Market Overview

The India Precision Guided Munition market is valued at approximately USD ~ billion, driven by increased defense budgets and modernization efforts within the Indian Armed Forces. Advancements in missile guidance technology and the growing demand for more accurate, efficient, and safe weaponry are key factors propelling this market. Additionally, the evolving security environment in South Asia, along with strategic collaborations and technology transfers, continues to support the market’s growth trajectory.India and key neighboring countries, including Pakistan and China, dominate the market due to their heightened defense requirements and technological advancements. The Indian government’s focus on indigenization and reducing dependency on foreign suppliers has led to strong demand for locally produced precision guided munitions. Strategic military alliances with global powers also contribute to India’s dominance in the sector.

Market Segmentation

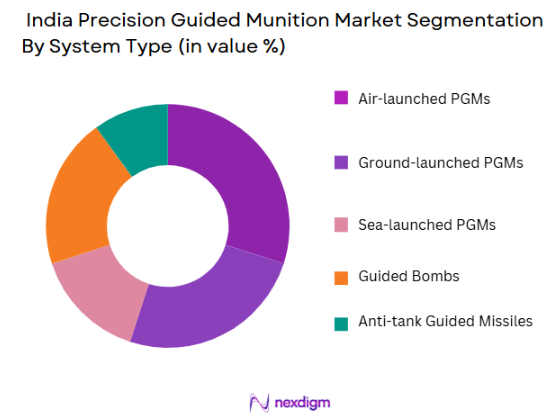

By System Type

The India Precision Guided Munition market is segmented by system type into air-launched PGMs, ground-launched PGMs, sea-launched PGMs, guided bombs, and anti-tank guided missiles. Among these, air-launched PGMs hold a dominant position due to their advanced capabilities and widespread use in various airstrikes. The Indian Air Force continues to focus on upgrading its fleet with precision-guided air-to-ground munitions, driving significant investments in this sub-segment. Additionally, the increasing collaboration with global defense manufacturers further strengthens the growth of air-launched PGMs in the market.

By Platform Type

The market is also segmented by platform type into land platforms, air platforms, naval platforms, subsea platforms, and space platforms. Air platforms are dominating the market, accounting for the largest share. The Indian Air Force’s ongoing modernization and procurement programs, alongside the rising reliance on precision strikes, have led to substantial growth in air-based platforms. Furthermore, the adoption of multi-role combat aircraft and UAVs equipped with PGMs is expanding the market share of air platforms.

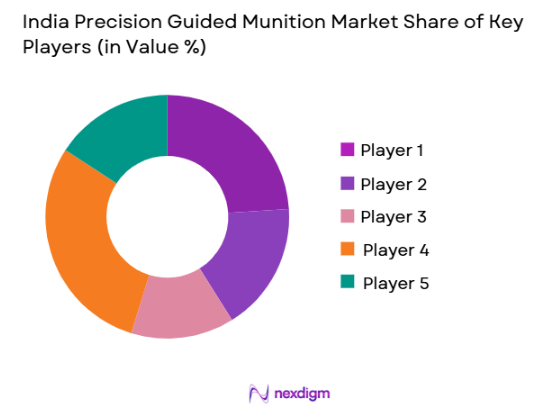

Competitive Landscape

The India Precision Guided Munition market is dominated by a few key players, including local manufacturers like Bharat Dynamics Limited and defense giants such as Lockheed Martin and MBDA. The consolidation of major players within the market highlights the influence of these companies in shaping the direction of India’s defense sector. Their strong presence is bolstered by long-term contracts with the Indian government and the expanding defense procurement plans of India.

| Company | Establishment Year | Headquarters | Technology Advancements | Global Reach | Partnerships | Revenue | Product Portfolio | Manufacturing Capacity |

| Bharat Dynamics Limited | 1970 | Hyderabad, India | ~ | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ | ~ |

| Rafael Advanced Defense Systems | 1958 | Haifa, Israel | ~ | ~ | ~ | ~ | ~ | ~ |

