Market Overview

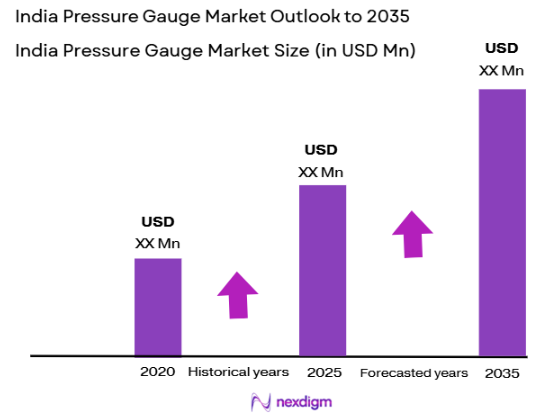

The India Pressure Gauge market, valued at USD ~million in 2023, is primarily driven by the demand for automation across industrial sectors and technological advancements in sensor-based technologies. Increasing adoption in sectors like manufacturing, automotive, and oil & gas is fueling growth. The growth is also supported by the government’s focus on industrial infrastructure development and the rise of smart manufacturing systems .India, being a manufacturing hub, sees dominance from cities like Mumbai, Delhi, and Pune. These regions are known for their thriving industrial infrastructure, proximity to manufacturing units, and a concentration of the country’s largest automotive, chemical, and oil & gas companies. The strategic positioning of these cities provides a competitive advantage and drives the demand for pressure gauges in industrial applications.

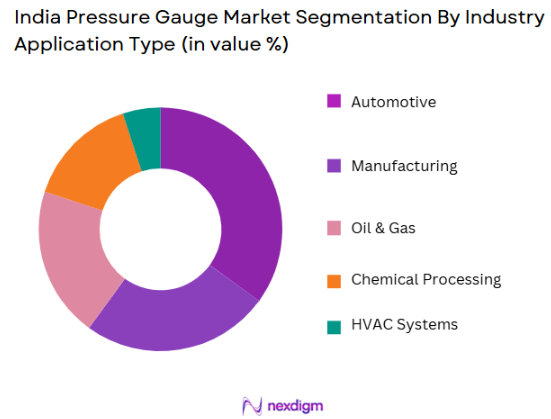

Market Segmentation

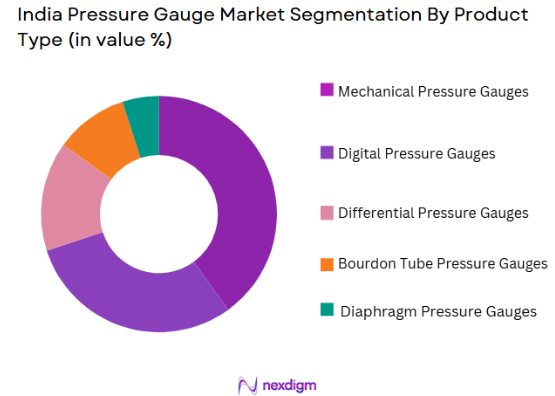

By Product Type

India’s pressure gauge market is segmented by product type into mechanical pressure gauges, digital pressure gauges, and differential pressure gauges. The mechanical pressure gauge segment holds a dominant share in the market, primarily due to its long-established presence in industrial applications. Mechanical gauges are widely used in sectors like automotive and chemical processing due to their durability, low cost, and ease of maintenance. These gauges offer simplicity and reliability, especially in high-pressure environments, contributing to their continued dominance.

By Industry Application

The market is segmented by industry application into manufacturing, automotive, oil & gas, chemical processing, and HVAC systems. The automotive segment holds the largest share of the market due to the growing need for precision in vehicle components and systems, especially in braking and fuel systems. Pressure gauges are critical for ensuring vehicle safety, and their high demand in automotive manufacturing plants across cities like Pune and Gurgaon strengthens the segment’s position in the market.

