations. For instance, phenol prices averaged around USD 1,800 per metric ton in 2023, reflecting a rise due to supply chain disruptions and geopolitical tensions. Such volatility can strain profit margins for manufacturers, as operational costs can rapidly escalate. With the average inflation rate for input costs projected at 5% in 2024, manufacturers must navigate these challenges while maintaining competitive pricing structures.

Fluctuating Demand Across End-user Industries

Demand for phenolic resins in India faces inconsistency, particularly among key sectors such as automotive and construction which directly impacts market stability. For example, automotive production dipped by about 5% in late 2022 due to semiconductor shortages, temporarily reducing demand for materials like phenolic resins used in auto parts. Moreover, seasonal fluctuations in construction activities affect the consistent requirement for phenolic resin-based applications. Companies must build flexible strategies to mitigate these demand changes and better align production with market needs.

Opportunities

Innovation in Production Techniques

Advancements in production techniques for phenolic resins provide significant growth opportunities for manufacturers. Innovations such as solvent-free curing processes and the development of high-performance resins are gaining traction. Moreover, as of 2023, around 30% of manufacturers in India are exploring new formulations that enhance environmental sustainability. The trend toward automation and increased efficiency in production lines is anticipated to lower costs, increase output, and enhance product quality, thereby attracting more customers in diverse sectors.

Rising Environmental Awareness and Sustainability Initiatives

The increasing prioritization of environmental sustainability creates opportunities for the development of bio-based phenolic resins in India. As of 2023, the Indian government has initiated various sustainability initiatives aimed at reducing carbon footprints in industrial processes. With public awareness around climate change rising sharply, demand for sustainably produced materials is expected to surge. Around 25% of the current phenolic resin market is beginning to shift towards eco-friendly alternatives, fostering growth in this segment and paving the way for innovative, green production practices.

Future Outlook

Over the next five years, the India phenolic resins market is expected to exhibit considerable growth, propelled by continued government support for infrastructure projects, advancements in resin technology, and a rising preference for sustainable materials in manufacturing. The market outlook remains positive as industries pivot towards high-performance materials that align with environmental standards, thereby bolstering demand for phenolic resins across various applications.

Major Players

- Kanoria Chemicals & Industries

- Bakelite Hylam Ltd.

- Atul Ltd.

- Aditya Birla Chemicals

- Sumitomo Bakelite Co., Ltd.

- Momentive Performance Materials Inc.

- Hexcel Corporation

- SI Group, Inc.

- Kolon Industries, Inc.

- Mitsui Chemicals, Inc.

- BASF SE

- LG Chem

- Hitachi Chemical Co., Ltd.

- Arclin, Inc.

- Allnex Group

Key Target Audience

- Manufacturers in the Automotive Sector

- Wood and Laminate Product Producers

- Electrical and Electronics Equipment Manufacturers

- Construction Firms

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Department of Chemicals and Petrochemicals)

- Research and Development Institutions

- Trade Associations and Industry

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the entire ecosystem of stakeholders within the India Phenolic Resins Market. This process relies heavily on comprehensive desk research, utilizing a blend of secondary and proprietary databases to gather extensive industry-level information. The goal of this step is to identify and define the critical variables influencing market dynamics, focusing on aspects such as demand drivers, current trends, and competitive landscapes.

Step 2: Market Analysis and Construction

In this phase, our team compiles and analyses historical data related to the India phenolic resins market. This analysis includes assessing market penetration across various applications and the prevailing supply chain dynamics. An evaluation of production capacities and service quality metrics will be conducted to ensure reliability and accuracy in revenue estimates, thereby providing a solid foundation for future projections.

Step 3: Hypothesis Validation and Expert Consultation

To refine and validate market hypotheses, interviews will be conducted with industry experts representing a broad range of companies within the phenolic resins sector. This can include manufacturers, suppliers, and end-users, ensuring diverse input. The insights gathered from these consultations will be pivotal in corroborating market data and enhancing the depth and accuracy of our analysis.

Step 4: Research Synthesis and Final Output

The final phase of the methodology entails direct engagement with various stakeholders in the industry. This includes in-depth discussions with leading manufacturers to gain insights into their product segments, sales performance, and evolving consumer preferences. These interactions will serve to verify statistics derived from foundational research and provide a comprehensive overview that reflects the current state and future prospects of the India Phenolic Resins Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis

- Timeline of Major Players

- Business Cycle

- Revenue Model

- Growth Drivers

Increasing Demand from Automotive Industry

Expanding Building and Construction Sector - Market Challenges

Volatile Raw Material Prices

Fluctuating Demand Across End-user Industries - Opportunities

Innovation in Production Techniques

Rising Environmental Awareness and Sustainability Initiatives - Trends

Adoption of Green Chemistry

Shift Towards Bio-based Phenolic Resins - Government Regulation

Environmental Health and Safety Regulations

Import Tariffs on Phenolic Resins - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Type (In Value %)

Novolac Resins

– Heat-resistant coatings

– Foundry binders

– Industrial laminates

– High-performance adhesives

Resol Resins

– Insulation foams

– Molding compounds

– Electrical laminates

– Structural wood adhesives

Others

– Modified Phenolic Resins

– Bio-based Phenolic Resins

– Flame-retardant Resins - By Application (In Value %)

Wood Products

– Plywood and Laminates

– Particle Boards

– Oriented Strand Boards (OSB)

– Furniture Components

Electrical and Electronics

– Printed Circuit Boards (PCBs)

– Electrical Insulators

– Switches and Relays

– Semiconductor Packaging

Automotive

– Brake Pads and Linings

– Clutch Facings

– Under-the-hood Components

– Molding Applications

Others

– Refractory Binders

– Industrial Filters

– Aerospace Components - By End-User Industry (In Value %)

Construction

– Insulation Panels

– Concrete Coatings

– Structural Adhesives

– Roofing Binders

Coatings

– Anti-corrosive Coatings

– Heat-resistant Coatings

– Marine and Industrial Coatings

Adhesives

– Structural Adhesives

– Hot-Melt Adhesives

– Laminating Adhesives - By Region (In Value %)

North India

South India

East India

West India - By Production Process (In Value %)

Traditional Methods

– Batch Reactor Process

– Acid- or Base-Catalyzed Condensation

Advanced Methods

– Continuous Flow Processing

– Microwave-assisted Synthesis

– Eco-friendly Resin Synthesis

- Market Share of Major Players by Value/Volume

Market Share of Major Players by Type of Resins Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strength, Weakness, Organizational Structure, Revenues, Revenues by Type of Resins, Number of Production Facilities, Market Reach, and Distribution Channels)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

BASF

Kanoria Chemicals & Industries

Bakelite Hylam Ltd.

Atul Ltd.

Aditya Birla Chemicals

Sumitomo Bakelite Co., Ltd.

Momentive Performance Materials Inc.

Hexcel Corporation

SI Group, Inc.

Kolon Industries, Inc.

Mitsui Chemicals, Inc.

BASF SE

LG Chem

Hitachi Chemical Co., Ltd.

Arclin, Inc.

Allnex Group

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision-Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030