India Precision Guided Munition Market Analysis

Growth Drivers

Increase in Defense Budgets

India’s defense budget allocation has risen in recent fiscal cycles, directly influencing procurement of precision guided munitions (PGMs). For FY 2024‑25, the Government of India allocated INR ~crore (~USD ~billion), up from INR ~crore in FY 2023‑24, with the capital budget (which funds acquisition of weapons and systems) growing by approximately ~percent over previous estimates. ~percent of the defence capital procurement budget has been earmarked for domestic industry, signaling funding directed toward domestically produced advanced weaponry, including PGMs. This robust fiscal commitment ensures consistent financial support for force modernization programs that incorporate precision strike capabilities.

Strategic Defense Collaborations with Global Powers

India’s strategic defense collaborations are augmenting access to advanced technologies relevant to precision guided munitions. Recent policy reforms plan to raise the foreign direct investment cap for defence firms from ~ percent to ~percent under the automatic route, potentially increasing foreign capital inflows and technology transfers from partners such as the United States, France, and Israel. In 2024‑25, defence exports hit a record INR ~crore, demonstrating growing integration with global supply chains. These collaborations facilitate co-development and local production of sophisticated PGMs, reinforcing India’s modernization and self‑reliance goals within the defence sector.

Market Challenges

High Development Costs

The development and integration of precision guided munitions involve high expenditure, reflected in major capital outlays within India’s defence procurement programs. For example, the Indian Ministry of Defence recently approved a comprehensive acquisition package valued at approximately INR ~crore (~USD ~billion) to enhance combat capabilities, which includes missiles and radar systems — significant funding indicative of the scale required for modern PGM systems. These high cost thresholds strain defense budgets and necessitate careful prioritization across competing modernization needs. Such capital intensity presents a barrier for accelerated domestic development and procurement cycles without sustained fiscal support.

Regulatory Barriers and Export Restrictions

While India’s defense industry is growing, regulatory controls and international export restrictions constrain the ability to fully commercialize precision guided munition technologies abroad. As India adheres to international arms control frameworks, including export licensing and technology transfer protocols, this creates compliance requirements that can delay or complicate foreign sales of sensitive PGM systems. Domestic regulations, coupled with necessary alignment to export control regimes maintained by partner countries, require rigorous certification and oversight before products can be exported, adding procedural complexity and slowing market expansion beyond India’s borders.

Market Opportunities

Growing Demand for Autonomous Defense Systems

The demand for autonomous defense platforms incorporating PGMs is increasing within India’s armed forces. Indigenous systems such as the Nagastra‑1 loitering munition, developed domestically with significant indigenous content, have been ordered in quantities exceeding 450 units, reflecting operational interest in autonomous precision strike capability. This demand is driven by evolving threat profiles and the need for lower‑risk engagement options. The drive toward networked, unmanned systems integrates PGMs into broader autonomous platforms (UAVs and loitering systems), enabling adaptive deployment in contested environments. These trends highlight PGM relevance within broader autonomous modernization pathways for the Indian military.

Technological Advancements in Missile Guidance

Technological innovation within India’s defense ecosystem is creating opportunities for advanced guidance technologies. India has ongoing indigenous development projects, such as Laser Beam Rider Guidance (LBRG) systems that enhance the accuracy of precision guided munitions. The Ministry of Defence’s 2024‑25 annual report highlights such advanced guidance initiatives, pointing to enhanced targeting performance and integration potential across missile classes. These advancements position Indian defense firms to offer improved PGM solutions that meet contemporary battlefield requirements, reducing reliance on legacy systems and promoting competitive indigenous technologies in both domestic and allied markets. (mod.gov.in)

Future Outlook

Over the next decade, the India Precision Guided Munition market is expected to experience substantial growth. This growth will be driven by India’s continued defense modernization, increased investments in indigenous manufacturing, and strengthening defense relations with global powers. Advancements in missile guidance technology and a growing emphasis on unmanned aerial systems are also expected to contribute to market expansion. Furthermore, regional geopolitical tensions are likely to spur demand for advanced weaponry and defense capabilities in India.