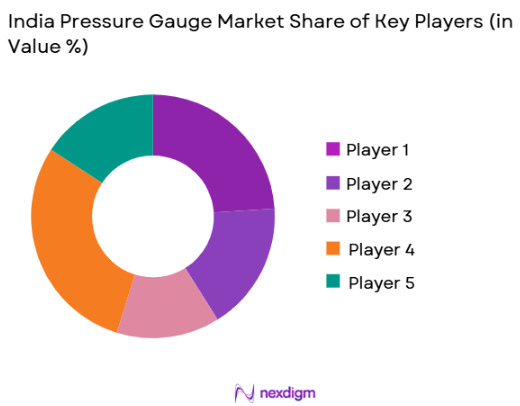

Competitive Landscape

The India pressure gauge market is highly competitive, with several global and domestic players operating in the industry. The market is dominated by key players like Emerson Electric, Honeywell, and WIKA, along with several local manufacturers catering to cost-sensitive sectors. These players have established strong market footholds due to their advanced technological capabilities, expansive distribution networks, and strategic partnerships across various industries.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Market Focus | Distribution Network | Innovation Strategy |

| Emerson Electric | 1890 | USA | ~ | ~ | ~ | ~ |

| Honeywell | 1906 | USA | ~ | ~ | ~ | ~ |

| WIKA | 1946 | Germany | ~ | ~ | ~ | ~ |

| Ashcroft | 1852 | USA | ~ | ~ | ~ | ~ |

| Omega Engineering | 1962 | USA | ~ | ~ | ~ | ~ |

India Pressure Gauge Market Analysis

Growth Drivers

Increasing demand for industrial automation

Industrial automation growth contributes directly to the India pressure gauge market, as gauges are core components in automated control systems. India’s industrial production, measured in constant U.S. dollars, was USD ~in 2024, reflecting the scale of manufacturing and processing activity that requires process monitoring and control instrumentation like pressure gauges. A ~ percent year‑on‑year growth in the Index of Industrial Production (IIP) in September 2025—with manufacturing up ~percent and electrical equipment up ~percent versus the same period in 2024—indicates expanding industrial output and equipment use. This industrial expansion increases demand for pressure measurement tools in sectors such as metals, machinery, and automotive assembly, where precise pressure monitoring is essential for automated operations.

Rising investments in the oil and gas industry

The oil and gas sector’s scale and investment activity support pressure gauge deployment across extraction, refining, and distribution processes. In the fiscal year 2024–25, India produced ~ Million Metric Tons (MMT) of crude oil and ~ Billion Cubic Meters (BCM) of natural gas, while importing 243.2 MMT of crude and 35.7 BCM of liquified natural gas to meet demand. The country’s ~million metric tons of recoverable crude oil reserves and 1,138.6 BCM of natural gas reserves reflect the scale of energy infrastructure needing measurement instruments for safety and operational monitoring. Additionally, strategic government investment plans like the USD~ billion gas sector plan motivate infrastructure expansion, increasing the need for reliable pressure gauges in pipelines, compressors, and processing units.

Technological advancements in sensor technologies

Advancements in sensor technologies underpin pressure gauge evolution, particularly in digital and IoT‑enabled systems that provide real‑time monitoring. The India IoT sensors market reached USD ~million in 2024, illustrating increased adoption of connected sensing solutions across industrial segments where precision measurement is critical. Expanded use of MEMS, AI‑enabled edge computing, and industrial sensor networks enhances gauge functionality and reliability in complex environments, enabling predictive maintenance and automated process control. These sensor innovations elevate the performance and data integration capabilities of pressure measurement devices used in manufacturing, energy, and process industries.

Market Challenges

High manufacturing costs of advanced pressure gauges

The transition from conventional mechanical gauges to digital and smart sensor‑based pressure gauges comes with increased manufacturing costs that strain affordability, especially among small and medium enterprises (SMEs) in India. High upfront expenditure for advanced sensors, microprocessors, and connectivity modules raises barriers for widespread adoption despite automation benefits. While macroeconomic conditions such as India’s GDP of USD ~ trillion in 2024 and relatively low per‑capita income of USD ~ show broad economic activity, capital intensity in precision instrument manufacturing remains challenging for domestic producers competing with imported products. This cost pressure is accentuated by mandatory quality and safety certifications under schemes like Bureau of Indian Standards (BIS) Quality Control Orders, affecting capital allocation for manufacturers who must invest significantly to meet compliance standards.

Regulatory compliance and certification barriers

Strict safety and equipment standards create compliance requirements that influence manufacturing and procurement cycles for pressure gauges. As of 2025, 187 Quality Control Orders covering 769 products have been notified for compulsory BIS certification, including categories of machinery and electrical equipment that influence gauge deployment. Manufacturers must navigate these regulatory frameworks to introduce products into the Indian market, incurring costs and lead times associated with meeting certification norms. The extension of the Machinery and Electrical Equipment Safety (Omnibus Technical Regulation) Order to September 2026 further emphasizes compliance burdens for complex instrumentation. These regulatory requirements, while improving quality and safety, add procedural complexity and can slow the introduction of technologically advanced gauges in industrial applications.

Limited access to quality components in remote areas

Supply chain limitations for high‑precision components, such as specialized sensors and electronic modules, present challenges for pressure gauge manufacturers and end users in remote or less industrialized regions. While India’s industrial hubs benefit from supplier clusters, areas beyond major urban centers often face scarcity of advanced components necessary for digital gauge production and maintenance. This disparity affects replacement cycles and reliability of instrumentation in sectors like mining or regional manufacturing facilities, where procurement delays can result in operational inefficiencies. The infrastructure gap for high‑quality component availability hinders timely maintenance and scaling of pressure measurement solutions across all geographies.

Market Opportunities

Growing focus on industrial safety and quality control

Enhanced emphasis on workplace safety and quality standards creates demand for precise measurement instruments such as pressure gauges, which are vital for monitoring critical parameters in industrial processes. Government and industry focus on occupational safety has prompted initiatives like 100 percent inspection of boilers in Gujarat, where certification was completed for 23,719 boilers and 675 economizers by 2024–25, contributing to zero boiler explosion‑related deaths. Accurate pressure monitoring is essential for safety compliance in boiler systems, chemical plants, and energy facilities, driving gauge usage. Broader enforcement of safety frameworks and certification requirements stimulates adoption of reliable gauges to ensure compliance with regulatory and risk‑management protocols.

Expanding demand from emerging economies

India’s expanding industrial base and its role as a major manufacturing destination enhance regional demand for pressure measurement technologies. The country is recognized as the third most sought‑after manufacturing destination globally and has potential to export goods valued at USD ~trillion by 2030, indicating robust industrial growth that necessitates measurement and control instruments. Pressure gauges are integral to manufacturing processes across sectors such as automotive, chemicals, and energy, supporting quality assurance and efficiency. As emerging markets like India invest in facility upgrades and smart manufacturing, demand for advanced gauges rises, driven by the need to meet both domestic production goals and international quality expectations.

Future Outlook

Over the next decade, the India Pressure Gauge market is expected to experience robust growth. This will be driven by continuous industrial advancements, the rise of automation, and increasing demand for precision measurement tools across key industries like automotive, chemical processing, and HVAC. Additionally, the development of smart sensors and the growing adoption of digital pressure gauges are anticipated to shape the market landscape. Industry-specific technological advancements will also play a pivotal role in expanding the market’s potential.