Major Players

- Bharat Dynamics Limited

- Lockheed Martin

- MBDA

- Raytheon Technologies

- Rafael Advanced Defense Systems

- Boeing

- General Dynamics

- Northrop Grumman

- Thales Group

- Elbit Systems

- Saab

- Kongsberg Gruppen

- Larsen & Toubro

- DRDO

- India Ministry of Defence

Key Target Audience

- Investors and venture capitalist firms

- Indian Ministry of Defence (MOD)

- Indian Air Force

- Indian Army

- Indian Navy

- Defense contractors

- Export markets

- Global defense agencies

Research Methodology

Step 1: Identification of Key Variables

This phase involves conducting an in-depth ecosystem analysis, identifying major stakeholders in the Indian Precision Guided Munition market. Key variables impacting the market, including technology trends, geopolitical influences, and defense procurement strategies, are gathered from secondary research sources and proprietary databases.

Step 2: Market Analysis and Construction

Historical data on market performance, including production capacities, defense spending, and product deployment, is compiled. Market trends, including procurement strategies and technological evolution, are analyzed to construct a reliable market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses related to market drivers, challenges, and growth opportunities are validated through consultations with defense experts, engineers, and senior professionals from defense manufacturing firms. Computer-assisted telephone interviews (CATI) will be conducted to refine data and ensure the validity of hypotheses.

Step 4: Research Synthesis and Final Output

Final market data is synthesized from bottom-up research, corroborated through direct engagements with leading defense manufacturers and end users. Insights from industry leaders

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in defense budgets

Strategic defense collaborations with global powers

Technological advancements in precision targeting systems - Market Challenges

High development costs

Regulatory barriers and export restrictions

Complex integration into existing platforms

- Trends

Miniaturization of guidance systems

Integration with AI for autonomous targeting

Rise in hypersonic precision guided munitions

- Market Opportunities

Growing demand for autonomous defense systems

Technological advancements in missile guidance

Emerging defense markets and international collaborations

- Government regulations

ITAR compliance

Missile Technology Control Regime

National Defense Authorization Act - SWOT analysis

Strong indigenous production capabilities

Challenges with technology transfer

Opportunities in foreign defense alliances

- Porters 5 forces

Bargaining power of suppliers

Threat of new entrants

Intensity of competitive rivalry

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Air-launched PGMs

Ground-launched PGMs

Sea-launched PGMs

Guided Bombs

Anti-tank Guided Missiles - By Platform Type (In Value%)

Land Platforms

Air Platforms

Naval Platforms

Subsea Platforms

Space Platforms

- By Fitment Type (In Value%)

Man-portable PGMs

Vehicle-mounted PGMs

Aircraft-mounted PGMs

Naval Platform-mounted PGMs

Ship-to-air PGMs - By EndUser Segment (In Value%)

Indian Armed Forces

Defense Contractors

Private Military Contractors

Defense Agencies

Export Markets - By Procurement Channel (In Value%)

Direct Government Procurement

Defense Contracts

Third-party Vendors

Strategic Partnerships

International Collaboration

- Market Share Analysis

- CrossComparison Parameters(Technology adoption, Market penetration, Product portfolio, Pricing strategy, Geographic reach)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Bharat Dynamics Limited

Larsen & Toubro Limited

Rafael Advanced Defense Systems

MBDA

Lockheed Martin

Boeing

General Dynamics

Saab

Northrop Grumman

Thales Group

Elbit Systems

Raytheon Technologies

Kongsberg Gruppen

Tata Advanced Systems

DRDO (Defence Research and Development Organisation)

India Ministry of Defence

- Growing demand from the Indian military for enhanced precision capabilities

- Shift towards modernization of India’s defense platforms

- Rising defense exports in neighboring countries

- Increased collaboration between defense contractors and government entities

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035