15 Major Players

- Emerson Electric

- Honeywell

- WIKA

- Ashcroft

- Omega Engineering

- Yokogawa Electric

- Endress+Hauser

- Sika Instruments

- Dwyer Instruments

- KROHNE

- Fisher Controls International

- Siemens

- Schneider Electric

- GE Measurement & Control

- Martel Electronics

Key Target Audience

- Investments and Venture Capitalist Firms

- Ministry of Heavy Industries & Public Enterprises

- Ministry of Power

- Automotive Manufacturers

- Oil & Gas Corporations

- Chemical Processing Units

- Industrial Automation Companies

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

This phase involves identifying the critical market variables that impact the India Pressure Gauge market, such as demand drivers from key industrial sectors, technological advancements, and regulatory standards. A combination of secondary research and industry databases will help identify these variables, which will serve as the foundation for the subsequent analysis.

Step 2: Market Analysis and Construction

We will gather historical data, focusing on market size, adoption rates of pressure gauges in key sectors, and the associated revenue generation. This analysis will encompass both primary and secondary research, with a thorough examination of service quality metrics and penetration across diverse industry applications.

Step 3: Hypothesis Validation and Expert Consultation

The data-driven hypotheses will undergo validation through interviews with industry experts, including manufacturers, distributors, and end-users. These expert consultations will refine our findings and provide real-time insights into market trends and potential growth areas.

Step 4: Research Synthesis and Final Output

In this final phase, all market data will be synthesized into a comprehensive report. Expert opinions and the gathered data will be integrated to ensure accuracy and reliability. Additionally, feedback from industry participants will be incorporated to ensure the report accurately reflects market realities.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for industrial automation

Rising investments in the oil and gas industry

Technological advancements in sensor technologies - Market Challenges

High manufacturing costs of advanced pressure gauges

Regulatory compliance and certification barriers

Limited access to quality components in remote areas - Trends

Adoption of IoT-enabled pressure gauges

Shift towards energy-efficient pressure gauges

Customization of pressure gauges for niche applications

- Market Opportunities

Growing focus on industrial safety and quality control

Expanding demand from emerging economies

Technological integration in smart manufacturing systems - Government regulations

ISO 9001 certification standards

Bureau of Indian Standards (BIS) regulations

Environmental regulations for industrial manufacturing - SWOT analysis

Strength: Strong demand from industrial sectors

Weakness: High dependency on imported components

Opportunity: Rising market for digital and smart gauges - Porters 5 forces

Supplier Power: Medium due to reliance on specialized components

Buyer Power: High due to competitive pricing in the market

Threat of Substitution: Medium with growing IoT alternatives

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Mechanical Pressure Gauges

Digital Pressure Gauges

Differential Pressure Gauges

Bourdon Tube Pressure Gauges

Diaphragm Pressure Gauges - By Platform Type (In Value%)

Industrial Applications

Automotive Applications

Oil & Gas Industry

Chemical Processing

HVAC Systems

- By Fitment Type (In Value%)

OEM Fitment

Aftermarket Fitment

Direct Fitment

Custom Fitment

Universal Fitment - By End-User Segment (In Value%)

Manufacturing Industry

Automotive Industry

Oil & Gas Sector

Chemical and Petrochemical Industry

Energy & Power Sector - By Procurement Channel (In Value%)

Direct Sales

Distributors & Resellers

Online Sales

Retail Sales

OEM Supply Chain

- Market Share Analysis

- CrossComparison Parameters(Technological Innovation, Price Competitiveness, Distribution Network, Brand Recognition, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Honeywell International Inc.

Emerson Electric Co.

Endress+Hauser Group

WIKA Alexander Wiegand SE & Co. KG

Yokogawa Electric Corporation

Schneider Electric

OMEGA Engineering

Ashcroft Inc.

KROHNE Messtechnik GmbH

Fisher Controls International LLC

Dwyer Instruments, Inc.

Sika Instruments

GE Measurement & Control

Ametek, Inc.

Martel Electronics Corporation

Sierra Instruments, Inc.

- Increasing adoption of pressure gauges in automotive manufacturing

- Need for accuracy in chemical processing industries

- Demand for high-performance gauges in oil & gas

- Growth of HVAC systems driving pressure gauge sales

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035